Life is full of uncertainties, but you need to devise ways to manage the risks arising out of these issues. A life insurance policy is one such means of providing financial security to the family in case of any eventuality like the sudden demise of the breadwinner. To get the benefit when needed, you should know and understand life insurance plans & policies in India.

What is Life Insurance?

Life insurance provides financial protection to the family in cases like the sudden death or the permanent disability of the main earning member of the family. Thus, it is an assurance that the insurance company will take care of the financial well-being of the family members even when the breadwinner is not around. This is done by paying the sum assured to the nominee or the beneficiary. The insurance can also cover other contingencies like critical illness and permanent or temporary disability. The policyholder is called the insured, while the insurance company is called the insurer.

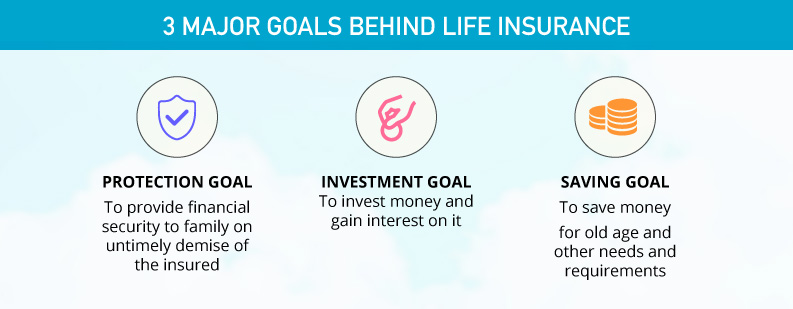

A life insurance policy helps in meeting three goals in life. Let us look at them:

- Protection: A life insurance policy provides financial security to the family on the untimely demise of the insured.

- Investment: Along with protection, life insurance also helps in investment so that the money can be used for meeting various financial goals.

- Savings: Along with protection, through life insurance, you also get to save money which can be used during retirement or for other financial needs.

What is Life Insurance Premium?

A premium is the amount paid to the insurance company for getting a life insurance policy. The premium or the cost of the insurance is an important aspect to be considered before finalising a policy. It depends on various factors like age and gender. To reap the benefits of the insurance policy, it is important to pay the premium on time. In case of a non-payment or a payment delay, the policy can be considered as a lapsed policy. However, before a policy happens to expire, you usually get a grace period of 30 days. The payment mode can be regular or single. A regular payment can be monthly, annually and so on. Let us understand some factors on which the premium depends.

Age: This is an important deciding factor while buying an insurance policy. Older you are, higher the premium amount. Accordingly, younger people have to pay lower premium amount for a life insurance policy.

Gender: Premium amount for women is lower compared to that for men.

Smoker/Non-smoker: In case you are a smoker, the premium will be higher because you are prone to higher risks in life. Thus, a non-smoker has to pay lower premium.

Sum assured: Higher the sum assured or the death benefit, higher the premium amount to be paid.

Policy term: If the policy is for a longer duration, the premium amount will be higher.

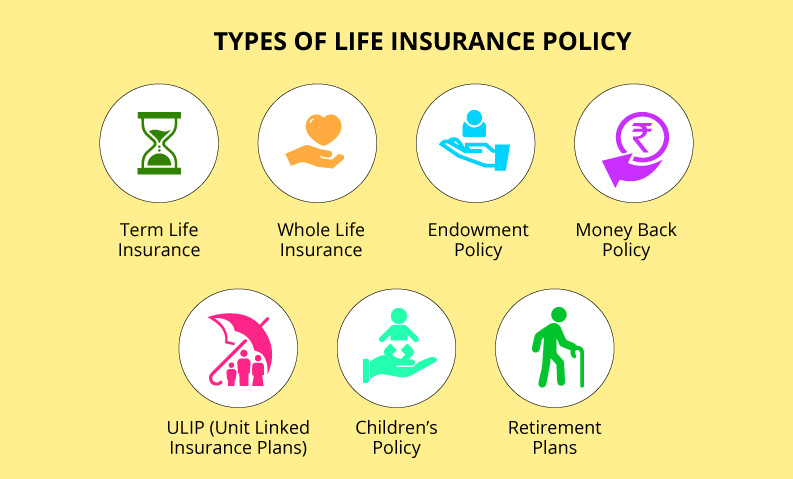

Types of Life Insurance Policy

Life insurance is of 7 types. And each has its own features and specialties. You can choose them as per your need and requirement. They are: Term Insurance, Whole Life Insurance, Endowment Policy, Money Back Policy, Child Plan, Retirement or Annuity Plan and United Linked Insurance Plan (ULIP).

Term Insurance

Term insurance is a pure protection plan where the beneficiary gets the sum assured, also called death benefit, if the policyholder passes away during the term of the plan. However, if the insured survives the term plan, the coverage also ends, with the beneficiary not getting any money. Even the premium paid is not refunded to the insured.

However, there are some term plans where the premium paid is returned, if the policyholder happens to the survive the plan. This payment is termed as survival benefit. The premium for such plans are quite high. Otherwise, a pure term plan is one of the most affordable plans compared to other types, as the amount of the premium is quite nominal. One can opt for regular payment or single payment mode.

3 Types of Term Insurance

- Level Term: The sum assured remains the same during the entire term of the policy. Thus, even the premium amount and renewal premium remain constant.

- Decreasing Term: In this type, the sum assured decreases over time; however, the premium amount does not change.

- Increasing Term: Both the sum assured and the premium amount increase over time. This is mostly opted by people who think beneficiaries will need more money.

| TYPES OF TERM INSURANCE | ||

| Level Term Insurance | Decreasing Term Insurance | Increasing Term Insurance |

| Sum assured for the beneficiary remains constant throughout the term of the plan. Even the premium and renewal premium remain same during the term | Sum assured decreases with time and the premium amount remains constant. Example: credit life insurance, mortgage redemption policies | Not just sum assured, but also premium amount increases with time |

Whole Life Insurance/Life Cover Insurance

Under this policy, the insured is covered for the lifetime, i.e. till his/her death. The maturity age is usually 100 years. Thus, you need to keep paying the premiums till 100 years of your age. Here, the beneficiary gets the sum assured along with maturity benefits on the untimely demise of the policyholder. On the other hand, the policyholder gets to enjoy the survival benefits, in case he/she happens to survive the policy term. A whole life insurance plan offers benefits in both the cases – when the policyholder survives the policy or on his/her sudden demise during the term.

2 Types of Whole Life Insurance

- ULIPs: In case of ULIPs, a part of the premium paid is used for coverage and a part is invested in the market

- Traditional Whole Life: Here, you get a guaranteed return on the maturity of the plan. These plans can be further classified as participating, where the insured gets the bonus or dividend from the company, and non-participating, where the insured does not get any bonus or dividend from the company. You can enjoy the benefits at the end or receive them as periodic payments.

Endowment Policy

This offers both coverage and a means for saving. Like any other life insurance plan, here, the beneficiary gets the sum assured in case of the death of the insured. However, if the insured survives the plan, he/she gets the maturity benefit. The policy can be both participating, where the insured gets bonus and dividends from the company, and non-participating, where the insured does not get bonus and dividends from the insurance company. An endowment policy can also be a ULIP, where a part of the premium is invested in market apart from a part being used in coverage.

Money Back Policy

In this policy, the insured gets a certain percentage of the sum assured at regular intervals during the term of the policy. If the insured survives the tenure of the policy, he/she also gets the sum assured irrespective of the percentage of the sum assured already paid out to him/her. Thus, at the end, the insured gets the sum assured along with the accumulated bonus.

And in case of the death of the insured during the term of the policy, the beneficiary gets the full sum assured regardless of the number of premiums paid. It is one of the expensive policies, as it provides benefit to the insured during the term period along with the long-term benefits of usual life insurance plans. A money back policy provides benefit to the insured in between the term of the insurance which he/she can use for meeting various financial goals.

Child Plan

People can take this insurance plan if they want to save money for the future of their child along with getting a coverage for the breadwinner. It is a combination of savings and insurance, where the insured can use the money for the future needs of the child like higher education. The investment in this plan do not have any vesting age – one can start investing soon after the birth of the child and one can withdraw money after the child reaches a certain age. Some child policies offer intermediate withdrawal options as well. This can be either a ULIP or an endowment plan.

Retirement or Annuity Plan

Retirement or Annuity Plan

Taking insurance policies for the sake of the family is not enough. One should also keep one’s old age in mind. When you are young you have a regular source of income, but during old age the situation can change. So, one needs to plan for the retirement also. Along with coverage, retirement or annuity plans give the option of saving and investing money which can be used in the old age. Life insurance companies in India provide retirement plans which help create a corpus from which a regular income, called annuity or pension, is given to the insured after reaching a certain age.

Retirement plans can be availed “with cover” or “without cover”. The first plan offers a sum assured to the beneficiary and the “without cover” one gives the corpus amount to the beneficiary only after the death of the insured.

2 Types of Retirement Plans

- Immediate Annuity: The insured gets the pension within one year of the premium amount being paid

- Deferred Annuity: The insured decides a time frame after which he/she will get the annuity from the company. This time frame is known as deferred time

Unit Linked Insurance Plan (ULIP)

Unit Linked Insurance Plan (ULIP) offers dual advantage – coverage and a means of investment. Under this plan, the cash value/paid up value of the policy depends on the current asset value. The total premium paid by the insured is divided into two parts: one that is invested in the market or debt funds and the other that is used for insurance. The type of investment is selected by the insured depending on the type of risk that he/she is willing to take.

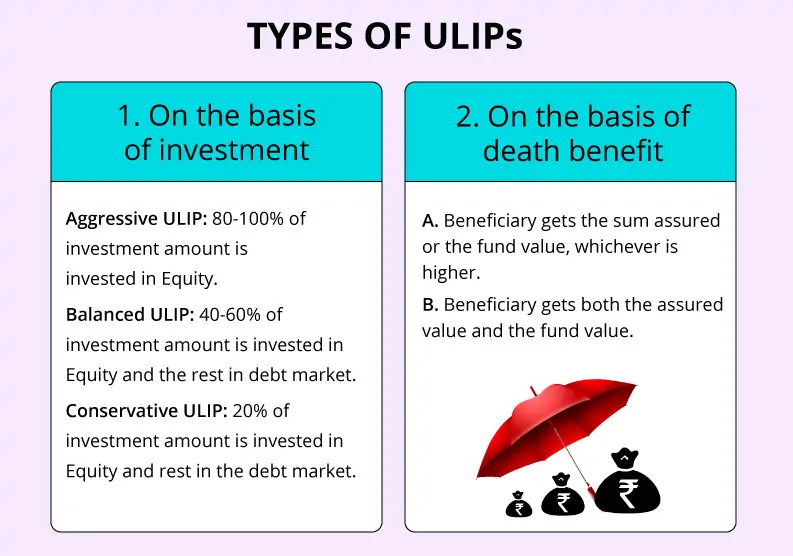

Types of ULIPs

On basis of investment:

- Aggressive ULIP: Here 80-100% of investment amount is invested in equity

- Balanced ULIP: In this case, 40-60% of investment amount is invested in equity and the rest is invested in debt market

- Conservative ULIP: Here 20% of investment amount is put in equity and the rest is invested in the debt market

On basis of death benefit:

- In the first case, the beneficiary gets the sum assured or the fund value, whichever is higher

- In the second case, the beneficiary gets both the assured value and the fund value

Other Types of Life Insurance

Group Life Insurance

Group life insurance is a type of life insurance that covers a group of people. It is mostly provided by companies to its employees. As the insurance is done in a group, a group life insurance is considered cost-effective. The group can comprise lawyers, members of cooperative banks, societies, doctors, etc. This life insurance can be contributory, where the employees contribute along with the employer in the payment of the premium, or non-contributory, where the employer pays the entire premium amount.

Life Insurance for Senior Citizens

You can brave various situations of life when you are young; however, in old age you need more protection and security. To manage such circumstances of life in old age, life insurance for senior citizens can be a good option. The insurance also provides financial coverage at times of need. For instance, in case you do not have any support for your spouse, life insurance for senior citizens can provide financial security to the spouse in case of your sudden demise. The death benefit can also be used to manage loans, debts and other financial needs.

What Life Insurance Covers?

Along with the standard coverage which varies with plan to plan, you can further enhance the protection with the help of riders, such as accidental death benefit rider, total or permanent disability rider and many more. The additional benefits can be availed on payment of some extra amount. Following are some common riders:

- Accidental death benefit rider: Nominee gets this financial benefit along with the sum assured, if the insured happens to dies in an accident

- Accidental total and permanent disability rider: Insured gets financial assistance if he/she is not able to earn due to some disability mentioned in the policy

- Critical illness rider: This covers major critical ailments like cancer, heart attack

- Hospital cash rider: A fixed amount is paid to meet the expenses of non-medical items in case of any hospitalisation

- Waiver of premium rider: Once you have this rider along with your life insurance policy, the company waives off the remaining premium payment on the sudden demise or total permanent disability of the insured

Eligibility Criteria

| Particulars | Details |

| Entry Age | 18-75 years |

| Policy Term | 5-75 years |

| Premium Payment Option | Regular, limited and single premium |

| Sum Assured | Rs 3 Lakh-100 Crore |

How Life Insurance Functions?

- Before purchasing a life insurance policy, you should understand your need and analyse your financial condition and also decide your beneficiary

- Choose the insurance company and the policy after a thorough comparison

- Once you finalise the company and the policy, also decide the policy term. The premium is decided on the basis of various factors like age, lifestyle, gender, policy term, etc.

- Policyholder has to pay the fixed premium to the insurance company for the fixed term. The premium is accumulated to provide the sum assured on the untimely demise of the insured

- In case of the sudden demise of the insured, the claimant should immediately inform the company and provide the required documents along with the claim form

- If the claim is approved, the beneficiary gets the sum assured. The claim can also get rejected because of reasons like nonpayment of premium, reason of death not covered in the policy, etc.

Documents Required For Claim Process

Following are the standard set of documents required to process a claim:

- Duly filled in and signed claim form

- Original policy certificate

- Death certificate issued by local authority

- FIR

- Post-mortem reports

- Hospital discharge summary

- KYC documents of beneficiary like copy of photo ID and address proof

- Copy of cancelled cheque and bank statement

- If the claim is made by someone other than the nominee or assignee, the person making the claim has to submit a legal proof of his or her title

Claim Process

In case of untimely demise of the insured, the nominee or beneficiary can file a claim to get the sum assured.

- Inform the insurance company as soon as possible with details like time of death, place of death and cause of death along with required set of documents given above

- Once these documents are submitted, insurance company would verify the details and accordingly settle the claim

- Sum assured would be transferred to the bank account of the beneficiary

- In case the company finds some problem while verification, it might reject the claim

Exclusions

A life insurance policy protects the insured and his family against different scenarios, but certain claims are not covered by the insurance company. Below are some common exclusions. However, this might vary for different policies.

- Self-inflicted surgery or deliberate self-harm

- Involvement in extreme sports activities like paragliding, water-sports activities, rock-climbing

- Man-made disasters or damage caused due to negligence on part of human beings

- Loss of life due to HIV and STDs

- If claim has arisen due to the involvement in any unlawful activity

Time Taken to Settle Claims

After informing the insurance company about the death of the insured, the claimant needs to submit the required documents, along with the claim form. The insurance company takes something like a week to a month to evaluate and approve or reject the claim. Settlement of a claim usually takes one or two months and in case it takes more time than specified, the insurance company might pay late payment interest on the sum assured. However, insurance companies also take the initiative to keep the nominee posted about the status of the claim.

Companies Offering Life Insurance Policy in India

There are 24 insurance companies providing life insurance policies in India. They are listed here according to their Claim Settlement Ratio (CSR) for 2017-18. A CSR is the total claims paid compared to the total claims received in a financial year.

Importance Aspects

Since there are many companies selling insurance policies, selecting a particular company and a policy is a big task. To ease this process, you should keep certain points in mind.

- Ask your insurance provider to explain the exclusions under the policy you have chosen. This helps in getting a clear picture of what is covered by the policy

- As your needs evolve, it becomes important to review your insurance needs on an yearly basis

- Don’t defer payment or pay after the renewal date as this will be considered as a ‘bad risk’ and your plan may lapse

- Choose wisely as per your need while selecting the type of insurance

- Consider the claim settlement ratio of the insurance company as this indicates how reliable the company is when it comes to settling the insurance claim

- Use life insurance premium calculator to gauge the pros and cons of various life insurance plans and then choose the best life insurance policy depending on your need and ability

Advantages of Buying Life Insurance Policy

- Managing unpredictability: Everyone wants one’s family to lead a good life even after his/her demise. No one can fill the void of one’s death, but financially, one can secure his/her family’s future so that the members don’t have to be dependent on someone else. This is when the sum assured of the life insurance policy helps

- Financial cushion: Life insurance policy helps bailing out the family from the financial troubles like loans and debts after the untimely demise of the breadwinner of the family

- Retirement: One needs to secure his/her old age, when various sources of income might start drying up. An annuity plan can help in such a situation. The money invested or saved through ULIPs or endowment plans can also be used in old age

- Tax benefits: Tax benefits can be enjoyed for the premium payment and the returns given by the company under Sections 80C and 10(10D) respectively of the I-T Act, 1961. You can get tax benefits even on riders.

- Mental peace: Once all the finances are sorted, a person is relieved from all the tension and thus, can concentrate on other aspects of life

- Savings tool: Along with the term plan, one has an option to choose a plan which will be a combination of protection and savings. This will help to create a corpus for future financial needs

- Safeguard children’s future: Things like education cost and marriage expenses can be a big concern while raising a child. Child plans can help in bailing you out from such situations

- Protection against other eventualities: The riders or additional facilities offered through these policies can provide financial help in cases like accidents and disabilities

Terms Related to Life Insurance

Below are some common terms related to life insurance:

Maturity Age: Every life insurance policy comes with the maturity age at which the policy ends. Basically, Life Insurance Company will beforehand communicate to the insured about the maximum age till which the coverage will be provided to the insured.

Premium: It is the amount which the life insured pays to the company in exchange for policy and the sum assured.

Premium Payment Term: The duration of paying the premium. It can be regular (monthly, annually), limited payment term and single payment.

Nominee: It is the legal heir chosen by the policyholder to whom the sum assured will be paid after the demise of life insured by the insurance company. The nominee could be wife, child and parents of the policyholder.

Sum Assured: It is the amount that the insurance company agrees to pay on death of the insured person to the nominee.

Riders: They are additional features or extra protection you can get on the payment of some extra amount. Riders increase the base cover and protect the insured against unexpected circumstances.