Credit score has become an essential part of our financial lives. Whether it’s applying for a loan or a credit card, your credit history plays a crucial role. But inconsistencies and delay in reporting can make tracking credit score confusing and inconvenient.

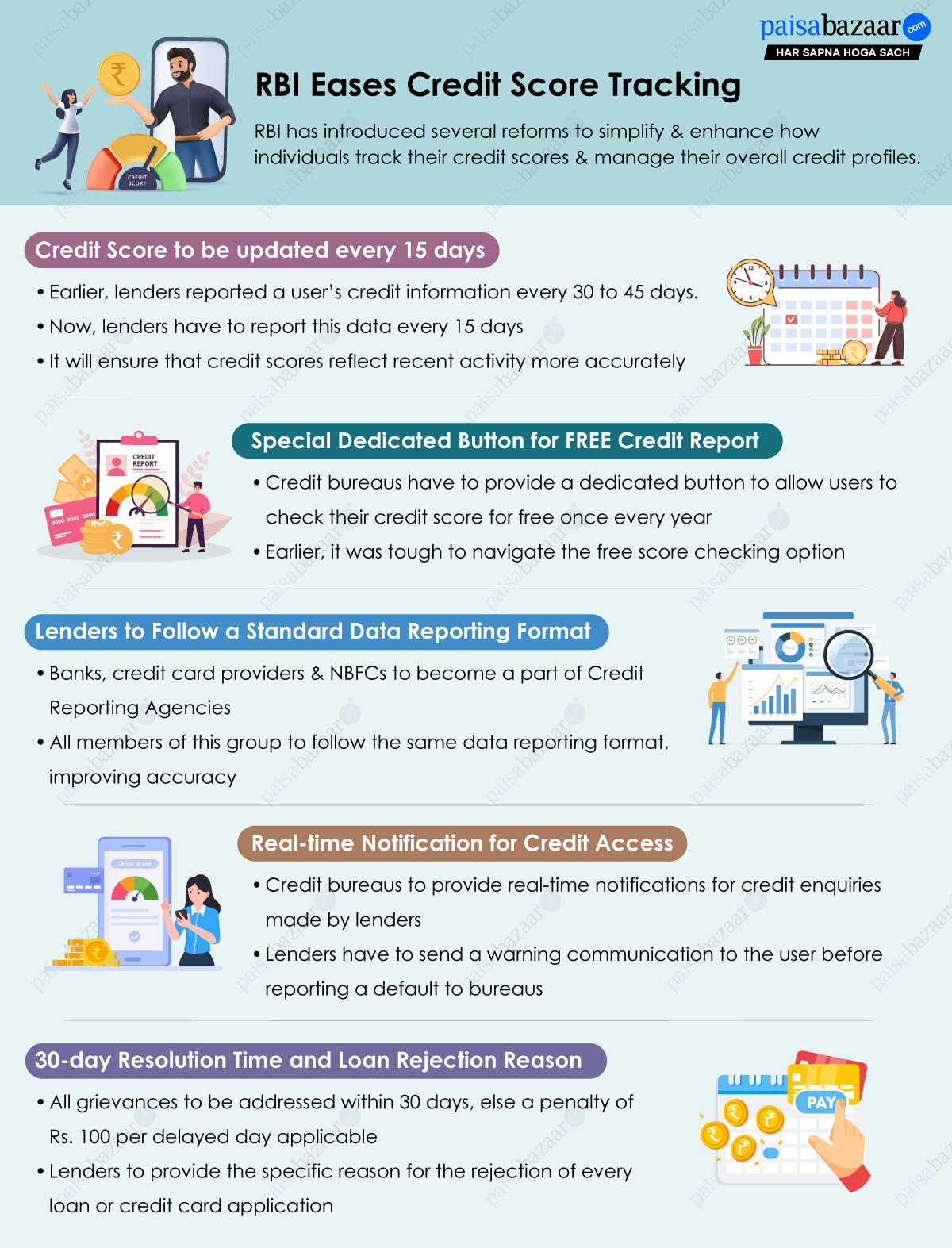

Recognising this, the RBI has rolled out a series of reforms to simplify and standardise how credit information is handled. The new measures should help consumers keep track of their credit profiles and help them manage their credit better. These are the 5 key changes:

1. Credit Score will Now be Updated Every 15 Days

Previously, credit bureaus updated your score every 30–45 days, causing delays in reflecting new credit actions and hence, further delaying improvements. This often meant borrowers paid higher interest rates or faced stricter loan terms due to outdated scores.

Now, your credit score will be refreshed every 15 days, bringing you slightly closer to your real-time credit standing. This is great for those actively taking steps to improve their creditworthiness. However, a downside of this update would mean that any default in the credit report would lower your credit score at a faster rate, if not addressed immediately.

2. One-Click Access to Free Credit Reports

Though the RBI had mandated one free credit report per year, it has now advised all credit bureaus to place a clearly visible, dedicated button on their platforms for easier access to the free credit reports. All 4 credit bureaus have already implemented this on their websites.

This move promotes transparency and encourages more consumers to track and improve their credit health. It will also enable consumers to become aware of their credit behaviour and take steps to improve their score beforehand.

Check your FREE Credit Score Now

3. All Lenders Must Join Credit Agencies & Follow One Format

The RBI has directed all lenders — banks, NBFCs, and credit card issuers — to become members of credit agencies and follow a standardised data format. This would enable all lenders to share data in the same format across all 4 bureaus and enable them to receive users’ latest credit information to update the score every 15 days without delay. This ensures uniform reporting and helps consumers receive more accurate scores.

4. Real-Time Alerts for Credit Enquiries & Missed Payments

Many users remain unaware when lenders pull their credit report multiple times, leading to a score drop. Also, several consumers weren’t able to make the payment on time due to various reasons that led to a dip in their credit scores.

RBI has advised all bureaus to send real-time notifications (via SMS/email) whenever your credit information is accessed. Plus, if you’re about to default, lenders must send you a warning before reporting it to a bureau, giving you a final chance to take corrective action.

Suggested Read: Ways to Rebuild your Credit Score

5. 30-day Grievance Resolution Window and Loan Rejection Reason Mandate

Dispute resolution with bureaus was often slow and unclear. Till now, bureaus classified grievances from users as requests or queries or communication. Now, lenders cannot re-classify your grievances under any other category. All grievances have to be treated as user complaints. If your complaint isn’t resolved within 30 days, the credit bureau shall pay you Rs. 100 for each delayed day.

Since credit bureaus need information from lenders, RBI has directed lenders to provide complete information within 21 days of receiving the request. If a lender doesn’t respond within these 21 days, they’ll face the same penalty of Rs. 100 per delayed day.

In addition to it, lenders have been asked to provide a clear, specific reason if they reject your loan or credit card application. They can no longer provide vague or generic reasons for credit rejection like “internal policy”.

Also Read: How to Raise a Dispute with CIBIL

Final Word

While these reforms are directed at lenders and credit bureaus, the biggest benefit is for borrowers. Faster score updates, standardised data, better access to reports, and real-time alerts will make managing credit much more transparent and empowering for individuals.