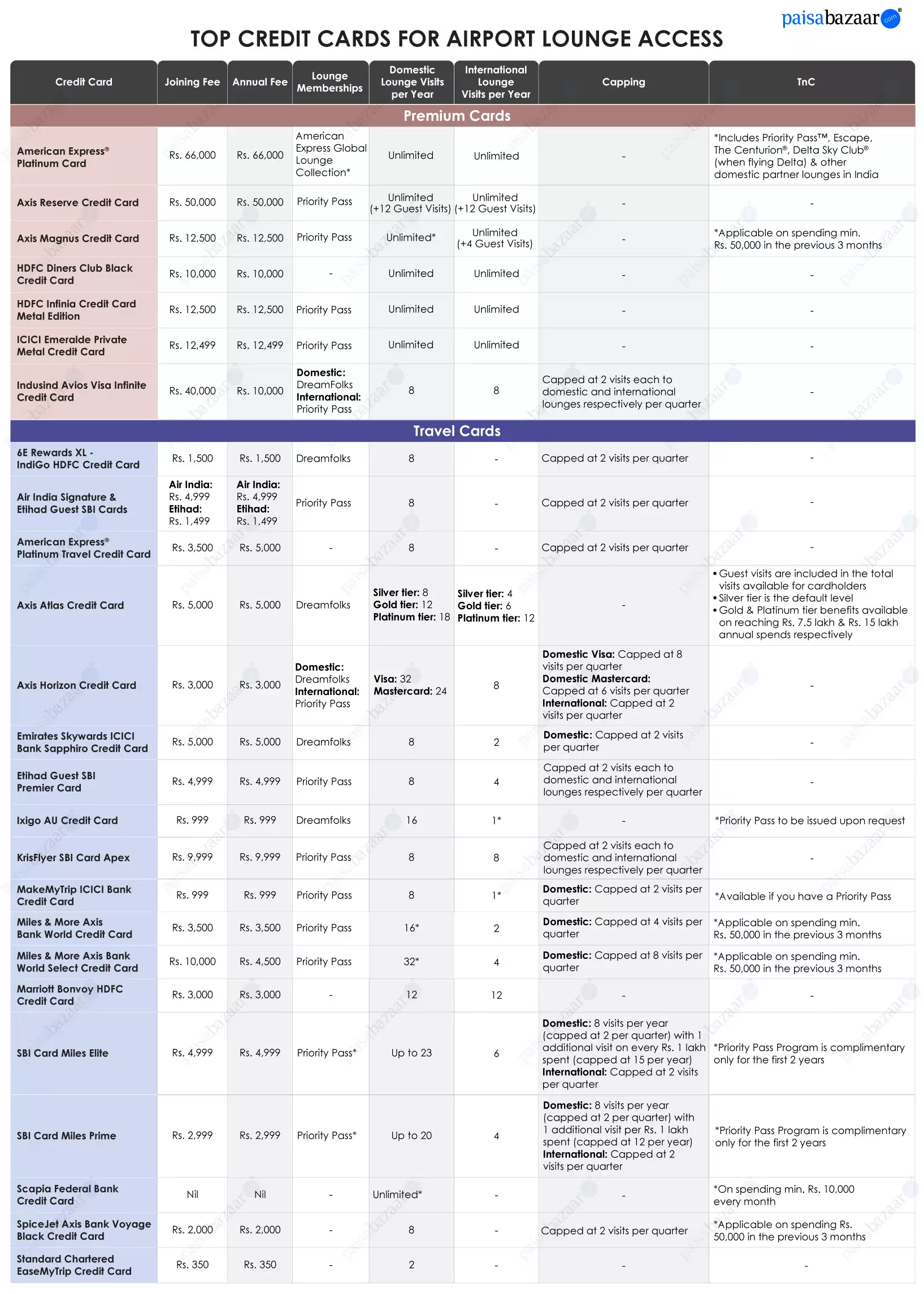

Credit cards offer many benefits to help you make your travels cheaper and more convenient. Among these, complimentary airport lounge access is a common feature that helps users avail free access to select lounges at domestic and international airports. Lounge access features are not limited to travel credit cards several all-rounder cards also provide free lounge access as an additional benefit. However, the number of free lounge visits in a year varies from card to card. Read on to know about the best credit cards with airport lounge access in India.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

Top 10 Airport Lounge Access Credit Cards in India for April 2025

Listed below are the best lounge access credit cards in India. Readers should note that travel-focused credit cards have been given priority in this list, followed by cards with more all-rounder benefits.

While the travel cards in the list are good on the lounge access front, some of them may lack on overall travel benefits.

| Credit Card | Annual Fee | Lounge Access* |

| Axis Atlas Credit Card | Rs. 5,000 | Up to 12 international and up to 18 domestic lounge visits in a year |

| Axis Horizon Credit Card | Rs. 3,000 | 8 international lounge visits and up to 32 domestic lounge visits in a year |

| IndusInd Bank Avios Visa Infinite Credit Card | Rs. 10,000 (Joining Fee: Rs. 40,000) |

8 domestic and 8 international lounge visits every year |

| SBI Card Miles Elite | Rs. 4,999 | Up to 23 domestic lounge visits and 6 international airport lounge visits in a year |

| Federal Bank Scapia Credit Card | Nil | Unlimited domestic airport lounge visits |

| Ixigo AU Credit Card | Rs. 999 | 16 domestic airport lounge visits and 1 international lounge visit in a year |

| YES Bank Marquee Credit Card | Rs. 4,999 (Joining Fee: Rs. 9,999) |

Up to 24 domestic lounge visits in a year (for primary and add-on users) and unlimited international lounge visits in a year |

| HDFC Regalia Gold Credit Card | Rs. 2,500 | 12 domestic lounge visits and 6 international lounge visits in a year |

| AU Zenith+ Credit Card | Rs. 4,999 | 16 international and 16 domestic lounge visits in a year |

| Axis Bank SELECT Credit Card | Rs. 3,000 | Up to 12 international lounge visits and 8 domestic lounge visits every year |

*Lounge access benefit may be subject to meeting certain spend-based milestones or other terms and conditions. Refer to the details below for each card.

13 Comments

I frequently travel overseas for business purposes. Can you suggest the best credit card for lounge access at international airports?

Some of the best credit cards for international lounge access are HDFC Regalia Gold, AU Zenith+, Axis Select and YES Marquee Credit Card. You can also avail other travel benefits like domestic lounge access, low forex mark-up fee, etc., depending on the card you choose.

How can a minor and infant access the lounge benifit, and which card offers add-ons member?

Policies regarding the complimentary lounge access benefits extended to children may vary from lounge to lounge. Generally, infants below 2 years of age are allowed free access, and minors get a discounted entry. However, some lounges may not offer such benefits to children and may charge you full. It is advisable to check the applicable terms and conditions on the respective airport lounge’s website, or you may confirm the same at the entry counter.

Complimentary membership for add-on members is usually available on premium cards like HDFC Infinia, Axis Magnus, etc.