Rupay is India’s own global card payment network that provides a secure and phishing-free environment for card transactions. In June 2022, the Reserve Bank of India allowed the linking of Rupay Credit Cards with UPI Platforms, allowing users to make quick and card-less payments using their smartphones. Initially, only a few credit cards were available on the Rupay platform, but now almost all major card issuers like HDFC Bank, SBI Card, Axis Bank and ICICI Bank have started offering Rupay variants of their existing credit cards, with some launching entirely new cards on the Rupay network.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

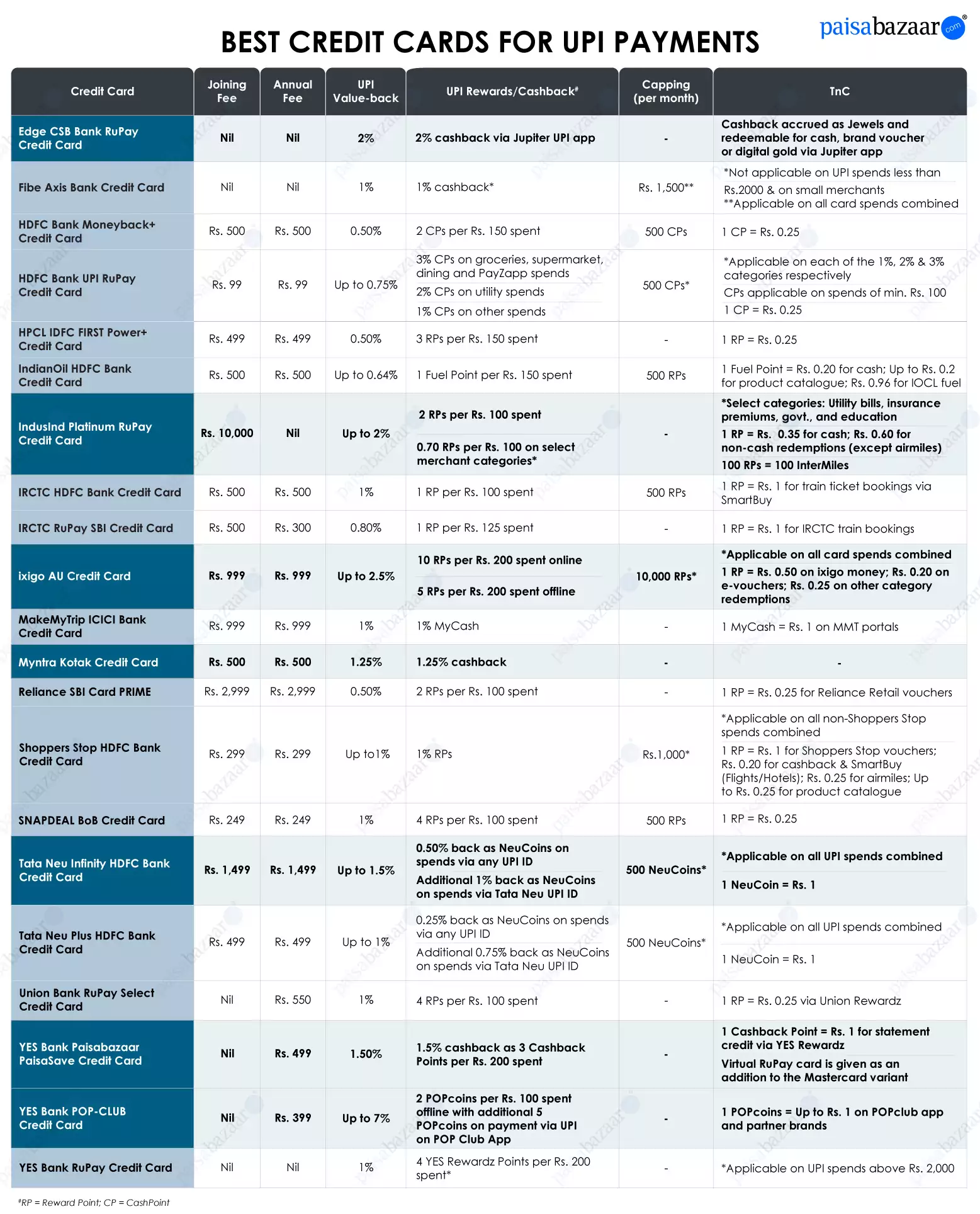

With a growing range of options available, it may be difficult for consumers to choose the best Rupay credit card for UPI payment. To help, we have curated a list of the most popular Rupay credit cards in India, offering benefits across multiple categories like online shopping, fuel, cashback, and more.

10 Best Rupay Credit Cards in India for April 2025

Tata Neu Infinity HDFC Credit Card

Joining fee: ₹1499

Annual/Renewal Fee: ₹1499

Up to 10% value-back on Tata Neu spends

8 domestic and 4 international Priority Pass lounge access per year

Product Details

- 5% NeuCoins on all non-EMI spends at Tata Neu & its partner brands

- Additional 5% NeuCoins on select spends at Tata Neu app/website

- 1.5% NeuCoins on UPI, non-Tata brand and merchant EMI spends

- 1,499 NeuCoins after the first spend within 30 days of card issuance

- Low forex markup fee of 2%

YES Bank Paisabazaar PaisaSave Credit Card

Joining fee: ₹0

Annual/Renewal Fee: ₹499

3% Cashback Points on e-commerce spends, max. 5,000 points/month

Unlimited 1.5% Cashback Points on all other spends, including UPI

Product Details

- Earned Cashback Points can be redeemed as statement credit in 1:1 ratio at zero redemption fee

- 1.5% cashback on online spends made after reaching the monthly capping

- Renewal fee waived off on reaching Rs. 1.2 lakh annual spends

- 1% fuel surcharge waiver, up to Rs. 250 per month, on all fuel spends worth Rs. 500 to Rs. 3,000

Myntra Kotak Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

7.5% off up to Rs. 750 per transaction on Myntra

Unlimited 1.25% cashback on other spends

Product Details

- 7.5% off up to Rs. 750 per transaction on Myntra

- 5% cashback up to Rs. 1,000 per month on Swiggy, Swiggy Instamart, PVR, Cleartrip & Urban Company

- 1.25% cashback across all other transactions

- 2 complimentary PVR tickets of Rs. 250 each on Rs. 50,000 quarterly spends

- 1% fuel surcharge waiver of up to Rs. 3,500 in a year on fuel spends of Rs.500 to Rs. 3,000

HDFC Bank UPI RuPay Credit Card

Joining fee: ₹99

Annual/Renewal Fee: ₹99

Up to 3% CashPoints on card spends, including UPI transactions

Gift voucher worth Rs. 250 as welcome bonus

Product Details

- 3% CashPoints, up to 500 points per month, on PayZapp, groceries, supermarket &dining spends

- 2% CashPoints, up to 500 points per month, on utility spends

- 1% CashPoints, up to 500 points per month, on other spends

- Annual fee waived off on reaching Rs. 25,000 annual spends

HDFC MoneyBack+ Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

10X CashPoints on Flipkart, Amazon, Swiggy, Reliance Smart SuperStore & BigBasket

5X CashPoints on EMI transactions at select merchants

Product Details

- 2 CashPoints per Rs. 150 spent on other categories

- 500 CashPoints as welcome benefit after the payment of joining fee

- Gift vouchers worth up to Rs. 2,000 in a year as milestone benefits

Ixigo AU Credit Card

Joining fee: ₹0

Annual/Renewal Fee: ₹0

10% discount on travel bookings at Ixigo

4X reward points on train bookings via Ixigo

Product Details

- 10% discount on bus bookings, max. Rs. 300 once per month via Ixigo

- 10% discount on flight bookings, up to Rs. 1,000 once per month via Ixigo

- 10% off on hotel bookings, up to Rs. 1,000 once per month via Ixigo

- 1% fuel surcharge waiver on transactions between Rs. 400 to Rs. 5,000 across all fuel stations in India

- Zero forex markup fee

ICICI HPCL Super Saver Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

Up to 6.5% savings on HPCL fuel spends

5% back on grocery & utilities

Product Details

- 4% cashback, max. Rs. 200 per month, on HPCL spends & 1% on fuel surcharge

- Save additional 1.5% as 6 reward points per Rs. 100 spent on HPCL fuel via the HP Pay app

- 2 reward points per Rs. 100 spent on other retail purchases, 1 RP = Rs. 0.25

- Rs. 100 cashback on recharge via HP Pay app & 2,000 reward points as joining bonus

- 1 domestic airport lounge access per quarter on spending Rs. 75,000 in the previous quarter

IRCTC SBI Platinum Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹300

10% value-back on railway ticket bookings

350 bonus reward points on card activation

Product Details

- 350 reward points worth Rs. 350 on card activation after a transaction of min. Rs. 500 within the first 45 days

- 10% value-back through reward points upon booking AC1, AC2, AC3 and AC Chair Car tickets via IRCTC website

- 1 reward point for every Rs. 125 spent on non-fuel retail purchases, including railway ticket purchases via IRCTC

- 4 complimentary railway lounge access in a year

- Waiver of 1% transaction charge on railway ticket bookings

IndusInd Bank Platinum Credit Card

Joining fee: ₹0

Annual/Renewal Fee: ₹0

1.5 reward points for every Rs. 150 spent

Product Details

- 1.5 reward points for every Rs. 150 spent

- Complimentary vouchers of brands like The Postcard Hotel, Montblanc, Amazon, Flipkart as welcome benefit

- 1% fuel surcharge waiver across all petrol pumps