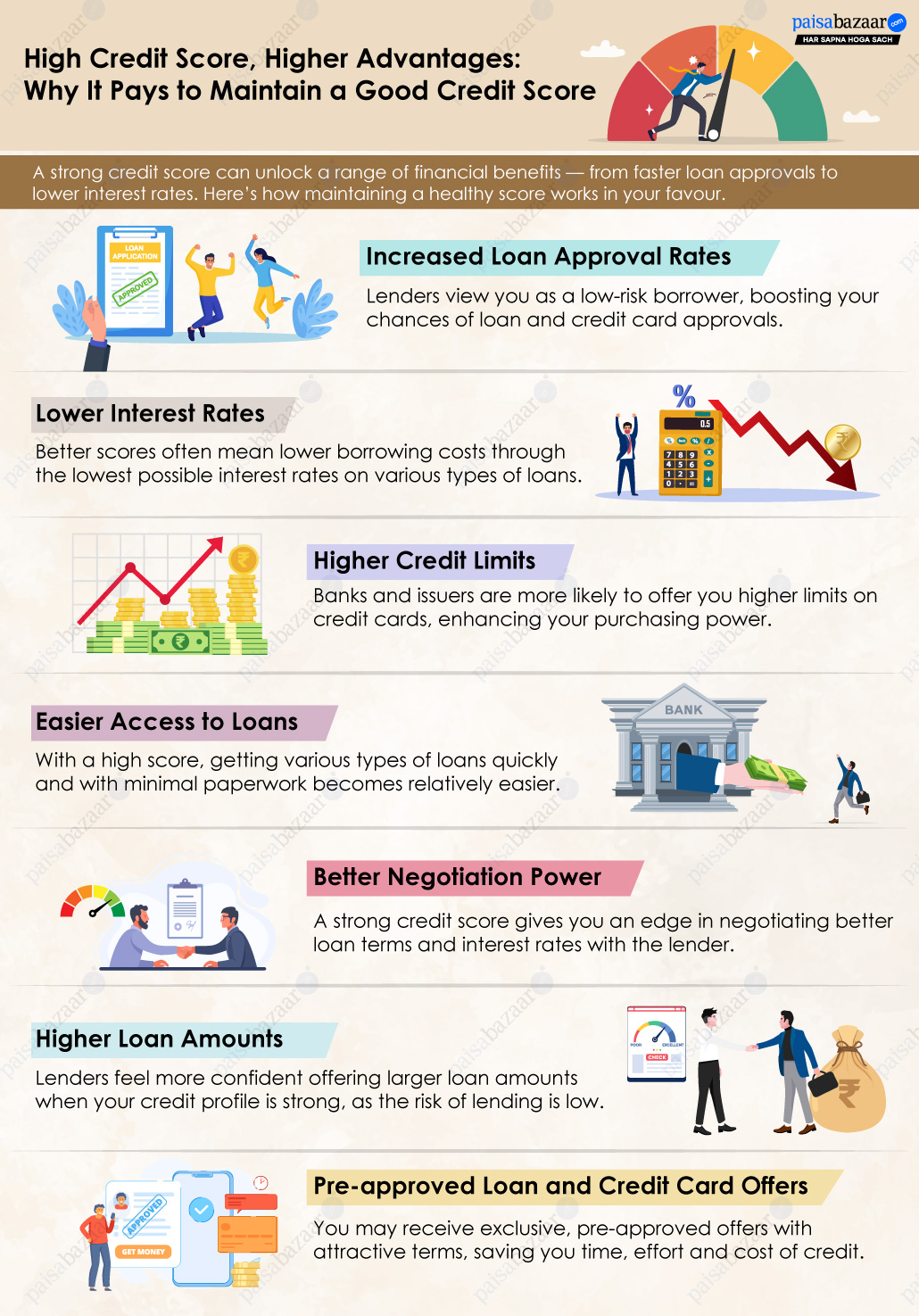

The approval and denial of your credit application depend mainly on a very important factor – credit score. A good credit score can help you get loans or credit cards easily and at a relatively lower cost of credit, whereas a low credit score can act as a major hindrance for those looking for credit urgently.

Most lenders look at an applicant’s CIBIL score (credit score provided by TransUnion CIBIL) before approving the application. A good credit score can help get loans approved at relatively lower rates and relaxed terms, apart from numerous pre-approved offers. Applicants with a poor score are not eligible for pre-approved offers, pay higher interest rates and have to adhere to stricter loan terms.

It is also noteworthy that most lenders do not approve credit applications of applicants having a poor credit score (650 or below). Even if a loan application is approved, the applicant has to pay the interest at a higher rate.

If you have a poor CIBIL score and you want to know how to increase CIBIL score to become creditworthy in future, then you should follow a disciplined credit behaviour.

47 Comments

Want to increase cibil

You should follow the points mentioned above to improve your CIBIL score.

I have taken a vehicle nd due to some issues from finance company I did not paid that amount since from 2019.If I will be repaying that all debt will my credit score increase nd will I be eligible for applying loans and credit cards.And how much time will it take to increase credit score after repaying the debt can u help me.

You should ideally repay all dues at the earliest. Do not go for loan settlement, instead, close the loan account after complete repayment. You will be able to see improvement in your credit score in the next 3 to 6 months.

I have zero cibil score , however I want to build a healthy cibil to get loans without any barriers in future. what do I need to do.

You can take an entry-level credit card or secured credit card and use it smartly (and making timely repayments) to start building your credit score. A small-ticket loan can also help you build your credit score without much difficulty.