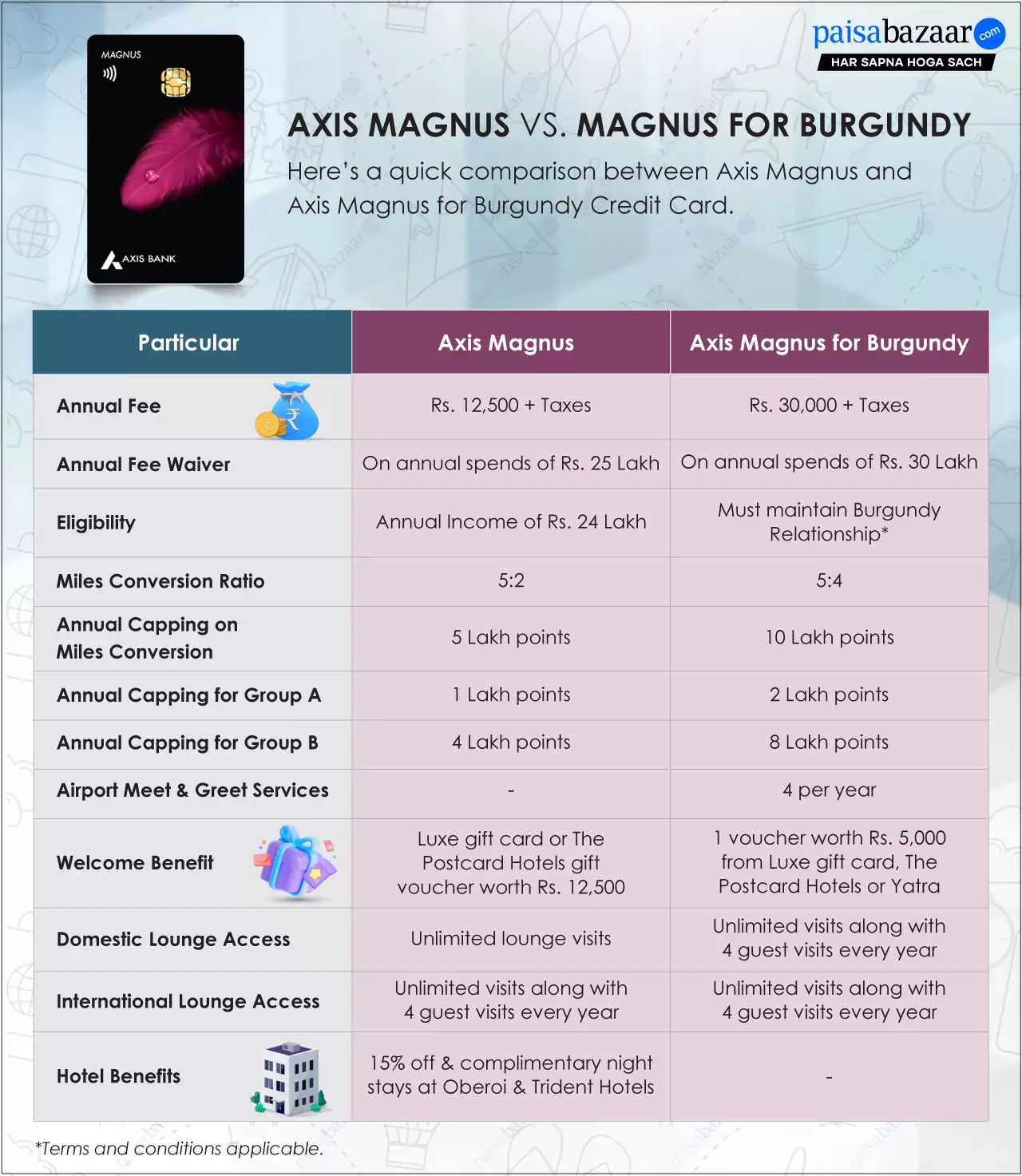

In 2023, Axis Magnus Credit Card quickly rose to fame for its high reward rate, monthly milestone benefits and an excellent 5:4 points-to-miles conversion ratio. However, things changed in April 2024, when Axis Bank significantly devalued the Magnus card, leaving many users disappointed. Slashed redemption value from 5:4 to 5:2 was the most notable downgrade, cutting travel value in half.

Meanwhile, Magnus for Burgundy—a variant of Magnus available exclusively to Axis Bank Burgundy customers—retained the superior 5:4 ratio, along with some other travel-focused benefits.

Redemption Rate & Annual Caps: The Real Differentiator

Redemption Rate & Annual Caps: The Real Differentiator

Reward Earning Rate (Same for Both Cards)

- 12 EDGE reward points per Rs. 200 spent on cumulative monthly spends of up to Rs. 1.5 Lakh

- 35 EDGE reward points per Rs. 200 spent above cumulative monthly spends of Rs. 1.5 Lakh

- 60 EDGE reward points per Rs. 200 spent on Travel EDGE portal up to cumulative monthly spends of Rs. 2 Lakh

- 35 EDGE reward points per Rs. 200 spent on Travel EDGE portal above monthly spends of Rs. 2 Lakh

Redemption Ratio

- Magnus now offers a 5:2 points-to-miles conversion ratio

- Magnus for Burgundy retains the more generous 5:4 ratio, effectively doubling your redemption value

Miles Transfer Capping

- Magnus: 5 Lakh Reward Points (1 Lakh for Group A & 4 Lakh for Group B)

- Magnus for Burgundy: 10 Lakh Reward Points (2 Lakh for Group A & 8 Lakh for Group B)

Other Travel Benefits: Burgundy Variant Pulls Ahead

Magnus for Burgundy offers some more travel benefits that are not available on Magnus:

| Benefit | Magnus | Magnus for Burgundy |

| Airport Meet and Greet | Removed | 4 per year |

| Guest visits at domestic lounges | Removed | 4 per year |

| Guest visits at international lounges | 4 per year | 4 per year |

Where Magnus for Burgundy Falls Short

Despite having an edge in rewards and some other perks, the Burgundy variant missed out on a few benefits that Axis Magnus offers:

- 15% discount and complimentary night stays at Oberoi and Trident Hotels

- Welcome voucher of Rs. 5,000 only, which is nowhere near the joining fee of Rs. 30,000

The Bottom Line

Magnus for Burgundy clearly outshines Magnus in terms of core rewards and travel benefits. However, the card is only available to Burgundy clients, which makes it inaccessible for many. If you are eligible, Magnus for Burgundy is the clear winner, especially if you are a traveller seeking significant value through point-to-mile conversion. Another important point to note is that Magnus for Burgundy charges a higher annual fee of Rs. 30,000, which could be a concern for some consumers.

On the other hand, Magnus cardholders–especially those who want to save on travel–should reconsider their options. Several mid-range and premium cards like Axis Atlas, Axis Horizon, HSBC Travel One and HDFC Diners Club Black can offer better value.