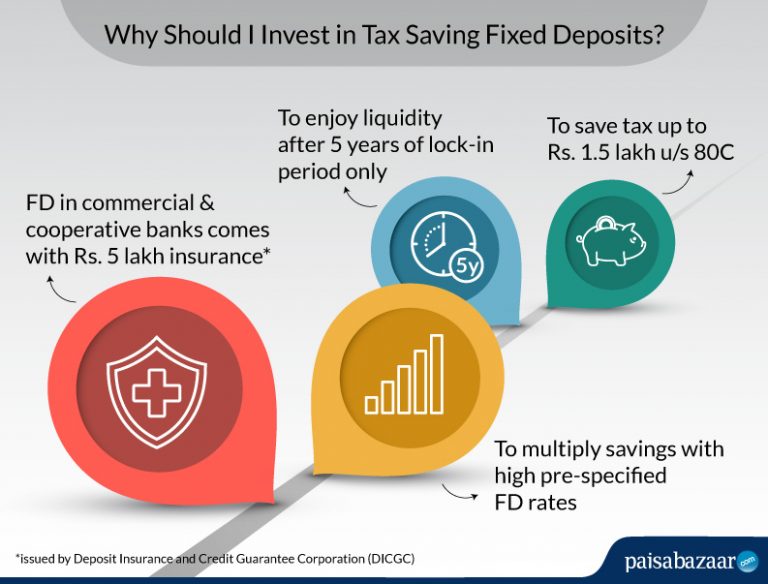

Investing in tax saving financial instruments is a must for any earning individual whose income falls in the taxable income slab. There is a wide range of tax-saving options available in the market but for the risk-averse investors, five year tax-saving fixed deposits rank comparatively higher. There are guaranteed returns at attractive FD rates thus making tax saver FD worth considering for all.