Life insurance is considered an important part of financial planning because it provides financial security to the family in case of the sudden death of the main earning member of the family. The most basic form of life insurance is a term insurance.

Table of Contents:

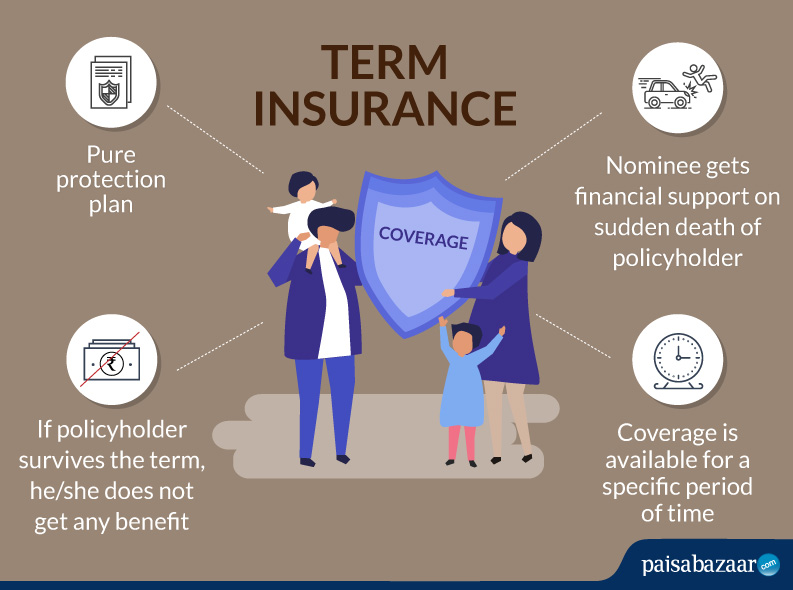

What is Term Insurance?

In a term insurance, the nominee or beneficiary gets an assured amount, if the policyholder happens to pass away during the term of the policy. Thus, the coverage is available only for a specific period of time. And in case the policyholder survives the term, he/she does not get any benefit.

Term Insurance Premium

A premium is the money that you pay to an insurance company to get the insurance or the coverage. It is an important deciding factor while selecting an insurance plan. The premium paid for a term insurance is considered cheap, given the kind of comprehensive coverage provided by a term plan.

Before buying a term insurance, compare the premium of various plans. This can be done by using a premium calculator, an online tool to calculate the premium. However, the calculator does not give the exact premium amount, but an estimate of the amount. The premium calculation of a term plan depends on various factors. These are:

- Age of insured: A younger person pays lower premium. This amount increases with age

- Sum assured: Higher sum assured means higher premium and lower sum assured translates to a lower premium

- Term of policy: If the policy is for a longer duration, the premium gets higher and vice versa

- Smoking habit: A person who smokes pays higher premium compared to a person who does not smoke

- Gender: Premium for a male is higher compared to premium for a female

- Health condition: Any pre-existing medical condition increases risks in life, resulting in higher premium

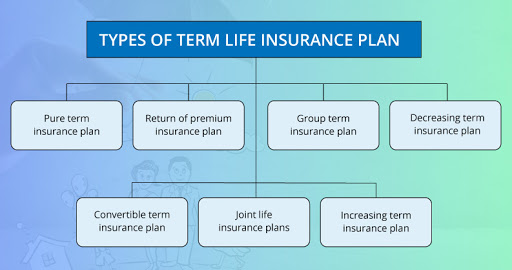

Types of Term Insurance

- Pure term insurance plan: Also called a vanilla plan, this type is a very simple plan. Here the beneficiary or the nominee gets the basic sum assured on the death of the insured during the term of the plan. However, the insured does not get any money, if he/she survives the term period.

- Return of premium insurance plan: The terms and conditions of the plan are same as that for a pure term insurance plan. However, if the insured survives the term of the insurance plan, he/she gets back the total premium paid to the insurance company. Thus, it is called return of premium plan.

- Group term insurance plan: It is usually taken by companies for its employees. Here, one common plan covers all the members of the group. A group term insurance plan is cheaper, as all the members of the group are secured, barring the members who have reached the maturity level.

- Decreasing term insurance plan: Here, the sum assured decreases over time, depending on the personal requirement of the insured. For instance, if a person feels that his savings and investment will increase with time, he/she can choose the decreasing term insurance plan.

- Increasing term insurance plan: If a person feels that with time, his/her family would need more money to meet the inflation cost and other expenses, he/she can choose increasing term insurance plan. Here, with each passing year, the sum assured increases.

- Convertible term insurance plan: After buying a term insurance plan, if the insured feels the need to switch to a new type, this type of term insurance gives the liberty to do so. Thus, after choosing a term plan, if the insured wants to change to a whole life plan or an endowment plan, he/she can do so.

- Joint life insurance plan: Many term insurance plans can be taken jointly, for instance by partners in a business or by couples. In this case, if one partner passes away, the other partner gets the sum assured and the plan continues as before. And if the surviving partner dies during the term, the nominee gets the sum assured after which the plans ends

Factors to Consider before Applying

- Evaluate and analyse your financial requirements, responsibilities and other savings goals of life

- Compare various insurance companies and policies, and check the coverage offered that suits your requirement

- Use online premium calculators to get an estimate of the premium for each plan. This will help to know whether the plan is affordable or expensive

Eligibility Criteria

| Particulars | Details |

| Entry Age | 18 years-65 years |

| Maturity Age | 75 years |

| Minimum Sum Assured | Rs. 50,000 |

Claim Process

In case of any eventuality, you need to make claims the correct way so that you do not miss out the benefits. Let us look at the process.

- On the sudden demise of the policyholder, immediately inform the insurance company

- On the registration of the claim, submit the required documents

- After this, a surveyor from the company will conduct a survey and then approve the claim, if considered fit

- In case there is any problem in the case, the claim might be rejected

Documents Required for Claim Process

Once you have approached the insurance company, you should keep the documents in place to avoid any claim rejection. The documents required vary with case to case. Let us look at some common documents required for claim.

- Duly filled in claim form

- Policy document

- Death certificate

- Medical certificate

- Postmortem report, in case of unnatural death

Exclusions

A term plan does not cover all situations. These are called exclusions. In case the death occurs under certain circumstances, the nominee does not get the claim amount. This varies from company to company. Some of these cases are:

- If the death occurs due to suicide within 12 months of the policy, no claim will be entertained by the beneficiary. The premium amount paid by the insured is returned after deducting the taxes.

- Accidental death due to influence of drugs or alcohol

- Participation in adventurous sports

- Accident due to car or bike racing

Important Aspects

Before finalising the type of term insurance plan, understand certain aspects to take an informed decision.

- Company reliability: Before purchasing any product, one should find out the reputation of the company in the market, performance of the funds of the company and claim settlement ratio (CSR). The FICO score of any insurance company is important as it gives an insight into the performance of the funds of the company The company should also have a high CSR so that claims are settled on time.

- Premium: The premium amount varies for every plan. A thorough comparison helps purchase the most affordable plan. However, one should not compromise with the coverage in order to get a plan with a lower premium.

- Convenience: With the advancement in technology, one can get all the information online and even compare the products also online. The insurance companies and online insurance aggregators have made the whole process convenient and easy for the applicants.

- Solvency ratio: Any company is judged by its solvency ratio, which states the true financial position of the company. It tells us whether at any point of the time the company is able to pay back all its dues or not. In insurance sector, the reliability of the company lies on the financial goodwill of the company.

- Enhanced coverage through Riders: These are additional benefits that one enjoys on payment of little extra amount. These are important, as they help provide comprehensive coverage.

Advantages of Term Insurance

A term insurance plan is one of the cheapest plans. It aims to financially secure the family, in case of the sudden demise of the main earning person of the family. Some of the other advantages of the plan are:

- Tax benefits: Sections 80C and 10(10D) of the Income Tax Act 1961 give tax benefits to the insured for the premium paid and the death returns received, respectively. If the insured applies for an accidental rider, he will get extra benefits under Section 80D of the I-T Act.

- Term of the policy: The policy term can range from 5 years to the whole life, depending on his/her requirement. An applicant who wants to make single premium payment can choose a term plan for a duration of 5 years to 15 years.

- Choice of plan: An applicant can take either single or joint insurance plan. Single life insurance means that claim for the benefit can be made only on the death of the insured life. Joint application means that the life of both the persons taking the insurance plan is insured and on the death of either of the person, claim can be made by the other. Joint term life insurance is usually taken by husband and wife, business partners. Here the policy expires on the first claim or at the end of the term plan.

- Survival benefit: For term plans, claim is given only on the sudden demise of the insured within the term of the insurance. However, many insurance companies are now offering survival benefit at the maturity of the insurance plan. This is also known as term return of premium plan, when the company returns the premium amount to the survivor at the end of the maturity period of the plan. This plan is best for people who want to secure their life and save for future, if they survive the term.

- Death Benefit: On the death of the insured, the nominee gets the claim amount, either in lump sum or in installments, as mentioned in the contract.

- Rider benefit: Term plans also offer riders or additional benefits which can be availed by the insured by paying some extra amount. Some available riders are:

- Critical illness rider: On the diagnosis of any critical Illnesses mentioned in the policy, the insured gets lump sum amount for treatment

- Accidental death benefit rider: Nominee gets additional amount along with the death benefit in case of accidental death of insured

- Permanent and total disability rider: If the insured is not in a condition to earn due to permanent or total disability, nominee and family gets financial support to carry on with life

- Hospital cash rider: Insured gets daily cash benefit in case of hospitalisation

- Waiver of premium rider: If insured is disabled or seriously ill, premium payment is waived off with the policy continuing as before

- Extra benefit: Some term insurance plans provide extra benefit to the nominee in case of the death of the insured. These benefits include the cost of the funeral and immediate annuity for the family.

FAQs

Q1. What is an ideal life insurance cover?

It should be at least 15-20 times the annual income of the policyholder.

Q2. Are there any riders available under term insurance plan?

Yes. There are many riders available under term insurance plans – Accidental Death Benefit Rider, Critical Illness Rider, Waiver of Premium Rider, Hospital Cash Rider and others.

Q3. What benefits will I get on maturity under term insurance plan?

There is no such benefit as on maturity under term insurance plan. Policyholders can only avail death benefit in the form of sum assured.

Q4. Can I change the premium amount during the term of the policy?

No. Policyholders need to pay the same premium amount for the entire policy term.

Q5. Can I avail more than one term insurance plan?

Yes. Policyholders can avail more than one term insurance plan.

Q6. Is term insurance available for NRIs?

Yes, NRIs can also avail term insurance plans.