Where plastic money has largely taken over paper money, using Credit Cards for every other transaction is a common practice. A credit card is definitely an addition to your financial assets, but did you know that this little plastic card can cost you a pretty penny if not used in a disciplined way. The wrong usage of credit cards can turn the boons into bane, negatively affect your credit score and land you into major debts.

So, what exactly is an undisciplined use of credit cards? Let’s understand this by addressing 5 common mistakes you could be making with your credit card.

Common Mistakes That Reflect Wrong Usage of Credit Cards

1. Only paying the minimum amount due

Suppose your total credit card bill is Rs. 40,000. Out of this amount, the bank allows you to pay a minimum amount, say Rs. 7,500, in case you are unable to pay the amount in full. This may seem a convenient way of paying bills but when you do not pay your credit card bill in full, the unpaid balance continues to attract hefty finance/interest charges. These extra charges can go up to 47 to 48 per cent per annum and eventually increase the outstanding balance.

What is minimum amount due?The minimum amount due on your credit card is the lowest amount that can be paid to avoid late fees. Usually, it is 5% of the total outstanding amount. In case you have converted any purchases on your credit card into EMIs or have incurred fees and charges such as annual fee or cash advance fee, the same amount is also added to the minimum amount. |

In case you are unable to pay your card bills in full, you can opt for viable options like converting the entire outstanding amount or the eligible big-ticket purchases into EMIs, or you can avail credit card balance transfer facility. Besides, there are alternative financing options like pre-approved loan against the credit card or personal loan that you can consider. Such loans have much lower interest costs that would not compromise your long-term goals. Also, if you have made some low-yield investments, you can liquidate them to pay your bills.

Related Article: Why you must always pay your credit card balance in full?

2. Not maintaining a proper Credit Utilisation Ratio

Credit Utilisation Ratio or CUR is the proportion of the total credit limit that you have utilised. As per credit bureaus, CUR above 30% is a sign of credit hungriness. Hence, it is important to maintain a proper CUR (below 30%) to avoid negative effects on your credit report.

If you often branch this percentage, it is suggested that you should either consider increasing your credit limit by requesting your existing credit card issuer, or you can also get an extra credit card to spread your expenses. Spreading your expenses on more than one card will help you bring down the credit utilization ratio.

To learn about some effective tips for lowering your credit utilisation ratio, Click Here

3. Late or missed credit card payments

Making late payments or missing your bill due dates is also a sign of irresponsible usage of credit cards. Credit bureaus do not bring down your credit score if your payment is less than 30 days late. However, you may incur a late fee. On the other hand, if your payment is more than 30 days late, you can expect a drop in your credit score.

You can use the autopay facility, set calendar reminders, or enable email notifications to make sure that your payments are done on time.

Let’s suppose your monthly credit card bill is Rs. 20,000 and your bank charges 3.5% interest per month on the unpaid balance. This implies that your one month’s interest would be Rs. 700. In case you fail to pay even the minimum amount due on or before the due date, the bank will also charge a late payment fee. Clearly, your total dues can go up to Rs. 25,000 or more if you fail to pay the bill for 3 months.

Know More: Why you should never miss your credit card payments?

4. Withdrawing cash from your credit cards

Yes, it is possible to withdraw cash from your credit card, just like a debit card. But, you cannot overlook the fact that such withdrawals are actually very expensive as they attract not one but two charges – cash advance fee and finance (interest) charge. Finance charges are levied on the cash withdrawn right from the day of the transaction until the amount is repaid. These charges can go up to 23 to 49 per cent per annum. Moreover, any new purchases on your card will also attract interest charges. On top of that, you will have to pay the cash advance fee as well. Banks usually charge 2.5% to 3% of the amount withdrawn as a cash advance fee.

Let’s suppose that you have withdrawn Rs. 50,000 from your credit card and your bank charges 3% or a maximum of Rs.500 cash advance fee. In that case, you will have to pay Rs. 500 cash advance fee. If you fail to repay the entire amount within 30 days from the date of transaction, you will be charged with 3.5% interest i.e. Rs. 1,750. After calculating the same, your payable amount will become Rs. 52,250, within one month.

Withdrawing cash from your credit card should be your last resort in case of any financial emergency. If there is no other option available, you should make sure that the withdrawn amount is repaid as soon as possible to avoid the associated charges.

Read More: Reasons why you should avoid Credit Card Cash Advance

5. Not using the accrued reward points before the expiry date

Besides the benefits such as annual fee waiver, complimentary lounge access, and free movie tickets, credit cards come with an extensive reward points program for the users. Most of the credit cards have a pre-decided validity period set for the rewards points. This period generally varies from 2 to 3 years. At times, users miss the expiry date and end up losing all their reward points.

Therefore, you should always go through the terms and conditions of the chosen credit card’s rewards program and ensure their redemption before expiry.

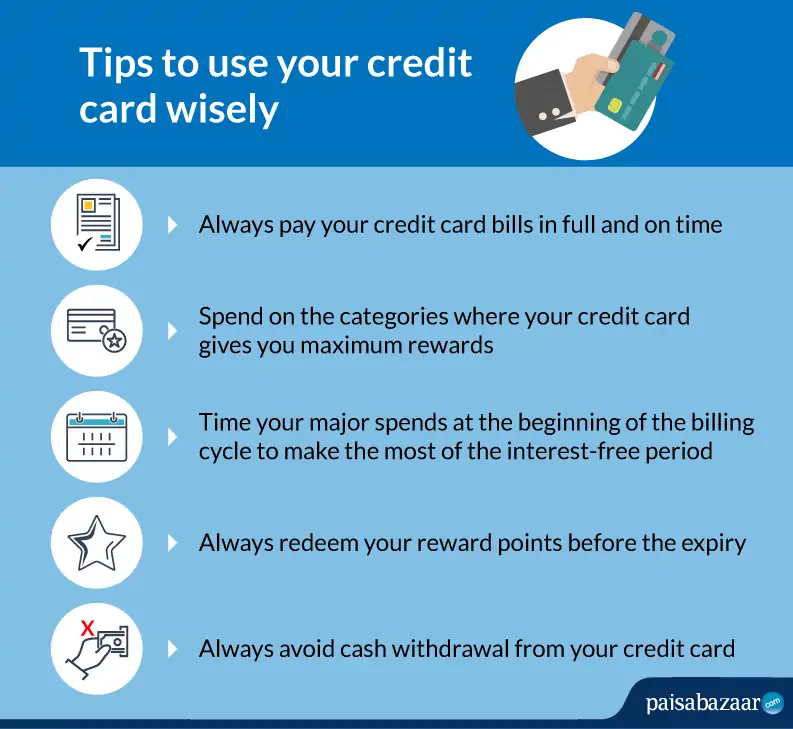

In a nutshell,

When you make such mistakes while using your credit cards, you are exposing yourself to unnecessary debts, bad credit score and report. On the other hand, if you are a responsible credit card user, you will be able to avail of maximum benefits from your card. Not just that but your credit report will also improve over time. Hence, read all the terms and conditions associated with your card carefully and try not to make the above-mentioned mistakes to stay away from additional charges.