What is DICGC?

DICGC or Deposit Insurance and Credit Guarantee Corporation is a wholly-owned subsidiary of the Reserve Bank of India. This corporation was built to provide insurance of deposits and also, to solidify the credit facilities in India.

What is the maximum insurance amount provided by DICGC?

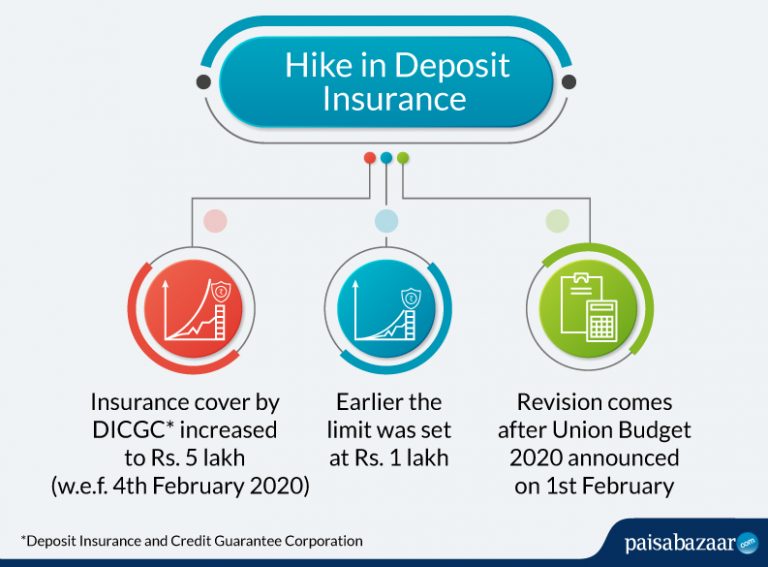

You are insured for up to Rs. 5 lakh (principal + interest) in a scheduled bank. It can be a commercial bank like SBI or HDFC Bank or it can be a small finance bank like Fincare or Suryodaya.

Case 1: You have Rs. 4.5 lakh in a bank and have earned an interest of Rs. 15,000 on it. The bank defaults. DICGC will pay you a total of Rs. 4.65 lakh.

Case 2: You have Rs. 5 lakh in a bank. You earned an interest of Rs. 25,000 on it. The bank defaults. DICGC will pay you a total of Rs. 5 lakh.

Case 3: You have Rs. 6 lakh in a bank. You earn an interest of Rs. 50,000 on it. The bank goes insolvent. DICGC will pay you a total of Rs. 5 lakh.

What is covered in the DICGC insurance?

Money kept in the following is insured by DICGC:

- Savings account

- Fixed deposit account

- Savings account

- Recurring account

(This is not an exhaustive list)

Book SBM Bank FD & Get Lifetime FREE Step UP Credit Card Know More

What is not covered in the deposit insurance by DICGC?

The following types of deposits are not insured by DICGC:

- Foreign Governments deposits

- Central/State Government deposits

- Inter-bank deposits

- Deposits of the State Land Development Banks with the State co-operative bank

- Any amount due on account of and deposit received outside India

- Any amount, which has been specifically exempted by the corporation with the previous approval of Reserve Bank of India

Are the company/corporate fixed deposits covered by DICGC?

No. DICGC deposit insurance is solely for banks. Non-banking financial companies (NBFCs) do not come under its umbrella.

Read More: Company/Corporate Fixed Deposits

What if I have different FDs in different banks?

All your deposits in a bank are covered for up to Rs. 5 lakh. Similarly, if you simultaneously invest in another bank, that amount will also be covered separately.

Let’s understand this with an example:

You have 3 FDs in 3 different banks, say, SBI (Rs. 1 lakh), Yes Bank (Rs. 4.5 lakh) and Kotak Mahindra Bank (Rs. 5 lakh). Now, Yes Bank and Kotak Mahindra Bank all go into liquidation (which is very unlikely). DICGC will pay you Rs. 4.5 lakh for your deposits in Yes Bank and Rs. 5 lakh for your deposits in Kotak Mahindra Bank.

What if there is more than one account in the same bank?

In case of more than one account in the same bank, whether it’s a combination of savings and fixed deposit account or the same type of accounts, the insurance coverage will be paid a total of Rs. 5 lakh and not separately per account. This coverage is provided per bank and not per account type.

In case of Joint Accounts

In case of a person holding two accounts in a bank, one individually and the other as a joint account, then DICGC shall be paying the compensation of Rs. 5 – 5 lakh separately to each depositor. Here, these accounts shall be held in different capacities and different rights.

Suppose, Mrs Arya has three accounts in, let’s say, DBS Bank, viz. a salary account (balance of Rs. 2.5 lakh), an FD account (Rs. 5 lakh) and a joint account, with her husband being the prime holder (balanced at Rs. 2.5 lakh). Now, unfortunately, the bank goes into liquidation. Mrs Arya’s salary account and FD account shall be treated as one, i.e. in the same capacity and right. Thus, DICGC shall be paying Rs. 5 lakh to Mrs Arya and Rs. 2.5 lakh to her husband, separately.

Get Secured Credit Card with credit limit of 100% of your FD Apply Now

Frequently Asked Questions (FAQs)

Does the interest accrued on a deposit also covered by the deposit insurance?

Yes. DICGC covers both the principal as well as the interest accrued. However, the total of the principal and interest cannot cross Rs. 5 lakh. If the principal itself is Rs. 5 lakh, the interest on it will not be covered.

Do I have to pay for the deposit insurance?

No. the cost of deposit insurance is borne solely by the insured bank.

When does DICGC come into the picture?

DICGC becomes liable to pay when an insured bank goes into liquidation. The bank provides the DICGC the claim list. Within 2 months of receipt of this claim list, the DICGC pays the total insurance amount to the liquidator. After this, it becomes the responsibility of the liquidator to proportionately disburse this amount to each insured depositor.

Can my bank withdraw from the DICGC coverage?

DICGC coverage is not a choice. It is compulsory. Therefore, no bank can withdraw from it.

How would I know if my bank deposit is insured by the DICGC?

Although it is established that all the commercial banks and cooperative banks are insured by the DICGC, in case of doubt, you must enquire about it with the bank’s official. Also, most of the times, in case of a fixed deposit, it will be clearly mentioned on your Fixed Deposit Receipt or FDR.

48 Comments

hi,please helpme.this statement is written on official site of DICGC faq 17.if bank dont pay

the premium then the corporation has no liability?

“On liquidation etc. of other de-registered banks i.e. banks which have been de-registered on other grounds such as non payment of premium or their ceasing to be eligible co-operative banks under section 2(gg) of the DICGC Act, 1961, the Corporation will have no liability”

Yes. DICGC is only liable to pay compensation for the “insured” banks only. This means that the bank needs to be registered with the DICGC. Also, if a registered bank has not paid an insurance premium to the DICGC and the corporation deregisters the bank on such grounds, then the DICGC will not be held liable for deposit compensation in liquidation (of such banks).

Important: The information given above is to convey the basic provisions of the deposit insurance scheme of the Corporation. The information is of a non-technical nature and is not intended to be a legal interpretation of the deposit insurance scheme.

then the money would be insecure in bank as the corporation wont have any liablity,even in an insured bank,just because it didnt paid the premium. Would this cause lose to public?

Hi,

Paying the premium to the DICGC is not an option. It’s compulsory for the insured banks to pay the premium without which the DICGC can de-register them from the list. No bank would want to lose its “insured” status as it means losing its credibility too.

Therefore, the chances of the banks not paying their insurance premium to the DICGC are extremely thin.

Also, please note that the DICGC is a wholly-owned subsidiary of the Reserve Bank of India.