Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

If you own a debit or a credit card, you must have used it at an ATM or a POS. However, not being vigilant during ATM withdrawals or POS transactions can pose the risk of a card fraud called skimming. Read on to find out how to protect your cards from skimming frauds.

Lately, it has become much easier to carry out financial transactions using your debit cards and credit cards. However, with advancement in technology, fraudulent ways to dupe people are also on the rise. Among many prevalent financial frauds, credit card skimming is quite common these days. This fraud involves stealing an individual’s card information via an ATM or a POS machine at fuel stations, merchant stores etc., using a skimmer – a small device attached to the payment terminal.

Therefore, it is important that card users remain vigilant and cautious of such incidents even when using their card for regular purpose. Credit card skimming can easily be avoided by paying little attention, otherwise it could lead to financial loss that you might not even be aware of immediately. For your help, we have covered important details on credit card skimming to help you understand what it is and how it can be avoided.

What is Credit Card Skimming?

Credit card skimming is a financial fraud where scammers install a device on card terminals of ATM and PoS to extract the user’s card information. The skimming devices are installed in a way that they look like parts of a machine and are difficult to spot. These record your card information by reading the magnetic strip to derive information like full name, credit card number, Cvv and expiry date. Additionally, a small camera might also be installed near the keyboard to record your card PIN as you enter it.

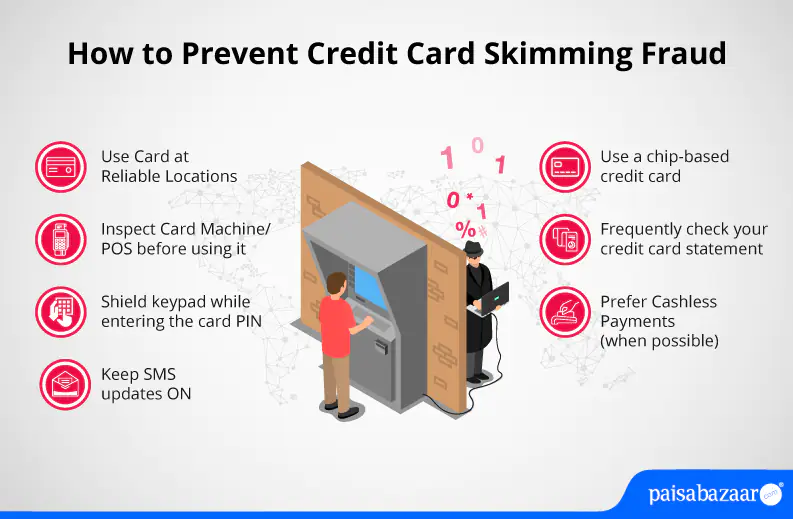

To avoid the credit card skimming fraud, you can ensure the following:

Use your Card at Reliable Locations

To safeguard your credit card from data skimming, ensure using your card at ATMs located inside bank branches or at well-lit areas that are under CCTV surveillance cameras. These locations are less likely to have tinkered machines, thereby are comparatively safe and secure than those located at isolated or shady locations. Similarly, for PoS transactions use your card at reliable and authorized merchants and stores at prime locations, instead of remote areas or with uncertified merchants. Also, ensure that the card is swiped for the exact amount as your transaction value, in your presence and is not taken away from your sight.

Examine the ATM/PoS

Before using the card for cash withdrawal at an ATM or for a merchant payment at a PoS, it is advisable to inspect the machine carefully. Here, try to look for visible signs of tampering if any, such as loose, damaged or broken parts, unusual or haywire devices, wires and extension, or for anything that feels inappropriate or out of order. If anything is ill-suited or improper, you must immediately switch to a different mode of payment like UPI or cash.

Protect your Card PIN

Just as you should protect your card PIN from fraudsters over fake calls, you should also protect it while physically entering it at an ATM or PoS. It is better to guard the keypad by covering it with your hands. This will avert hidden cameras to record the keypad, and thereby your entered PIN. Additionally ensure that the person next in line is standing far from you, so that the PIN is not visible to him or her.

Switch to Contactless Payments

Credit cards now come with the ‘contactless’ feature where you can make transactions up to Rs. 5,000 without entering the card PIN. Thus, eliminating the need to provide your card to the POS machine. Therefore, opting for contactless payments enhances security by shielding the card from skimming fraud, since no contact with the machine limits the data theft via skimming devices.

Use a Chip-based updated Credit Card

Credit card issuers now offer chip-based credit cards that come with enhanced security in comparison to the previously issued magnetic strip credit cards. Thereby, to avoid chances of data skimming ensure using an up-to-date credit card that is feature loaded with latest security and safety measures.

Keep an eye on the Card Statements

Regularly keeping a check on your card statement and transaction history will help you identify and spot any counterfeit transaction done on your card. If you recognize anything inappropriate or false, you can immediately contact your card issuer for resolving it or can take appropriate measures to shield your card from such transactions in future.

Keep SMS Updates ON

While keeping your card statement in check is a healthy financial practice, sometimes it could be tedious especially with a busy schedule. Thereby, to avoid fraudulent transactions and delayed rectification, it is better to keep SMS updates ON for your card. This will help you observe your card transactions feasibly. Thus, helping you to identify frauds immediately.

Fuel Stations, Merchant Outlets & Restaurants: Credit card skimming at these places could happen when making payment via a POS machine. Skimmers could be installed at the card insertion tab or an artificial keypad could be placed over the original one to record your keystrokes.

ATM Machines: When withdrawing cash be cautious of skimmers installed on the ATM machines at the card slots or a small camera placed over the keyword to record your card PIN. At ATMs, also be cautious of shoulder surfing, and ensure that the next person in queue does not see your card details on the screen or the PIN when you enter it.

Unsolicited Loans: Using your card details, a fraudster can duplicate a credit card account and then can raise an unsolicited loan request against your credit card on your name.

Unauthorized Purchases: Scammers can also make unauthorized purchases online using your card details if they have what is needed to make a card transaction- card number, CVV, expiry date, name on the card and PIN.

Clone Credit Card: Using the card information, fraudsters can also create a replicated clone credit card and can use it for making offline purchases across merchants and retail stores. The details can also be shared with third parties, who can further misuse it.

In case you notice an unauthorized transaction on your credit card statement it must immediately be reported to the card issuer. Generally, credit cards come with covers like zero lost card liability, credit shield cover etc, thus, reporting fraudulent incidents to issuers within the stipulated time can help you get a rational resolution.

You may contact your issuer via contacting the credit card customer care center, available on the issuer’s website or on your card statement. You can also resort to SMS banking numbers for blocking your card or for immediate fraud resolution. For reporting frauds, ensure keeping important details handy such as date and time of the concerned transaction, Location of the transaction, amount, and card details.

With the rise in credit card usage and unfortunately a corresponding rise in digital frauds, it has become important to protect your card from potential frauds and financial threats. While it is crucial to keep the above protective measures in place to shield your card, what is equally important is to safeguard your card virtually. For your help, Paisabazaar now provides the ‘Wallet Protect Service’ to add an additional layer of security to your credit card and overall financial well being.

With this service you have access to a single call block feature, that is helpful for immediate resolution on losing your card physically and in case of data theft due to frauds like card skimming. Additionally, not just credit cards you are also covered for frauds related to UPI and mobile wallet. Availing the wallet protect service will definitely enhance your financial well-being by shielding you from rising financial thefts and frauds, securing not just your money, but also your overall well being that can be largely impacted due to a financial loss.