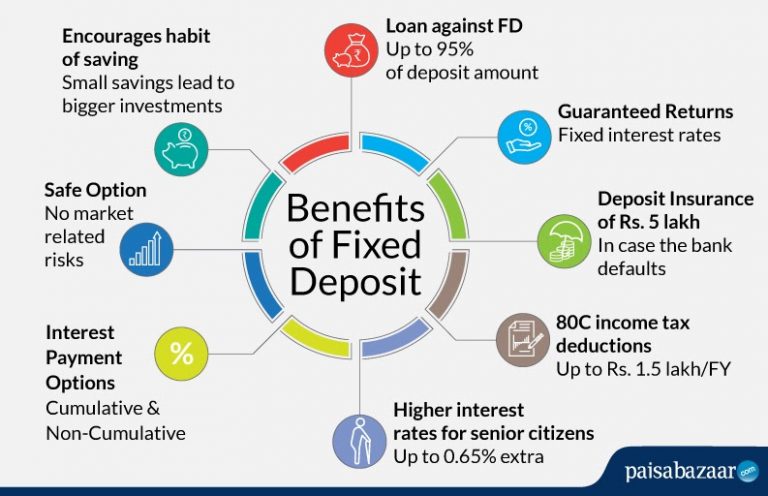

For Indians, investing in a fixed deposit has always been one of the preferred choices. There is very low risk involved while the returns are guaranteed. Also, fixed deposits are not market linked thus market volatility plays no part, thus, an ideal choice for those who are less aware of the capital market.

What is a Fixed Deposit?

Fixed deposit is a financial instrument in which there is a fixed rate of interest for a fixed period of time. Tenure of deposit can range from as little as 7 days and it can stretch out till 10 years (20 years in some banks).

Here, investors are offered with a higher rate of interest and thus the returns are ascended as compared to keeping one’s money in a savings account.

6 Comments

Can be online FD be transferred from 1 branch to another?

Hi Basu,

Yes, many banks (like SBI) provide the facility of online transfer from branch to another. Please check with your bank to confirm.

Thanks

In the case of fixed deposits, if we take the amount which was deposited in the FD, before the maturity date, is any decline of the amount considered?

Hi Balaji,

If you take out FD amount before maturity, this will be called as premature withdrawal. Some of the banks charge a penalty on premature withdrawal which can range from 0.5% to 1% of the FD amount (principal + interest), approximately. However, there are some banks who do not charge any penalty on premature withdrawal of some specific fixed deposits. Read here about these.

Will be the fd’s safe with SBI during the financial emergency in india during this covid pandemic?

Hi Mandar,

Your FD in SBI is safe. The FD rates sure are falling but it will not affect existing term deposit investments.