While credit cards have become quite a common financial tool in India, a lot of users are still apprehensive about putting expenses on their cards regularly. Many cardholders only put big-ticket purchases on their credit cards to avail the EMI benefit without utilizing the benefits of the cards to their best advantage.

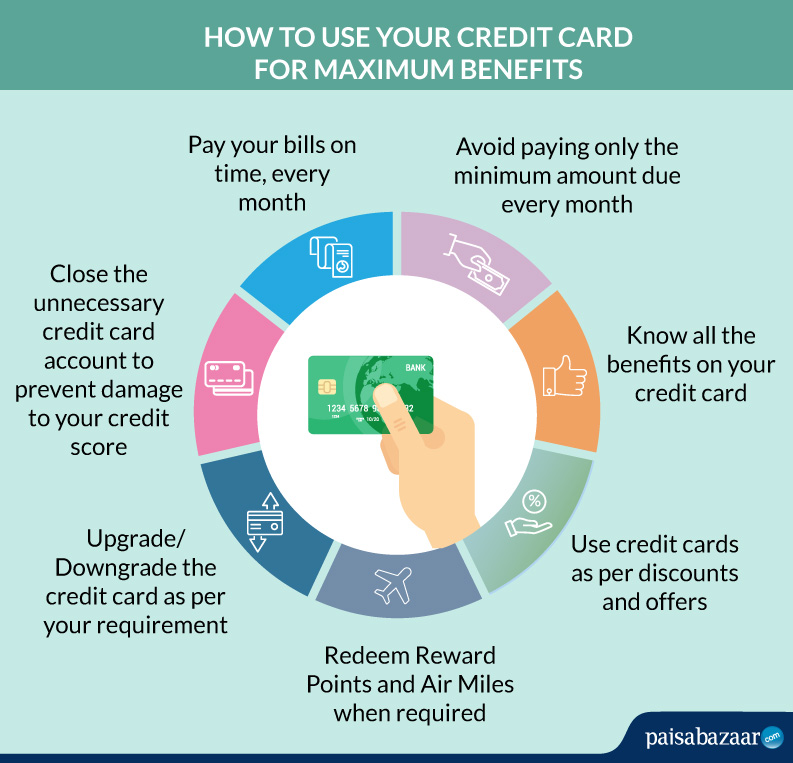

It is the fear of running into debt that keeps people from using the card. However, with proper usage of the card and paying the bills on time, credit cards can be really beneficial. So, here we will talk about how to use your credit cards for maximum benefits.

| On this Page: |

Pay Your Credit Card Bills on Time and in Full

Credit card extends a line of credit to cardholders. Users have a chance to make interest free purchases for a certain time, 30 to 50 days. During this period they won’t incur a finance charge. However, this facility is provided only if the user clears the dues by the due date and does not make any cash withdrawals.

Failure to do so will result in the finance charge, also known as credit card interest rate. This interest can go as high as 42% p.a. and is applicable from the day of the transaction until the amount is paid off in full.

So, a credit card will not turn into debt until you keep paying your bills timely.

Want to know how the credit card interest rate is calculated? Click Here

Understand Credit Card Fees & Charges

Besides credit card interest rates, there are a few other charges that you should be aware of. These are:

Overlimit Charges: Card issuers assign a credit limit on your card, which is the maximum amount you can spend. If you go over this limit, the bank will impose a fee and might even block your credit card. Overlimit fee is usually charged as a percentage of the amount you spend over the assigned limit.

|

Note |

Late Payment Fee: If you fail to pay off even the minimum amount due by the due date then you will be liable to pay the late payment charges. You also risk getting your credit card blocked. Late payment fee is also charged as a percentage of the outstanding amount. So, if you have Rs. 20,000 outstanding balance, late fee at the rate of 3% will amount to Rs. 600. You should pay the dues by the due date to maintain a healthy credit score.

Foreign Transaction Fee: If you are a frequent international traveller, chances are you are being charged a hefty foreign transaction fee on each and every international transaction. It is usually about 3.5% of the transacted amount.

We suggest you get a 0% foreign transaction mark-up fee credit card or a forex card, for international transactions.

Cash Withdrawals: Cash withdrawals, also known as cash advance, is one of the most expensive forms of credit that you can avail. You will incur finance charge from the day of transaction till the amount is paid off. You will also incur cash withdrawal fee, which can be anywhere around Rs. 150 to Rs. 300.

These are the prominent fees and charges that you should be aware of. As you can see if you make timely payment and don’t withdraw cash then you won’t incur interest which is the leading cause of debt spiralling out of control.

Use the Right Card for the Right Purchase

It is a good practice to identify your spending habits and then get a card that complements your lifestyle. Given below are some common spender categories and the types of benefits they should look for in a credit card.

| Spender’s Category | Benefits to look out for |

| Shopper | Cashback, discounts, No-cost EMI, Bonus Reward Points, Grocery offers |

| Traveller (Domestic) | Lounge Access (Airport & Rail), Airmiles, discounted or free travel tickets, Dining offers, Discounted Hotel stays, Travel insurance |

| Traveller (International) | Airport Lounge Access, Low or zero international transaction fee, Discounted Hotel stays, Dining offers, Airmiles, overseas medical insurance, Travel insurance, car rental services |

| Entertainment Seeker | Cashback/discount on movie tickets, dining offers |

| Commuter | Fuel offers, Metro Offers, Ride sharing app offers |

|

Note |

Credit Card Benefits for Frequent Shoppers

Most people fail to make full use of the various benefits credit card provides to shoppers. The offers include but are not limited to No-cost EMI, cashback, discounts and bonus reward points.

If you have a credit card, you should explore the offers that are available. You can also visit various merchant websites for the same. This will require time; however, the potential savings will be well worth the effort.