Have you found an error in your CRIF High Mark credit report? If yes, you must know that an error in your credit report can decrease your credit score. This, in turn, can lower your chances of getting a loan at lower rates. Also, your bank may not give you the best credit card options if your credit score stoops lower than 600.

To counter this, you can and should inform your bank as well as CRIF High Mark of the wrongful entries in your credit report and get these corrected immediately.

Please note that if your CRIF credit report has errors, chances are that your credit reports from other bureaus like CIBIL, Experian or Equifax might also have the same problem. Therefore, make sure to check your credit reports from the said bureaus as well and file a dispute, if needed.

Get Your Latest Credit Score in Just 2 mins. Check Now

How to File a Dispute with CRIF High Mark

Once you’ve analyzed your credit report thoroughly and are sure of the errors, you can follow the below-mentioned simple steps to raise a dispute with CRIF High Mark:

Step 1: Log in onto the official portal of CRIF High Mark

Step 2: Enter your details on the login page to locate your account linked in the CRIF report

Step 3: Click on the “Raise a Query” tab and select the dispute category

Step 4: Enter your query details, and correction required and click on the “SUBMIT” button

You can email your concern as well at crifcare@crifhighmark.com

Customer Care Numbers: 020-6715-7771/776 /779/780 (9:00 AM to 6:00 PM, Monday to Friday)

Contact Address:

FOFB -04, 05,06, 4th Floor Art Guild House, Phoenix Market City

CTS no. 124/B, 15, LBS Marg, Kurla West, Mumbai, Maharashtra, 400070

Important Points for Filing Dispute(s) with CRIF High Mark

- Quote your CRIF High Mark Reference Number/Report ID (mentioned in the top right corner of your report)

- Keep the Subject Line as your CRIF High Mark Reference Number

- Provide details of your CRIF Account (S. No.) and contact information along with the account information being disputed/complained

- Only actual errors will be classified and treated as Complaints/Grievances; the rest of the communication will be labeled as Requests or Queries

- The bureau will send you a Ticket Number upon receipt of your correspondence. In case you wish to enquire about the progress of your dispute filed, quote this number in your inquiry.

Don’t Know your Credit Score? Check it now – Its FREE. Check Now

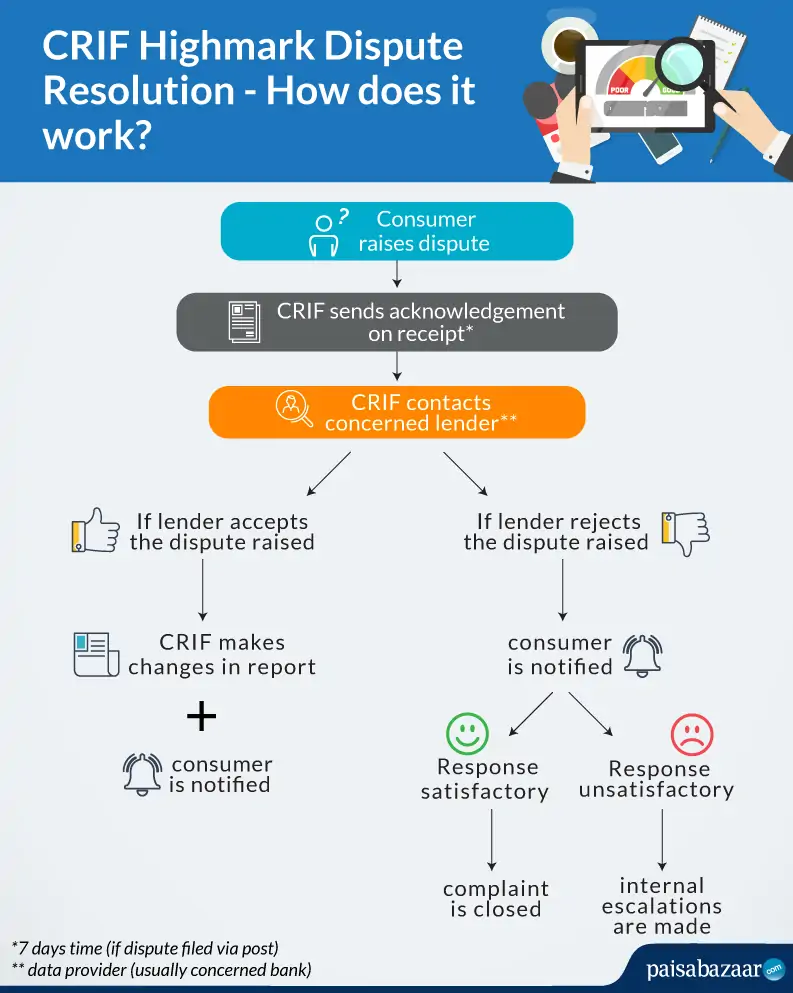

How will my CRIF High Mark Dispute get Resolved

After filing your dispute with the CRIF High Mark, the bureau shall resolve the dispute in a systematic manner which is depicted in the infographic below:

Note: These steps are only indicative and can be changed by the company at any time. Thus, it is advised to not treat these steps as descriptive.

If you are not satisfied with the steps taken by the bureau/resolution offered, you can write to the Nodal Officer at the address given below:

Email ID: nodalofficer@crifhighmark.com

Contact No.: 020 67157777

Timings: Monday to Friday; 9:00 AM to 6:00 PM

Know your Credit Score if planning for a Home Loan Check Now

FAQs

Q. How much time does CRIF High Mark take to resolve a dispute/complaint?

Ans. CRIF High Mark can take up to a maximum of 30 days to resolve your complaint/issue.

Q. If do I do if my complaint/issue is not resolved within 30 days or I am unsatisfied with the resolution offered?

Ans. If your complaint/issue is not resolved within 30 days or you are unsatisfied with the resolution offered, you can escalate the issue with RBI under the Integrated Ombudsman Scheme 2021 at https://cms.rbi.org.in, dedicated email address or via physical mode in the prescribed format to- ‘Centralised Receipt and Processing Centre’ set up at Reserve Bank of India, 4th Floor, Sector 17, Chandigarh – 160017.

Q. Are there any fees/charges to file a complaint with CRIF High Mark?

Ans. No, you are not required to pay any fees/charges to raise a complaint or dispute an error on your CRIF High Mark credit report.

Other Credit Score Related Articles: