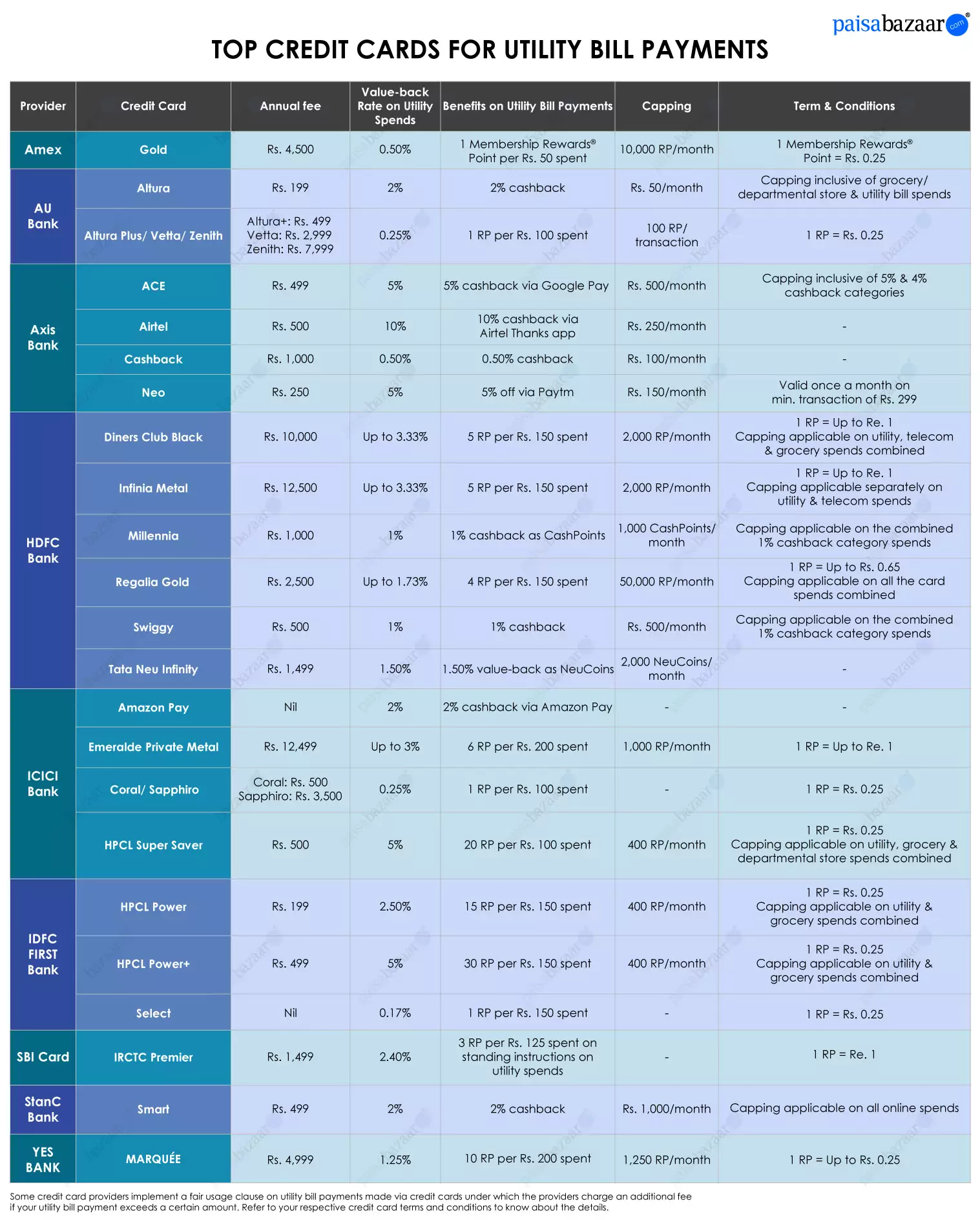

On most credit cards, utility bill payments are excluded from reward earning. However, there are a few cards that offer benefits on utility bill payments in the form of higher reward points or cashback. Some of these cards are co-branded with platforms like Google Pay or Airtel and offer generous value-back if you pay your bills through the associated platform. If you are looking to save on this monthly expenditure, check & compare the best credit cards for utility bill payments below.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

Top 6 Credit Cards for Utility Bill Payments in India

Axis Bank ACE Credit Card

Joining fee: ₹499

Annual/Renewal Fee: ₹499

5% cashback on utility bill payments and recharges via Google Pay

4% cashback on Swiggy, Zomato and Ola

Product Details

- 1.5% cashback on other offline & online spends

- 4 domestic lounge access per year on spending Rs. 50,000 or more in the previous quarter

- 1% fuel surcharge waiver across all fuel stations on transactions between Rs. 400 to Rs. 4,000

Airtel Axis Bank Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

25% cashback on payment for Airtel Mobile, DTH, etc. via Airtel Thanks App

10% cashback on utility bill payment via Airtel Thanks App

Product Details

- 10% cashback on utility bill payments via Airtel Thanks app

- 10% cashback on spends at Zomato, Swiggy and BigBasket

- Unlimited 1% cashback on other spends

- 4 complimentary domestic airport lounge visits every year

Swiggy HDFC Bank Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

10% cashback on Swiggy food orders, Instamart, Dineout & Genie

5% cashback on online spends

Product Details

- 1% cashback on other spends

- Up to Rs. 3,500 cashback in a month

- 3-month Swiggy One Membership worth Rs. 1,199 on card activation

- Renewal fee waived off on Rs. 2 lakh annual spends

Standard Chartered Super Value Titanium Credit Card

Joining fee: ₹750

Annual/Renewal Fee: ₹750

5% cashback on fuel, telephone and utility bills

1 reward point per Rs. 150 spent on other categories

Product Details

- 1 reward point for every Rs. 150 spent on other categories

- No annual fee charged for Premium banking customers

- Complimentary Priority Pass membership for Premium banking clients

- 1 free Priority Pass lounge visit per month outside India for Premium clients on satisfying TnC

Tata Neu Infinity HDFC Bank Credit Card

Joining fee: ₹1499

Annual/Renewal Fee: ₹1499

Up to 10% value-back on Tata Neu spends

8 domestic and 4 international Priority Pass lounge access per year

Product Details

- 5% NeuCoins on all non-EMI spends at Tata Neu & its partner brands

- Additional 5% NeuCoins on select spends at Tata Neu app/website

- 1.5% NeuCoins on UPI, non-Tata brand and merchant EMI spends

- 1,499 NeuCoins after the first spend within 30 days of card issuance

- Low forex markup fee of 2%

HDFC Regalia Gold Credit Card

Joining fee: ₹2500

Annual/Renewal Fee: ₹2500

5X reward points on Nykaa, Myntra, Marks & Spencer and Reliance Digital

4 reward points per Rs. 150 across all retail spends

Product Details

- Complimentary Swiggy One & MMT Black Elite Memberships

- Gift voucher worth Rs. 2,500 on the payment of joining fee

- 6 complimentary international lounge visits & 12 complimentary domestic airport lounge visits per year

- Marks & Spencer, Reliance Digital, Myntra or Marriott vouchers worth Rs. 1,500 on Rs. 1.5 Lakh quarterly spends

- Flight vouchers worth Rs. 5,000 on annual spends of Rs. 5 Lakh

Note: Details mentioned in the video have been sourced from the issuer’s website as of July 2024. For updated information, refer to this page.