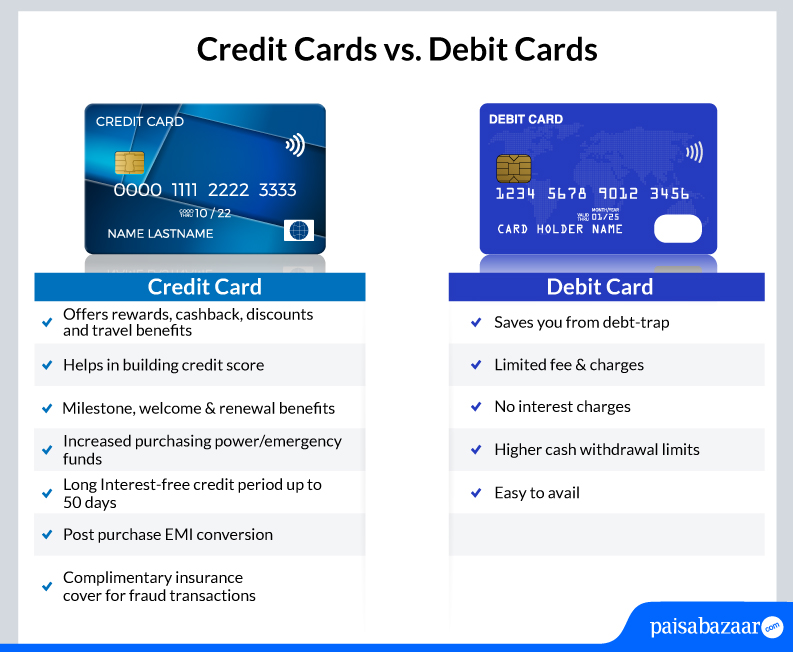

Credit cards and debit cards both serve as convenient payment methods and come with their own set of pros and cons. However, when it comes to choosing between the two, credit cards often stand out due to their value-back structure, enhanced security, and additional purchasing power beyond the available balance in your savings account. Responsible use of credit cards also helps you build a strong credit profile, again making them a better option than debit cards. Let us explore the key reasons why credit cards are often the better choice.

Better Value-back

Credit cards are popularly known for their excellent value-back programs – offered as reward points, cashback or loyalty points. While debit cards offered with some premium savings account may also come with rewards program, they would be much less than what one can get out of credit cards. With the right credit card, consumers can earn substantial value-back on their preferred spending categories. For example, Axis Atlas Credit Card gives up to 10% value-back on travel spends whereas YES Bank Paisabazaar PaisaSave Credit Card offers 3% direct cashback on all online spends, without any merchant restrictions.

Post the integration of Rupay Credit Cards on UPI, consumers can also make UPI transactions with their credit cards, enabling them to put smaller transactions on their credit cards. With this facility, cardholders can use their cards even at local shops that do not have POS machines.

Suggested Read: Best Rewards Credit Cards | Best Cashback Credit Cards

Additional Benefits on Travel, Dining and more

In addition to offering impressive value-back across different spending categories, most credit cards come with additional benefits like complimentary lounge access, discount on dining and movies, fuel surcharge waiver, etc. Depending on the type of credit card you own, you can save a significant amount through these perks. With a premium card, for instance,

you can get wide-ranging and substantial benefits like membership to premium hotels, unlimited domestic and international lounge access, complimentary golf games and insurance covers. Whereas, mid-range or entry-level cards may offer discounts with select brands, Buy One Get One offer on movies, etc.

While debit cards may also offer lounge access and limited period offers with select brands, the extent of benefits you get with credit cards would be much higher.

| Explore the Best Credit Cards in India | |

| Best Travel Credit Cards | Best Dining Credit Cards |

| Best Online Shopping Credit Cards | Best Fuel Credit Cards |

Building Credit History

Since credit cards are a form of borrowing, how you manage them has direct impact on your credit profile. In fact, most people begin their credit journeys with credit cards. With timely bill payment and responsible use of available credit limit, you can build a strong credit history over a period. However, debit cards have no effect on your credit profile.

Additional Purchasing Power

When you use a debit card, funds are deducted directly from your savings account. On the other hand, credit cards provide you with additional purchasing power. You can use the available credit limit to make purchases, even if you do not have sufficient funds in your account. You can also make big-ticket purchases and convert the transaction into EMIs.

Though debit card EMI feature is also available now, it is not extended to all consumers and typically comes with lower spending limits compared to credit cards. Moreover, the additional credit limit offered with credit cards is quite valuable in case of emergencies like hospitalization, travel, etc.

Enhanced Security

Most credit cards come with lost card liability cover wherein cardholders are not held liable in case of card loss or theft, if they report the loss timely. Moreover, as compared to debit cards, credit card disputes are easier to resolve, since funds are not debited directly from your account.

Things to Keep in Mind when Using a Credit Card

While credit cards are quite valuable, they can also lead to a huge debt if used recklessly. You must ensure responsible use of your credit cards in order to make the most of it. Here are few things to consider:

- Choose a credit card that aligns with your spending preferences so that you can maximize it.

- Do not apply for multiple credit cards at a time. Instead, compare the features, benefits, fees and charges, and then apply for the card that best matches your needs.

- Always pay your credit card bills in full and on time to avoid finance charges and other penalties.

- Use your credit limit responsibly; do not exhaust the entire credit limit. Instead, plan your purchases smartly across different credit cards.

- Do not withdraw cash using your credit card as it cash withdrawals are not eligible for the interest-free period and start attracting finance charges from the first day.

- Read all terms and conditions related to the features, fees and charges.