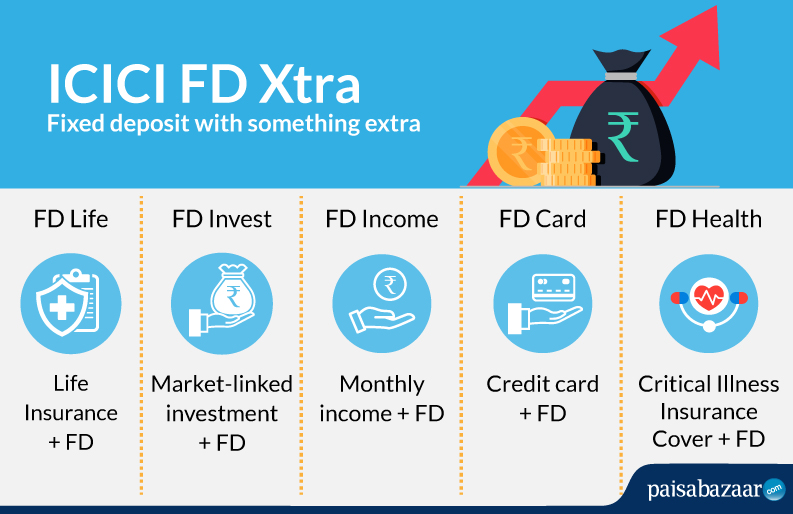

ICICI Bank fixed deposit schemes provide assured returns along with factors like growth, flexibility and protection. Investors who are looking for extra benefits along with wealth creation can choose from a range of products offered under its flagship term deposit, i.e. ICICI FD Xtra.

ICICI Bank FD Xtra Interest Rates

|

Tenure |

ICICI FD Xtra Interest Rates (p.a.) w.e.f. 4 December 2021 | |

| General | Senior Citizens | |

| 7 days to 14 days | 2.50% | 3.00% |

| 15 days to 29 days | 2.50% | 3.00% |

| 30 days to 45 days | 3.00% | 3.50% |

| 46 days to 60 days | 3.00% | 3.50% |

| 61 days to 90 days | 3.00% | 3.50% |

| 91 days to 120 days | 3.50% | 4.00% |

| 121 days to 184 days | 3.50% | 4.00% |

| 185 days to 289 days | 4.40% | 4.90% |

| 290 days to less than 1 year | 4.40% | 4.90% |

| 1 year to 389 days | 4.90% | 5.40% |

| 390 days to < 18 months | 4.90% | 5.40% |

| 18 months to 2 years | 5.00% | 5.50% |

| 2 years 1 day to 3 years | 5.20% | 5.70% |

| 3 years 1 day to 5 years | 5.40% | 5.90% |

| 5 years 1 day to 10 years | 5.60% | 6.30%* |

| 5 Years Tax saver FD (max. up to Rs. 1.50 lac) |

5.40% | 5.90% |

Interest Rates with effect from 04 December 2021. *Additional interest rate in ICICI Golden Years FD Scheme for senior citizens only.

Also Read: Comparison of ICICI Bank FD interest rates and FD Rates of Other Banks/NBFCS

What is FD Xtra?

ICICI Bank recently launched new term deposit option by the name of FD Xtra. FD Xtra is specially designed to meet life-stage needs and goals of investors. Sub-types in this scheme include FD Life, FD Invest, FD Income, FD Card and FD Health. Detailed information about the said categories of FD Xtra is discussed below:

1. FD Life

FD Life comes with various benefits of returns and security of Fixed deposits. It also offers a fixed deposit with Group Term Plan (GTP) Life Cover. Additional details are mentioned below.

| Particulars | Details |

| Min. Amount of Deposit | Rs. 3 lakh |

| Duration of Deposit | 2 years (min.) |

| Eligibility |

|

| Life Cover |

|

| Interest Treatment | Prevailing fixed deposit interest rates applicable for the deposit period for which the deposit was opened |

| Taxation | Interest earned on the deposit will be subject to Tax Deducted at Source (TDS) |

| Premature Withdrawal |

|

2. FD Invest

ICICI Bank provides its customers with the facility of FD Invest in which the customers have assured the safety of a Fixed Deposit and the growth opportunity of a Mutual Fund Systematic Investment Plan (SIP). FD Invest helps the investors to earn monthly interest on the principal invested and the same interest which is invested in Mutual Fund (MF) SIP providing the Xtra opportunity.

| Particulars | Details |

| Amount of Deposit | Rs. 2 lakh (min.) |

| Duration of Deposit | 12 months – 10 years |

| Eligibility |

|

| Investment Details |

|

| Interest Treatment |

|

Book SBM Bank FD & Get Lifetime FREE Step UP Credit Card Apply Now

3. FD Income

A sub-type of FD Xtra, FD Income is available in two phases of Investment Phase (Fixed Deposit Monthly Income Option) and Payout Phase (Lump-sum and Monthly Income Option). Further details about the scheme are mentioned below:

| Particulars | Details |

| Eligibility | Resident Individuals (for single/joint account) |

| Amount of Deposit | Min. Rs. 1 lakh and thereafter in multiples of Rs. 25,000 |

| Duration of Deposit |

|

| Investment Options | Option 1: Entire maturity proceeds invested in Annuity FD in Payout Phase (after completion of Investment Phase) with monthly payout option

Option 2: 30% of maturity amount paid at the end of Investment Phase & remaining amount invested in FD with monthly payout option |

| Partial/Premature Withdrawal |

|

| Interest Treatment | Same interest applicable for investment and payout phase |

| Taxation | Interest earned subject to Tax Deducted at Source (TDS) |

Let’s look at the example mentioned below to know how it works:

- Case 1

| Investment Phase | |||

| Installment Amount | Tenure | Rate of Interest | Total Corpus |

| Rs. 1,00,000 | 24 months | 7.25% | Rs. 1,15,454 |

| Rs. 2,00,000 | 24 months | 7.25% | Rs. 2,30,908 |

| Payout Phase | ||

| Lump-Sum Payment | Tenure | Monthly Payout |

| 0 | 24 months | Rs. 5,182 |

| 0 | 24 months | Rs. 10,365 |

Note: Stated figures are indicative. Actual numbers may vary.

Get Secured Credit Card with credit limit of 100% of your FD Apply Now

- Case 2

| Investment Phase | |||

| Installment Amount | Tenure | Rate of Interest | Total Corpus |

| Rs. 1,00,000 | 24 months | 7.25% | Rs.1,15,454 |

| Rs. 2,00,000 | 24 months | 7.25% | Rs. 2,30,908 |

| Payout Phase | ||

| Lump-Sum Payment | Tenure | Monthly Payout |

| Rs. 34,636 | 24 months | Rs. 3, 628 |

| Rs. 69, 272 | 24 months | Rs. 7,255 |

Note: Stated figures are indicative. Actual numbers may vary.

Also Check: FD Calculator 2023

4. FD Card

ICICI Bank customers can avail of the facility of a credit card against fixed deposit with no income documents required. Additional details are mentioned below:

| Particulars | Details |

| Eligibility | Resident Individuals (Single or joint) |

| Duration of Deposit | Min. 6 months |

| Min. Amount of Deposit | Rs. 10,000 |

| Types of Cards Available | |

| Interest Treatment |

|

| Taxation | Interest earned subject to Tax Deducted at Source (TDS) |

Get Lifetime FREE Step UP Credit Card With No Annual Fees Know More

5. FD Health

The newest addition in the varied versions of FD Xtra, investors can avail of Critical Illness Cover (protection) along with the investment of their savings. The insurance will be provided by ICICI Lombard General Insurance for 1 year. Customers can renew this cover on completion of 1 year. The said insurance shall cover costs up to Rs. 1 lakh for 33 critical illnesses including kidney failure, cancer, liver disease, Alzheimer’s disease, and benign brain tumor.

Further details about the plan are discussed below:

| Particulars | Details |

| Eligibility | Individuals (individually or in a joint account) ages between 18 – 50 years |

| Duration of Deposit | Min. 2 years |

| Amount of Deposit | Rs. 2 lakh – less than Rs. 3 lakh |

| Interest Treatment | Prevailing interest rates as applicable to FD |

| Taxation | Interest earned subject to TDS |

| Premature Withdrawal | Available (Critical Illness Cover terminated on withdrawal) |

Book FD with SBM Bank & Get Virtual Credit Card Instantly Apply Now

Documents Required to Apply

To open a fixed deposit account with ICICI Bank, customers are advised to keep the following list of documents in check and avoid delay related to the documentation:

- Duly filled-in and signed application form

- KYC documents for ID proof, residence proof, age proof, etc. (Aadhaar Card, passport, voter’s ID card, driving license, etc.)

- PAN Card

- Passport size photograph(s)

Note: This is not an exhaustive list. Further alterations in the same can be expected.