For years, HDFC credit cardholders have been maximizing their benefits through the SmartBuy portal—earning accelerated rewards and redeeming them across multiple categories. Now, with iShop, ICICI Bank credit cardholders can also get a similar experience and accelerated value-back.

Through iShop, ICICI cardholders can earn up to 12X rewards on hotel bookings and 6X on flight bookings and shopping vouchers, putting it in direct competition with SmartBuy. Reward points can be redeemed for travel bookings at a 1:1 ratio, giving meaningful returns. However, this platform currently does not support air mile conversions, and its overall redemption options are comparatively narrower.

So, does iShop truly measure up to SmartBuy? Let’s find out.

What is iShop?

What is iShop?

ICICI Bank’s iShop is a rewards-based shopping and travel portal that aims to compete directly with HDFC Bank’s SmartBuy. ICICI cardholders can earn accelerated rewards on iShop spends, similar to the benefits that HDFC cardholders can avail through SmartBuy. Moreover, accumulated reward points can be redeemed for travel bookings through iShop at a 1:1 ratio.

However, these benefits vary from card to card, with premium card users being able to maximize their rewards through this portal. For example, ICICI Emeralde Private Credit Cardholders can earn up to 18% rewards on flight bookings or shopping vouchers and 36% on hotel bookings through iShop. Similarly, ICICI Times Black cardholders can earn 12% rewards on flights/vouchers and 24% on hotel bookings.

Reward Benefits

Here is a list of popular ICICI Bank Credit Cards along with their reward rates across different categories on iShop:

| Credit Card | General Reward Rate | Reward Rate on Flights/ Vouchers (6X) | Reward Rate on Hotel Bookings (12X) |

| Emeralde Private Metal | 3% | 18% | 36% |

| Times Black | 2% | 12% | 24% |

| Diamant World | 0.75% | 4.5% | 9% |

| Emeralde | 1% | 6% | 12% |

| Other ICICI Credit Cards* | 0.75% | 3% | 6% |

| Co-branded Credit Cards** | – | 4% | 4% |

Capping on Reward Points

While ICICI cardholders can maximize their benefits through the iShop portal, there is a monthly capping on each card that you should keep in mind to make the most of these benefits:

| Credit Card | Maximum Capping Per Month |

| Emeralde Private Metal | 18,000 Points |

| Times Black | 15,000 Points |

| Diamant World | 12,000 Points |

| Emeralde | 12,000 Points |

| Other ICICI Credit Cards* | 9,000 Points |

| Co-branded Credit Cards** | Rs. 1,100 Cashback |

In addition to the above table, accelerated rewards on Flipkart and Amazon vouchers are capped at Rs. 12,000 per month.

As per the above table, Emeralde Private cardholders can maximize their benefits by spending Rs. 1 Lakh on flight bookings/vouchers or Rs. 50,000 on hotel bookings. Similarly, the table below shows the required spends for some of the popular ICICI credit cards to maximize reward points:

| Credit Card | Spends Required for Flights/ Vouchers | Spends Required for Hotel Bookings |

| Emeralde Private Metal | Rs. 1 Lakh | Rs. 50,000 |

| Times Black | Rs. 1.25 Lakh | Rs. 60,000 |

| Diamant World | Rs. 2.60 Lakh | Rs. 1.30 Lakh |

| Emeralde | Rs. 2 Lakh | Rs. 1 Lakh |

| Other ICICI Credit Cards* | Rs. 3 Lakh | Rs. 1.5 Lakh |

| Co-branded Credit Cards** | Rs. 27,500 | Rs. 27,500 |

Redemption Options

ICICI Credit Cardholders can redeem reward points against travel bookings, including flights, buses, hotels, and e-vouchers of top brands through the iShop portal. However, there is a maximum limit on redeeming rewards against each category, which is mentioned below:

- Flights: Up to 95% of points can be redeemed at a value of 1 Point = Rs. 1

- Hotels: Up to 90% of points can be redeemed at a value of 1 Point = Rs. 1

- eVouchers: Up to 50% of points can be redeemed at a value of 1 Point = Rs. 0.60

With the addition of iShop, ICICI cardholders can now redeem their reward points across two portals – iShop and the general rewards portal. However, a reward redemption fee of Rs. 99 will be applicable for all redemptions, except for ICICI Private Emeralde Metal and ICICI Times Black Credit Cardholders.

Where It Falls Short?

While iShop offers a straightforward 1:1 redemption ratio and accelerated rewards, the portal falls short as it does not allow the conversion of accumulated rewards into airmiles. Therefore, adding partner airlines or hotels can help ICICI cardholders maximize their benefits through this portal.

Additionally, while HDFC’s SmartBuy portal was designed to cater to all card users, ICICI’s iShop primarily benefits premium cardholders, such as Emeralde Private Metal or Times Black, making it difficult to extract similar value from entry-level or mid-range cards.

Value Back Comparison of Premium Cards

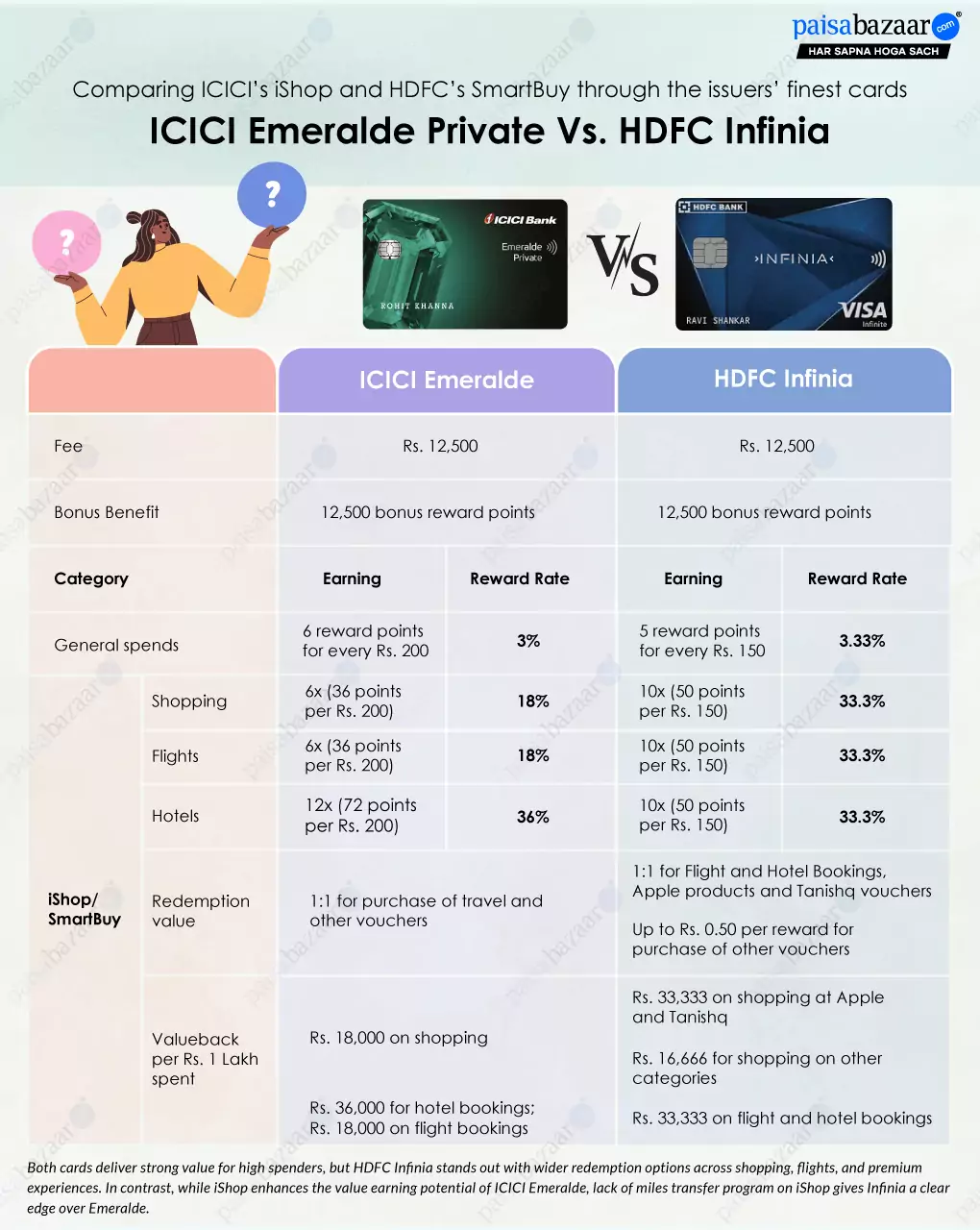

Let’s compare two of the premium cards, ICICI Emeralde Private and HDFC Infinia, to see how much value back these cards offer on their respective rewards portals, iShop and SmartBuy:

Most ICICI credit cards have lagged in the rewards race, largely due to their low earning rates—even mid-range options like Sapphiro and Rubyx offer below-average value for the annual fee charged. However, with iShop, ICICI cardholders now have an opportunity to earn accelerated rewards on flights, hotels, and vouchers—especially those with premium cards like the Emeralde Private or Times Black. Still, the lack of air mile conversion keeps it a step behind HDFC’s more versatile platform- SmartBuy. It remains to be seen whether ICICI Bank’s iShop will continue to improve and close that gap.

*Include cards, such as Sapphiro, Coral, HPCL Super Saver, Rubyx, Parakram, Manchester United and more.

**Include cards, such as Amazon ICICI, Adani, Emirates, MakeMyTrip, etc.