The credit score is one of the most important factors determining the approval or rejection of your credit application. It helps banks, NBFCs and credit card providers analyse your creditworthiness and assess the risk of providing you the credit.

A good credit score can help you get loans and credit cards at a low cost of credit and on preferential terms whereas a low credit score can make it difficult for you to avail any loan or credit card.

Our interactions with our consumers over the years who have low credit scores have given us an insight that most such people didn’t know how to improve their credit scores even after reading their credit reports. They needed expert guidance to rebuild their scores over time. This is where our Credit Health Report becomes helpful. Let us understand more about the Credit Health Report below.

What is Credit Health Report by Paisabazaar?

The Credit Health Report is a detailed credit report provided by Paisabazaar to its subscribers. It is designed specifically to help you understand your credit score, factors that impact your score, how you have managed your credit in the past and whether it is enough for you to get your credit application approved in future.

The report also contains tips and insights on improving your credit score depending on your credit behaviour. You can access separate reports from all credit bureaus with complete details at Paisabazaar and analyse your past credit performance.

Why is Credit Health Report by Paisabazaar important?

Paisabazaar’s Credit Health Report is beneficial for people with good credit scores as well as those with low scores. Let us understand how the Credit Health Report can be beneficial for you:

Rebuild Credit Score – Our Credit Health Report can help you understand the mistakes that have led to the fall in your credit score. There can be missed payments, incorrect reporting of payments, credit card limits, etc. Custom tips and insights in the CHR will guide you in improving your credit behaviour.

Rectify Errors in Credit Report – Our detailed Credit Health Report with insights can help you assess all credit products availed by you. There can be cases where credit products not availed by you feature in your credit report. Sometimes, accounts closed successfully might be mentioned as “settled”. This can either be due to an administrative error at the bureau’s end or fraudulent activities/identity theft. Such cases, if found in your report, can seriously impact your credit score.

With the help of our Credit Health Report, you can raise a dispute with the credit bureau and track the resolution status. The issue gets resolved within 30 days and you become ready for credit in future.

Suggested Read: How to Rectify Errors in Credit Report?

Credit-ready to meet a Requirement/Life Goal – Credit score does not improve overnight and can take from three months to many years to strengthen depending upon your situation. The tips and suggestions in the credit report help spread awareness regarding credit and mend your credit behaviour if required.

Credit Health Report by Paisabazaar helps you to rebuild or repair your poor credit score in due course of time to become credit-ready in future and improve your creditworthiness. You can utilise your good credit score in an emergency or to meet a life goal such as buying a car or home, funding your child’s higher education, etc.

How to benefit from CHR by Paisabazaar?

Let us understand how subscribers of Credit Health Report by Paisabazaar can benefit by availing this service:

- The subscriber gets regular updates to their credit report that can help track the performance and growth.

- Weeding out identity theft issues instantly by raising a dispute as soon as discrepancies occur.

- Tips and suggestions to help understand how credit reporting and ecosystem work.

- Credit health reports from multiple bureaus shall help subscribers see how they are performing for each bureau.

- Rebuild/improve credit score beforehand to ensure one is ready for credit to meet an emergency requirement/life goal.

- Pre-approved loan and credit card offers depending upon the subscriber’s eligibility.

- Expert assistance by credit experts for resolving subscribers’ specific queries.

How is the CHR by Paisabazaar different from other Credit Reports?

Let us understand how the Credit Health Report by Paisabazaar is better than credit reports provided by others:

| Credit Health Report by Paisabazaar | Credit Report by Others |

| Detailed credit report with in-depth analysis of all factors | Only reports and numbers without proper analysis |

| Credit Reports from multiple credit bureaus | Credit report from only one credit bureau |

| Credit report of 4 bureaus at a low subscription cost | Credit report of only 1 bureau at a considerably higher cost |

| Custom tips and suggestions depending on the issue | No tips or suggestions provided |

| PB Assist (AI Assistant Chatbot) support for quick resolution of queries | No chatbot support |

| Resolutions and suggestions by Credit Experts for subscribers | No expertise provided to subscribers |

| Available in multiple languages such as Hindi, English, Marathi, Kannada, Tamil, Telugu and Bengali | Available only in English |

Paisabazaar’s Credit Health Report by far is the most detailed and the most credible credit report available for borrowers to assess their credit bahaviour and improve it accordingly.

Subscribers get CHR by Paisabazaar for All Credit BureausYou get Credit Health Reports from multiple credit bureaus. As the credit scoring algorithm is different for each bureau, the credit score from multiple bureaus may be different for the same individual. The CHR by Paisabazaar for multiple bureaus can help one identify if there is an error from the lender’s end or the bureau’s end. If there’s a wrong entry in your credit report from one bureau, you can consult the bureau to get it rectified. If there is an error in all credit bureaus, you will have to consult the lender for rectification. |

How to Get your Credit Health Report?

It is very easy to get your Credit Health Report from Paisabazaar. Here’s how to do it in 5 simple steps:

Step 1: Sign in to your Paisabazaar account using your mobile number and OTP

Step 2: Check your credit score for free

Step 3: Navigate to the Credit Health Report banner and click on Know More

Step 4: Select from the subscription plans – One-day Access, Monthly Access or One-year Access

Step 5: Make the payment and your subscription plan should start immediately.

PB Assist – AI Assistant for Query ResolutionPB Assist – the AI Assistant chatbot helps subscribers get resolution regarding their issues quickly. When you mention your query in the chatbot, the AI Assistant figures out your concerns and responds accordingly. This chatbot keeps on learning from the issues and queries of our users and provides the best possible solutions depending on the issue faced by the user. As of now, the AI Assistant is available only for subscribers. |

What does a subscriber get in the Credit Health Report by Paisabazaar?

The Credit Health Report generated by Paisabazaar is a well-structured document that contains a detailed analysis of your credit accounts and behaviour over the past few years (7 years in many cases). Let us find out about what subscribers get in their Credit Health Report:

1. Credit Score

Your credit score is the first thing mentioned in the Credit Health Report. This section also explains what your credit score means for the lenders and how your score can impact your loan or credit card approval chances.

An Enquiry Control Number (ECN) issued by CIBIL is also mentioned here which is required when raising a dispute for correcting inaccuracies in your credit report.

Also Read: What is Credit Score?

2. Credit Health Report Snapshot

This section contains a gist of what’s covered in your report. You can click on each component and navigate to the concerned section directly.

The elements covered in this section are Personal Details, Credit Report at a Glance, Credit Factors, Payment History, Credit Enquiries and Raise a Dispute to CIBIL.

3. Profile Details

This section contains your basic personal details as provided by lenders and credit card providers to the credit bureau. It includes your full name, date of birth, registered mobile number, email address and residential address.

You shall get some exclusive tips in this section that will help you understand the information in detail and what action is recommended based on your profile.

Credit Report at a Glance

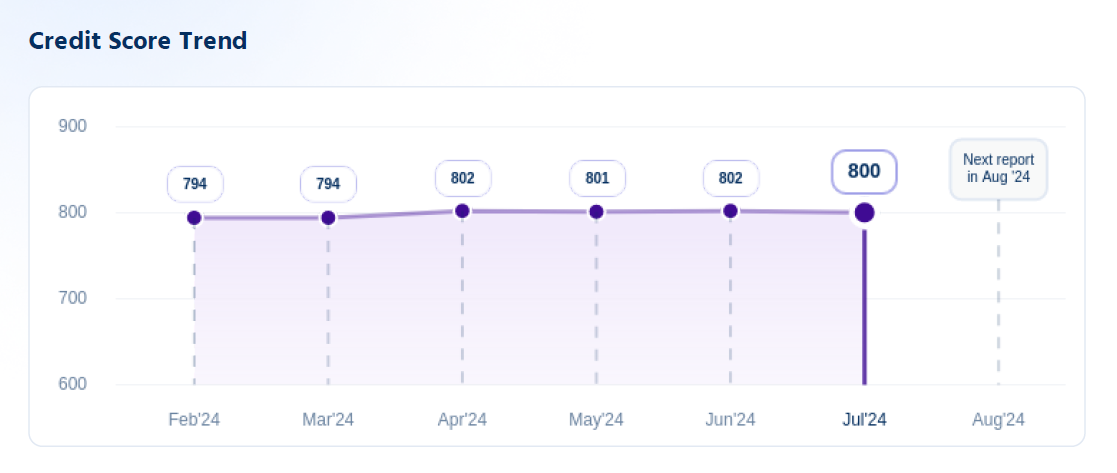

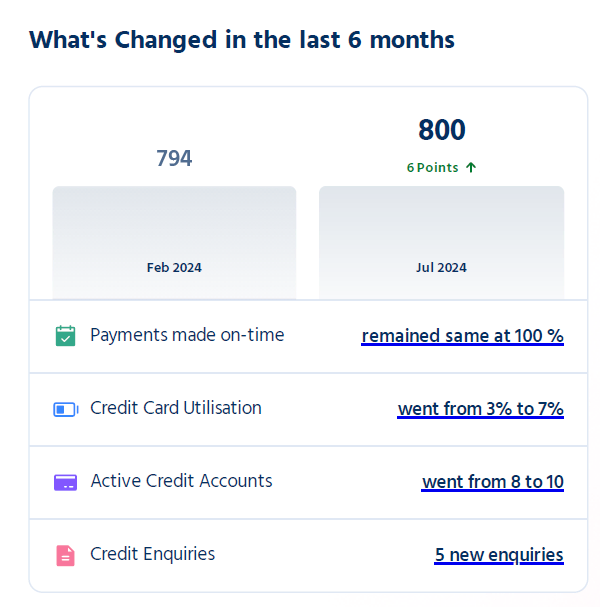

This section is very important for you as it contains a preview of your credit report where all changes over the last 6 months are highlighted. Credit Score Trend for the past 6 months is shown in the first section.

In the next section, What’s changed in the last 6 months is shown. This comparative analysis helps understand how you have performed in the last 6 months and what impact has it had on your credit score.

4. Credit Factors

This section contains the list of credit factors on which your credit score depends. Here, you get a summary of all credit factors and their possible impact on your credit score.

The 5 most important factors on which your credit score depends are – Payment History, Credit Card Utilisation or Credit Utilisation Ratio, Length of Credit History, Credit Enquiries and Credit Mix.

a. Account Summary

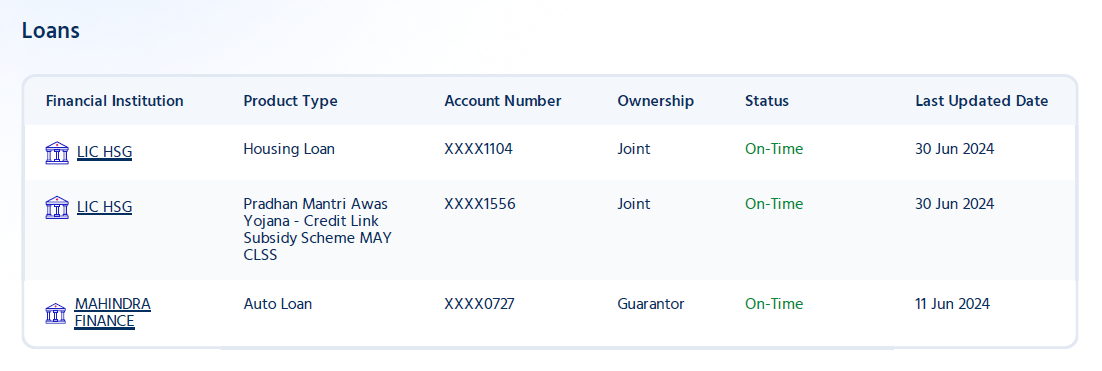

This section contains a list of all credit accounts associated with you that include both loans and credit cards.

All loans whether secured loans such as car loans or home loans or unsecured loans such as personal loans or business loans are mentioned in the first part of this section.

Details such as a lender, product type, account number, ownership status, loan status and last update date are shown against each loan in this section.

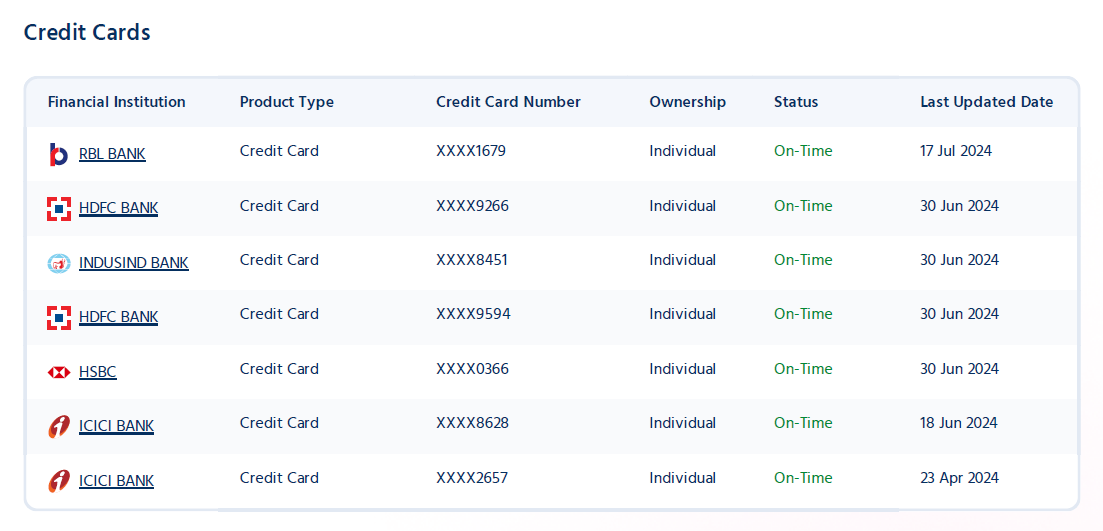

In the next part of this section, a list of all active credit cards is provided.

Details such as credit card provider, product type, last 4 digits of the credit card, ownership type, account status and last update date of each card are mentioned.

In the third part of this section, all accounts that are successfully closed after clearing all dues are mentioned.

It is worth mentioning that a closed account may have no negative impact on your credit score whereas a settled account can severely impact your credit score.

b. Payment History

This section is very important for lenders and borrowers alike. It contains details of all repayments done by you in the past 36 months for each loan and credit card account.

This section indicates the product details such as product type, last 4 digits of the account number, ownership type, last payment date, last update date, date of account opening, current outstanding, overdue amount and total sanctioned amount.

The next part of this section shows the payment history details such as Days Past Due (Payment Delayed) and monthly payment status.

All green ticks signify that you have made all payments on time and this is the best-case scenario for improving your credit score. Any deviation from this is taken negatively and has the potential to reduce your credit score.

Also Read: What is Days Past Due in Credit Report?

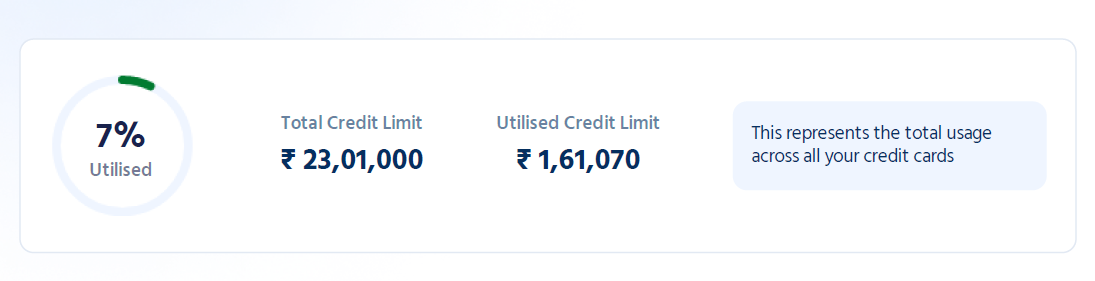

c. Credit Card Utilisation

This section shows your overall credit card utilisation (also known as Credit Utilisation Ratio or CUR) and all the details of available and used credit limits for each credit card.

Experts recommend to keep your overall credit utilisation low. It signifies that your hunger for credit is low and you would relatively be at a low risk of default in case of an unforeseen difficulty.

A high credit utilisation depicts your overdependence on credit and the risk of default in such cases can be very high. However, many lenders might not penalise you for having a high CUR if you pay off your dues regularly and on time.

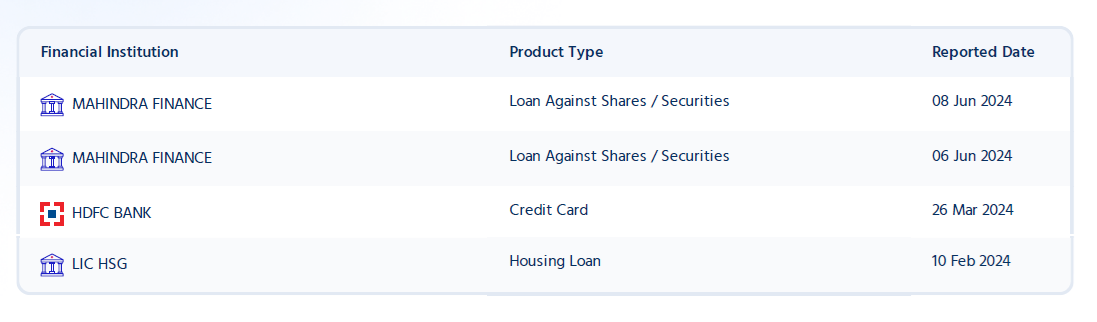

d. Credit Enquiries

This section contains details of all credit enquiries carried out by you in the past six months. Details such as the financial institution, product type and reporting date for each enquiry are mentioned here.

It is worth mentioning that when you check your credit score, it is considered as a soft enquiry and it has no negative impact on your credit score.

When you apply for credit, the lender requests your credit report from a bureau. This is considered a hard enquiry. This enquiry is present here in the Credit Health Report and it has the potential to impact your credit score.

5. Raise a Dispute

When you notice any discrepancy in your credit report, you should get it rectified at the earliest. Any incorrect information in your report can impact your credit score negatively. This section will help you raise a dispute with CIBIL and improve your credit score.

You can take the assistance of Paisabazaar to raise a dispute with CIBIL if you have subscribed to the Credit Health Report. This can be very beneficial if you have some errors in your report and you don’t know how to get it resolved.

Our experts guide subscribers to raise the issue with a lender or CIBIL and keep you updated with the latest status. It can take up to 30 days for the dispute to be resolved. However, if the resolution is not what you expected, you can raise a fresh grievance with the help of our credit experts.

Suggested Read: CIBIL Dispute Resolution

Credit Health Report FAQs

Q. What is the password for the Credit Health Report?

To ensure the safety and security of your data and Credit Health Report by Paisabazaar, your downloaded PDF document is password-protected. Your date of birth in the format DDMMYYYY is the password for the Credit Health Report generated by Paisabazaar.

Q. How many times can I download my Credit Health Report?

There is no capping for downloading your credit reports as long as you have subscribed to the Credit Health Report service. You can download the Credit Health Report by Paisabazaar for each credit bureau every month as soon as it is updated.

Q. How frequently is the Credit Health Report updated?

Your Credit Health Report by Paisabazaar is refreshed every month till your subscription plan is active. The last refresh date and the next date of refresh are mentioned in the report.

Q. Can I access the Credit Health Report in my regional language?

You can access Paisabazaar’s Credit Health Report in many regional languages apart from English and Hindi. These languages are as follows – Bengali, Kannada, Marathi, Telugu and Tamil.

Q. Is the credit score in the Credit Health Report taken directly from the credit bureau?

All details in the Credit Health Report are fetched directly from the respective credit bureau. Paisabazaar provides insights, tips and expert information depending upon the data received from the credit bureau to help borrowers understand their credit better.

Q. How safe is my information in the Credit Health Report?

All information in your Credit Health Report is safe and secure. It is not shared with any person, institution or organisation. It is fetched only after your approval and the downloaded PDF is password-protected and can be accessed only by you.

Q. Who can access my Credit Health Report?

Paisabazaar does not share your Credit Health Report with any entity. Only you can download your CHR from your dashboard after securely logging in to your Paisabazaar account. When you apply for a credit product through Paisabazaar, the credit report is requested by the prospective lender from the credit bureau directly and no CHR is shared with the lender.

Q. Will I get a CHR for every credit bureau?

When you subscribe to the Credit Health Report provided by Paisabazaar, you get access to Credit Health Reports by multiple credit bureaus from among TransUnion CIBIL, Experian, Equifax and CRIF High Mark.

It is worth noting that your credit score can be different for every credit bureau as each bureau has its own algorithm for calculating your credit score. Also, the reporting of details by lenders from one bureau to another can vary.

Q. What is a Credit Score?

Your credit score is a 3-digit number ranging from 300 to 900. It is calculated based on several credit factors. The closer the score to 900, the better it is considered.

A credit score of 750 and above is considered very good by lenders as it depicts your high creditworthiness. It makes you eligible for preferential rates and relaxed loan terms.