Note: Axis Bank is not accepting new applications for Vistara co-branded credit cards. The content on this page is for information only.

Update (6 September 2024): Existing Vistara credit cardholders can continue availing the benefits on their Vistara credit cards as per the existing structure and terms until 31 March 2026.

Vistara was among the first airlines in India to enter the co-branded credit cards market. Currently, the airline offers 7 co-branded credit card variants with 4 of India’s leading credit card issuers- Axis Bank, SBI Card, IDFC FIRST Bank and IndusInd Bank. Cardholders can earn CV Points on all their spends and use them to avail award flights or class upgrade with Vistara. Complimentary tickets on reaching spending milestones is a standout feature across all Vistara Credit Cards. While the core benefits largely remain the same, the extent of benefits varies across entry-level, mid-range and premium variants.

While choosing the right Vistara Credit Card, a number of factors will come into play including your eligibility for the chosen variant, annual fee, preferences with respect to airline class- economy, premium economy or business, etc. To help you find the best card amongst these, here is our comparison of all Vistara cards on some primary parameters.

1. Consider your Eligibility and Airline Class Preference

Vistara co-branded cards are available across entry-level, mid-range and premium segment. The entry-level cards offer benefits with the carrier’s economy class, mid-range with premium economy class and the premium cards come with business class benefits. As per the card variant- from entry-level to premium, the annual fee increases, and the eligibility criteria becomes more stringent. The table below shows all Vistara credit cards available in the market with category segmentation:

| Entry level (Economy Class) | Club Vistara SBI Card | Axis Vistara Platinum |

| Mid-range (Premium Economy Class) | Club Vistara IDFC FIRST Credit Card | Club Vistara SBI Card Prime | Axis Vistara Signature |

| Premium (Business Class) | Axis Vistara Infinite | Club Vistara IndusInd Bank Explorer |

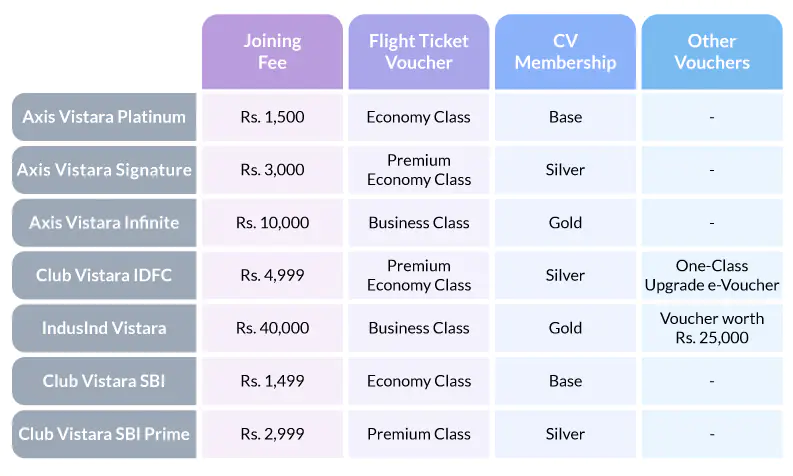

2. Welcome Benefits

While welcome benefits should not be a deciding factor when selecting a card, they could still give you a good start. All Vistara cards offer similar benefits upon card activation, justifying the joining fee. Refer to the below image: Both SBI Card’s and Axis Bank’s entry-level cards offer the same welcome benefit, that is a free economy class ticket voucher and Club Vistara Base Membership. Among mid-range options, Club Vistara IDFC has an edge over other variants as along with the premium economy voucher and CV Silver membership, users also get an upgrade voucher, enabling a high-end experience.

Both SBI Card’s and Axis Bank’s entry-level cards offer the same welcome benefit, that is a free economy class ticket voucher and Club Vistara Base Membership. Among mid-range options, Club Vistara IDFC has an edge over other variants as along with the premium economy voucher and CV Silver membership, users also get an upgrade voucher, enabling a high-end experience.

Among the premium variants Axis Vistara Infinite and IndusInd Explorer, the IndusInd card comes with a high joining fee of Rs. 40,000 in comparison to Axis Infinite, which charges Rs. 10,000 only. However, the card compensates for the high joining fee by offering an additional benefit of Rs. 25,000 over and above the business class ticket and CV Gold membership (which is also available on Axis Vistara Infinite). Users have the flexibility to utilize the voucher for shopping or travel with options like Oberoi Hotels & Resorts, Lux Gift Card, and Vouchagram.

The complimentary Club Vistara membership on these cards enhance the overall benefits for travelers flying via Vistara Airlines. Click to check detailed benefits on Base, Silver and Gold CV memberships.

| The free flight tickets offered on Vistara credit cards are given in the form of vouchers with one-way base fare waiver on domestic ticket bookings. Thus, users can avail the waiver of the base fare but will have to bear other charges like taxes, surcharges, etc. as applicable on the ticket at the time of booking. You can redeem the voucher at Club Vistara website within 3 months from the date of issuance, as received on the primary cardholder’s email ID. |

3. Rewards Program

All Vistara co-branded credit cards offer value-back in the form of CV Points that are redeemable across Vistara flight ticket bookings. The monetary value of CV Points cannot be determined as it depends on the flight you are redeeming for, ticket class type, date of travel, etc.

Among entry-level cards, Club Vistara SBI has an edge over Axis Platinum due to a slightly better reward earn rate of 3 points per Rs. 200 in comparison to 2 points per Rs. 200. Additionally, the SBI card also includes fuel in its rewards program, which the other card excludes. The long list of exclusions on Axis Cards is a major problem across all its variants. While it is acceptable for the basic variant, for the other two, this is troublesome, as they come with a high fee of Rs. 3,000 and Rs. 10,000.

Among the mid-range cards, both SBI Card and Axis Bank offer the same reward rate. However, the IDFC FIRST Card clearly outshines the other two due to a higher reward rate (6 CV Points per Rs. 200), inclusion of not just fuel but utility, rent, government transactions and insurance in the rewards program.

When it comes to the premium cards, the IndusInd Vistara Explorer clearly disappoints with a very low earn rate of 2 CV Points per Rs. 200 on retail spends. The card offers the highest rewards only on travel bookings at 6 CV Points per Rs. 200, thus a suitable choice for those looking for travel benefits and not on other general spends. As compared to this, Axis Vistara Infinite offers the same reward rate of 6 CV Points per Rs. 200 across all spends (except exclusions), thus giving users more opportunities to earn CV Points.

Since reward point is a core benefit on credit cards, consumers should consider the base rate, accelerated earning (if any), exclusions and other terms and conditions related to the rewards program.

Click to check detailed reward structure and exclusions on all Vistara Cards

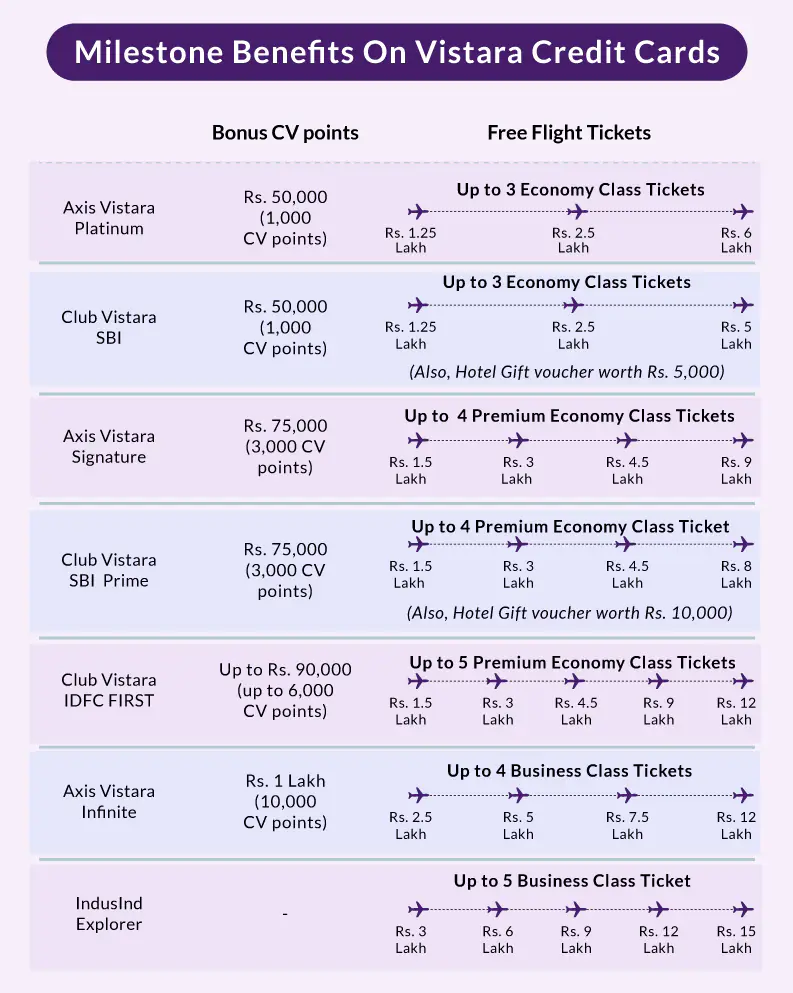

4. Milestone Benefits

Milestone benefit is a standout feature across all Vistara Cards. Based on the card variant, users can get some complimentary Economy, Premium Economy or Business Class tickets on reaching spending thresholds. Along with flight tickets, the Vistara cards also offer bonus CV Points once a year. The details are shown below:

Both entry-level cards, Axis Vistara Platinum and Club Vistara SBI, offer up to 3 free tickets as milestone benefits. However, the SBI card has an edge here, as the maximum spend limit is Rs. 5 lakh in comparison to Rs. 6 lakh required by the Axis variant. Besides, the former also offers a hotel gift voucher of Rs. 5,000, worth a good value for domestic travelers.

Among the mid-range cards, Club Vistara IDFC has an edge over Axis Signature and SBI Club Vistara Prime, as it offers the highest number of free flight tickets. You can get up to 4 premium economy tickets with Axis Bank and SBI Card on spends of Rs. 9 Lakh and Rs. 8 Lakh respectively. The IDFC FIRST Card also provides 4 tickets on spends of Rs. 9 Lakh but you can get another complimentary ticket if you reach annual spends of Rs. 12 Lakh. Thus, the IDFC card is more suited to high spenders.

Across premium cards – Axis Vistara Infinite and Club Vistara IndusInd Explorer – the Axis Card provides up to 4 Business Class tickets and you can get up to 5 free tickets on the IndusInd Card as milestone benefit. Axis Vistara Infinite also offers 10,000 CV Points on spends of Rs. 1 Lakh in a year, which is an easily achievable number for frequent travellers, but can add good value.

An important thing to note here is that while spending Rs. 12 lakh on the premium variant could fetch users 4 free flight tickets, with the IDFC card users can earn 5 on this spend value. Thus, even at a comparatively low fee of Rs. 4,999, the IDFC variant offers an equivalent milestone benefit as premium cards. The only difference is the class type- the IDFC FIRST Card offers Premium Economy Class tickets whereas Axis Vistara Infinite provides Business Class tickets. Hence, travellers who do not have class preference while flying could consider getting the IDFC FIRST Card.

5. Travel benefits beyond Vistara

Since these are travel credit cards, consumers should also consider the benefits offered across travel spends beyond Vistara. The table below shows some such features:

| All Variants Axis (Platinum, Signature,Infinite) | Club Vistara IDFC | Club Vistara SBI | Club Vistara SBI Prime | IndusInd Vistara Explorer | |

| Lounge Access | Domestic Airport – 2 per quarter | Domestic Airport Spa & Lounge – 2 per quarter

International Airport Lounge – 1 per quarter |

4 domestic (1 per quarter) & Priority Pass membership | 8 domestic ( 2 per quarter); Priority Pass membership with 4 international lounge visits (subject to max of 2 per quarter) |

4 domestic (1 per quarter); Priority Pass membership with 16 international lounge visits (4 per quarter) |

| Forex Markup | 3.5% | 2.99% | 3.50% | 3.50% | 0% |

Let’s begin with the premium variants. Living up to its premium status, IndusInd Vistara Explorer offers a 0% forex mark-up and good frequency of international lounge access, making it a good choice for frequent international travelers. In contrast, Axis Vistara Infinite falls short in this regard, as it does not come with a concessional forex mark-up nor does it provide international lounge access.

Talking about the entry-level cards, in comparison to Axis Vistara Platinum, Club Vistara SBI offers better domestic lounge access and even complimentary Priority Pass membership. But the standard 3.5% forex keeps these cards restricted as a suitable option for domestic travelers.

The mid-range variants Vistara IDFC FIRST and Axis Signature offer airport lounge access. However, the IDFC variant stands out with access to international lounges and a lower forex markup fee of 2.99%, which is not very low but still lower than the standard 3.5%. Additionally, complimentary lounge access for all Axis variants and the Club Vistara IDFC comes with spend-based conditions. To be eligible, users will have to spend Rs. 50,000 per quarter for Axis and Rs. 20,000 per month for IDFC. While this may not be an issue for high spenders, moderate spenders might find it challenging to meet these thresholds.

Overall, most Vistara co-branded cards cater to domestic travellers. Free ticket vouchers are redeemable only for domestic flights. Most cards either do not provide any international lounge access or if they do, the frequency is quite low. Forex mark-up is also high on most cards. Hence, people who mostly travel internationally could extract better value out of other travel cards or premium cards.

How to choose the right Vistara Credit Card for you?

Choosing the best credit card depends on your own individual needs. Firstly, being co-branded cards, the value-back structure is designed around Vistara. Hence, you must assess if you prefer flying with Vistara Airlines and if you can fully utilize the Vistara-specific benefits, including rewards earning, redemption, welcome, and milestone benefits.

Secondly, most of these cards do not extend benefits on international travel. So, you should evaluate if you need this benefit or if you already have a card that offsets this drawback. For instance, Vistara mid-range and entry-level cards can work well with users owning another credit card with international lounge access, low forex markup, hotel membership, etc. Similarly, users owning another rewards credit card can well utilize the milestone, welcome, and zero forex benefit on IndusInd Explorer.

Additionally, consider if you want lifestyle benefits such as golf, movies, or dining. For golf and dining perks, the Axis Vistara Signature or Infinite cards are good choices, while the IndusInd Explorer offers great movie benefits.

Ultimately, your decision should be based on the specific benefits you want from your credit card, whether they are Vistara-specific or more exhaustive features covering multiple categories.