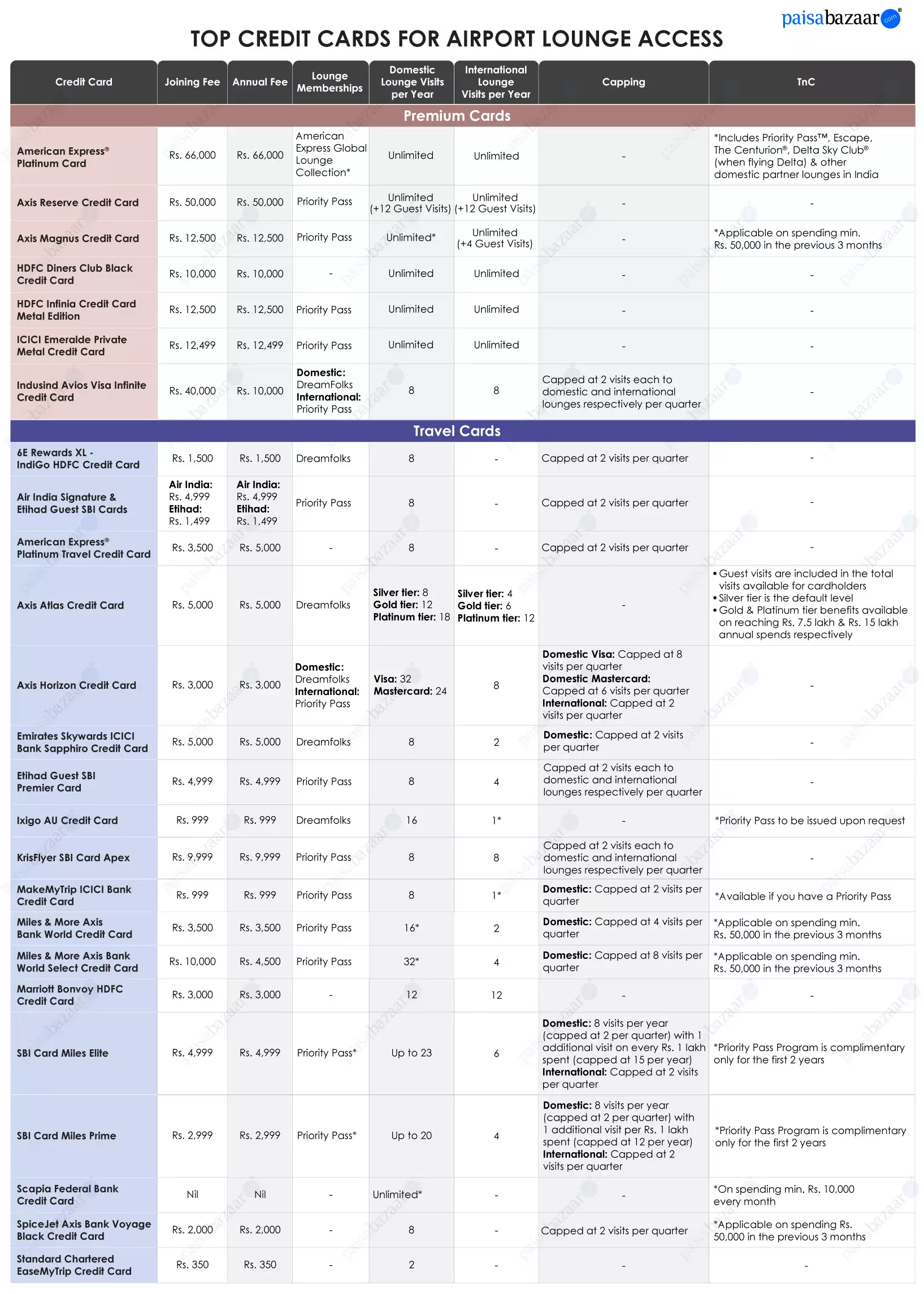

Credit cards offer many benefits to help you make your travels cheaper and more convenient. Among these, complimentary airport lounge access is a common feature that helps users avail free access to select lounges at domestic and international airports. Lounge access features are not limited to travel credit cards several all-rounder cards also provide free lounge access as an additional benefit. However, the number of free lounge visits in a year varies from card to card. Read on to know about the best credit cards with airport lounge access in India.

Exclusive Card Offers from India’s top banks are just a click away

Error: Please enter a valid number

Top 10 Airport Lounge Access Credit Cards in India for April 2025

Listed below are the best lounge access credit cards in India. Readers should note that travel-focused credit cards have been given priority in this list, followed by cards with more all-rounder benefits.

While the travel cards in the list are good on the lounge access front, some of them may lack on overall travel benefits.

| Credit Card | Annual Fee | Lounge Access* |

| Axis Atlas Credit Card | Rs. 5,000 | Up to 12 international and up to 18 domestic lounge visits in a year |

| Axis Horizon Credit Card | Rs. 3,000 | 8 international lounge visits and up to 32 domestic lounge visits in a year |

| IndusInd Bank Avios Visa Infinite Credit Card | Rs. 10,000 (Joining Fee: Rs. 40,000) |

8 domestic and 8 international lounge visits every year |

| SBI Card Miles Elite | Rs. 4,999 | Up to 23 domestic lounge visits and 6 international airport lounge visits in a year |

| Federal Bank Scapia Credit Card | Nil | Unlimited domestic airport lounge visits |

| Ixigo AU Credit Card | Rs. 999 | 16 domestic airport lounge visits and 1 international lounge visit in a year |

| YES Bank Marquee Credit Card | Rs. 4,999 (Joining Fee: Rs. 9,999) |

Up to 24 domestic lounge visits in a year (for primary and add-on users) and unlimited international lounge visits in a year |

| HDFC Regalia Gold Credit Card | Rs. 2,500 | 12 domestic lounge visits and 6 international lounge visits in a year |

| AU Zenith+ Credit Card | Rs. 4,999 | 16 international and 16 domestic lounge visits in a year |

| Axis Bank SELECT Credit Card | Rs. 3,000 | Up to 12 international lounge visits and 8 domestic lounge visits every year |

*Lounge access benefit may be subject to meeting certain spend-based milestones or other terms and conditions. Refer to the details below for each card.

13 Comments

What is meant by “International lounge access “? Is it access to lounges in the International departure section of Indian airports, or access to lounges in airports outside India?

With credit cards, you can get access to both- lounges at select international airports and lounges at the international departure section of select domestic airports. The list of participating lounges, however, varies from card to card. Issuers update the list of eligible lounges from time to time, thus we advise you to check the list of participating lounges before visiting.

how to count airport lounge period of quarter month to month are Usage date

For lounge access, usage period is generally based on calendar months and calendar quarters, irrespective of when you open the card account. For example, if you get a new card in February, the quarterly benefit will end in March (considering the Jan-Feb-Mar quarter). However, this might vary from card to card or issuer to issuer; you may reach out to your card provider for more clarity around this.

I have both visa and rupay Canara debit card can I get access in airport launge

For details on debit cards that offer complimentary lounge access, visit this page- https://www.paisabazaar.com/debit-card/best-airport-lounge-access-debit-cards/

Which credit card having min 4 domestic and 2 international lunge access with0ut any annual charges

Generally, credit cards with complimentary airport lounge visits come with an annual fee which can range from Rs. 1,000 to Rs. 5,000 or even higher. However, there are credit cards with low or no annual fee which offer limited lounge access based on your card spends. You can consider IDFC FIRST Select Credit Card which is lifetime-free and offers 4 domestic airport lounge visits per quarter if you spend minimum Rs. 5,000 every month. MakeMyTrip ICICI Bank Signature Credit Card also offers 2 free domestic lounge visits per quarter on reaching quarterly spends of Rs. 5,000 and 1 international lounge visit in a year. Though the card carries no annual fee, it charges a one-time joining fee of Rs. 2,500.

Very well explained and compared. Good work, and thanks.