Life is full of various types of risks because of uncertainties. These situations might give rise to unexpected financial needs. In case one is not prepared, this might lead to a big hole in the pocket or create roadblocks in meeting the financial goals of life. However, to overcome such problems and manage the financial risks of life, you can opt for an insurance, which can be classified under different heads.

What is Insurance?

An insurance provides protection in the form of financial compensation for specified loss, damage, illness or death. To get this coverage, you need to pay a certain amount of money to the insurance company which is called a premium. In simple terms, an insurance is a promise of providing for the uncalled expenses during emergency situations for you and your family. An insurance is of various types and can help in meeting unexpected health expenses, children’s education or marriage expenses, creating a corpus for retirement or for other financial requirements.

How Insurance Works?

Before buying an insurance cover, be it of any type, it is imperative to understand its functioning. In an insurance, a policyholder or the insured pays the premium to the insurance company which agrees to pay the money or sum assured to manage the risks arising out of various situations of life. The insurance policy is taken for a certain duration of time, also called the policy term. This is the basic idea behind insurance, but different types of insurance function differently. However, not all situations are covered by an insurance. These are called exclusions. There are different sets of exclusions for different types of insurance. Let us understand insurance a little more in detail.

What is Insurance Premium?

A premium is the money paid by the policyholder to the insurance company for getting an insurance policy. The premium is an important aspect to be considered before finalising a policy. Various factors like age and gender, lifestyle, duration of the plan, sum assured or insured play a role in deciding the premium amount. To reap the benefits of an insurance policy, it is important to make timely payment of the premium. In case of a non-payment or a payment delay, the policy can lapse. However, before a policy happens to expire, you usually get a grace period of 30 days to make the payment. The payment mode can be regular or single. A regular payment can be monthly, annually and so on. Let us understand some factors on which the premium depends.

What is Insurance Claim?

Once you have purchased the required insurance policy, you should be aware of the situations covered under the plan so that you can make claims when needed. An insurance claim is the request made to the insurance company to get coverage for the situations mentioned in the policy. In case of any eventuality, always immediately inform your insurance provider and submit the duly filled in claim form along with other requirements documents. The list of documents will vary for different types of plans.

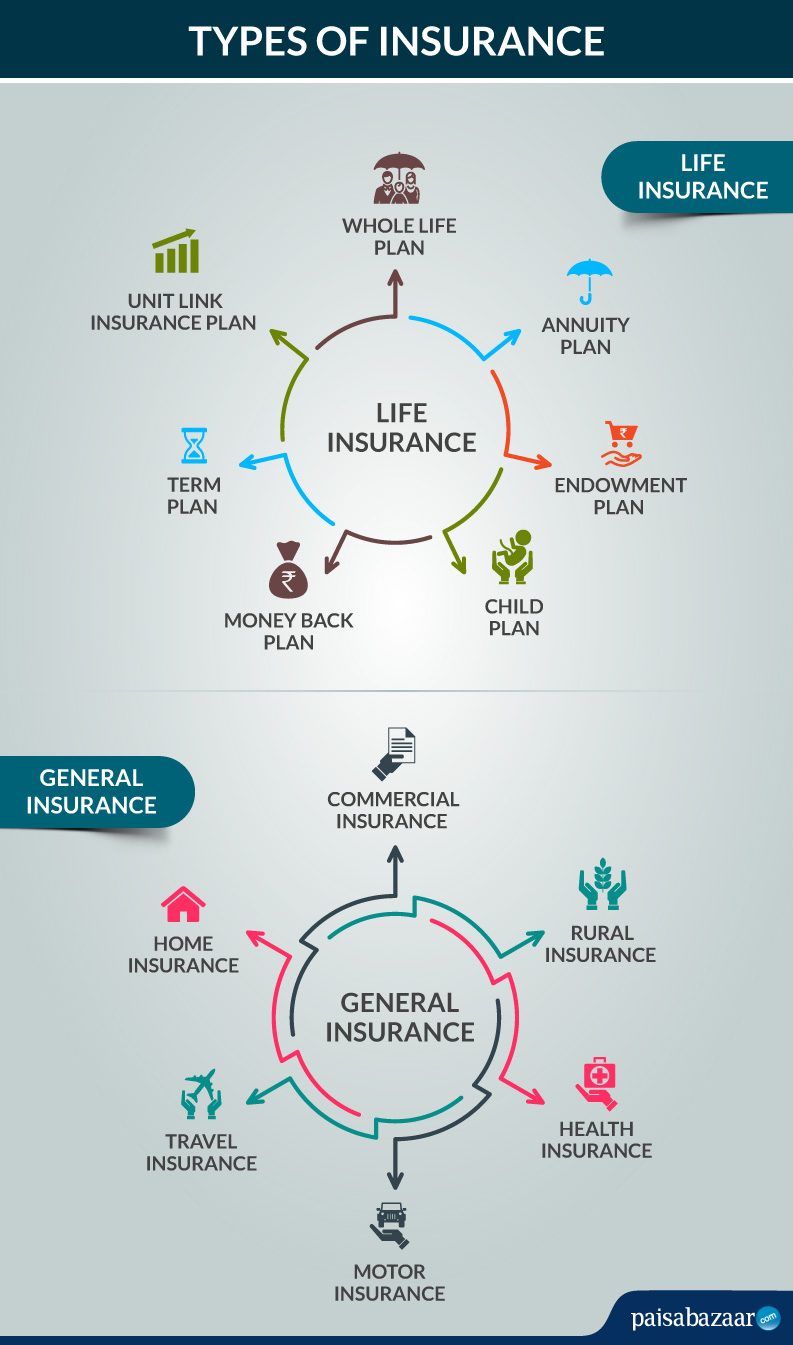

Types of Insurance

In India, there are broadly 2 main categories of insurance – life insurance and non-life or general insurance.

Life Insurance

This is the most common type of insurance. It works on the common principle that the insured pays a premium for coverage to the insurance company. In return, the company pays the sum assured to the family of the insured on his/her sudden death. Other additional benefits offered, also called riders, along with the coverage help make it a comprehensive package. However, there are certain situations not covered under the plan that are called exclusions. There are 7 types of life insurance policy.

General Insurance

All non-life insurance plans are clubbed under general insurance. Here, the insurance company provides financial coverage for various risks in life, such as health problems, travel issues, etc. There are different types of general insurance plans.

Types of Life Insurance Plans

A life insurance is of 7 types. Let us understand them and how they function

- Term Plan: It provides financial security to the family members of the insured on the untimely death of the insured during the policy term. However, if the insured survives the policy term, he/she does not get any money. The insured pays timely premium to get this coverage.

- Endowment Plan: This is a combination of insurance and savings. Here, a policyholder pays the premiums for which the company gives death benefit on his untimely demise. But if the policyholder survives, he/she gets maturity benefit at the end of the policy. It is a fairly expensive plan compared to a term plan because certain plans give maturity benefit along with bonus and dividends.

- Unit-Linked Insurance Plan (ULIP): A combination of insurance and investment, a ULIP is best for those who have a fair risk-return appetite and don’t hesitate from investing in market. A part of the premium paid by the policyholder is invested in equity and debts and the rest is kept safe for providing the sum assured. At the end of the policy term or on the sudden demise of the life insured, the sum assured, bonus (if any) and profits made from market investment are credited to the account of the beneficiary.

- Whole Life Insurance: Unlike a term plan, a whole life insurance plan provides coverage throughout the life of the insured. It is usually up to 100 years of age. If the person insured dies before the maturity age, the nominee specified in the policy receives the sum assured. But if the insured outlives the maturity period, he get survival benefits. There are 2 types of whole life insurance plan – traditional and unit linked. The former is further classified as participating, where the insurance company shares the bonus and dividends with the insured, and non-participating, where the company does not share any bonus and dividends with insured.

- Annuity Plan: Also known as pension plan, an annuity insurance plan is your key to age gracefully post-retirement. This insurance plan basically has two phases. The first phase is called the accumulation phase in which the policyholder keeps adding to the policy in the form of regular premiums. This is usually till the person is working. Post retirement, the second phase, i.e. the annuity or vesting phase gets into effect. There are usually two options, viz. to either receive the entire accumulated corpus in one go or receive a part of it as lump sum while the rest of the amount stays in the policy fund. This is credited to the account of the policyholder in regular installments, usually as monthly income.

- Child Plan: It is a perfect plan for those who want to save money for their children’s future needs like higher education. This way you get to handle the expenses for your child’s needs without digging a hole in your pocket. A child plan can be in the form of ULIP, where a part is invested in market and the remaining is used for coverage. Thus, the plan also offers support in the form of financial coverage even when the insured, who can also be the breadwinner, is not around.

- Money Back Policy: This policy is a type of life insurance where lifetime coverage is provided to the life insured whereas the money is paid (the Sum Insured) back at regular intervals and the remaining amount is paid at the end of the policy along with accrued bonus. In case the insured dies before the maturity date, the full sum assured is paid to the beneficiary irrespective of the benefits paid before.

Types of General Insurance Plans

There are various types of general insurance. Each has its own purpose and need. Let us understand them to take a informed decision before buying one when needed.

Motor Insurance

Also called vehicle insurance, it offers financial protection against any loss, theft or damage to cars, two wheeler, trucks and other vehicles. There are 2 types of motor insurance coverage – comprehensive coverage and third party coverage. As part of third party coverage, it extends financial aid for any accidental death or bodily injury to others on the road. On the other hand, a comprehensive coverage includes protection to both the owner, the insured car and the third party. Apart from the regular coverage, additional benefits or add-on coverage offered with the insurance make it a complete package. This is further segregated into 3 categories – car insurance, two wheeler insurance and commercial vehicle insurance.

- Car Insurance: It is mandatory to get your car insured before taking it on the roads. The financial coverage offered helps in dealing with uncalled for events like accidents, car theft or loss. This insurance offers both Comprehensive and Third Party Liability Coverage. As part of add-on coverage, a car insurance also provides financial protection under personal accident to the owner/driver of the car and other passengers in the car. Other additional covers are Zero Depreciation Cover, Engine Protection, No Claim Bonus (NCB), etc.

- Two-Wheeler Insurance: Bike or Two Wheeler Insurance: According to a report, around 20 million two-wheeler vehicles were sold in India in 2017-2018. To stay safe on the road, a two-wheeler user needs two-wheeler insurance. A two wheeler insurance offers both Third Party Liability Cover (covering damage done by the bike to third party) and Comprehensive (covering third party liability + damage to own bike and the riders). Along with these two major covers, one can get protection against depreciation costs by opting for Zero Depreciation Cover which enables the insured to receive full amount of repair and/or replacement in case of claims made (except for tyres and tubes).

- Commercial Vehicle Insurance:Apart from private vehicles, a large number of commercial vehicles also ply on the road. A Commercial Vehicle Insurance provides financial protection to these commercial automobiles. Getting this insurance will help the owner in managing the costs incurred in handling situations like theft, loss or damage to the vehicle.

Health Insurance

It is not easy to save a huge sum like Rs 10-12 lakh from your salary to meet your medical expenses whenever needed. To manage such situations, you need a health insurance which provides coverage against rising medical expenses, including treatment and hospitalisation. One can choose from a number of health plans like cancer insurance and dental insurance. A health insurance has 2 broad categories – indemnity plans and fixed benefit plans. These are further divided into various types.

- Indemnity Plans: This type of health insurance helps meet the costs incurred during treatment or hospitalisation. However, this cost cannot be more than the sum insured chosen. E.g. John has an indemnity plan with sum insured equalling to Rs. 2 lakh and undergoes treatment worth Rs. 2.1 lakh. In this case, the insurance company will pay Rs 2 lakh and the rest will be paid by John. Most of the plans, cover pre- and post-hospitalisation charges. This is also called mediclaim plans. Let us look at various types of indemnity health plans.

- Individual Plans: This is medical coverage meant for individuals. This type of health plan makes sure the cost of hospitalisation is taken care so that no holes are drilled in your wallet at times such requirements. Along with hospitalisation costs, pre- and post-hospitalisation expenses are also covered. Apart from this, one can benefit from tax exemptions too.

- Family-Floater Plans: If you’re a family person, i.e. a family to support, signing up for a family floater health plan is a wise choice. Here just one insurance plan can be shared for the entire family. It is considered a cost-effective plan, as a single premium is used for all the family members. Some plans even include parents’ coverage.

- Group Plans: This type of health plan is designed to cater to the needs of employees. This is offered by an organisation to its employees. This costs less than a usual health plan as the risk of insurer gets divided among multiple policyholders.

- Fixed Benefit Plans: This type of health plan provides financial coverage only for specified ailment(s). There is a fixed sum insured that the policyholder signs for at the time of commencement of the policy which is paid in treatment of specified illness. There is further classification of fixed benefit health plans.

- Critical Illness Plans: This is a must-have health policy, especially if you have a family history of diseases like cancer, kidney failure, chronic lung dysfunction, cardiac arrest, etc..

- Hospital Daily Cash Plans: It provides cash to meet the costs incurred in managing other needs during hospitalisation. This cash amount is fixed and ranges from Rs. 300 to Rs. 5000 per day..

- Personal Accident Plans: Apart from critical illnesses, one needs coverage against uncalled events like an accident that leads to circumstances like loss of limbs, partial or full disablement, etc. including accidental death. This is exactly the core reason of existence of this plan.

Home Insurance

Home is a place where we feel the most secure and warm. Thus, it makes perfect sense to insure the safety zone called home. A home insurance offers protection against damage or theft that may affect your house and/or its belongings. There are various types of home insurance available, viz.:

- Standard Fire and Special Perils Plan: This is a standard plan that provides coverage against fire and related mishaps mentioned in the policy. Structures included can range from buildings, stocks, plans & machines to furniture.

- Home Structure Plan: This insurance plan covers the structure of the house (plinth and foundation, both). Any damage to the structure of the house due to events like fire, flood, lightning, man-made calamities, is covered in this policy.

- Renters Insurance Plan: This insurance is particularly designed for the tenants of a house. In case of a mishap like a fire or some other calamity, the landlord will insure only the building and not the belongings of the tenant. This insurance provides coverage to the belongings of the tenants in the house against man-made or natural calamities.

- Landlord Insurance Plan: This insurance plan is specifically designed for landlords who have let out their houses. Any loss occurring due to fire, flood, etc. is financially covered.

Travel Insurance

A travel insurance plan ensures that while travelling (be it domestic or abroad) you stay financially covered to manage any untoward incident. These situations include loss of ticket or baggage, cancellation of flight, trip delay, emergency medical situations, etc. In the absence of a travel insurance, in case you encounter such circumstances, you might waste your time and money in dealing with them instead of enjoying or utilising your trip. Let us look at various types of travel plans available in India.

- Domestic Travel Plans: This travel plan provides financial backing when the policyholder is travelling within the country. While travelling, you might need financial aid for handling situations like loss of baggage, medical emergencies, flight delays/cancellation, etc. So, if you have this insurance, aforementioned situations can be tackled smoothly.

- Family Travel Plans: A single travel insurance plan for the entire family is what a family travel plan is all about. It is considered as a cost-effective plan compared to a single policy and is thus, recommended to have one if you are travelling with your family.

- Group Travel Plans: This type of travel insurance is taken by organisations planning trips for their employees. This can be both a leisure or official trip. This insurance costs less considering the huge number of policyholders involved and thus, helps the organisation save money.

- International Travel Plans: When travelling outside the national territory of India, a domestic travel insurance turns void. Then International Travel Plans come into the picture to provide financial protection in countries outside India.

- Schengen Travel Plans: If you’re planning to travel to any of the European countries, then getting yourself covered with a Schengen travel insurance is a must. Without this insurance, you are not allowed to visit these countries, either for business purpose or leisure.

- Multi Trip Travel Plans: This type of plan is perfect for those who frequently travel abroad, usually more than once in a year. Main points covered in this insurance are medical expenses, loss of baggage, trip delay/cancellation, personal liability, etc.

- Student Travel Plans: Taken by students who are planning to go abroad in order to pursue education, this travel insurance takes care (financially) of medical emergencies, accidental injuries, theft, passport and baggage loss/damage, legal action, etc. A comprehensive travel insurance for students comprises two main categories, viz. medical and regular expenses so that one can cut on out-of-pocket expenses.

- Travel Insurance Plans for Senior Citizens: Generally, an individual travel insurance plan designed only for senior citizens (i.e. people of 71 years or above) is called a senior citizen travel insurance. This age may vary for different providers. This type of travel insurance covers medical expenses for existing diseases along with ICU treatment, doctor’s visits, surgical care, etc. along with general coverage.

- Travel Medical Plans: As the name suggests, this type of travel insurance is a short-term insurance, catering to medial needs arising while travelling abroad. Unlike other travel insurance plans, this one is designed to target the medical requirements related to emergency like situations or otherwise too.

Rural Insurance

Rural areas cover the most of Indian land and to cover the financial risks faced by people in these ares, there is rural insurance. People involved in manufacturing and tertiary sectors, primary sector also need financial protection. Farmers form the backbone of any economy and to be in healthy side, their backbone (financial aspect) should be well taken care of. There are various types of rural insurance plans available in the insurance sector that one can benefit from. These are:

- Crop Insurance: This insurance helps in risk mitigation among groups in rural areas. In India, the prime crop insurance plan goes by the name of Pradhan Mantri Fasal Bhim Yojana (PMFBY), which is an initiative of the Government of India. This plan is designed to stabilise farmers’ income by providing financial support in times of crop loss/damage. Also, it aims to encourage farmers to adopt new-age innovative agricultural techniques so as to enhance their crop production and yield in a sustainable manner.

- Kisan Suvidha Bima: One of the prime products under rural insurance, this policy is custom-made for welfare of farmers and rural households involved in agricultural activities. It provides coverage against fire and burglary along with critical illness, stocks of farm produce, insured tractor and personal accident.

- Tractor Insurance: Just like a car or bike requires an insurance, a tractor which is a prime instrument in field of agriculture, also must be financial insured. It insures the policyholder against accidental external damage, theft, burglary, earthquake, landslide, etc., including third-party liability coverage.

- Cattle insurance: Especially designed for animal husbandry, cattle insurance in is still a new concept. It provides financial protection to cattle-breeding sector of India, thus safeguarding their primary source of income in case of death or disablement to the same. One of the prime policies under this type is Pashudhan Bima Yojna which aims at providing insurance to indigenous/hybrid milch cattle and buffaloes against natural disasters like droughts and floods. The animals are insured on their maximum market value and premium in determined at a maximum of 50%.

- Weather Insurance: Perfect for those whose business depends largely on weather fluctuations, weather insurance is designed to provide financial assistance in adverse weather conditions hampering the income of policyholders. Farmers, Association of Farmers, Governments and agro-related business entities are entitled to this particular type of insurance.

- Janata Suraksha Bima Yojna: One of the widely used products under the head of rural insurance, this Janata Suraksha insurance plan targets rural households, farmers and small & marginal labour class involved in agricultural and allied activities along with engagement in unorganised sectors of urban economy. Its scope of coverage stretches from dwellings, household goods (against fire and/or burglary) to personal accidents leading to permanent total disability and/or death.

- Jan Sewa Bima Yojna: Providing insurance to entirety of one’s assets, interests, liability and self, Jan Sewa Bima Yojna targets rural and semi-urban dwellers.

- Unified Package Insurance Scheme (UPIS): A single year policy with lifelong renewal option, this insurance plan comprises 7 sections, viz.: Crop Insurance, Personal Accident Insurance, Life Insurance, Building and Content Insurance, Agricultural Pumpset Insurance, Student Safety Insurance and Agricultural Tractor Insurance. Since it targets rural households and farmers, the premium amount is kept small in order to fit in the tight-budget of a farmer and likes.

Commercial Insurance

This is the extended branch of insurance. Here you will find all the insurance plans that are not contained in the aforementioned categories. Plans like mobile insurance, laptop insurance, title insurance, jewellery insurance, business liability insurance, etc. find place in this column. A commercial insurance usually covers various risks involved in managing business. These can include plans like marine insurance which is designed to provide financial assistance to water vehicles like cargo, ships, submarines, etc. in case of loss or damage to these. Other plans can be shopkeeper’s insurance, engineering insurance, worker’s compensation insurance, professional liability insurance and so on. Here are some of the types of commercial insurance provided in India.

- Hull Insurance: It covers the expenses related to the loss or damage to the framework of a ship. Hull insurance is designed to safeguard the interests of the ship owner in case things go wrong with the framework and machinery of the ship or boat.

- Cargo Insurance: This insurance provides coverage for goods in transit. This is more of a basic carrier insurance and provides indemnity cover for goods being carried via sea, road, air or rail.

- Freight Insurance: This insurance is like an extra layer to the already existing marine insurance. Unlike basic carrier insurance plans, this policy covers the value of the freight and reimburses the same in full if something happens to the goods in transit. If one has fragile goods in transit or the cost of the ship is relatively high, then freight insurance helps overcome any untoward incident that might affect the goods or the ship.

- Liability Insurance: If case of any unfortunate event like a crash, collision or attack by pirates, this insurance provides financial coverage for the consequential loss or damage.

Companies Providing Insurance in India

An insurance is important for managing various risks of life. There are various types of insurance plans available in India. There are some companies that offer only life insurance, while some provide only non-life insurance plans. Before zeroing in on a particular company for purchasing your plan, always check their latest Claim Settlement Ratio (CSR). A CSR is the total claims paid compared to the total claims received in a financial year.

|

Life Insurance Providers |

|

| Life Insurance Corporation of India | Aviva Life Insurance Company India Ltd. |

| HDFC Life Insurance Co. Ltd. | Sahara India Life Insurance Co. Ltd. |

| Max Life Insurance Co. Ltd. | Shriram Life Insurance Co. Ltd. |

| ICICI Prudential Life Insurance Co. Ltd. | Bharti AXA Life Insurance Company Ltd. |

| Kotak Life Insurance Co. Ltd. | Future Generali India Life Insurance Company Limited |

| Aditya Birla Sun Life Insurance Co. Ltd | IDBI Federal Life Insurance Company Limited |

| TATA AIA Life Insurance Co. Ltd. | Canara HSBC OBC Life Insurance Company Limited |

| SBI Life Insurance Co. Ltd. | Aegon Life Insurance Company Limited |

| Exide Life Insurance Co. Ltd. | DHFL Pramerica Life Insurance Co. Ltd. |

| Bajaj Allianz Life Insurance Co. Ltd. | Star Union Dai-Ichi Life Insurance Co. Ltd. |

| PNB MetLife India Insurance Co. Ltd. | IndiaFirst Life Insurance Company Ltd. |

| Reliance Nippon Life Insurance Co. Ltd. | Edelweiss Tokio Life Insurance Company Limited |

|

Non-Life (General) Insurance Providers |

|

| Apollo Munich Insurance Co. Ltd. | Max Bupa Health Insurance Co. Ltd. |

| Aditya Birla Health Insurance Co. Ltd | National Insurance Co. Ltd. |

| Bajaj Allianz Allianz General Insurance Co. Ltd. | Raheja QBE General Insurance Co. Ltd. |

| Bharti AXA General Insurance Co. Ltd. | Reliance General Insurance Co. Ltd. |

| Cholamandalam MS General Insurance Co. Ltd. | Reliance Health Insurance Ltd. |

| CIGNA TTK Health Insurance Co. Ltd. | Religare Health Insurance Co. Ltd |

| DHFL General Insurance Co. Ltd. | Royal Sundaram General Insurance Co. Ltd. |

| Edelweiss General Insurance Co. Ltd. | SBI General Insurance Co. Ltd. |

| Future Generali India Insurance Co. Ltd. | Shriram General Insurance Co. Ltd. |

| HDFC ERGO General Insurance Co. Ltd. | Star Health & Allied Insurance Co. Ltd. |

| ICICI LOMBARD General Insurance Co. Ltd. | Tata AIG General Insurance Co. Ltd. |

| IFFCO TOKIO General Insurance Co. Ltd. | The New India Assurance Co. Ltd |

| Kotak General Insurance Co. Ltd. | The Oriental Insurance Co. Ltd. |

| Liberty General Insurance Ltd. | United India Insurance Co. Ltd. |

| Magma HDI General Insurance Co. Ltd. | Universal Sompo General Insurance Co. Ltd.

|

|

Health Insurance Providers |

|

| National Insurance Co. Ltd. | The New India Assurance Co. Ltd |

| The Oriental Insurance Co. Ltd. | United India Insurance Co. Ltd. |

| Bajaj Allianz General Insurance Co. Lt. | Bharti AXA General Insurance Co. Ltd. |

| Cholamandalam MS General Insurance Co. Ltd. | Future General India Insurance Co. Ltd. |

| HDFC ERGO General Insurance Co. Ltd. | ICICI Lombard General Insurance Co. Ltd. |

| IFFCO Tokio General Insurance Co. Ltd. | Kotak Mahindra General Insurance Co. Ltd. |

| Liberty General Insurance Co. Ltd. | Magma HDI General Insurance Co. Ltd. |

| Raheja QBE General Insurance Co. Ltd. | Reliance Health Insurance Co. Ltd. |

| Royal Sundaram General Insurance Co. Ltd. | SBI General Insurance Co. Ltd. |

| Shriram General Insurance Co. Ltd. | TATA AIG General Insurance Co. Ltd. |

| Universal Sompo General Insurance Co. Ltd. | Aditya Birla Health Insurance Co. Ltd. |

| Apollo Munich General Insurance Co. Ltd. | Cigna TTK Health Insurance Co. Ltd. |

| Max Bupa Health Insurance Co. Ltd. | Religare Health Insurance Co. Ltd. |

| Star Health Insurance | |

|

Travel Insurance Providers |

|

| Bajaj Allianz General Insurance | Bharti AXA General Insurance Co. Ltd. |

| Cholamandalam MS General Insurance Co. Ltd. | Future Generali India Life Insurance Company Limited |

| HDFC ERGO General Insurance Co. Ltd. | ICICI Lombard General Insurance Co. Ltd. |

| IFFCO Tokio General Insurance Co. Ltd. | Shriram General Insurance Co. Ltd. |

| Apollo Munich Insurance Co. Ltd. | TATA AIG General Insurance Co. Ltd. |

| National Insurance Co. Ltd. | United India Insurance Co. Ltd. |

| New India Assurance Co. Ltd. | Universal Sompo General Insurance Co. Ltd. |

| Oriental Insurance Co. Ltd. | Religare Health Insurance Co. Ltd. |

| Reliance General Insurance Co. Ltd. | Star Health and Allied Insurance Co Ltd |

| Royal Sundaram General Insurance Co. Ltd. | SBI General Insurance Co. Ltd. |

Important Aspects while Buying Insurance

When you decide to buy an insurance policy, there are certain pointers to hover through in order to gain the best out of this decision. Let’s look at these in a little detail:

- Know your needs: It is imperative to understand your goal while putting your money in any insurance policy. For a risk-averse person, an endowment policy would do just fine but for someone who wants to pool in despite the risk factor, a ULIP shall prove beneficial

- Number of dependents: If you are a family person, an individual plan won’t be able to do justice to you and vice-versa

- Affordability: It is important to invest as per what your pocket allows. There is absolutely no wise enrolling in a policy where your premium payment is so huge that you end up taking loan to cover for the coverage you opted for

- Child’s expenses: If you have children, chances are your expenses are only going to soar with coming future. To counter this rise, you should stay prepared for cases like incremental educational expenses, wedding load or for abroad trips for higher education trips. A child plan might come handy then

Advantages of Buying Insurance

There are a number of advantages of buying an insurance policy. Some of these are:

- Future financial security: Keeping your money locked in an insurance policy keeps it from being spent in a mindless manner. The money invested in certain insurance plans like ULIPs and Endowment can serve as a corpus to be used for future financial needs. Also in case of emergencies, tools like a money-back plan can come quite handy.

- Tax saving: Premiums paid towards any type of life insurance policy are exempt from tax under Section 80C of the Income Tax Act. Even the returns received in the form of death benefit or maturity benefit is not taxable under Section 10(10D) of the I-T Act. For health insurance, the premiums paid are tax exempt under Section 80D of the I-T Act. Thus, locking your money in an insurance policy also keeps it safe from tax charges.

- Forced savings (to pay for the premiums): Saving is a great habit but unfortunately not many foster it. When you enrol in an insurance policy, you automatically have to start saving so as to pay for premiums as if you miss even a single premium, chances are your policy shall suffer with charges or in some case, total shut down. Involvement in insurance keeps a check on spendthrift expenses.

- Peace of mind: Death is unavoidable and so is an emergency like cancer or accident. But knowing you have a financial back-up sure makes things easy. With the changing lifestyle, we are exposed to multiple life-threatening diseases and to cope up with the same, one needs a solid bank balance. An insurance policy, especially a mediclaim or a critical illness plan sure helps a great deal.

- Continued income post-requirement: For a person involved in service sector, retirement is always a mix-stage. You get rest from work but so does your income. To lead a financially independent post-retirement life, annuity plan or a pension plan plays a pivotal role. Some jobs do offer pension facility after you retire but that is a small segment and it’s usually the half of your usual salary. Thus to maintain the lifestyle, you need a corpus to address post-retirement expenses and an annuity plan helps in exactly the same.

FAQs

Q1. How is Surrender Value calculated?

Surrender Value is a pre-decided percentage of premiums paid. For e.g. if the premium paid totals to Rs. 50,000 and the percentage charged is 30% , then at the end of 4 years, you get Rs. 45,000.

Q2. What are the documents required for making a claim?

Usually you need to submit the filled in Claim Form, medical reports & bills (for health insurance claims), FIR copy, policy document, copy of Registration Book (for motor insurance), passport sized photographs and ID proofs. There can be some addition or omission of the documents mentioned above for different plans and policies.