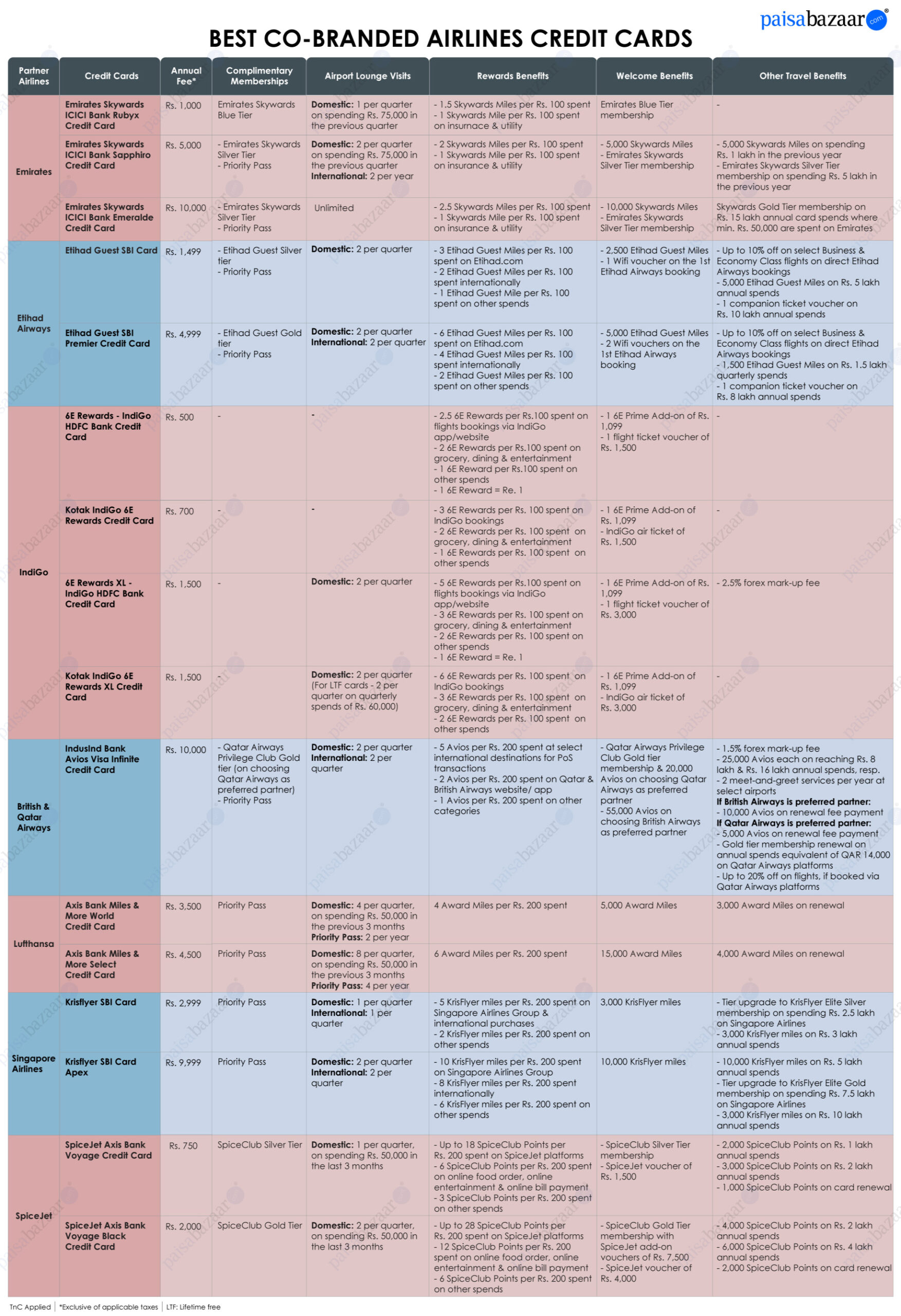

Whether for business or as a leisure activity, travel has become popular among the masses. Owing to this popularity, several airlines have also partnered with leading credit card providers to offer co-branded air travel credit cards to the customers. These airline credit cards come with several travel discounts, vouchers, frequent flyer privileges, lounge access and other related perks offered by the partner airline to make air travel more affordable and comfortable for the cardholders. Here’s a list of some of the top airline credit cards in India with their benefits and features:

Best Airline Credit Cards in India 2025

IndusInd Bank Avios Visa Infinite Credit Card

Joining fee: ₹40000

Annual/Renewal Fee: ₹10000

2X Avios on bookings at Qatar Airways & British Airways

Up to 50,000 bonus Avios as milestone benefit

Product Details

- 20,000 Avios and Gold Tier Membership as welcome benefits on choosing Qatar Airways as preferred partner

- Bonus 55,000 Avios as welcome benefit on choosing British Airways as preferred partner

- 5 Avios per Rs. 200 spent at select preferred international destinations for PoS transactions

- 2 international lounge visits per quarter with complimentary Priority Pass Membership

- 2 complimentary meet-and-greet services every year

6E Rewards XL Indigo HDFC Credit Card

Joining fee: ₹1500

Annual/Renewal Fee: ₹1500

Free IndiGo flight ticket worth Rs. 3,000 & Indigo 6E Prime Add-on

5% value-back as rewards on IndiGo website and mobile app

Product Details

- 5 6E Rewards per Rs. 100 spent on IndiGo website or mobile app

- 3 6E Rewards per Rs. 100 spent on dining, grocery, and entertainment spends

- 2 6E Rewards per Rs. 100 for all other retail spends

- 1 complimentary 6E Prime Add-On and Accor Hotel stay voucher as welcome benefit

- 8 complimentary domestic lounge visits in a year

Emirates Skywards ICICI Bank Rubyx Credit Card

Joining fee: ₹1000

Annual/Renewal Fee: ₹1000

1.5 Skywards Miles on every Rs. 100 spent

Complimentary Emirates Blue Tier Membership

Product Details

- 25% discount on movie tickets at BookMyShow & INOX

- Renewal of Blue Tier Membership on the payment of annual fee

- Exclusive dining offers via ICICI Bank Culinary Treats Programme

Kotak IndiGo 6E Rewards XL Credit Card

Joining fee: ₹1500

Annual/Renewal Fee: ₹1500

8 complimentary domestic airport lounge access per year

Up to 6% rewards on spends across different categories

Product Details

- Rs. 3,000 IndiGo ticket & Rs. 1,099 6E Prime add-ons as welcome gift

- 6 reward points per Rs. 100 spent on IndiGo flight

- 3 reward points per Rs. 100 spent on dining, grocery & entertainment

- 2 reward points per Rs. 100 spent on other categories

Etihad Guest SBI Card

Joining fee: ₹1499

Annual/Renewal Fee: ₹1499

Complimentary Etihad Guest Silver Tier Status

3X Etihad Guest Miles on spends at Etihad.com

Product Details

- 3 Etihad Guest Miles for every Rs. 100 spent on Etihad

- 2 Etihad Guest Miles for every Rs. 100 spent internationally

- Up to 10% discount on select Etihad Airways booking

- Free companion voucher on spending Rs. 10 Lakh

Top Airline Credit Cards in India for 2025

Below mentioned are the top 5 co-branded airline credit cards to help you save on travel expenses:

1. IndusInd Bank Avios Visa Infinite Credit Card

Joining Fee: Rs. 40,000

Annual Fee: Rs. 10,000

Key Features & Benefits:

- 5 Avios for every Rs. 200 spent at select preferred international destinations for PoS transactions

- 2 Avios for every Rs. 200 spent on Qatar Airways & British Airways website and app

- 1 Avios per Rs. 200 spent on online spends on select preferred international destinations, domestic & other international destinations and other categories

- 10% discount on flight bookings through Qatar Airways, on choosing Qatar Airways Privilege Club as the preferred airline loyalty programme

- 10% additional discount for Privilege Club members on all flights originating from India, if booked via Qatar Airways platform

- Low forex markup fee of 1.5%

- 2 international lounge visits in a quarter with complimentary Priority Pass membership

- 2 complimentary domestic airport lounge visits in a quarter

IndusInd Bank Avios Visa Infinite Credit Card is a premium card designed for frequent air travellers. What makes this card stand out is its exclusive partnership with Qatar Airways and British Airways, offering greater flexibility compared to general co-branded airline cards. Cardholders can earn accelerated rewards and benefits on their preferred airline and travel destinations, making it an excellent choice for international travellers. This credit card offers value back in the form of Avios Points, which are redeemable against flight bookings and travel-related expenses.

2. 6E Rewards XL IndiGo HDFC Credit Card

Joining Fee: Rs. 1,500

Annual Fee: Rs. 1,500

Key Features and Benefits:

- 5% 6E Rewards per Rs. 100 spent on IndiGo airlines

- 3% 6E Rewards per Rs. 100 spent on dining, grocery, and entertainment

- 2% 6E Rewards per Rs. 100 for all other retail spends

- Complimentary IndiGo air ticket worth Rs. 3,000 as a welcome benefit

- Complimentary Prime add-ons worth Rs. 1,099, including priority check-in, choice of seat, complimentary meal and quicker baggage assistance

- 8 complimentary domestic lounge access every year

- Low forex markup fee of 2.5%

Kotak IndiGo Ka-ching 6E Rewards XL Credit Card is an upgraded variant of Kotak IndiGo Ka-ching 6E Rewards Credit Card. This credit card offers value back on your spends in the form of 6E rewards. Cardholders can earn accelerated reward points on IndiGo as well as other day-to-day spends such as dining, entertainment, and groceries. The accumulated reward points can be redeemed on booking tickets via IndiGo. Overall, this credit card offers decent value for frequent travellers through a 6% reward rate on IndiGo spends, complimentary lounge access, and a free IndiGo airline ticket worth Rs. 3,000.

3. Emirates Skywards ICICI Bank Sapphiro Credit Card

Joining Fee: Rs. 5,000

Annual Fee: Rs. 5,000

Key Features & Benefits:

- Complimentary Emirates Silver Tier Membership

- 5,000 Skywards Miles on the payment of joining fee

- Renewal of Silver Tier Membership on spending Rs. 5 Lakh in a year

- 5,000 Skywards Miles on spending Rs. 1 Lakh in a year

- 2 Skywards Miles on every Rs. 100 spent

- 1 Skywards Mile on every Rs. 100 spent on insurance & utility

- 2 complimentary domestic lounge visits every quarter

- 2 complimentary international airport lounge visits and 2 spa sessions at select airports in India every year via Dreamfolks Pass

Emirates Skywards ICICI Bank Sapphiro Credit Card is tailored for frequent Emirates flyers, offering an array of travel-focused benefits. Cardholders can earn up to 2 Skywards Miles on every transaction, which can be redeemed for flight bookings or upgrades with Emirates. The card also offers complimentary domestic and international airport lounge visits, as well as complimentary spa sessions, making it an excellent choice for those who often fly internationally with Emirates. However, if you do not want to pay a high annual fee of Rs. 5,000, you can opt for the lower fee variant- Emirates Skywards ICICI Bank Rubyx Credit Card.

4. Kotak IndiGo Ka-ching 6E Rewards XL Credit Card

Joining Fee: Rs. 2,500

Annual Fee: Rs. 2,500

Key Features & Benefits:

- IndiGo Airline ticket worth Rs. 3,000 as a welcome benefit

- 6% rewards on IndiGo spends

- 3% rewards on merchant spends including dining, entertainment, grocery

- 2% rewards on all other spends excluding wallets

- 2 complimentary domestic airport lounge visits every quarter, adding up to 8 airport lounge access per year

- Complimentary 6E prime add-ons for priority check-in, choice of seat, complimentary meal, quicker baggage assistance, etc.

Kotak IndiGo Ka-ching 6E Rewards XL Credit Card offers benefits similar to the 6E Rewards XL Indigo HDFC Credit Card but comes with a higher annual fee of Rs. 2,500. It is an upgraded variant of the Kotak IndiGo 6E Rewards Credit Card and offers up to 6% value back on IndiGo spends. Additionally, the card offers accelerated benefits across everyday categories such as dining, entertainment, and groceries. Cardholders can redeem the accumulated reward points for booking tickets via IndiGo. Beyond rewards, the card enhances its overall value for frequent travellers with benefits like a free ticket worth Rs. 3,000, complimentary 6E Prime add-ons, and complimentary lounge access.

5. Etihad Guest SBI Card

Joining Fee: Rs. 1,499

Annual Fee: Rs. 1,499

Key Features & Benefits:

- 1 wifi voucher on first booking, 2,500 Etihad Guest Miles & Etihad Guest Silver tier status as welcome benefit

- 3 Etihad Guest Miles per Rs. 100 spent on Etihad.com

- 2 Etihad Guest Miles for every Rs. 100 spent internationally

- Up to 10% off on select Business Class & Economy Class flight bookings

- 1 companion voucher on spending Rs. 10 Lakh

- 5,000 Etihad Guest Miles on annual spends of Rs. 5 Lakh

- 8 complimentary domestic lounge visits every year

- Complimentary Priority Pass Membership

Etihad Guest SBI Card offers exclusive travel benefits on Etihad airlines through which you can save up to 10% on your bookings and also earn Etihad Guest Miles on every spend. The earned Guest Miles can be redeemed against flight bookings as well as hotel stays across the world. The annual fee can also be reversed on annual sends of just Rs. 3 lakh which is quite easy to achieve for an average spender. Bonus miles as welcome and milestone benefits also increase your travel savings. These features make this card suitable for those searching for a travel credit card for their international travels that comes at an affordable card fee.