Fixed Deposits are one of the safest investment options and quite popular in our country among risk-averse investors. FDs are also called term deposits as they are booked for a fixed term which may range from as low as 7 days and can go up to 10 years. Also, fixed deposits provide guaranteed returns at fixed FD rates thus giving assurance of said returns. As safe an option as a fixed deposit is, it is equally liquid too, i.e. one can open and close it anytime as per their convenience. Investors have the choice of continuing their FD till maturity or access it before the time, via premature withdrawal. However, it’s not advisable to prematurely close your fixed deposit. A credit card against FD is a better option when you immediately need funds. Click the banner below to know about Paisabazaar’s credit card against FD. Now when it comes to knowing how to close an FD, it is important to know that there are two modes to exercise FD closure. The first one is closing FD on maturity while the other one aids those who wish to close FD before maturity.  Let’s first talk about how to close FD on maturity.

Let’s first talk about how to close FD on maturity.

Closing FD on Maturity

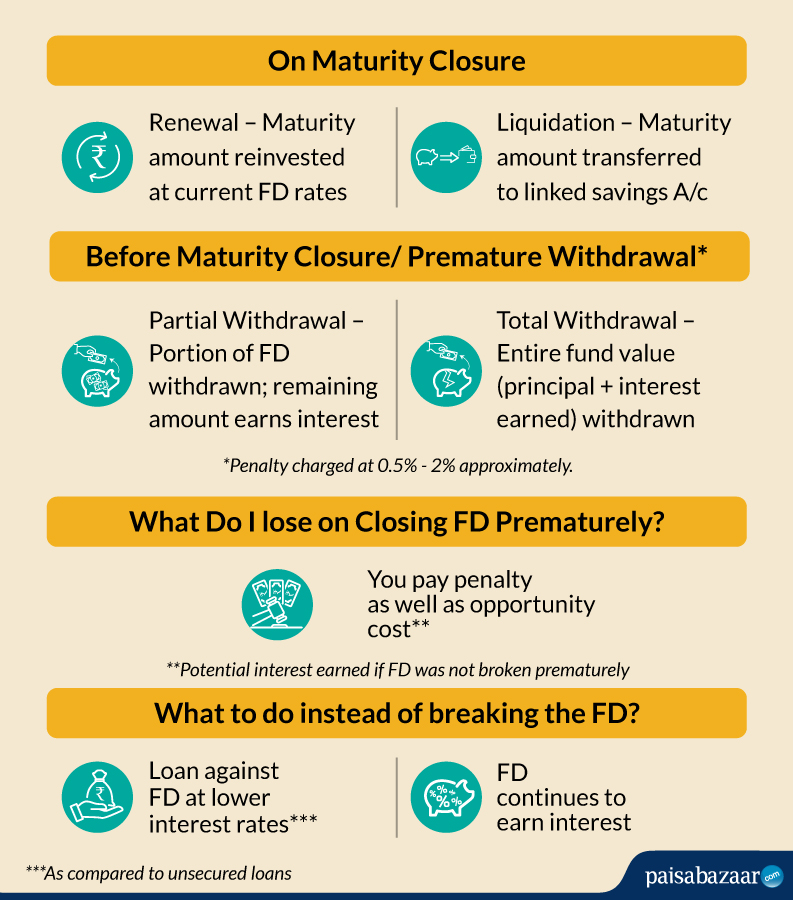

Although the process of FD closure may vary from bank to bank, the surrender of a fixed deposit certificate is a pre-requisite in all banks and other providers as well. Before submitting this certificate, make sure that it is duly signed by all the depositors if it was jointly held. Along with the deposit certificate, your provider may also ask for the submission of an account closing form, just like an account opening form, giving necessary details which should include savings account details, FD details, etc. Banks usually use either of the following two options to deal with fixed deposits when they mature:

2 Comments

Is it advisable to open ONLINE fixed deposit ?

Yes. Opening an online FD is as viable as an offline FD.

Use only your bank’s official website or mobile banking app to open your deposit. Never use a public internet connection for any type of transaction, be it transfer of funds or opening a fixed deposit.