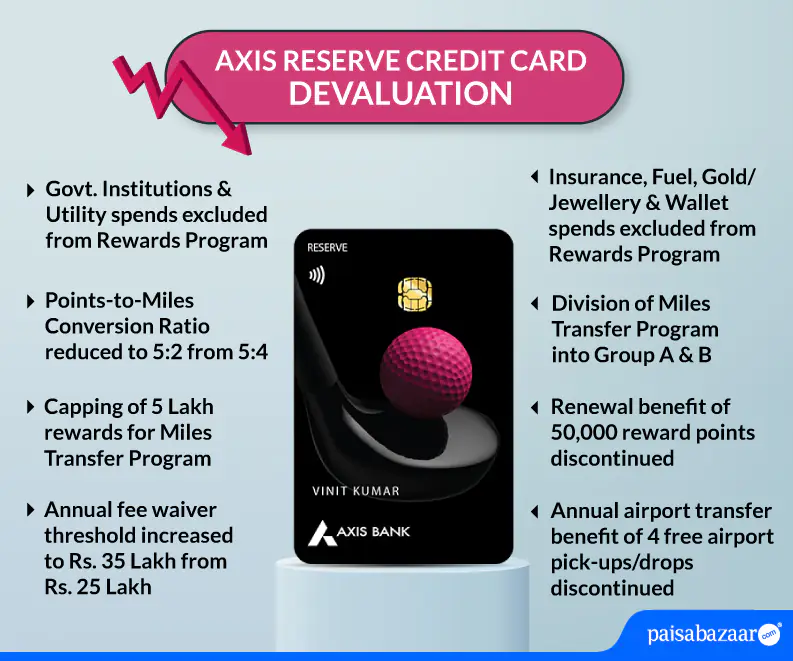

In September 2023, Axis Bank made significant changes to its super premium card- Axis Reserve, including revisions in the air miles transfer program and annual fee waiver condition. Again, in April 2024, Axis Bank announced another round of devaluation, grouping of Miles Transfer Program partners, removing renewal benefits & airport transfers, affecting the overall value of Axis Reserve. Already, after the devaluation in September, the premium status of this card was at risk, and now another round of devaluation could potentially affect its popularity in the market. So, let’s see how these changes impact the overall value of this card and how they could affect its status.