ICICI home loan is a great credit facility for those looking for quick funds to buy a new plot/house or renovate their existing house. The bank offers financing of up to Rs. 10 crore at 6.90% onwards for a maximum tenure of 30 years. Customers can track the status of their home loan application or know the status of their ongoing home loan online as well as offline.

Table of Contents:

- How to Track ICICI Home Loan Application Status

- How to Register Online for ICICI Home Loan Account

- How to Check ICICI Home Loan Status Online

- How to Check ICICI Home Loan Offline

- FAQs

How to Track ICICI Home Loan Application Status

Steps to Track Home Loan Application Status Online on ICICI Bank’s Official Website

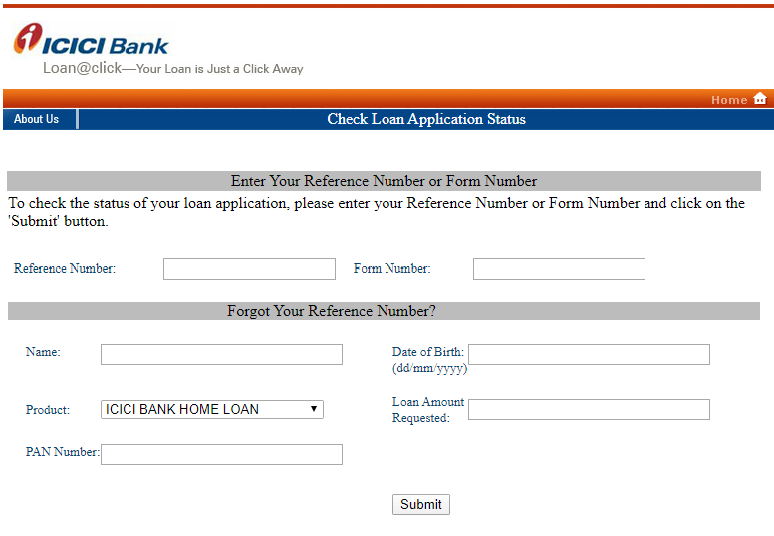

- Visit the Check Loan Application Status page on ICICI Bank’s website

- Enter your ‘Reference Number’ and ‘Form Number’

- Click on ‘Submit’

Get Home Loan at the Low Interest Rate from Top Lenders Apply Now

If you forget your ‘Reference Number’ and ‘Form Number’, follow these steps:

- In the ‘Forgot Your Reference Number’ section, enter your ‘Name’, ‘Date of Birth’, ‘Product’ (type of loan), ‘Loan Amount’ and ‘PAN Number’

- Click on ‘Submit’

Or

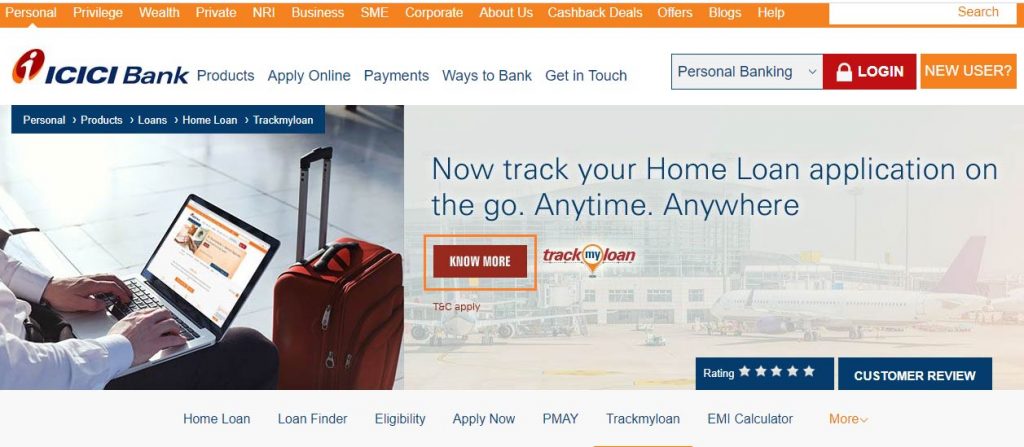

Another way to track the status of your home loan application is given as below:

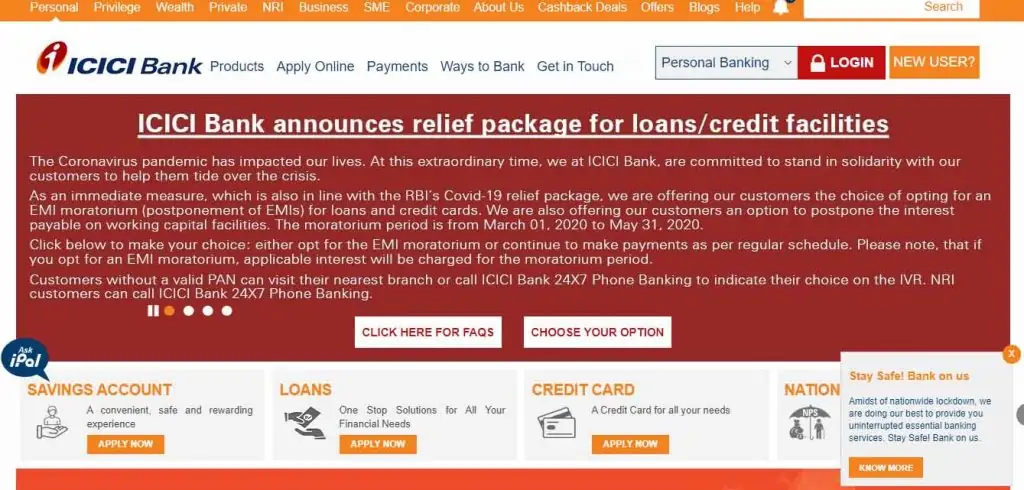

- Visit the official website of ICICI bank at https://www.icicibank.com/.

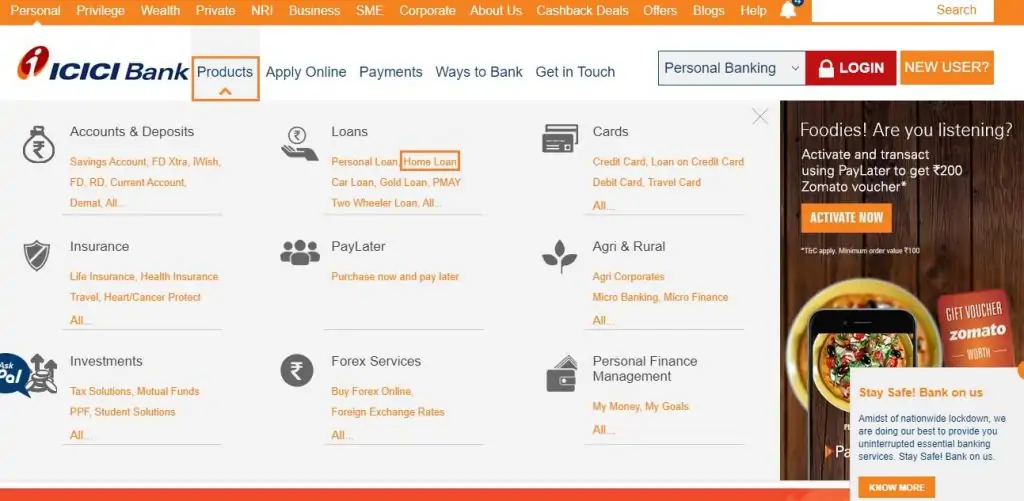

- Click on ‘Products’ and select ‘Home Loan’.

- Click on ‘TrackmyLoan’.

- Click on ‘Know More’.

- Provide details as required and track your home loan application status.

Steps to Track Your Home Loan Application Status Using ICICI Bank’s iMobile App

Check the status of your home loan application using the bank’s iMobile application by following these steps:

- Log in to iMobile app.

- Tap on the ‘Cards, Loans & Forex’ option from the Home menu.

- Tap on ‘Loan Account’.

- Under the ‘Loan Account’ option, tap on the ‘Track New Loan’ button.

- Enter the required details and tap on ‘Submit’.

Track Your Home Loan Application Status via Call

You can check the status of your home loan application by contacting ICICI bank customer care team. Call on the ICICI bank toll-free customer care number 1860 120 7777 from your registered mobile number to know details regarding your home loan application status.

Track Your Home Loan Application Status by Visiting the Nearest ICICI Bank Branch

You can check the status of your home loan application by visiting the nearest ICICI bank branch. To locate the nearest ICICI Bank branch, use the Branch Locator available on the ICICI Bank’s official website.

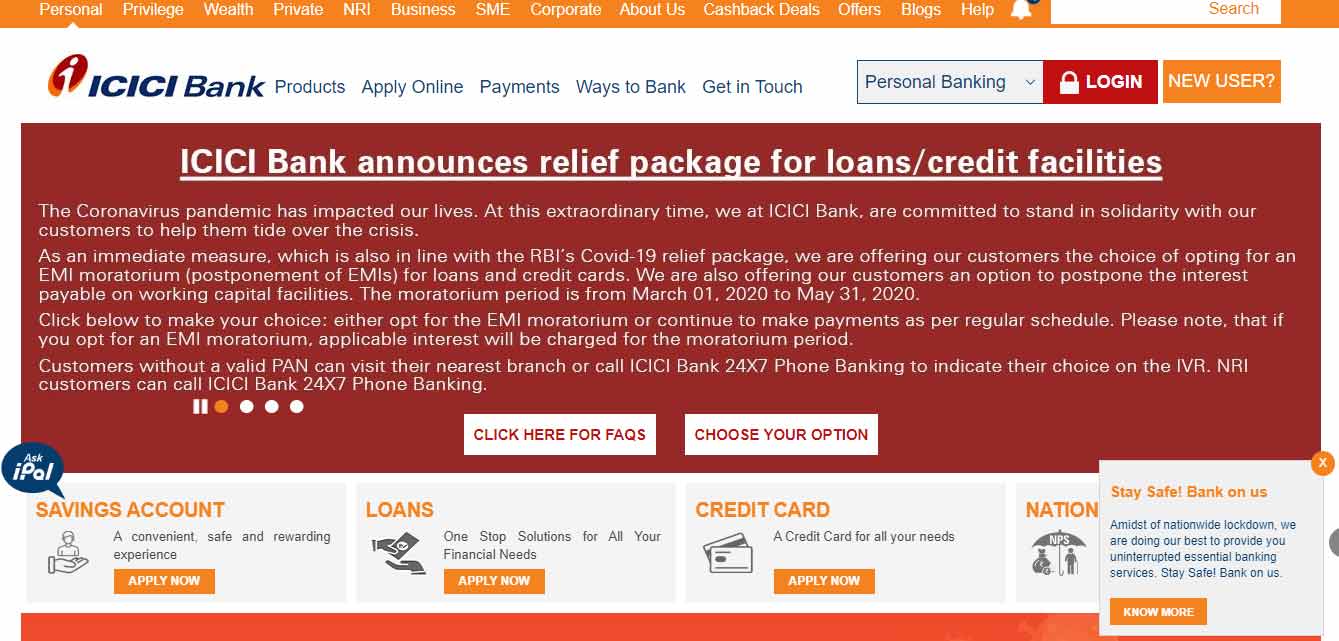

How to Register for ICICI Home Loan Account Online

To register for your ICICI Bank home loan account online by following the steps given below:

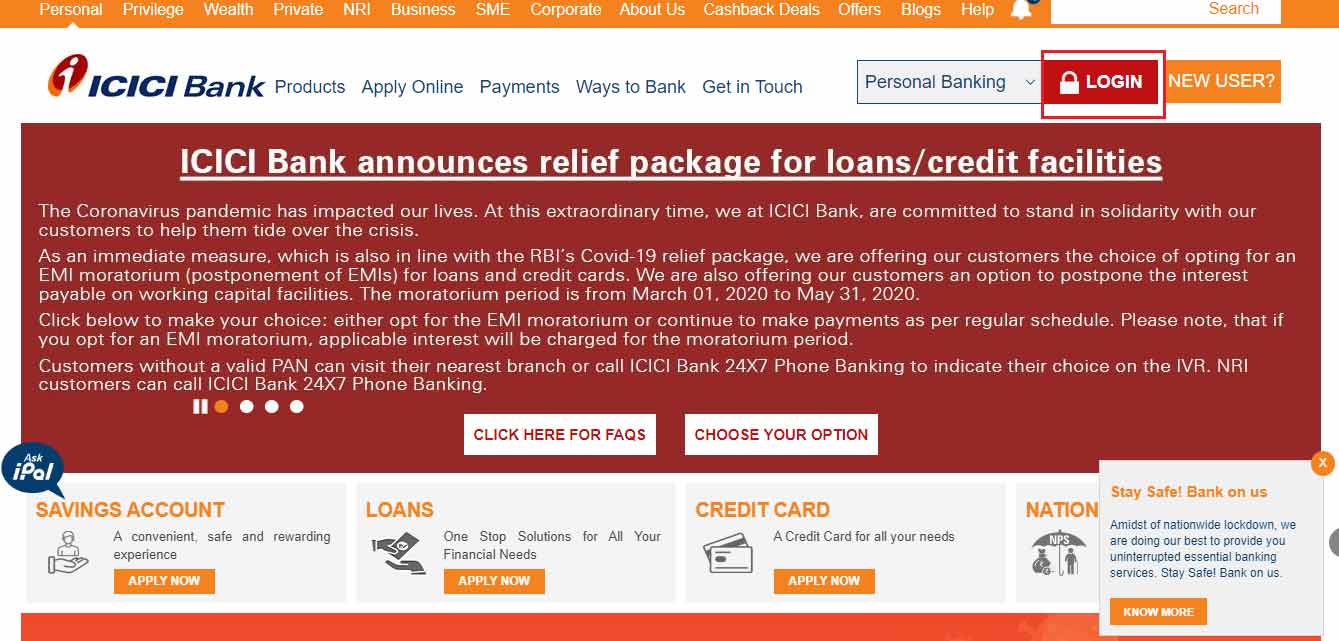

- Visit the official website of ICICI bank at https://www.icicibank.com/

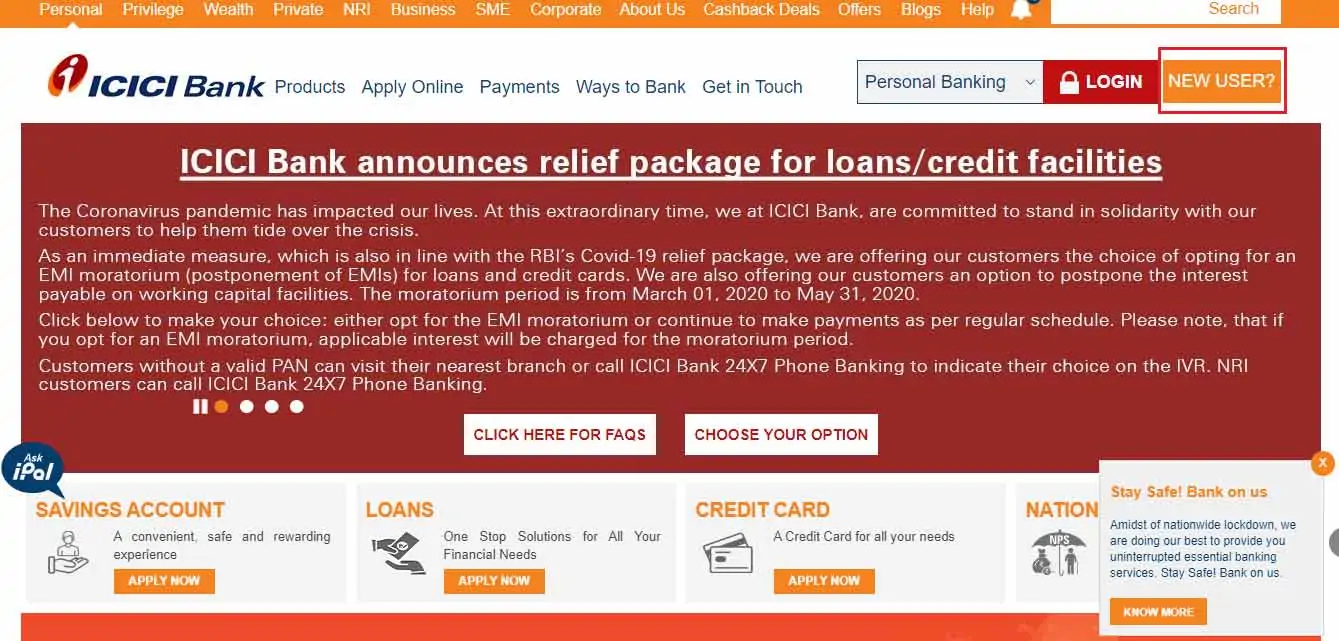

- Click on ‘New User’.

- You can start using Internet Banking services by using your User ID and Password, which can be found in the Welcome Kit given to you at the time of Account opening.

- If you forget your User ID or Password but have a registered mobile number, you can get your User ID immediately on your registered mobile number and can quickly set a new password online.

- If you do not have a registered mobile number, you can visit your nearest ICICI Bank Branch or call ICICI Home Loan Customer Care to request the User ID.

How to Check ICICI Home Loan Status Online

Check the status of your ongoing home loan online via any of the ways listed below:

- Net Banking:

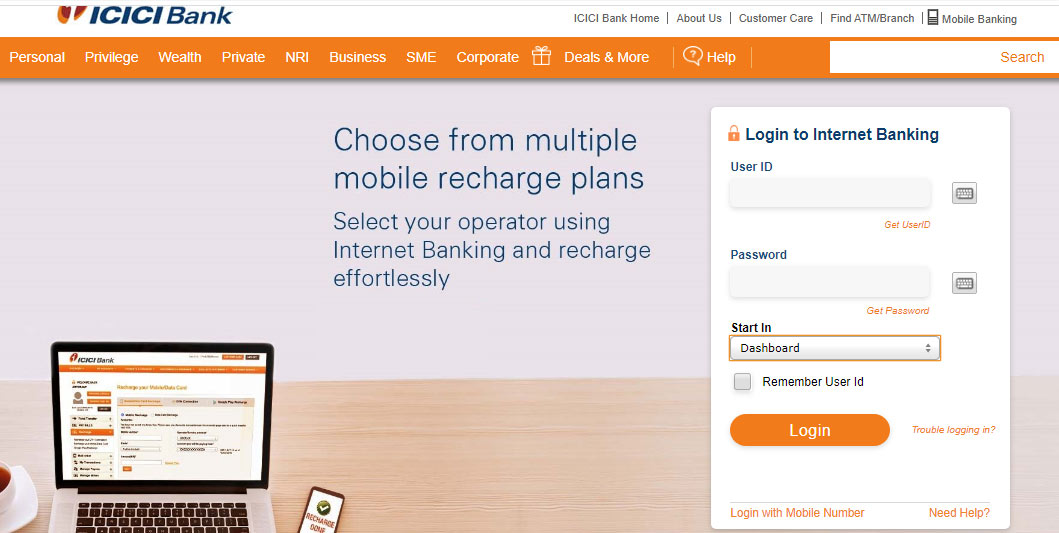

On successfully registering yourself for net banking, check the status of your ongoing home loan by following these steps:

- Visit the official website of ICICI bank https://www.icicibank.com/.

- Click on ‘Login.

- Provide your User ID/Mobile Number and Password to log in.

- On successful log in, you can check the status of your ongoing home loan.

- Mobile Application:

ICICI bank allows you to track the status of your ongoing home loan using the bank’s iMobile application. The application is available for both Android and iOS users. To benefit from the features of this mobile application, download the app and log in to your account to check the status of your ongoing home loan.

How to Check ICICI Home Loan Offline

You can check the status of your active home loan offline by visiting the nearest branch office or calling up the bank’s customer care toll-free number.

- Branch Visit: Visit the nearest ICICI bank branch and contact the bank officials to know the status of your ongoing home loan. Find the nearest ICICI bank branch at maps.icicibank.com/mobile

- Call: To know the status of your ongoing ICICI housing loan, call the bank’s customer care on the toll-free number 1860 120 7777

FAQs

1. What is trackmyloan?

It is an online loan application tracking platform that allows you to check the status of your home loan from login to sanction. You can access the information regarding your loan by simply entering your loan application number and registered mobile number.

2. How can trackmyloan help me?

You can use trackmyloan to view the status of your loan application in real time and to instantly get in touch with the bank in case of any query.

3. How can I check my ICICI bank home loan application status?

Check the status of your ICICI bank home loan through:

- Online: Check the status of your ICICI bank home loan online through the bank’s official website, net banking platform or iMobile app

- Offline:Track your ICICI bank home loan offline by visiting the bank’s nearest branch office or by contacting the bank’s customer care team

4. Is trackmyloan available for new as well as existing customers of the bank?

Yes, trackmyloan is available for all those who have applied and availed home loans with ICICI Bank.

5. Is trackmyloan available on iMobile app?

Yes, trackmyloan is available on iMobile app.

6. What is the current ICICI home loan interest rate?

The interest rate of ICICI home loan starts as low as 7.45% p.a.

7. What is the maximum ICICI home loan tenure?

The ICICI home loan tenure can stretch up to 30 years.

8. How can I apply for ICICI bank home loan?

You can apply for ICICI home loan by:

- Visiting the bank’s official website and submitting the home loan application form online

- Visiting the nearest bank branch and submitting the home loan application form there along with the required documents

- Visiting Paisabazaar.com, which is an online lending marketplace that allows you to compare and apply for home loan offered from 30+ lending partners

9. Is the top up facility available on an existing home loan?

Yes, ICICI bank offers top up on existing home loans to its customers, provided they have already paid at least 12 EMIs of their existing loan with the bank.

10. Does ICICI bank offers an instant home loan?

Yes, ICICI bank offers pre-approved home loans to its customers. However, the facility is only for select customers, which the bank decides after online verification and the acceptance of final offer.