ICICI Current Account provides a variety of services to its customers. Keeping in consideration the different banking needs of the users, ICICI Bank provides a large number of current account variants to cater to the user’s financial needs. The customers can avail the facility of ‘Anywhere Banking’ which enables them to operate from any branch and get access to facilities like faster collection of upcountry cheques, doorstep banking, internet banking, hassle-free bulk transactions and more.

Features of ICICI Bank Current Account

The ICICI current account provides several features and benefits to its customers. Listed below are some of the key features:

- Anywhere cash deposit and withdrawal

- Multi-location fund transfer

- Mobile or Internet Banking

- Electronic money transfer

- Corporate Internet Banking

- Periodical email-statements in different formats

- Club Elite Ivy facility

Types of ICICI Current Account

Below given is the list of current account variants offered by ICICI Bank. Before opting for any account, the ICICI current account minimum balance requirement and other fees and charges should be kept in mind.

| ICICI Current Accounts | Primary Features |

| Regular Current Account Variants | |

| New Start Up Current Account |

|

| Shubhaarambh Current Account |

|

| Smart Business Account |

|

| Smart Business Account-Gold |

|

| Roaming Current Account Gold |

|

| Roaming Current Account Premium |

|

| Roaming Current Account Classic |

|

| Roaming Current Account Standard |

|

| Premium Current Account Variants | |

|

|

| Roaming Current Account Elite |

|

| Smart Business Account-Platinum |

|

|

|

| Roaming Current Account Gold Plus |

|

|

|

|

One Globe Trade Account Variants |

|

| Trade Basic |

|

|

|

| Trade Premium |

|

Given below is the detailed explanation of fees, charges and other facilities offered by the different current account variants provided by ICICI Bank. It is to be noted that the ICICI current account opening minimum balance varies from one account type to another.

New Start Up Current Account

This current account is ideal for startups and offers various transaction benefits to its customers.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Zero MAB requirement for first 6 months

Post 6 months – Rs.25,000 |

| Cash Deposit (Base & Non-Base location) | Free limit up to 12 times of maintained MAB |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs 50,000 per day (self only) |

| Number of Cheque leaves | 100 cheque leaves free per month |

| DD / PO | 10 DD / PO free per month |

| Non-maintenance of balance | Rs.1000 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Shubhaarambh Current Account

This is a current account variant for Proprietorship startups that provides the majority of financial benefits to its customers.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Zero MAB requirement for first 6 months

Post 6 months – Rs 25,000 |

| Cash Deposit (Base & Non-Base location) | Free limit up to 12 times of maintained MAB |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Rs.50,000 free per day (self only) |

| Number of Cheque leaves | 100 cheque leaves free per month |

| DD / PO | 10 DD / PO free per month |

| Non-maintenance of balance | Rs.1000 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Smart Business Account

Current Account variant providing high value transaction benefit to the customers. The users can avail free mobile alerts facility.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.25,000 (Rs.5000 for RIB / select SURU location) |

| Cash Deposit (Base & Non-Base location) | Free limit up to 12 times of maintained MAB |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 100 cheque leaves free per month |

| DD / PO | 10 DD / PO free per month |

| Non-maintenance of balance | Rs.1000 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Smart Business Account (Gold)

A business current account with anywhere free cash deposit of up to 12 times the maintained MAB.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.1 lakh |

| Cash Deposit (Base & Non-Base location) | Free limit up to 12 times of maintained MAB |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 300 cheque leaves free per month |

| DD / PO | 25 DD / PO free per month |

| Non-maintenance of balance |

Rs.1000 if MAB > = 50% Rs.3000 if MAB < 50% |

| NEFT / RTGS charges | Free NEFT and RTGS transactions |

| IMPS Payments | Rs.3.50 for transactions up to Rs.25,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Roaming Current Account Gold

A current account variant best suitable for mid-size retailers with facility of free cheque collection and payment.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.1 lakh |

| Cash Deposit (Base location) | Free limit up to Rs.10 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 200 cheque leaves free per month |

| DD / PO | 25 DD / PO free per month |

| Non-maintenance of balance | Rs.2000 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Roaming Current Account Premium

Using this ICICI Bank current account variant, the users can avail unlimited and free cash withdrawals plus can get free cheque collection and payment.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.50,000 |

| Cash Deposit (Base location) | Free limit up to Rs.5 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 100 cheque leaves free per month |

| DD / PO | 20 DD / PO free per month |

| Non-maintenance of balance | Rs.1500 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Roaming Current Account Classic

This current account variant offered by ICICI Bank is ideal for local businesses. The users can get free cheque collection and payment anywhere across the country.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.25,000 |

| Cash Deposit (Base location) | Free limit up to Rs.2.5 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 50 cheque leaves free per month |

| DD / PO | 10 DD / PO free per month |

| Non-maintenance of balance | Rs.1000 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Roaming Current Account Standard

ICICI Standard Current Account ensures smooth functioning of the business and offers free NEFT and RTGS transactions (online).

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.10,000 |

| Cash Deposit (Base location) | Free limit up to Rs.1 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 25 cheque leaves free per month |

| DD / PO | Nil |

| Non-maintenance of balance | Rs.750 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Roaming Current Account Elite

This product is ideal for high end businesses with transactions mostly in the city. The users can avail free mobile alert facility.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.10 lakh |

| Cash Deposit (Base location) | Free limit up to Rs.1 crore |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 2000 cheque leaves free per month |

| DD / PO | Free |

| Non-maintenance of balance | Rs.5000 if MAB > = 50%

Rs.10,000 if MAB < 50% |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Smart Business Account (Platinum)

Users can get a variety of financial benefits with this current account variant. One can avail free mobile alert facility.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.1 lakh |

| Cash Deposit (Base & Non-Base location) | Free limit up to 12 times of maintained MAB |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 600 cheque leaves free per month |

| Non-maintenance of balance | Rs.1000 if MAB > = 50%

Rs.5000 if MAB < 50% |

| NEFT / RTGS charges | Free NEFT and RTGS transactions |

| IMPS Payments | Rs.2.50 for transactions up to Rs.25,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Roaming Current Account Platinum

Receive higher cash free limits up to Rs.50 lakh. Avail free cheque collection and payment anywhere across the country.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.5 lakh |

| Cash Deposit (Base location) | Free limit up to Rs.50 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 1000 cheque leaves free per month |

| DD / PO | Free |

| Non-maintenance of balance | Rs.2500 if MAB > = 50%

Rs.5000 if MAB < 50% |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Roaming Current Account Gold Plus

This account is ideal for carrying bulk transactions on a daily basis. Get free cheque collection and payment anywhere across the country.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.3 lakh |

| Cash Deposit (Base location) | Free limit up to Rs.30 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Free limit of Rs.50,000 per day (self only) |

| Number of Cheque leaves | 600 cheque leaves free per month |

| DD / PO | Free |

| Non-maintenance of balance | Rs.3000 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Monthly Physical Account Statement | Rs.25 per month |

| Account Closure Charges | Within 14 days – Nil |

Made 2 Order Account

Using this ICICI Bank current account variant, the users get the facility to customize the account according to their specific business needs.

| Primary Features | Charges |

| Monthly Average Balance (MAB) | Rs.3 lakh |

| Cash Deposit (Base & Non-Base location) | Flexible cash deposit limits |

| Free limits in services | Flexibility in deciding the higher free limits |

| Number of Cheque leaves | Flexibility in choosing free cheque leaves |

| DD / PO | Customized DD / PO limits |

| Account Statement | Free email statement on daily basis |

Trade Basic

The account is suitable for cross border or domestic business transactions. Get a dedicated Relationship Manager for this account.

| Primary Features | Charges |

| Monthly Average Balance (MAB) or Monthly Throughput USD equivalent (MTP) | Rs.50,000 MAB or 5000 MTP |

| Cash Deposit (Base location) | Free limit up to Rs.5 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Rs.50,000 free per day (self only) |

| Number of Cheque leaves | 100 cheque leaves free per month |

| Non-maintenance of balance | Rs.1500 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Account Statement (via fax) | Rs.5 per page |

| Account Closure Charges | Within 14 days – Nil |

Trade Gold

This Current Account variant provides a free cash deposit limit of up to Rs.5 lakh. The customers get the advantage of free RTGS and NEFT collections.

| Primary Features | Charges |

| Monthly Average Balance (MAB) or Monthly Throughput USD equivalent (MTP) | Rs.1 lakh MAB or 20,000 MTP |

| Cash Deposit (Base location) | Free limit up to Rs.10 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Rs.50,000 free per day (self only) |

| Number of Cheque leaves | 200 cheque leaves free per month |

| Non-maintenance of balance | Rs.2000 per month |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Statement (via fax) | Rs.5 per page |

| Account Closure Charges | Within 14 days – Nil |

Trade Premium

The account is ideal for customers processing large value transactions on a daily basis. The account provides the users with unlimited and free cash withdrawal from base location.

| Primary Features | Charges |

| Monthly Average Balance (MAB) or Monthly Throughput USD equivalent (MTP) | Rs.5 lakh MAB or 80,000 MTP |

| Cash Deposit (Base location) | Free limit up to Rs.50 lakh |

| Cash Withdrawal (Base location) | Unlimited and Free |

| Cash Withdrawal (Non-Base location) | Rs.50,000 free per day (self only) |

| Number of Cheque leaves | 1000 cheque leaves free per month |

| Non-maintenance of balance | Rs.2500 if MAB / MTP is > = 50%

Rs.5000 if MAB / MTP is < 50% |

| NEFT / RTGS charges | Free NEFT and RTGS collections |

| IMPS Payments | Rs.3.50 for transactions up to Rs.10,000 |

| Account Statement (via fax) | Rs.5 per page |

| Account Closure Charges | Within 14 days – Nil |

Comparison of ICICI Bank Current Account Variants

| Account Type | Primary Features | |||

| Monthly Average Balance (MAB) | Non-maintenance charges

(per month) |

Cash Deposit | Cash Withdrawal (non-home branch) | |

| New Start Up Current Account | Zero for first 6 months

Post 6 months – Rs.25,000 |

Rs.1000 | Free limit up to 12 times of maintained MAB | Free limit of Rs 50,000 per day (self only) |

| Shubhaarambh Current Account | Zero for first 6 months

Post 6 months – Rs.25,000 |

Rs.1000 | Free limit up to 12 times of maintained MAB | Free limit of Rs 50,000 per day (self only) |

| Smart Business Account | Rs.25,000 (Rs.5000 for RIB / select SURU location) | Rs.1000 | Free limit up to 12 times of maintained MAB | Free limit of Rs 50,000 per day (self only) |

| Smart Business Account-Gold | Rs.1 lakh | Rs.1000 if MAB > = 50% | Free limit up to 12 times of maintained MAB | Free limit of Rs 50,000 per day (self only) |

| Roaming Current Account Gold | Rs.1 lakh | Rs.2000 | Free limit up to Rs.10 lakh | Free limit of Rs 50,000 per day (self only) |

| Roaming Current Account Premium | Rs.50,000 | Rs.1500 | Free limit up to Rs.5 lakh | Free limit of Rs.50,000 per day (self only) |

| Roaming Current Account Classic | Rs.25,000 | Rs.1000 | Free limit up to Rs.2.5 lakh | Free limit of Rs.50,000 per day (self only) |

| Roaming Current Account Standard | Rs.10,000 | Rs.750 | Free limit up to Rs.1 lakh | Free limit of Rs.50,000 per day (self only) |

| Roaming Current Account Elite | Rs.10 lakh | Rs.5000 if MAB > = 50% | Free limit up to Rs.1 crore | Free limit of Rs.50,000 per day (self only) |

| Smart Business Account-Platinum | Rs.1 lakh | Rs.1000 if MAB > = 50% | Free limit up to 12 times of maintained MAB | Free limit of Rs.50,000 per day (self only) |

| Roaming Current Account Platinum | Rs.5 lakh | Rs.2500 if MAB > = 50% | Free limit up to Rs.50 lakh | Free limit of Rs.50,000 per day (self only) |

| Roaming Current Account Gold Plus | Rs.3 lakh | Rs.3000 | Free limit up to Rs.30 lakh | Free limit of Rs.50,000 per day (self only) |

| Made 2 Order | Rs.3 lakh | NA | Flexible cash deposit limits | NA |

| Trade Basic | Rs.50,000 | Rs.1500 | Free limit up to Rs.5 lakh | Rs.50,000 free per day (self only) |

| Trade Gold | Rs.1 lakh | Rs.2000 | Free limit up to Rs.10 lakh | Rs.50,000 free per day (self only) |

| Trade Premium | Rs.5 lakh | Rs.2500 if MAB is > = 50% | Free limit up to Rs.50 lakh | Rs.50,000 free per day (self only) |

Eligibility Criteria for ICICI Bank Current Account Opening

ICICI current account can be opened by below displayed entities engaged in business activity:

- Individual

- Sole Proprietor

- Partnership Firm

- Company

- Trust, Society, Association and Club

- HUF

- Limited Liability Partnership

ICICI Bank Current Account opening minimum balance requirement varies from one account type to another. Also, the cash deposit limit in ICICI Bank Current Account variants is a major factor to be kept in consideration while opting for one.

How to Open Current Account in ICICI Bank?

The customers wishing to open ICICI current account can do so either online or by visiting the nearest bank branch. Below mentioned are the steps one needs to follow:

Online

- Visit the official website of ICICI Bank and click on the ‘Business’ section.

- In the newly opened page, Click on the ‘Apply Now’ section.

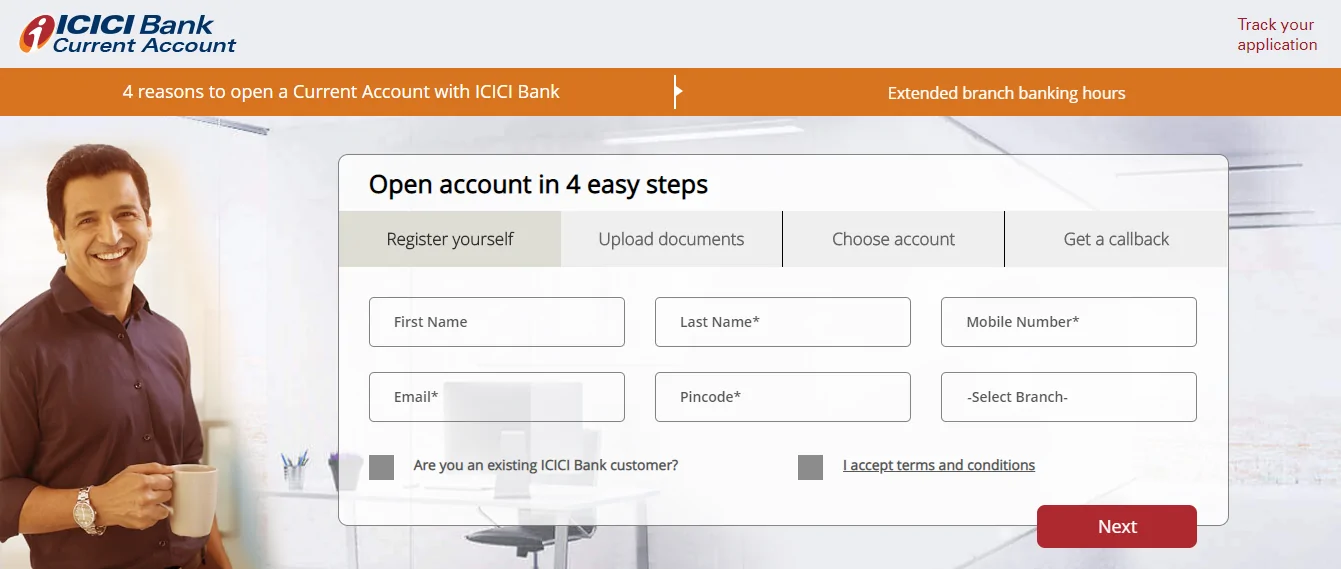

- In the redirected page, register by providing all the required information like name, mobile, number, pincode and branch and Click on ‘Next’. Have a look at the below mentioned picture for better understanding

- Verify the mobile number by entering the OTP received on the registered mobile number

- After successful verification, proceed to the next step and upload all the required KYC acceptable documents

- Choose the ICICI Bank Current Account variant

- Get a call bank from ICICI Bank representative for further confirmation

Offline

The customer can visit the nearest ICICI Bank branch and submit the account opening form along with the required KYC acceptable documents. For any assistance and further information, the user can contact the ICICI current account customer care.

Documents Required for Opening ICICI Bank Current Account

|

List of Common Documents |

|

Below mentioned is the list of additional documents required in accordance with the chosen current account variant.

|

For Sole Proprietorship Firm |

|

|

For HUF |

|

|

For Partnership Firm |

|

|

For Private / Public Limited Company |

|

|

For Trust, Society, Association and Club |

|

Frequently Asked Questions (FAQs)

Q. What is Club Elite Ivy by ICICI Bank?

A. It is an exclusive relationship programme designed keeping in consideration the banking needs of special current account clients. ICICI Bank’s current account minimum balance need not to be maintained here.

Q. How to contact ICICI Bank Current Account customer care?

A. One can call on the toll-free number (1860 120 7777, 1800 103 8181, 1860 120 3399) for customer care assistance.

Q. How can one do ICICI Bank Current Account login via Internet?

A. For a new user account, the Internet Banking User ID and Password is present in the Welcome Kit provided at the time of account opening. Use that ID and Password to get access to all banking facilities online.

Q. How to get ICICI Bank Current Account Statement?

A. Follow the below mentioned steps:

- Login to ICICI Current Account Net Banking

- Enter the User ID and Password

- Click on ‘E-Statement’

- Select Account Number, Period and Click on ’PDF’ to generate