Choosing the right shopping credit card can make a significant difference when it comes to getting the most out of your shopping. From cashback on purchases to exclusive discounts and additional perks, these credit cards cater to the diverse needs of consumers. Shopping credit cards offer numerous deals, discounts, cashback, and reward points to users every time they shop at stores or online. To help you find the best shopping credit cards, we have listed the top online as well offline shopping credit cards in India for 2025, from the below cards you can easily compare & apply credit cards.

Best Credit Cards for Online Shopping in India

YES Bank Paisabazaar PaisaSave Credit Card Joining fee: ₹0 Annual/Renewal Fee: ₹499 3% Cashback Points on e-commerce spends, max. 5,000 points/month Unlimited 1.5% Cashback Points on all other spends, including UPI Product Details Cashback SBI Card Joining fee: ₹999 Annual/Renewal Fee: ₹999 5% cashback on all online spends 1% cashback across all offline spends Product Details Amazon Pay ICICI Credit Card Joining fee: ₹0 Annual/Renewal Fee: ₹0 Up to 5% cashback on Amazon purchases 1% cashback across all offline spends Product Details Flipkart Axis Bank Credit Card Joining fee: ₹500 Annual/Renewal Fee: ₹500 5% cashback on transactions at Flipkart and Cleartrip 4% cashback on partner merchants, like Swiggy, PVR, Uber, etc. Product Details Myntra Kotak Credit Card Joining fee: ₹500 Annual/Renewal Fee: ₹500 7.5% off up to Rs. 750 per transaction on Myntra Unlimited 1.25% cashback on other spends Product Details HDFC Millennia Credit Card Joining fee: ₹1000 Annual/Renewal Fee: ₹1000 5% cashback on Amazon, BookMyShow, Flipkart, Myntra, Zomato & more 1% cashback on spends at other categories Product Details HDFC MoneyBack+ Credit Card Joining fee: ₹500 Annual/Renewal Fee: ₹500 10X CashPoints on Flipkart, Amazon, Swiggy, Reliance Smart SuperStore & BigBasket 5X CashPoints on EMI transactions at select merchants Product Details American Express SmartEarn™ Credit Card Joining fee: ₹495 Annual/Renewal Fee: ₹495 10X* Membership Rewards® Points on Zomato, Flipkart, Myntra, etc. 5X* Membership Rewards® Points on spends at Amazon Product Details SBI SimplyCLICK Credit Card Joining fee: ₹499 Annual/Renewal Fee: ₹499 10X reward points on top online brands - BookMyShow, Swiggy, Myntra, etc. 5X reward points on other online spends Product Details

Know More

Know More

Know More

Know More

Know More

Know More

Know More

Know More

Know More

Best Credit Cards for Offline Shopping in India

Axis Bank SELECT Credit Card Joining fee: ₹3000 Annual/Renewal Fee: ₹3000 2X EDGE Reward Points acrosss all retail transactions 10,000 EDGE Reward Points worth Rs. 2,000 as welcome benefit Product Details HDFC Regalia Gold Credit Card Joining fee: ₹2500 Annual/Renewal Fee: ₹2500 5X reward points on Nykaa, Myntra, Marks & Spencer and Reliance Digital 4 reward points per Rs. 150 across all retail spends Product Details SBI Card PRIME Joining fee: ₹2999 Annual/Renewal Fee: ₹2999 5X reward points on dining, groceries, departmental stores, and movies 8 international Priority Pass & 4 domestic airport lounge visits per year Product Details Tata Neu Plus HDFC Credit Card Joining fee: ₹499 Annual/Renewal Fee: ₹499 Up to 7% value back on Tata Neu spends 4 domestic lounge access per year Product Details Reliance SBI Card Joining fee: ₹500 Annual/Renewal Fee: ₹500 Multi-brand benefits Accelerated rewards on dining and movies Product Details Lifestyle Home Centre SBI Card SELECT Joining fee: ₹1499 Annual/Renewal Fee: ₹1499 5X Reward Points on Home Centre, Lifestyle, Max, Spar, dining & movies Up to 34,400 Reward Points worth Rs. 8,600 as milestone benefits Product Details

Know More

Know More

Know More

Know More

Know More

Know More

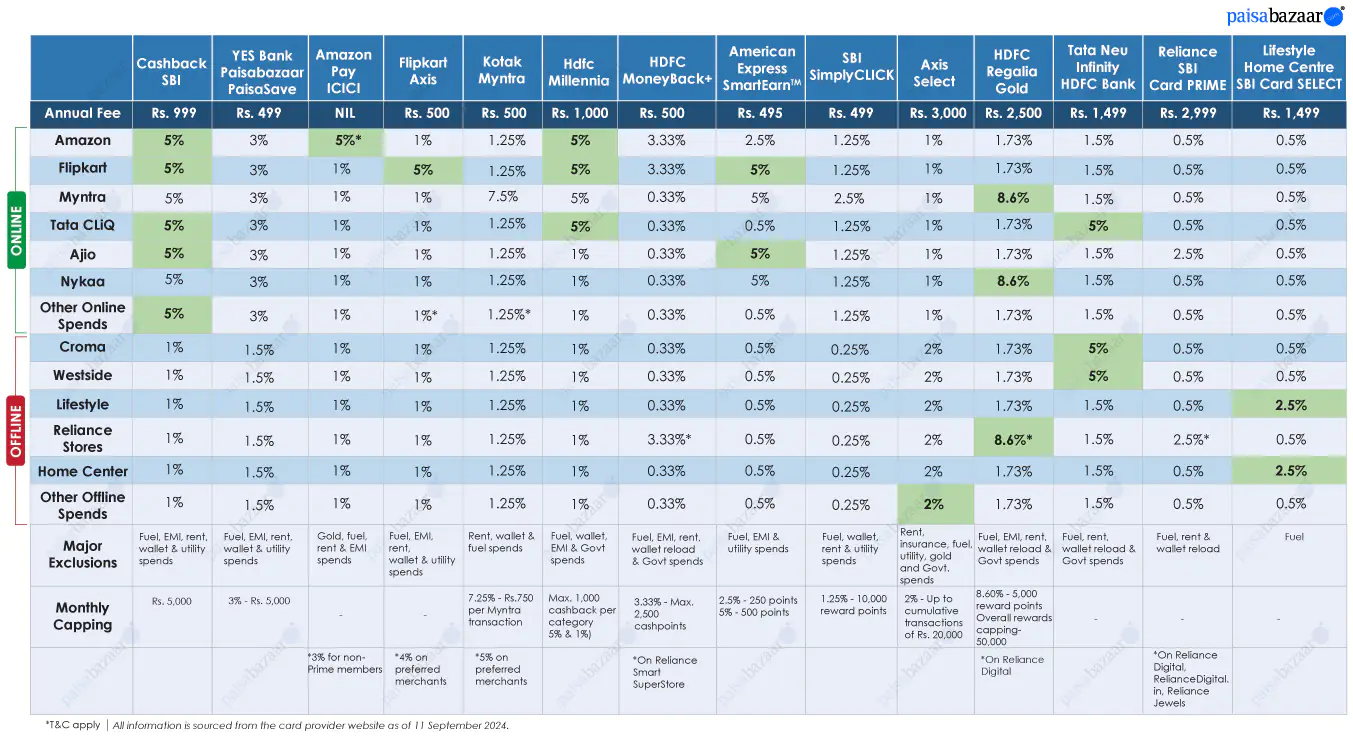

Value-back Comparison: Top Shopping Credit Cards

To help you find the right card, here we have compiled the value-back offered best credit cards in India for shopping around popular online and offline shopping brands. Look for a card that can help you earn substantial returns on your major purchases, justifying the fee you pay and benefits you derive as aligned with rewards capping and exclusions.

How to choose the right shopping credit card?

Different people have different shopping needs. For instance, some would prefer e-commerce platforms over stores, while others would have preferences even among these online shopping websites.

Your choice of the right shopping card will depend on how you plan to use the credit card. We have categorized the shopping credit cards above based on what category they are best suited for.

Once you have decided why you need the card and have shortlisted a few, the next step would be a comparison of those cards on the following grounds:

- Flexibility of Benefits (Cashback/Reward redemption process)

- Final Value Back (Cashback percentage/Rewards value in Rupee)

- Annual Fee

- Welcome Gift/ Sign-up Bonus

2 Comments

I need for shopping credit card like ICICI amazon credit card

Hi Yagya,

If you are looking for a co-branded card- Flipkart Axis Bank Credit Card and Citi Paytm FIRST Cards can be good options. However, these cards are suitable only for those who shop frequently with Flipkart or Paytm.

If you do not prefer a particular website and wish to get cashback on all purchases, consider the following cards-

HDFC Millennia Credit Card

HSBC Cashback Credit Card

Citi Cashback Credit Card