As can be derived from the name, it is the loan provided against your gold. Many banks and non-banking financial institutions provide Gold Loan. Gold can be in any form — gold bar, jewelry, gold coins etc. It is a secured loan against your loan. The lender has the right to auction your gold if you fail to repay your loan amount.

Gold loan is a better option than other forms of unsecured loans as the rate of interest is lower. Also, the documentation process is very fast and easy. You don’t have to provide any income proof. One of the unique features about the gold loan is that you have the option to repay the interest amount as an equated monthly installment (EMI) and you can repay the principal amount at the time of maturity. Also, most of the lenders don’t chare any processing fees. However, these are short-duration loans with of up to 15 months.

So, if you are in need of funds, utilize the gold lying idle in you bank locker to avail the gold loan at lower interest rate. The bank will ensure the safety of your loan till the tenure of the loan is over. After you repay the loan (both principal as well as interest), you get your gold back.

Now you don’t have to go to bank to get a gold loan. You can avail the loan easily sitting in your office or relaxing at home through Paisabazaar.com. Follow the below steps to compare and choose the best gold loan for you.

Step1: Visit PaisaBazaar.com.

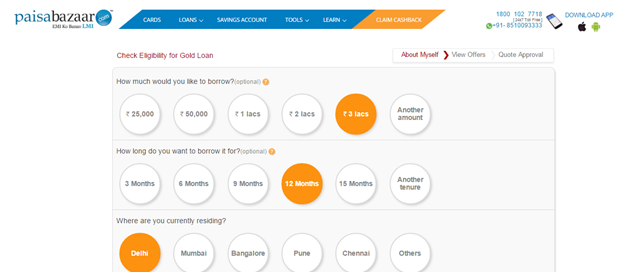

Step2: Go to Loans tab and click on Gold loan. You will be required to mention the amount you want to borrow, the tenure, your city where you are currently residing, your personal details such as name, date of birth, mobile number, email Id etc and click on view offers.

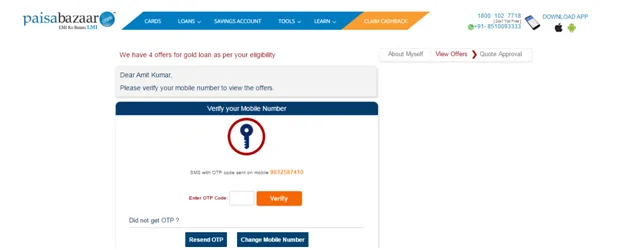

Step3: Verify your mobile number to view the offers