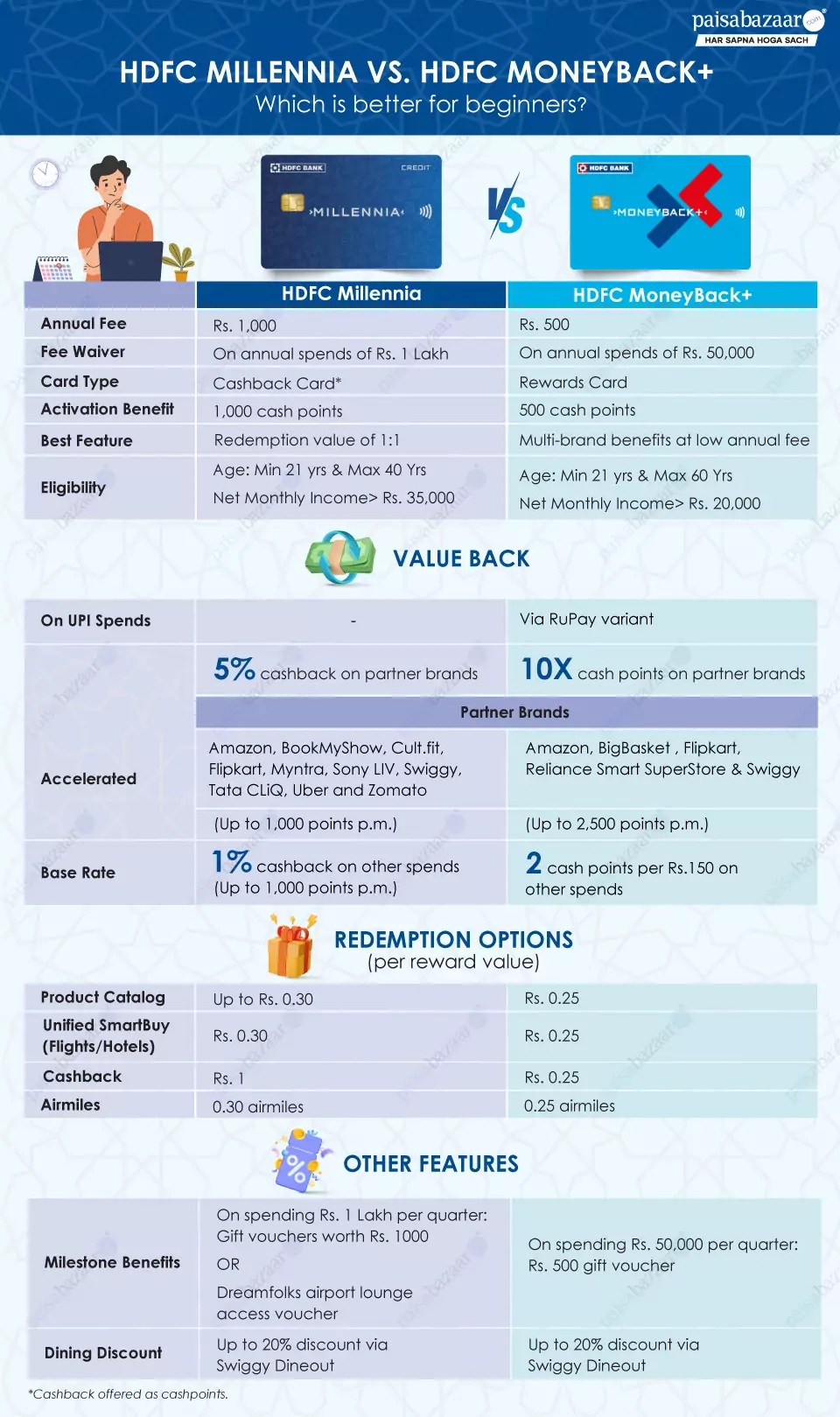

HDFC Millennia and HDFC MoneyBack+ are both entry-level cards for new to credit customers. The cards extend accelerated benefits around popular everyday brands like Amazon, Swiggy, Flipkart, etc and some similar type of benefits around card activation and milestone spends.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

Additionally despite falling into cashback and rewards credit cards category respectively, Millennia and MoneyBack+ both offer valueback via CashPoints. On that ground, choosing the right card can be confusing. To help you make a smart choice, here we have compared these credit cards. You must go for a card that matches well with your spending patterns and justifies the annual fee.

2 Comments

HDFC MoneyBack Credit Card reward point can be change into HDFC Millennia Credit Card after upgrade.

In general, credit card reward points are non-transferable. In case of a card upgrade, it is better to redeem your accumulated rewards before activating the upgraded card. However, for more details on this, we advise you to connect with HDFC Bank customer care.