Many credit cards cater to a specific customer base and offer benefits that target the same. A defence credit card is one such example that is designed while keeping in mind the needs of defence personnel. To be eligible for any of these credit cards, you must be serving the Indian Army, Air Force, Navy, or Paramilitary Forces. Most of these defence credit cards offer accelerated rewards on household and other lifestyle-related categories and come at a low annual fee. Read below to know about some of the best credit cards that are customised for the defence personnel.

Exclusive Card Offers from India’s top banks are just a click away Error: Please enter a valid number

Top Credit Cards for Defence Personnel in April 2025

The following are some of the best credit cards for defence personnel which are selected basis the value-back they can offer you:

| Defence Credit Card | Annual Fee | Key Features |

| BoB Indian Army Yoddha Credit Card | Nil | Up to 10 reward points per Rs. 100 spent; Complimentary domestic lounge access; FITPASS Pro membership on joining |

| ICICI Bank Parakram Select Credit Card | Nil | Up to 10 reward points per Rs. 100 spent; Complimentary international & domestic lounge access |

| BoB Vikram Credit Card | Nil | Up to 5 reward points per Rs. 100 spent; 3 months Disney Hotstar membership & bonus reward points on joining |

| Axis Bank Pride Signature Credit Card | Rs. 500 | 8 EDGE rewards per Rs. 200 spent; Complimentary domestic lounge access; Dining discount |

| Shaurya Select SBI Card | Rs. 1,499 | Up to 10 reward points per Rs. 100 spent; Complimentary domestic lounge access; Brand vouchers as milestone bonus & bonus reward points on card renewal |

Top Credit Cards in India | Check Eligibility

Video: Best Credit Cards for Defence Personnel

Note: Details mentioned in the video have been sourced from the issuer’s website as of August 2024. For updated information, refer to this page.

5 Best Credit Cards for Defence Personnel in 2025

Here are the top 5 credit cards for defence personnel that reward you with decent value-back for your expenses:

1. Indian Army YODDHA BoB Credit Card

For Indian Army Personnel

Joining Fee: Nil

Annual Fee: Nil

Key Features and Benefits:

- Complimentary 6-month FITPASS Pro membership worth Rs. 15,000 on card activation

- 500 reward points on spending Rs. 5,000 within 60 days of card issuance

- 12 months Amazon Prime membership on spending Rs. 1 lakh within the first 90 days

- 5X reward points on spends at departmental stores & movies, up to 1,000 reward points per month

- 2 reward points per Rs. 100 spent on other categories, where 1 Reward Point = Rs. 0.25

- 8 complimentary visits to domestic airport lounges per year, 2 per quarter

- Personal accidental death (air/non-air) insurance cover worth Rs. 20 lakh

- 1% fuel surcharge waiver, up to Rs. 250 per month, on fuel spends worth Rs. 400 to Rs. 5,000

| Unlike most cards which come with joining benefits that are worth the same value as their annual fee, this Bank of Baroda credit card offers considerable welcome benefits despite being a lifetime free credit card. These benefits combine fitness, entertainment and shopping together in the form of complimentary memberships, along with bonus reward points, which you can maximise by satisfying the spend-based conditions. In addition to this, you can avail incremental rewards on your movies and departmental store spends. The earned reward points can later be redeemed against cashback. This card also offers one of the highest number of domestic lounge visits among all the other defence credit cards included in our list. |

Suggested: Best Grocery Credit Cards in India | Check Eligibility for Top Cards

2. ICICI Bank Parakram Select Credit Card

For Indian Defence & Paramilitary Personnel

Joining Fee: Nil

Annual Fee: Nil

Key Features and Benefits:

- 5X reward points on spends at grocery, departmental stores and canteen stores department (CSD), up to 1,000 points per month

- 2 reward points per Rs. 100 spent on other spending categories

- 2 complimentary visits to domestic airport lounges per quarter

- 1 complimentary visit to international airport lounge per year

- 1 complimentary golf round on every Rs. 50,000 spent, max. 4 rounds per month

- Personal accident insurance cover of Rs. 2 lakh and air accident cover worth Rs. 20 lakh

- 1% fuel surcharge waiver, up to Rs. 250 per month, on fuel spends worth Rs. 400 to Rs. 4,000

| This ICICI bank credit card offers accelerated rewards on transactions made on daily use and household spends, including groceries, departmental stores and CSD spends. Those who travel frequently can also avail complimentary domestic and international airport lounge access to make their journeys more comfortable. This card also offers spend-based complimentary golf access – a feature which is not very common for lifetime-free cards. |

Must read: Best Credit Cards for Reward Points | Check Eligibility for Top Credit Cards

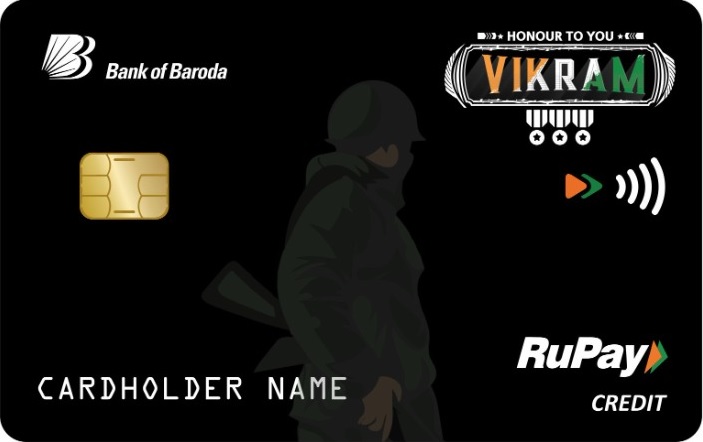

3. BoB Vikram Credit Card

For Defence Personnel

Joining Fee: Nil

Annual Fee: Nil

Key Features and Benefits:

- Complimentary 3 months Disney Hotstar membership on making the 1st transaction within 30 days of card issuance

- 500 reward points on spending Rs. 5,000 within 60 days of card issuance

- 5X reward points on movies and departmental store spends

- 1 reward point per Rs. 100 spent on other categories, where 1 Reward Point = Rs. 0.25

- Personal accidental death (air/non-air) cover worth Rs. 20 lakh

- 1% fuel surcharge waiver, up to Rs. 250 per month, on fuel spends of Rs. 400 to Rs. 5,000

| This is a lifetime-free rewards credit card that offers accelerated rewards on movies as well as departmental store purchases. The accrued reward points can be redeemed as cashback. Apart from this, the Vikram cardholders also get lucrative welcome benefits which is not common for most cards that do not charge any annual fee. The spend-based condition for bonus reward points that you get on joining is also easily achievable. |

Suggested: Best Entertainment Credit Cards in India | Check Eligibility for Top Cards

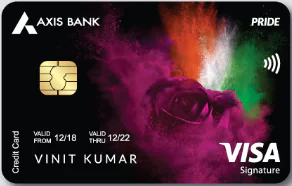

4. Axis Bank Pride Signature Credit Card

For Indian Defence Personnel

Joining Fee: Nil

Annual Fee: Rs. 500 (Waived off on spending Rs. 40,000 in the previous year)

Key Features and Benefits:

- 8 EDGE reward points per Rs. 200 spent

- Up to 2 complimentary visits to domestic airport lounges per quarter

- Minimum 15% off on dining via Axis Bank Dining Delights program

- 1% fuel surcharge waiver, up to Rs. 400 per month, on fuel spends of Rs. 400 to Rs. 4,000

| This Axis bank credit card comes with decent rewards benefits on every spend, but unlike most cards, it doesn’t offer accelerated rewards for any spending category. The earned EDGE reward points can later be redeemed against the EDGE Rewards catalogue. The cardholders also get certain lifestyle-related benefits, like the dining discount and complimentary domestic lounge access. However, you can avail the lounge access only if you are able to spend Rs. 50,000 in the previous 3 months. |

Suggested: Best Dining Credit Cards in India | Check Eligibility for Top Cards

5. Shaurya Select SBI Card

For Air Force, Army, Navy & Paramilitary Personnel

Joining Fee: Nil

Annual Fee: Rs. 1,499 (Waived off on spending Rs. 1.5 lakh in a year)

Key Features and Benefits:

- 5X reward points on dining, CSD, movies, grocery & departmental store spends

- 2 reward points per Rs. 100 spent on other categories, where 4 Reward Points = Rs. 1

- 1,500 reward points on renewal fee payment

- Pizza Hut e-voucher worth Rs. 500 on spending Rs. 50,000 in a quarter

- Yatra/Pantaloons e-gift voucher worth Rs.7,000 on reaching Rs. 5 lakh annual spends

- 4 complimentary visits to domestic airport lounges every year, 1 per quarter

- Personal accident insurance cover worth Rs. 10 lakh

- 24×7 concierge services with assistance in gift delivery, restaurant referral, courier service, car rental, etc.

- 1% fuel surcharge waiver, up to Rs. 250 per month, on fuel spends of Rs. 500 to Rs. 4,000

| This SBI credit card offers accelerated rewards on spends made on household items, including groceries, departmental store and CSD spends, and on lifestyle categories like movies and dining. The milestone benefits are offered in the form of brand e-vouchers where the quarterly bonus appears to be quite easy to achieve. If you are an average spender or have multiple credit cards then reaching Rs. 5 lakh annual spends to maximise on your milestone benefits might come as a challenge. You can also avail the complimentary lounge access and concierge services which contribute in making your travel and life more comfortable. |

Apply for the Best-Suited Credit Card for You

2 Comments

Mujha HDFC CREDIT CARD CHAHIYE

You can apply for an HDFC credit card by filling your details, like your mobile number, in the form available on this page. You can browse through some of the top HDFC credit cards and check your eligibility for the one you wish to get.