Premium credit cards offer a lot of travel benefits including travel insurance. This can be really useful for people who have to travel overseas quite often. Complimentary travel insurance offered with credit cards usually covers overseas medical expenses, air accident, passport loss coverage and more.

Travel insurance provided by credit cards is usually free of cost. Since travel insurance taken from insurance companies can be very costly depending upon the country and duration of visit, travel insurance on credit cards is truly beneficial.

Note: Overseas Medical insurance provided by credit cards is not accepted as a legitimate form of coverage by countries/colleges/universities that mandate medical insurance.

| Note We advise that users check the validity of their travel insurance as they usually don’t come with lifetime validity. |

Coverage Provided by Credit Card Travel Insurance

Crises don’t come with a warning and hence it is in your best interest to be prepared for them. Given below are the various scenarios where the travel insurance provided by a credit card can be beneficial for you.

Suggested Read: Everything You Need to Know About Medical Services on Credit Cards

Loss of Passport, Baggage, or Documents

Loss of passport, baggage, traveller’s cheques or documents can be a nightmare when you are travelling overseas. Travel insurance will reimburse you for the same up to a certain amount. They will also bear the cost of replacing or getting you a temporary passport.

Health Problems

Medical emergencies can strike anyone at any time. If you fall sick and require hospitalization overseas then you can run up a big bill. Thus, it is in your best interest to at least get a credit card that offers overseas or domestic medical expenses. They can be really beneficial during a crisis.

| Note: Ensure that the country you are visiting is covered by the credit card. Also, be aware of the amount of coverage that you are provided. Some cards do not provide sufficient coverage to cover major illnesses. |

Flight Cancellation or Delay

There are many reasons for a flight cancellation or delay. You might even have to cancel your plans because of an illness or other emergencies. In this scenario, the travel insurance will reimburse a certain amount on the basis of the policy. Some cards will also cover lodging and food expenses in case of flight cancellation or delays.

Emergency Medical Evacuation

In case of severe illness you might require medical evacuation by an ambulance. The cost of transportation may be covered by the travel insurance provided by credit cards.

| Note: Travel Insurance provided by credit cards generally does not provide dental cover. |

Top Credit Cards providing Travel Insurance

| Credit Card | Coverage & Amount | Minimum Income Requirement* |

| HDFC Regalia Credit Card | Accidental air death: 1 crore Emergency overseas hospitalization: 15 lakh |

Rs. 90,000 p.m. |

| Standard Chartered Visa Infinite Credit Card | Air accident cover: Rs. 1.2 crore Medical insurance: USD 25,000 |

Check with bank** |

| Axis Bank Privilege Credit Card | Air accident cover: 2.5 crore Loss of travel documents: USD 300 Delay of Check in Baggage: USD 300 Loss of Check in Baggage: USD 500 |

6 lakh per year |

| IndusInd Bank Platinum Aura Credit Card | Lost Baggage: Rs. 1 Lakh Delayed Baggage: Rs. 25,000 Loss of Passport: Rs. 50,000 Lost ticket: Rs. 25,000 Missed Connection: Rs. 25,000 Air Accident Cover: Rs. 25 lakh |

Rs. 30,000 p.m. |

*The minimum income mentioned is for salaried applicants. The requirement may vary for self-employed individuals.

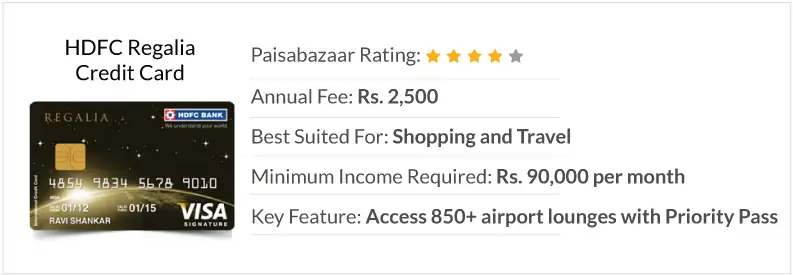

HDFC Regalia Credit Card

HDFC Regalia is one of the most sought after credit cards as it meets every traveller’s most basic insurance requirements. It also provides other travel benefits making it an all-rounder card.

HDFC Regalia is one of the most sought after credit cards as it meets every traveller’s most basic insurance requirements. It also provides other travel benefits making it an all-rounder card.

Coverage Provided:

- Accidental air death: 1 crore

- Emergency overseas hospitalization: 15 lakh

Other Benefits:

- 6 free airport lounge accesses in a year

- Concierge Services that help make your travel, gift and other arrangements

- Up to 40% off on dining through Good Food Trail Dining Program

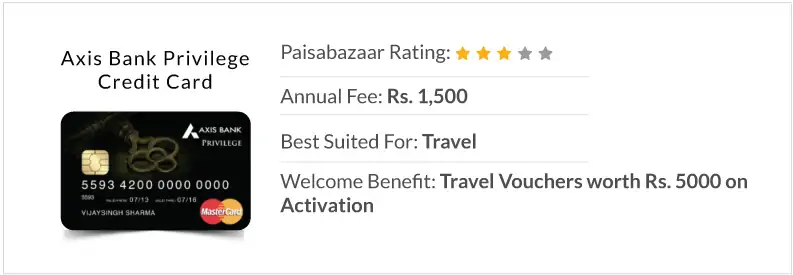

Axis Bank Privilege Credit Card is a premium credit card that can is best suited for Axis Bank Priority customer, as they can avail the card for free. It has many perks to offer besides the insurance coverage.

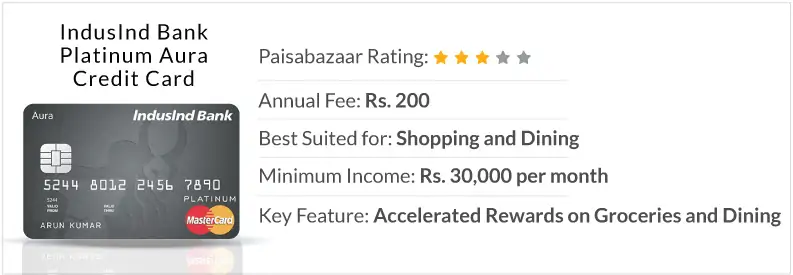

Axis Bank Privilege Credit Card is a premium credit card that can is best suited for Axis Bank Priority customer, as they can avail the card for free. It has many perks to offer besides the insurance coverage. IndusInd Bank Platinum Aura Credit Card is an ideal card for your travel needs. Besides offering a comprehensive insurance, users can get lounge access, roadside assistance and much more.

IndusInd Bank Platinum Aura Credit Card is an ideal card for your travel needs. Besides offering a comprehensive insurance, users can get lounge access, roadside assistance and much more.