Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Insurance plans are protection products to manage the uncertainties of life. However, the added advantage of these plans are that they can also act as means of investment and saving. However, one should keep in mind the protection and future need of the family while selecting the type of the product.

An insurance is a contract between the insured and the insurer, wherein, the insured needs to pay a cost called premium to the insurer, who in return promises to make a lump sum payment called sum assured in case of any contingency mentioned in the contract.

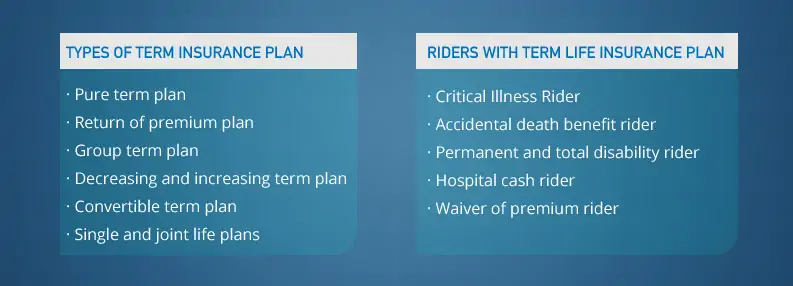

1. Critical Illness Rider

2. Accidental death benefit rider

3. Permanent and total disability rider

4. Hospital cash rider

5. Waiver of premium rider

Along with the benefits, the term plans comes with exclusion. According to the exclusion, within one year of the term plan, if the insured commits suicide and dies, no claim made by the beneficiary is entertained. Even the premium paid till then is refunded to the beneficiary, but after deducting taxes and other charges.

Mistakes to avoid while purchasing Term Insurance Plans

Term insurance plans have a plethora of lucrative benefits; however, choosing the best term life insurance plan is a big task. We should keep certain points in mind to avoid making any mistakes while selecting a plan.

• Choosing a low sum assured: High sum assurance means higher amount of premium. To save on the premium amount, one might choose a low sum assured which can be insufficient for the future of the family, in case of the death of the breadwinner. There is a thumb rule in selecting sum assurance – one should select at least 15 times of the current salary as the sum assurance amount. This fund will be enough for the family to meet the expenses of inflation and other future requirements, in case of the death of the insured. The term insurance plan is the only plan where one can reap the benefit of high sum assurance at a lower premium amount.

• Lower term period: The plan does not come with maturity benefits; the payouts come only after the death of the insured. So one should choose a longer term period to make the future of the family secure. Over time, a person’s life expectancy decreases, so the longer term period would cover the old age as well. For example, if a person takes a 20-year term plan at the age of 18 years, and plans to renew the plan after 20 years, the premium will be higher in the latter case. The overall premium amount paid by this person would be higher than the premium had he taken a 40-year plan initially. The amount gets distributed over the number of years. So a longer duration of the plan is always beneficial.

• Not filling up the application form and verifying the details: All insurance policies come with a disclaimer that all the documents should be read properly before investing. The usual practice while purchasing an insurance product from an agent is just putting in the signature without reading it. The proposal form is full of questions about the person and his/her family medical history and other details. According to the answers in the proposal form, the company calculates the premium amount and the claim settlement is also done on the basis of the proposal form.

• Term insurance comparison: The market is flooded with various term insurance plans by different companies. Before purchasing the plan, one should study the market, make proper comparisons and then find an appropriate plan suiting ones’ needs and future requirements.

Points to consider while comparing plans

1. Claim settlement Ratio: this is one of the most important points in selecting the best term insurance plan. Claim settlement ratio gives the image of the insurance company. Let’s take an example in understanding the claim settlement ratio. Suppose a company has received 5,000 claims from the beneficiary of the insurance plans issued by the company and out of these, the insurance company settles 4,800 claims and rejects 200 claims. The claim settlement ratio of the company is 4800/5000*100= 96%. This is the company settlement ratio. The higher the settlement ratio the higher is the reliability of the company.

2. Features and benefits of plans: One should compare the benefits and features of the plan and also the amount of premium charged by the companies. One should select plans with maximum features and benefits at the lowest premium amount. Each person has different needs, thus, it is essential for an applicant to analyze the different products and select the product accordingly.

3. Rider benefits: The plan which offers various riders at a low cost is more beneficial to the applicant. Thus, one should select wisely. Riders are the added advantage at a small cost. All the products do not include all types of riders. It is essential to find out various options available before finalizing a plan. With the proper utilization of the rider benefit, one can secure the future of one’s family.

Benefits of Term Insurance Plan

Insurance plans are great investment tools along with providing future security for the family in case of the untimely demise of the breadwinner of the family. Some other benefits of term insurance plan are:

• In case of the death of the insured or any contingency covered in the plan, the beneficiary gets a lump sum amount to be used for the future and well being of the family.

• If an insured needs an amount of money during his survival period, he can avail for the loan amount against the term insurance policy.

• It helps the family to maintain the same lifestyle after the uncertain death of the insured.

• It helps the family wriggle out of any immediate cash crunch after the demise of the breadwinner – the plan also provides for the funeral expenses of the insured in case of his/her untimely demise.

• Riders like financial help during physically disabled or critically ill which can be availed by the insured. According to these riders if during the term period if the insured meet with any of this situation then the insurance company pays the lump sum amount to the insured. All the riders that are available with the plan can be availed by the insured by adding some extra amount to the premium.

• The government also supports term insurance plan. Thus, offers a tax rebate to the insured as well as the beneficiary. According to Sec 80C of Income Tax Act 1961, the policy holder gets a tax rebate on the annual premium amount up to Rs. 1.5 lakh annually. And according to sec 10(10D) the amount received by the beneficiary in case of the death of the insured is tax free.

• The term insurance plan provides flexibility to its applicant in term of choosing the term period of the plan. That is an applicant can choose from 5 years to the whole life plan.

• Various portals are available to the applicant from whom they can purchase the term life insurance plan. For example the applicant can buy term plan from the agent, employee, and website of the company.

Best Term Insurance Plans in India (claim settlement ratio)

List of companies with best term plan on the basis of IRDA-issued claim settlement ratio for the year 2016-17

| Insurance Provider | Claim Settlement Ratio | Claims Pending |

| Life Insurance Corporation (LIC) | 98% | 3,203 |

| Max Life Insurance | 98% | 3 |

| HDFC Life | 98% | 59 |

| ICICI Prudential Life | 97% | 36 |

| Aegon Life | 97% | 0 |

| SBI Life | 97% | 132 |

| Tata AIA Life | 96% | 0 |

| Exide Life | 96% | 0 |

| Reliance Life | 95% | 35 |

| Birla Sunlife | 95% | 48 |

| Canara HSBC Life | 95% | 1 |

| Edelweiss Tokio Life | 93% | 0 |

| Bharti AXALife | 92% | 34 |

| Bajaj Alliaz | 92% | 63 |

| Kotak Life | 91% | 19 |

| Aviva Life | 91% | 7 |

| DHFL Paramerica | 91% | 6 |

| Sahara Life | 90% | 26 |

| Future Generali Life | 90% | 17 |

| IDBI Federal Life | 90% | 7 |

| PNB Metlife | 87% | 108 |

| Star Union Dai-Ichi Life | 84% | 19 |

| IndiaFirst Life | 83% | 29 |

| Shriram Life | 64% | 293 |