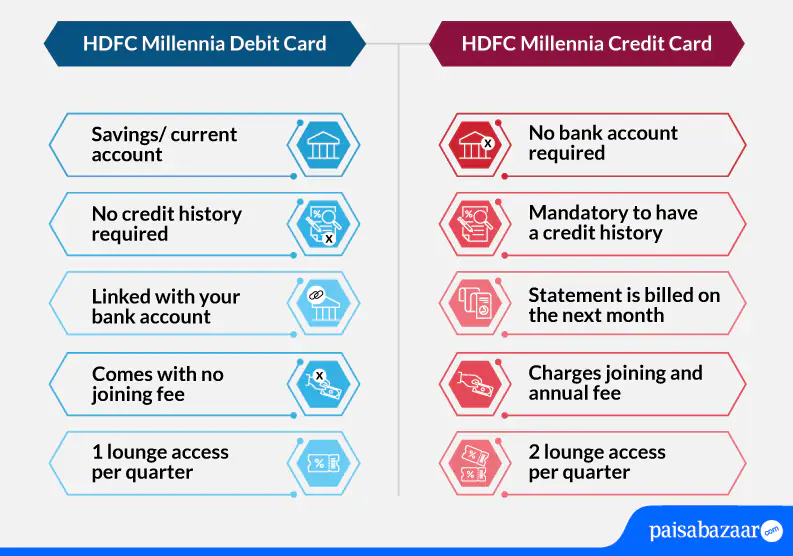

HDFC Millennia Debit Card and HDFC Millennia Credit Card, both are popular for their rewarding features like cashback, lounge access, insurance coverage, dining discount and much more. Just like credit cards, HDFC debit cards also allow you to earn decent rewards on your transactions and later redeem them against multiple categories. Choosing the best option between these two depends on your requirements and relationship with the bank. Here is a detailed comparison between both of them to help you make an informed decision:

Key Highlights: HDFC Millennia Debit Card Vs. Credit Card

|

||

| Particular | HDFC Millennia Debit Card |

HDFC Millennia Credit Card |

| Joining Fee | Nil | Rs. 1,000 |

| Renewal Fee | Rs. 500 | Rs. 1,000 (Waived off on spending Rs. 1 lakh in a year) |

| Welcome Benefits | NA | 1,000 CashPoints after the payment of joining fee |

| Reward Benefits |

|

|

| Travel Benefits | 4 complimentary domestic lounge access every year | 8 complimentary domestic lounge access every year |

| Paisabazaar’s Rating | ★★★ (3/5) | ★★★ (3.5/5) |

Popular HDFC Bank Debit Cards | Popular HDFC Bank Credit Cards

Note: Debit cards are issued whenever you open a savings account with the bank. If you do not have a debit card, you can also apply for it separately by filling out the application form. It is mandatory to have a savings/ current account with the bank to avail of a debit card.