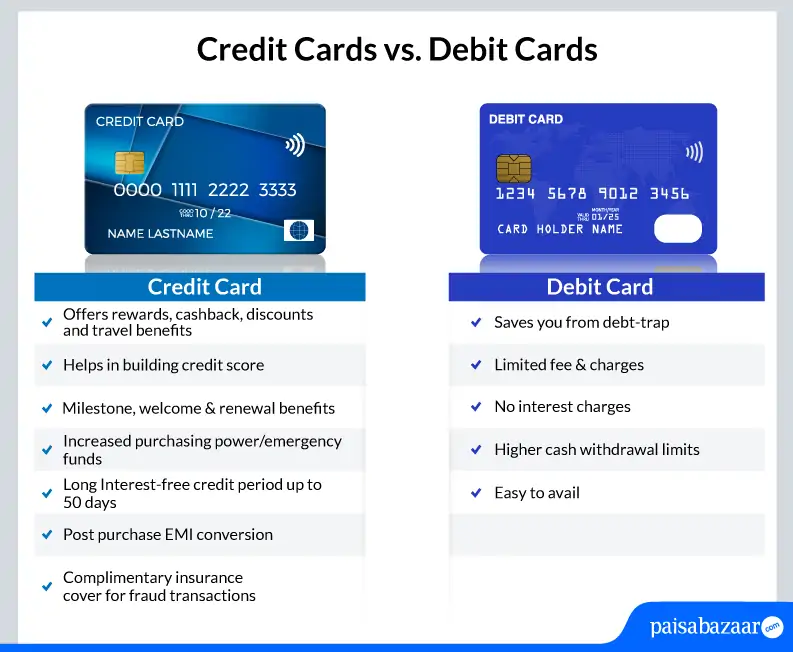

Most young Indians, whether salaried professionals or business owners, carry at least one of these cards for everyday expenses like fuel, bill payments, and grocery shopping, as well as big ticket purchases like flight bookings, consumer durables, and more. However, not many consumers are aware of the key differences between a credit card and a debit card and which of these is better. Below, we have listed the major differences between the two.