Despite being a considerable part of monthly expenditure, fuel transactions are usually kept as an exclusion from credit card reward programs. However, some credit cards are co-branded with leading fuel brands like Indian Oil, HPCL, and BPCL, designed to help users save on their day-to-day fuel spends. Unlike most cards that offer minimal fuel benefits as surcharge waivers, these cards offer inclined benefits on fuel via accelerated rewards.

Some of the best fuel credit cards in India are:

IndianOil RBL Bank Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

Up to 6% savings on IndianOil fuel purchases

1,000 Fuel Points as welcome benefit

Product Details

- 5% savings as 10 Fuel Points per Rs. 100 spent on IndianOil fuel

- 1 Fuel Point per Rs. 100 spent on other categories; 1 Fuel Point = Rs. 0.50 for IOCL fuel purchase

- 1% fuel surcharge waiver, up to Rs. 100 per month, on fuel spends

- Annual fee waived off on Rs. 1.75 lakh annual spends

BPCL SBI Card Octane

Joining fee: ₹1499

Annual/Renewal Fee: ₹1499

7.25% value back on BPCL fuel expenses

10X rewards on dining, movies, groceries & departmental store spends

Product Details

- 25 reward points per Rs. 100 spent on BPCL fuel, lubricants & Bharat Gas; 1 reward point on others

- 1% fuel surcharge waiver, up to Rs. 100 per month, on BPCL fuel spends of up to Rs. 4,000

- 6,000 reward points as welcome bonus on fee payment, 1 RP = Rs. 0.25

- 4 complimentary visits per year to domestic Visa lounges in India

- Fee waived on Rs. 2 lakh annual spends & Rs. 2,000 e-gift voucher on Rs. 3 lakh annual spends

IndianOil Axis Bank Credit Card

Joining fee: ₹500

Annual/Renewal Fee: ₹500

Save up to 5% on IOCL fuel spends

1% back as 5 EDGE reward points per Rs. 100 spent on online shopping

Product Details

- 4% back as 20 EDGE reward points per Rs. 100 spent on IOCL fuel

- 1% fuel surcharge waiver of up to Rs. 50 per month on fuel spends of Rs. 400 to Rs. 4,000

- 1 EDGE reward point per Rs. 100 spent on other spends, 1 EDGE reward point = Rs. 0.20

- 100% cashback, up to Rs. 250, as EDGE rewards on the 1st fuel spend made within the 1st 30 days

- Annual fee waived off on Rs. 3.5 lakh annual spends and up to 15% off on dining via EazyDiner

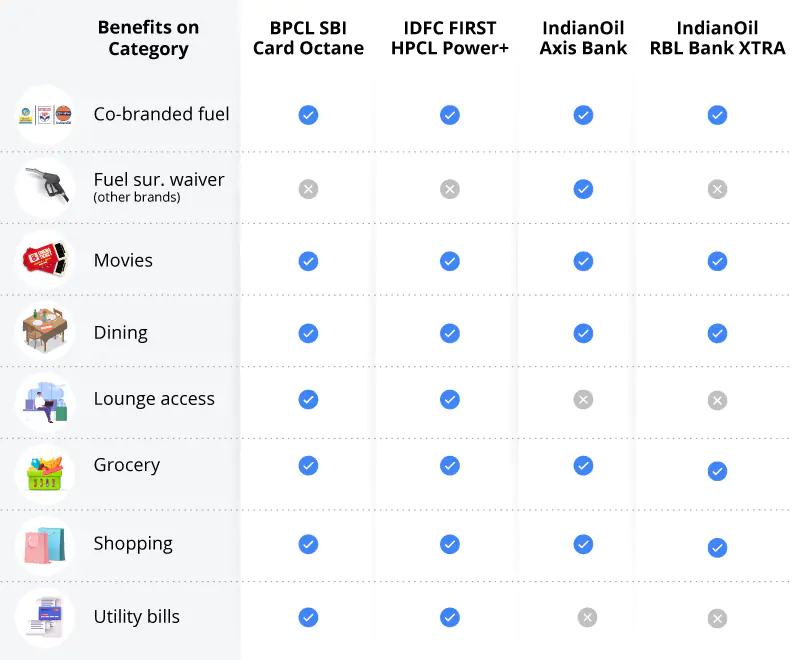

Currently, these four are the most popular and rewarding fuel credit cards in the market based on the savings potential on fuel and even non-fuel spends. You should choose a card that matches well with your spending patterns and aligns the most with your preferences. To make the right choice, keep the following things in mind:

2 Comments

madam/sir,

i am using axis bank fuel credit card.but u have told when 50000 spend on purchases we r eligible ti waive off annual subsription of rs 500.my query is can i purchase apple mobile 16 proutilising this card.

Yes, you can use your IndianOil Axis Bank Credit Card to purchase Apple iPhone 16, provided it is within your available credit limit. You can also opt for the EMI facility and pay in easy monthly installments. Also, if you have IndianOil Axis Bank Credit Card, the annual fee waiver condition has been revised. Effective 20th April 2024, the annual spending threshold for the waiver has increased from Rs. 50,000 to Rs. 3.5 Lakh.