Living a healthy and protected life has become quite expensive today. Certain medical emergencies can lead to financial crisis within no time. One solution to manage emergency medical expenses is to get a health insurance plan. Today, majority of Indian companies offer health insurance policies to their employees in the form of group health insurance to help employees get financial support for emergency medical spending.

Table of Contents:

What is Group Health Insurance Policy?

What is Group Health Insurance Policy?

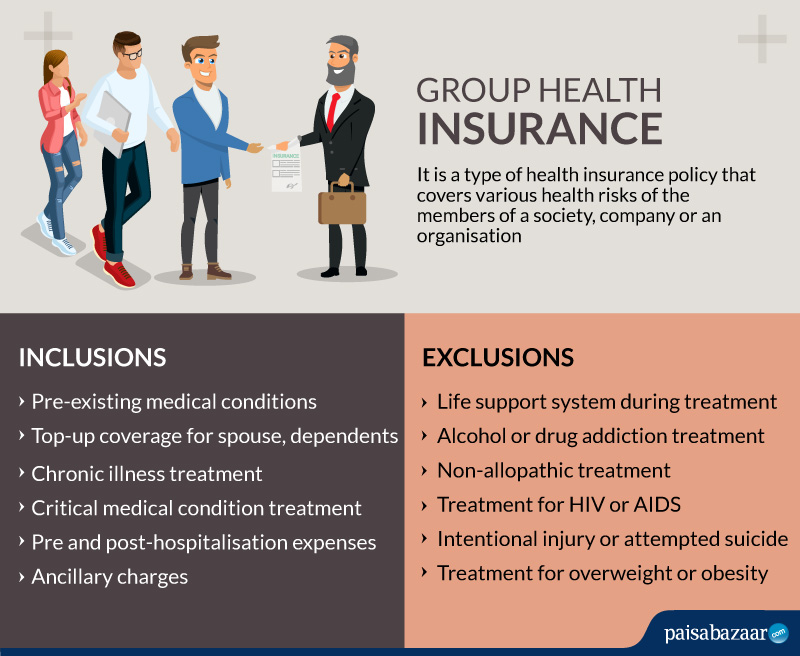

A health insurance policy that offers comprehensive health coverage to the members of a society, company or an organisation is called a Group Health Insurance policy. All major corporations, including private, public and government organisations, offer group health insurance to their employees. Thus, the plan provides financial support to the group members to manage various health risks. The insured pays a lower premium for a group health insurance compared to other insurance policies because of the risks being divided in the group.

How does Group Health Insurance Function?

- Employers of companies usually offer group plans to their employees.

- The group policy offers comprehensive covers with low premium payment.

- The employer can choose the coverage of the policy. If the policyholder does not opt for health insurance plans for family, one can take additional plans known as top-ups.

- In case of any eventuality, use the health policy in network hospitals

- Submit the required documents

- On verification, the insurance company will pay directly to the hospital

What all Group Health Insurance Covers?

The wider and extensive coverage offered by a group health insurance plan makes it popular among the corporations. Below are the features and coverage provided by a group insurance plan.

- Pre-existing medical conditions are covered without any waiting period

- Insured can extend the coverage by top-ups for spouse, dependent parents, in-laws and children

- Treatment expenses for chronic illness are also covered by group plans

- Hospital bills paid for a critical medical condition are also considered

- Cashless hospitalisation in network hospitals of the insurance company

- Pre-hospitalisation and post-hospitalisation expenses

- Ancillary charges are also covered. These are medical costs of items like medicines, bandages incurred during hospitalisation

Riders (Add-on Coverage)

Riders or top-ups are additional features that an individual can opt for along with the group plan. These riders add more value to the existing plans. Some of the riders include:

Accidental cover:

In case of accident leading to deaths, the plan provides financial support to carry on with life.

Critical illness cover: The insurer pays lump sum to the policyholder in case of diagnosis and treatment of critical illnesses like cancer.

Exclusions under Group Health Insurance

Certain cases and situations are not covered by group health insurance plans. Thus, these common exclusions are not entertained by the claims department of any insurance company. This is not a complete list as the exclusions might vary for different companies.

- Use of life support system during any kind of treatment

- Treatment for substance (alcohol and drugs) use disorders

- Treatment for addiction to alcohol or drugs

- Non-allopathic discipline of treatment

- Treatment for HIV or AIDS

- Sex change

- Intentional injury or attempted suicide

- Treatment for overweight or obesity

Claim Process for Group Health Insurance

In case of hospitalisation or medical need covered by the insurance company, it is important to file claims on time.

- Immediately inform the insurance provider either online or by calling at the toll-free number

- On hospitalisation, share the policy details with the hospital

- The insurance help desk at the hospital will forward the claim form and the supporting documents to the insurance company

- On approval, the insurance provider will directly pay the bills to the hospital

Documents Required for Claim Process

Here are some documents required for filing claims. The insurance provider might ask for other documents as per the case.

- Claim form

- Medical reports

- Prescriptions

- Discharge summary

- Investigation reports

- Hospital bills

- FIR report (accidents)

- Other bills and documents required by the insurance company as per the case

Advantages of Group Health Insurance

- One need not submit any medical checkup reports while claiming money with a group insurance plan

- The premium payment is divided among the members of the group, making it an affordable policy

- The premium of this policy is about 30% to 35% cheaper compared to that of an individual insurance plan

- It is one of the best possible ways to assure a considerable amount with comprehensive coverage for large and small corporate institutions

- This plan provides private medical assistance and health checkup for each member of the insured group

- The extensive plan offers a wide range of benefits for maternity, child vaccination, health checkups for parents, etc.

- The sum assured under this plan ranges from Rs 1 lakh to 50 lakh, though this range can differ from one insurer to the other

- This insurance plan offers coverage against pre-existing medical conditions

- There is no waiting period to get the benefits of the insurance for any medical condition

FAQs

Q1. When can I use the sum provided in the top-up scheme?

You can use the amount offered by the top-up plan only when the sum of the actual group health insurance plan is exhausted.

Q2. Can I claim insurance for hospitalisation of less than 24 hours?

Yes, group health insurance policies cover the costs incurred in day-care treatment.

Q3. What should I do if I get admitted to non-network hospitals?

You can get reimbursement in case you get admitted to non-network hospitals. You may need to provide the necessary documents like the bills paid for the treatment in order to get the claim money.