What is an IFSC Code

IFSC (Indian Financial System Code) is an 11-digit alphanumeric code that uniquely identifies all banks and their respective branches participating in the online fund transfer process. The IFSC Code is assigned to each bank branch by the Reserve Bank of India (RBI) to monitor the online transfer of money. The electronic or online transactions for transferring funds via NEFT (National Electronic Fund Transfer), RTGS (Real-time Gross Settlement) and IMPS (Immediate Payment System) cannot be initiated without a valid IFSC.

Features of IFS Code

- Smooth online funds transfer: IFSC enables convenient and hassle-free transfer of funds from one bank account to another. The use of IFSC is mandatory in facilitating all the electronic or online transfer of funds via NEFT, RTGS or IMPS

- Monitoring transactions: IFSC is used by the RBI to keep a regular track of all the banking transactions, thereby minimising the possible chances of any discrepancy in the fund transfer process

- Unique identification: IFSC helps in the unique identification of all banks and their respective branches, hence helping customers to avoid any possible errors

- Eliminating Errors: IFSC helps users to carry out the fund transfer process securely, hence eliminating the possible chances of any fraudulent activity in the online funds transfer process

IFSC Code Format

The format of IFSC code contains 11 characters and is a combination of 3 essential components:

- The first 4 characters represent the bank code

- The 5th character is a ‘0’

- The remaining 6 characters signify a specific branch code

Have a look at the below-mentioned example of the SBI IFSC Code, Delhi branch.

| State Bank of India Code | Zero | State Bank of India Branch Code | ||||||||

| S | B | I | N | 0 | 0 | 0 | 1 | 7 | 0 | 7 |

In the above-mentioned example (SBIN0001707), the first 4 characters ‘SBIN’ represent the bank code of SBI, the 5th character is a ‘0’ and the last 6 characters ‘001707’ represent the branch code of Azadpur, Delhi.

IFSC Code of Top 5 Banks of India

Given below is the list of IFSC codes of the top 5 banks in India of one of the branches. It is to be noted that the IFSC stands unique for each bank branch in India. Hence, no two bank branches can have the same IFSC.

| Bank Name | Branch Name | IFSC Code |

| State Bank of India IFSC Code | DLF Phase IV, Gurugram | SBIN0070695 |

| HDFC Bank IFSC Code | Chandni Chowk, Delhi | HDFC0000553 |

| Bank of Baroda IFSC Code | Lucknow Main Branch, U.P. | BARB0HAZARA |

| Axis Bank IFSC Code | Dwarka, Delhi | UTIB0000278 |

| Canara Bank IFSC Code | Avenue Road, Bangalore | CNRB0000402 |

Importance of IFSC Code

The significance and benefits of the Indian Financial System Code (IFSC) are as follows:

- The code uniquely identifies a specific bank branch, hence helping customers to avoid any possible mistakes during the online transfer of funds via NEFT, RTGS or IMPS

- The customer need not visit the branch for any financial transfer, hence can opt for an online money transfer with the help of the IFSC. It is, therefore, a convenient and eco-friendly option

- All online transactions including paying bills can be easily processed with the help of the IFSC

- The code is used by the RBI to monitor all the online transactions performed by an individual hence eliminating the chances of any discrepancy in the fund transfer process

Why is IFSC Code required

- IFSC is used to facilitate the electronic or online transfer of funds using NEFT, RTGS, IMPS or UPI

- The code helps the respective bank with IFSC as well as the RBI to track and seamlessly maintain all financial transactions which are carried out using online payment services

- The IFSC is required to make an online payment to another bank so it can recognize the specific beneficiary's branch where the amount has to be credited

- IFSC helps in the unique identification of all banks and their respective branches enabling customers to avoid any fraudulent activity while facilitating online fund transfer

How to use IFSC Code

Given below are the different uses of IFSC. It is to be noted that the IFSC helps to route the fund transfer to the concerned banks and their branches.

- Electronic Funds Transfer: With the help of the IFSC, the user can transfer funds online instantly and conveniently. One needs to mention the beneficiary’s bank account number, bank branch, and IFSC code to carry out convenient online transactions

- Credit Card Bill Payments: IFSC can also be used to make credit card bill payments. The transactions can be performed using mobile phones, tablets or laptops

[bureau-banner banner_img="https://www.paisabazaar.com/wp-content/uploads/2017/10/coa-meter.png" cta_text="Check Now" cta_link="https://creditreport.paisabazaar.com/apply?utm_source=incon_banner&utm_medium=organic&utm_campaign=banking_bu"]Get FREE Credit Score from Multiple Credit Bureaus[/bureau-banner]

How to Transfer Money by Using IFSC Code

The use of IFSC is mandatory in the electronic or online transfer of funds using NEFT, RTGS and IMPS. It is to be noted that the NEFT and RTGS payment services were introduced by the Reserve Bank of India (RBI), while the IMPS service was introduced by NPCI (National Payments Corporation of India). The 3 main payment services through which online transfer of funds is initiated include NEFT, RTGS & IMPS.

| Payment Service | NEFT | RTGS | IMPS |

| Process | Process is based on Deferred Net Settlement (DNS) and the transfer of funds will be carried out in half-hourly batches starting from 12:30 am to 12:00 am | Payment process in which the money is credited to the beneficiary’s bank branch in real-time and on a gross basis | Real-time and instant interbank fund transfer process, IMPS is considered a secure & faster mode of fund transfer |

| Minimum Transfer Limit | Re. 1 | Rs. 2 lakh | Re. 1 |

| Maximum Transfer Limit | No limit | No limit | Rs. 2 lakh |

| Operational Timings | Available 24x7, 365 days (including bank holidays) | 7 am to 6 pm on all working days | Available 24x7, 365 days (including bank holidays) |

| Inward Transaction Charges | No charges | No charges | Decided by individual member banks and PPIs |

*The above-given information is as per the guidelines of RBI (Reserve Bank of India)

How to Search for IFSC Code

The users can do an IFSC Code search of a particular bank branch both online as well as offline. Below mentioned are the different ways to find the IFSC code.

Online Method to Find IFSC Code

1. IFSC Code search tool by Paisabazaar

Go to the IFSC Code search tool page provided by Paisabazaar for the convenience of its customers and follow the below-listed steps:

- Visit the page and select the particular bank

- Select the state, city and the bank branch

- IFSC along with all the required details will be displayed on the right-hand side of the page

Also, the users have the option to search banks by IFSC Code.

2. IFSC Code Search through Netbanking / Mobile Banking

The account holders can get the IFSC from their respective bank’s netbanking portal or mobile banking application provided by the bank.

3. Reserve Bank of India

The users can also look for the IFSC on the official website of the RBI (Reserve Bank of India).

Offline Methods to Check IFSC Code

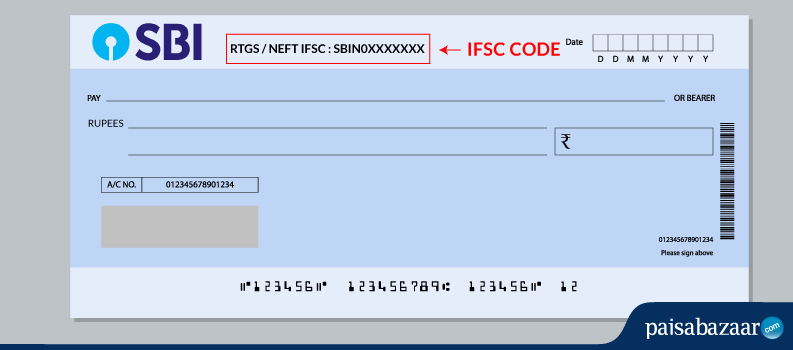

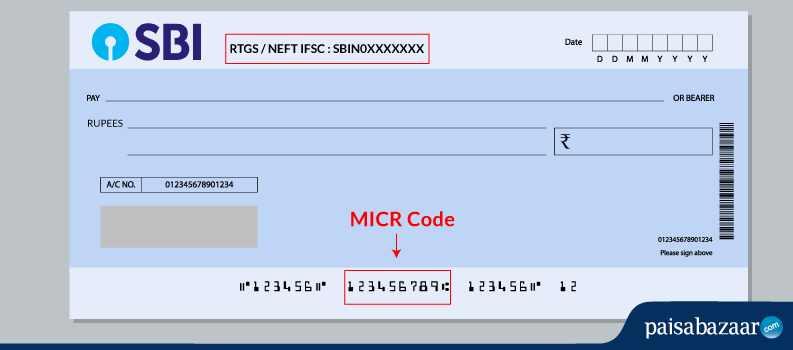

Check IFSC Code in a Cheque Book

The IFSC can be found on the top of the cheque leaf provided by the particular bank (as shown in the below image), while the MICR no. on the cheque (Magnetic Ink Character Recognition) is printed at the bottom.

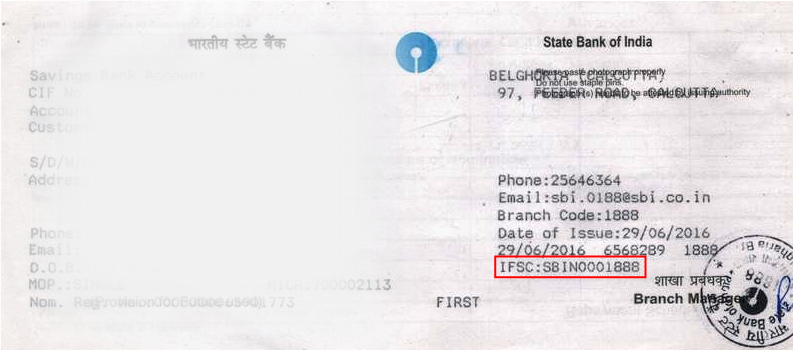

Find IFSC Code on a Passbook

Both the IFSC and MICR codes can be found on the first page of the passbook provided by the bank.

How to search IFSC Code through Internet Banking

To search for the IFSC Code of a particular bank branch via internet banking, the user needs to login into the net banking portal of the particular bank using the User ID and password.

The user can find the IFSC Code of his or her particular branch in the “Accounts” section given in the menu. However, it is to be noted that the net banking portal of every bank functions differently.

What is MICR Code

MICR or Magnetic Ink Character Recognition Code is a 9-digit code used for faster processing of cheques. MICR number is also unique for every bank branch, hence it helps in uniquely identifying the bank and branch participating in an Electronic Clearing System (ECS). MICR Code like IFSC is a combination of 3 essential components:

- The first 3 digits represent the city code

- The middle 3 digits represent the particular bank code

- The last 3 digits represent the specific branch code

Examples of MICR Code

Given below is the list of MICR codes of banks (top 5) in India along with their branch name. It is to be noted that the MICR Code like IFSC stands unique for each bank branch in India. Hence, no two bank branches can have the same MICR Code.

| Bank Name | Branch Name | MICR Code |

| SBI MICR Code | Bailey Road, Patna | 800002006 |

| HDFC MICR Code | Anjuna, Goa | 403240035 |

| Bank of Baroda MICR Code | Service Branch Bangalore | 560012001 |

| Axis Bank MICR Code | Defence Colony, Delhi | 110211036 |

| Canara Bank MICR Code | Circle Office, Chandigarh | 160015995 |

What is the Purpose of MICR Code

- MICR or Magnetic Ink Character Recognition Code is a character recognition technology used by the banking industry to streamline the processing and clearance of cheques and other documents

- The primary need of the code is to authenticate the originality and legality of paper-based documents in the banking system and is majorly used on cheques

- MICR Code stands on par with IFSC, where the transfer of funds using NEFT or IMPS is concerned

- The technology helps the banking officials who are MICR readers to scan cheques and read the information directly through the system

- Each bank branch has a unique MICR Code given by RBI, which helps to identify the particular bank branch and speed up the clearing process

How to Find MICR Code from IFSC Code

It is possible to do a MICR Code search from IFSC Code by visiting the IFSC Code search tool page provided by Paisabazaar. The user needs to just follow the below-listed steps:

- Visit the IFSC Code search tool page by Paisabazaar

- Enter the IFSC of the specific bank branch and Click on “Get Details”

- The MICR Code along with the branch name, address and contact number will be displayed on the right-hand side of the page

Where to find IFSC Code & MICR Code on a cheque

Both the IFSC and MICR codes can be found on the cheque book provided by the bank. The IFSC can be seen printed on the top of the cheque leaf, while the MICR Code can be seen printed on the bottom side. Also, the IFSC, as well as the MICR Code, can also be found on the first page of the passbook provided by the respective bank branch.

Difference: IFSC Code vs MICR Code vs SWIFT Code

| IFSC Code | MICR Code | Swift Code |

| It is an 11-digit alphanumeric code | It is a 9-digit numerical code | SWIFT Code consists of 8 or 11 characters |

| Used in the online funds transfer via NEFT, RTGS or IMPS | Used in the faster processing or clearing of cheques | Used to facilitate international credit transfer between two banks |

| Developed by Reserve Bank of India (RBI) | Developed by Reserve Bank of India (RBI) | Approved by International Organization for Standardization (ISO) |

| First 4 characters indicate bank code, 5th character is ‘0’ & last 6 characters represent branch code | First 4 digits signify city code, middle 3 indicate bank code & the last 3 represent branch code | First 4 characters indicate the bank code, next 2 represent country code, 5th & 6th character represent location code, last 3 are optional that represent branch code |

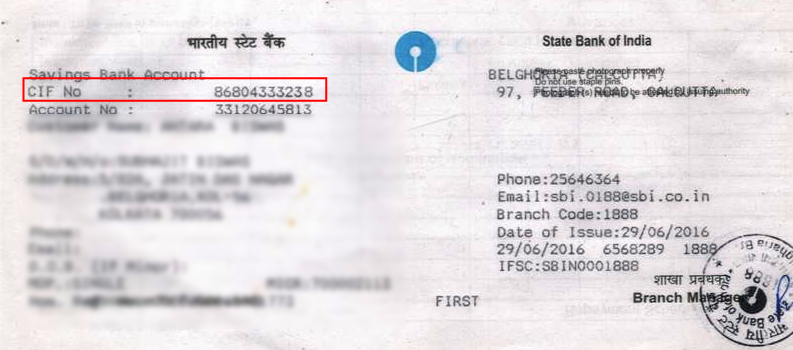

What is CIF Number?

CIF stands for Customer Information File and is unique for every customer. It is an 11-digit number representing the file. CIF is basically a digital or virtual file containing all the important banking details of the account holder. All the customer’s accounts are linked to one CIF no provided to the customer, so even if the customer holds more than one account, he / she will be having only one CIF number.

The CIF no. is decoded by the bank to retrieve all the financial and personal information of the customer. The information generally includes details regarding loans, demat etc. and other KYC details like identity, address and photo ID. Customer Information File in short contains all the valuable banking information of an account holder in digital format.

How to find CIF Number in State Bank of India (SBI)

There are many ways in which a user can find the CIF Number in SBI. Below mentioned are the different online as well as offline methods to find CIF no.

Online

For finding CIF Number SBI online the users can opt for any of the below-mentioned ways:

- Net Banking

- State Bank of India Mobile App

Offline

The users can find the CIF Number offline by choosing any of the below-mentioned ways:

- Cheque Book (On the first page of the chequebook)

- Pass Book

- CIF Number via SMS

- By calling SBI Customer Care- The user can also get to know the CIF Number by calling on the SBI Customer Care Number. The SBI Customer Support numbers are given below:

1800-11-2211 (toll-free) / 1800-425-3800 (toll-free) / 080-26599990

- By visiting SBI Branch

Frequently Asked Questions (FAQs)

Q. What is IFSC and what is IFSC Code full form?

A. IFSC is an acronym for Indian Financial System Code and is an 11-character alphanumeric code used to facilitate the electronic or online transfer of funds from one bank account to another using NEFT, RTGS or IMPS.

Q. How many digits are there in IFSC Code & MICR Code?

A. The IFSC is a unique combination of 11 characters while the MICR Code comprises 9 digits.

Q. How to know the bank name from IFSC Code?

A. The users can easily know the bank name by IFSC Code just by seeing the first 4 characters of the code. For example, in the code “ICIC0002634”, it is evident by seeing the first 4 characters that the code is an example of the IFSC Code of ICICI Bank.

Q. How to find BSR code from IFSC Code?

A. BSR or Basic Statistical Return Code is a 7-digit code provided to all the registered Indian banks by the RBI. Both IFSC and BSR are similar in the purpose they serve, they uniquely identify a bank branch, but one cannot find the BSR Code from IFSC Code.

Q. Is the CIF number the same as the IFSC code?

A. Both the CIF number and IFSC Code contain eleven characters but serve different purposes. While IFSC Code is used in the facilitation of electronic or online funds transfer via NEFT, RTGS or IMPS, a CIF number is a digital or virtual file containing all the important banking details of the account holder and contains all the valuable banking information of an account holder in digital format.

Q. How to get a bank address from IFSC Code?

A. The user can get all the required bank details by IFSC Code. The user needs to just visit the IFSC search tool page provided by Paisabazaar and follow the below-mentioned steps:

- Visit the IFSC Code search tool page by Paisabazaar

- Enter the IFSC Code of the particular bank branch and click on “Get Details”

- The branch address, name, MICR code and contact number will be displayed on the page

Q. What happens if one uses the wrong IFSC code?

A. While making a fund transfer, if the remitter enters an incorrect IFSC code, money from the remitter’s account will be debited but will not be credited into the beneficiary's account due to the wrong IFSC. For instance - If the beneficiary’s account is in SBI and the incorrect IFSC code is of some other SBI branch, the bank will do an internal settlement and the money will be credited to the beneficiary’s account only. If the incorrect IFSC code is of some other bank, then the remitter should submit an application at his bank branch with his bank details and transaction ID.

Q. How to identify branch code from IFSC Code?

A. It is easy to find the branch IFSC Code online. In the 11-character IFSC, the last 6 characters represent the specific branch code. Have a look at the below-mentioned example of the IFSC Code of HDFC Bank, Delhi.

HDFC0001563

Here, in the above-mentioned 11-character IFSC , the last 6 characters ‘001563’ represent the branch code of Connaught Place, Delhi. The branch code is unique for every bank branch in India, hence no 2 branches can have the same code.

Q. How to find IFSC Code by Account Number?

A. It is to be noted that after the implementation of core banking, the user’s account number might remain the same even if he or she changes bank branch. So, it is not possible to search any Indian Bank IFSC code by account number. But the users can easily find banks by IFSC.

Q. What is the difference between IFSC and MMID?

A. IFSC is an 11-character unique alphanumeric code used in the electronic or online transfer of funds via NEFT, RTGS or IMPS while MMID (Mobile Money Identifier) is a 7-digit unique number that allows the customer for carrying out IMPS transactions. The MMID is provided by the bank upon registration.

Q. How can one find India Post Payments Bank IFSC Code?

A. To find the IFSC Code of India Post Payments Bank, the user can choose from any of the below-mentioned ways:

- By visiting the IFSC Code search tool by Paisabazaar

- Cheque Book / Passbook

- Net Banking / Mobile Banking

Q. Can IFSC Code change in any circumstance?

A. Yes, the IFSC Code of a particular bank changes upon its merger with any other bank.

Q. Is a SWIFT Code the same as an IFSC Code?

A. No, both codes serve different purposes. The SWIFT Code is used when funds transfer between banks takes place internationally while IFSC Code is used when there is a nationwide interbank fund transfer.

Q. Can one use IFSC instead of SWIFT Code?

A. No, as both IFSC and SWIFT Code are used for different purposes, hence one cannot use IFSC Code instead of SWIFT Code.

Q. If someone has a bank account number and IFSC code of any other person, can the person do any harm?

A. No, in any such case the person cannot do any harm because the account number and IFSC code are meant primarily for depositing money in the account and not for withdrawing any amount.

Q. Is IFSC Code required for IMPS?

A. Yes, the use of banks' IFSC Code in India is mandatory in facilitating the online transfer of funds using IMPS. Also, there are 2 ways of transferring funds via IMPS, one is by using the account number and IFSC and the other is by using the registered mobile number and MMID. The user can choose any of the 2 ways to process funds transfer using IMPS.

Q. Has the Punjab National Bank IFSC code also changed?

A. Only the United Bank of India IFSC code and Oriental Bank of Commerce IFSC code have changed and they now are covered under the PNB IFSC code.

Q. Where can I find the merged Allahabad Bank IFSC code?

A. Allahabad Bank has been merged with Indian Bank. In case you want to check IFSC of an erstwhile Allahabad Bank branch, you can select the specific branch of the Indian Bank.

Q. Can I search bank by IFSC code?

A. Yes, the first four characters of IFSC determine the bank name. For example, the IFSC code of State Bank of India starts with SBIN.

Q. Has the Union Bank IFSC code also changed?

A. No, after the merger of two banks into Union Bank, Andhra Bank IFSC code and Corporation Bank IFSC code have only changed and there has been no change in Union Bank of India IFSC code.

Q. Do I have to provide IPPB IFSC code for online transaction?

A. All online transactions, apart from UPI, need IFSC code. One need to provide India Post Payments Bank IFSC code at the time of making online transaction. The same holds true for any other payments bank. You have to provide Airtel Payments Bank IFSC code, Paytm Payments Bank IFSC code or Fino Payment Bank IFSC code.