Festivals are around the corner and so are the amazing offers and discounts of the festive season. India has seen a huge shift in the way people make purchases these days. There has been a huge increase in online purchases owing to the confidence built by eCommerce giants like Amazon and Flipkart. Pay on Delivery (PoD) is a major reason for this confidence building. However, PoD orders have the least conversion rate and EMIs have the highest conversion.

Almost all eCommerce portals provide No Cost EMIs on credit cards on a range of products. It enables the portals as well as banks to increase the purchasing power of buyers and giving them the opportunity to purchase high-value products even if they do not have savings to spare for it. In this article, we will find out everything about no cost EMIs and how can one benefit from it.

What is No Cost EMI?

No Cost EMI or Zero Cost EMI is an equated monthly instalment scheme where the buyer has to pay for a purchased product at the listed price in small EMIs every month at no extra cost. No interest or processing fee is charged from the customer.

No cost EMIs are applicable for a tenure of 3, 6 or 9 months. In some cases, it can go up to 1 year as well.

How No Cost EMIs Work?

As it is clear that No Cost EMIs are EMIs where the buyer does not have to pay in excess to the listed price at the store or the website, one may wonder where does the interest component or the processing fee component goes.

EMIs consists of two components –

- Interest component

- The actual cost of purchase

Interest waiver – There are instances where the interest of EMIs is waived off completely. In this case, the interest amount that has to be charged is paid off by the seller or the bank and the interest amount is then adjusted in the selling price of the product keeping the listed price and total amount after EMIs the same.

Note: Some retailers might replace the term “interest” with a “Processing Fee”. This is not an example of No cost EMI. A true No cost EMI would just have an interest waiver with no additional charge imposed by the seller/retailer.

How to Apply for No Cost EMIs Online?

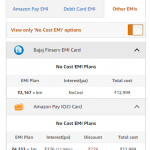

When you shop for an appliance or product online, you get the No Cost EMI option in the offers section. If there is no such offer present, it means that the seller has not listed it for No Cost EMIs. You just have to add the product to the cart and proceed for the payment.

Now you have to select the card (both debit and credit card) on which the No Cost EMI offer is applicable. You will get the option to select tenure for EMIs. If you select the tenure that falls under the No Cost EMI criteria, your payment will be done. The total amount of the product will be deducted from your credit card.

Now you have to select the card (both debit and credit card) on which the No Cost EMI offer is applicable. You will get the option to select tenure for EMIs. If you select the tenure that falls under the No Cost EMI criteria, your payment will be done. The total amount of the product will be deducted from your credit card.

It takes up to 3 days for an EMI request to be processed. Once processed, the credit limit on your credit card for that amount would be blocked. The EMI amount and applicable GST would reflect in your monthly statement and the amount you pay would be unblocked every month and would clear out finally when you pay the last instalment.

How to Get No Cost EMIs Offline?

Offline stores, retailers and supermarkets have also grabbed the No Cost EMI facility with both hands. When you purchase a product at those stores, you have to ask the seller whether the product is available for No Cost EMIs or not. If available, choose the option for zero-cost EMI for the longest possible tenure and pay using your credit card.

No Cost EMIs are now available with many credit cards. Some of the major credit cards offering No Cost EMIs are – Amazon Pay ICICI credit card, HDFC Diners Club Rewardz credit card, SBI SimplySAVE credit card, Axis Bank MyZone credit card, etc.

The Science behind Zero Cost EMIs

The science behind zero cost EMI is very simple. The amount listed on the product is the total amount you need to pay eventually. If you select tenure of 3 months, the amount is divided into 3 equal parts and you have to pay the instalment every month.

For example, if you buy a refrigerator worth Rs. 30,000 on No Cost EMI for 3 months from Amazon, you have to pay principal and interest every month. The total order value is Rs. 30,000 and the interest cost is Rs. 638 at a rate of 13%. The interest of Rs. 638 is the instant discount offered to the buyer as part of the no cost EMI plan. It is worth mentioning that the bank charges GST at 18% on the interest amount which is payable by the buyer to the bank.

| Instalment | Monthly Instalment | Interest Amount(@ 13%) | Principal Amount |

| 1st Installment | Rs. 10,000 | Rs. 318* | Rs. 9,682 |

| 2nd Installment | Rs. 10,000 | Rs. 213* | Rs. 9,787 |

| 3rd Installment | Rs. 10,000 | Rs. 107* | Rs. 9,893 |

| Total | Rs. 30,000 | Rs. 638* | Rs. 29,362 |

*GST Extra

Here, the buyer will have to pay 3 monthly instalments of Rs. 10,000 each. The principal for the first month comes to Rs. 9,682 and the interest paid is Rs. 318 amounting to a total of Rs. 10,000.

In the second month, the principal amount is Rs. 9,787 and the interest amount is Rs. 213 whereas he principal and interest for the third month are Rs. 9,893 and Rs. 107 respectively.

| Order Cost/List Price | Rs. 30,000 |

| Interest Amount* | Rs. 638 |

| No Cost EMI Discount | Rs. 638 |

| Monthly Installment | Rs. 10,000 |

*GST applicable at 18% on the interest amount only.

Initially, Rs. 30,000 from you credit limit will be blocked and it will keep on getting cleared by Rs. 10,000 every month till you pay off the last instalment.

Should you go for No Cost EMIs?

No Cost EMI is a lucrative deal and it actually is a great option if you want to make any high-value purchase. Longer the tenure more is the interest discount on your purchase. It is always a better option to choose the tenure of 9 months instead of 3 months as you get more time to repay your loan and have less financial burden every month.

Normally, banks charge EMIs at a rate of 13% to 18%. When one purchases a product at no cost EMI, he saves the additional interest. In case you are planning to buy appliances or electronics this festive season, you should look out for No Cost EMI first and if it is not available, try searching your product offline for no cost EMI. If the product is not available at No Cost EMI, you can look out for the maximum discount that is offered on the product.