Stamp Duty and Registration Charges are the two most critical factors in determining the total cost of property in Pune. The property once purchased must be registered in the name of the buyer to safeguard it from any conflict/fraud. Stamp Duty rates keep on changing from time to time, as per the directive of the Maharashtra government.

The table below shows various charges applicable to property registration in Pune.

| Owner | Stamp Duty | Registration Charges |

| Male | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) | For properties above Rs 30 lakh – Rs 30,000. For properties below Rs 30 lakh – 1% of the property value. |

| Female | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) | For properties above Rs 30 lakh – Rs 30,000. For properties below Rs 30 lakh – 1% of the property value. |

| Joint (Male& Female) | 6% (Stamp duty 4% + Local Body Tax (LBT) 1% + Transport Surcharge 1%) | For properties above Rs 30 lakh – Rs 30,000. For properties below Rs 30 lakh – 1% of the property value. |

Get Home Loan at the Low Interest Rate from Top Lenders Apply Now

Factors Affecting Stamp Duty Charges

There are several factors that affect the Stamp Duty charges in Pune. These are:

- Type of property:The type of property to be registered is one of the key determinants of the actual Stamp Charges to be paid by the buyer. For example, stamp duty applicable attracted by a commercial property is higher than residential property.

- Area/Location of Property:In Pune, properties falling in municipal localities and urban areas are charged a higher stamp duty, whereas properties falling in rural/panchayat areas attract lower stamp duty.

- Market value:The value of the property is another main component that impacts the actual stamp duty charge to be paid by the buyer. In simpler words, higher the value of the property, more will be the Stamp Duty.

How to Pay Stamp Duty and Registration Charges Online?

In Pune, the Maharashtra Government has facilitated online payment Stamp Duty and Registration Charges for the ease of buyers. The online system is safe and transparent to ensure no fraud at all. Follow the steps mentioned below to do the same.

- Visit the link: https://gras.mahakosh.gov.in/igr/frmIndex.php

- Choose either ‘Create User Account’ or ‘Pay Without Registration’

If you choose ‘Create User Account’, submit your details and login into your account to pay Stamp Duty and Registration Charges. If you choose ‘Pay Without Registration’, follow the steps below,

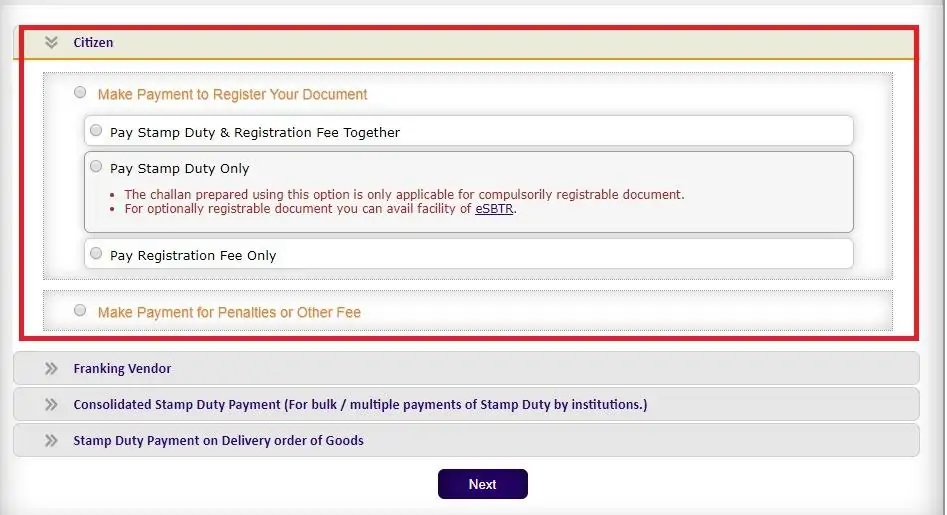

- First, click on the Citizen tab and then click on ‘Make Payment to Register Your Document’

- Select your option:

- Pay Stamp Duty & Registration Fee Together

- Pay Stamp Duty Only

- Pay Registration Fee Only

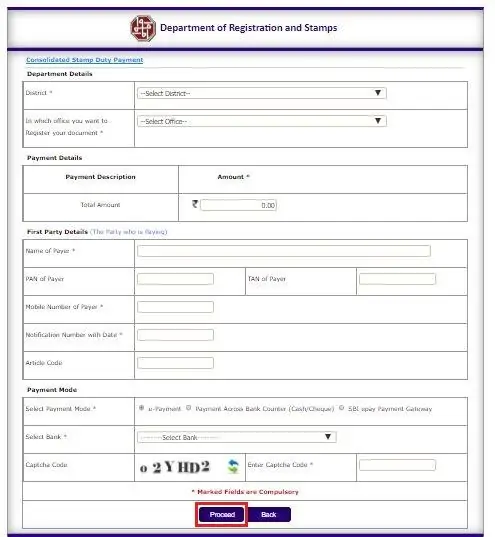

- Fill in all the required fields in the form and click on the ‘Proceed’ button

- Once all the required details are filled, choose your preferred payment gateway (The website has links with all the major banks).

- Choose your bank and make the payment.