Do you think it’s okay to let go of misinformation or incorrect details in your credit report? Here’s the news – it’s not. An error in your credit report could primarily be because of two reasons:

- The lenders (banks, etc.) shared wrong details to the bureau (here, Equifax) or the bureau made errors on its part

- Misinformation in your credit report due to some fraudulent activity

In the first case, it’s your credit score that’ll be impacted and subsequently, your credit-taking abilities will get affected too. If it’s the second case, i.e. misinformation as a result of fraud, you might end up losing access to your account and funds along with a significant dip in your credit score.

To counter this, it is advisable to regularly check your credit report so as to know and report any such information to your bank (lender) as well as Equifax and get it corrected at the earliest.

Don’t know your Credit Score? Check it here for FREE. Check Now

How to Raise a Dispute with Equifax

Follow the steps mentioned below to successfully file a complaint regarding an error in your credit report with Equifax:

Step 1: Visit the official website of Equifax India.

Step 2: Under the Forms tab, select “Dispute Resolution Form”

Step 3: Read the information on the redirected page and then scroll down to download the Dispute Resolution Form

Step 4: Fill up the Dispute Resolution Form, attach self-attested copies of the necessary KYC documents and send the above documents through courier/regular post/speed post to Equifax. Alternatively, you can also send scanned documents and Form via email to ecissupport@equifax.com.

Documents Required to File a Dispute with Equifax

When reporting an error in your credit report, Equifax demands your identity proof as well as address proof documents for authentication. Given below is the list of acceptable documents from which you can choose from when you raise a dispute/complaint with Equifax:

List of Documents for ID Proof (Any One)

- Copy of valid driving license

- Copy of PAN Card

- Copy of voters ID card

- Copy of valid passport

List of Documents for Residence Proof (Any One)

- Copy of phone bill (mobile/landline)

- Copy of credit card or other bank statements

- Copy of ration card

- Copy of gas utility bill

Please note:

- All the photocopies must be self-attested and credentials on the proof must be clearly visible

- If submitting bills, make sure that these aren’t older than 3 months from the present date

- The name and address in the documents produced must be of the one who is filing the complaint

How will My Equifax Dispute be Resolved

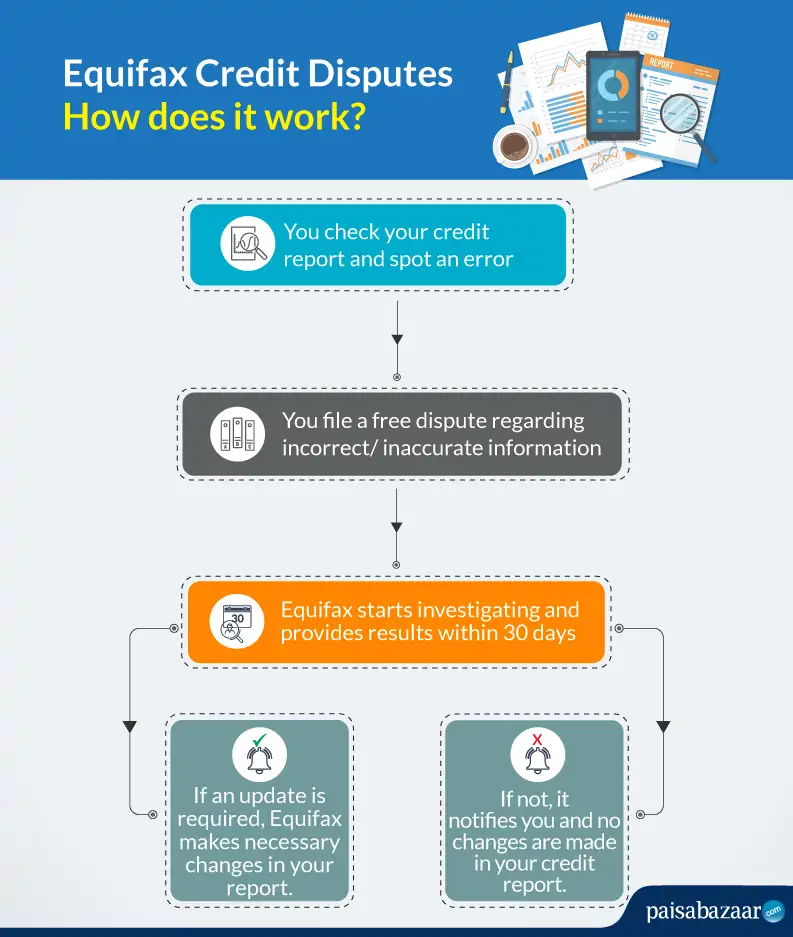

Once you raise a dispute with Equifax, the bureau shall resolve the dispute in a systematic manner which is depicted in the infographic below:

However, in case you are not satisfied with the resolution offered/steps taken by the bureau, you can escalate the issue in order mentioned below:

Level 1: Nodal Officer

| Name | Email ID |

| Yashpal Deora | yashpal.deora@equifax.com |

| Swati Sawant | swati.sawant@equifax.com |

Level 2: Principal Nodal Officer

| Name | Email ID |

| Museb Shaikh | pno2equifax.com |

Denied a Loan? Could be Because of Low Credit Score! Check Now

FAQs

Q, What are the different types of errors for which I can raise dispute with Equifax?

Different types of errors in your Equifax credit report that can affect your credit score are:

Identity-related – Your documents or your name could be mentioned incorrectly. For example, if your PAN is not correct or belongs to someone else, your credit score will be affected.

Balance or credit limit related – Your account balance displayed incorrectly; credit card limit shown less can lower your credit score. This is because a lower credit limit will increase your credit utilization ratio which will ultimately decrease your credit score.

Wrong reporting of accounts – Sometimes a closed loan account may still be showing as an active or settled account. This can affect your credit history negatively. Please note that a “settled” loan account acts as a red flag for potential lenders.

Suggested Read: Know the what factors affect your CIBIL score and what you should do to maintain a good score?

Q. What is Equifax India address where I can send the dispute resolution form and the copies of my KYC documents?

You can send the dispute resolution form and the relevant documents at the following address:

Equifax Credit Information Services Pvt Ltd.,

Unit 932, 3rd floor, Building no. 9,

Solitaire Corporate Park, Andheri Ghatkopar Link Road,

Andheri East, Mumbai – 400093

Q. What are different means to reach out to the Equifax customer care team?

You can contact the Equifax customer care Monday to Friday 10:00 AM to 7:00 PM via the following means:

Email- ecissupport@equifax.com

Phone- 1800 209 3247

Q. How long does Equifax take to resolve a dispute/complaint?

Equifax can take up to a maximum of 30 days to resolve your complaint/issue.

Articles You May Also Like: