The sudden demise of the main earning member of the family can lead to big financial troubles. To manage such uncertainties of life and stay financially secure, you should consider buying life insurance.

What is Life Insurance?

Life insurance is a contract between two parties. The first party pays a cost to the second party for financial support to be provided to the family in case he/she passes away during the policy term. This cost is called the premium that can be paid at regular intervals or all at once, depending on the options provided by the insurance company. The financial support is the coverage amount decided at the start of the policy. A life insurance plan can also provide maturity benefits at the end of policy term other than death benefits.

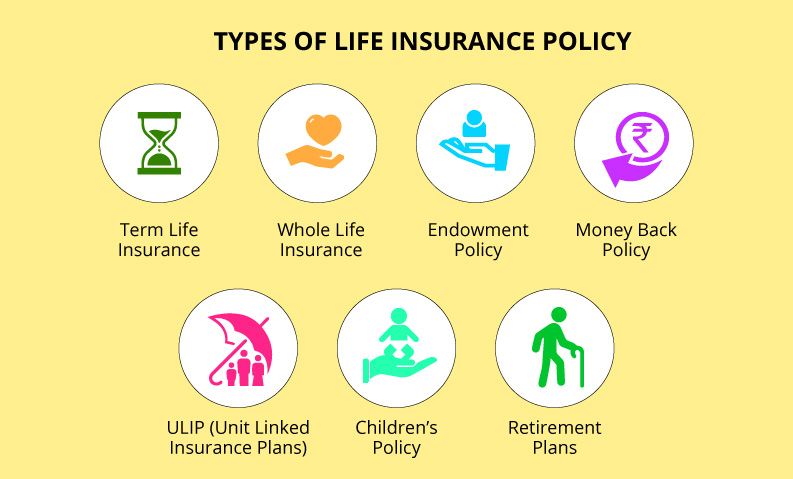

Types of Life Insurance

Broadly speaking, life insurance can be classified into 7 main categories:

- Term Plan: Pure risk cover for a limited period of time.

- Whole Life Plan: Protection against death + maturity benefit for whole life.

- Money-Back Plan: Insurance cover with periodic returns as survival benefit.

- Endowment Plan: Insurance + savings (low risk-return factor).

- Unit Linked Insurance Plan: Insurance + investment (high risk-return factor).

- Children’s Policy: Insurance cover for expenses related to the child’s educational, matrimonial, etc.

- Retirement/Pension Plan: Financial benefit for the post-retirement period.

1. Term Insurance Plan:

This is the simplest form of life insurance that caters to the basic protection needs of an individual. This insurance plan is an extremely easy-to-understand product and light on the pocket too.

There is no savings or profit aspect involved in a term plan. Death risk cover is provided to the policyholder where the death benefit is paid to the nominee appointed by the policyholder. If the Life Assured, i.e. the policyholder survives the entire policy term, then nothing is paid back. This means there is a no maturity benefit in a term plan.

Although there are some insurance companies that have come up with Return of Premiums option. In such a scheme, if the policyholder survives the complete policy period of the term plan, the company returns all the premiums paid. This option makes the plan more beneficial than a vanilla term plan and thus costlier too.

Advantages of a term insurance plan:

- It offers various additional rider policies to enhance the coverage

- No

- The death cover is provided to the beneficiaries and can be availed either in one go or in installments

2. Whole Life Insurance Plan:

A whole life insurance plan provides protection to the policyholder for the entirety of his life or for a period of 100 years, whichever is higher. Since there is no specific validity defined, the policyholder is given cover for his/her entire life.

In a whole life plan, the policyholder gets twin benefit of death claim and maturity claim, whichever is applicable. However, this makes the plan costlier than a term insurance plan and is usually not much preferred by customers.

Advantages of a whole life insurance plan:

- Coverage offered for as long as the insured lives

- There is no age limit in this plan

- After the premium payment period is over, the insured can make partial withdrawals from the assured sum

3. Unit Linked Insurance Plan (ULIP)

This is an upgraded version of an insurance plan where a person is provided with protection for a fixed period of time while a part of the premium paid towards the policies in invested in the capital market like bonds, equities, etc. selected either by the policyholder or the financial experts of the insurance company. Thus, there is a goof profit component involved in a ULIP along with considerable risk factor involved too. Such an insurance plan works perfectly for someone who has a good risk-return appetite and wants to invest in addition to an insurance cover.

- The plan provides long term investment option with the flexibility to switch funds

- Maturity and/or death benefits provided, whichever deems suitable

- Option to add riders to enhance the coverage

4. Endowment Insurance Plan

An endowment plan is a type of insurance which provides both the benefits of insurance and savings. In it, a specific amount of premium is kept aside for life cover while the remaining premium is invested by the insurance company.

- If the policyholder outlives the policy term, he/she is entitled to receive the maturity benefit

- Periodic bonuses may also be offered that are paid either with maturity benefit to the policyholder or with the death benefit to the appointed nominee

- The risk factor in the investment component is comparatively lower than other types of plans and so are the returns

- Perfect long-term saving option for people with lower risk appetite for investment

- The policyholder can earn returns on maturity

5. Money-Back Insurance Plan

A money-back plan is a type of endowment plan in which a pre-decided percentage of sum assured is paid back to the sum assured at fixed intervals. These paybacks are called Survival Benefits. This type of insurance plan works best for those who are risk-averse and wish to save in an insurance plan while maintaining liquidity throughout.

- If the policyholder outlives the term of the policy, he/she gets the remaining sum assured

- On the death of the policyholder, the beneficiary gets the full sum assured, irrespective of the payments made during the policy term

6. Retirement/ Pension Plan

A retirement plan is a type of insurance product that is designed to provide financial security when one retires, i.e. when the regular income stops. It’s more than just a vanilla insurance plan and thus provides one with investment opportunities so that one doesn’t have to compromise on the standard of living when the regular income starts to ebb.

- The policyholder shall start receiving benefits at the start of vesting age

- There is an option to buy additional riders to amp-up the insurance cover

- One may surrender the policy before the expiration of the policy term, although this may lead to certain charges

7. Child Plan: The policy is opted by the insured for the financial assistance for his child’s future. This plan ensures a financial corpus for the child when the policy matures (usually when the child turns 18). This can help the insured sponsor his child’s education or wedding smoothly. If unfortunately, the insured passes away, the immediate payout is provided to the nominees.

-

- Helps the insured to financially secure the future of his/her child

- Financial security in case of insured’s demise is also a major benefit that ensures that the child will be financially protected even after the demise of the breadwinner

What is a Premium?

Premium is the amount one pays towards an insurance policy. It is the most important aspect one needs to consider before finalizing an insurance plan other than the sum insured. Premium basically helps determine the affordability of a plan. It depends on various factors like age and gender of the applicant, life cover opted, policy term, etc. The premium can be paid monthly, quarterly, semi-annually or annually, depending on the options provided by the insurance company. If this amount is not paid in time, the policy may lapse. Thus it is highly imperative to pay the premium in time. However, insurance companies now provide policyholders with the facility of paying the premium within the grace period. This period starts after the due date of payment and usually lasts for a period of 30 days. After the grace period is expired, policy gets lapsed.

Also Read:- LIC Retirement Plans in India

How to Claim a Life Insurance Policy?

An insurance policy is subject to the solicitation. This means that one needs to ask for the insurance amount, i.e. the sum insured, from the insurance company. This is done by registering a claim with the insurance company on the death of the policyholder or on the event of completion of the policy term if there are maturity benefits.

To make a claim, the following documents need to be submitted with the insurance company:

- Copy of the policy document

- ID proof of the policyholder (AADHAAR, voter’s card, etc.)

- ID proof of the beneficiary (AADHAAR, voter’s card, etc.)

- Address proof of the claimant (utility bills, ration card, etc.)

- PAN card of the policyholder

- Account details of the policyholder (cancelled cheque, copy of ITR, etc.)

Also Check:- LIC Money Back Policy

General Exclusions

Some of the cases where a life insurance policy cannot be claimed are:

- Suicidal death

- Death due to involvement in life-threatening activities/sports

- On-road death under the influence of drugs or alcohol

- Death due to lifestyle-related reasons like smoking, alcoholism, drug abuse, etc.

Companies Offering Life Insurance Policies

Following is the list of all the registered companies in India providing life insurance policies:

|

Life Insurance Companies in India |

|

| Life Insurance Corporation of India | Aviva Life Insurance Company India Ltd. |

| HDFC Life Insurance Co. Ltd. | Sahara India Life Insurance Co. Ltd. |

| Max Life Insurance Co. Ltd. | Shriram Life Insurance Co. Ltd. |

| ICICI Prudential Life Insurance Co. Ltd. | Bharti AXA Life Insurance Company Ltd. |

| Kotak Life Insurance Co. Ltd. | Future Generali India Life Insurance Company Limited |

| Aditya Birla Sun Life Insurance Co. Ltd | IDBI Federal Life Insurance Company Limited |

| TATA AIA Life Insurance Co. Ltd. | Canara HSBC OBC Life Insurance Company Limited |

| SBI Life Insurance Co. Ltd. | Aegon Life Insurance Company Limited |

| Exide Life Insurance Co. Ltd. | DHFL Pramerica Life Insurance Co. Ltd. |

| Bajaj Allianz Life Insurance Co. Ltd. | Star Union Dai-Ichi Life Insurance Co. Ltd. |

| PNB MetLife India Insurance Co. Ltd. | IndiaFirst Life Insurance Company Ltd. |

| Reliance Nippon Life Insurance Co. Ltd. | Edelweiss Tokio Life Insurance Company Limited |

How is Life Insurance Helpful?

The sudden death of an individual, especially if he/she has dependents, can lead to a major financial crisis. Although it is not possible to compensate for the loss of human life, a pre-determined sum can help significantly in covering the financial liabilities of the family. Insurance policies also aid in saving tax and thus act as a financial cushion in the long-term.

A life insurance policy can help in the following ways:

- Death benefits are generally income-tax-free to the beneficiary

- Premium paid towards a life insurance policy are tax-free

- Many life insurance policies are exceptionally flexible in terms of adjusting to the policyholder’s needs

- The death benefit may be adjusted while the policy is on and thus premium be reduced if need be

- Many life insurance policies give the option of taking a loan against the policy, thus helping out in financial emergencies

- If a policy does not completely comply with the needs of the policyholder, there are additional riders that can maximize the coverage

There are many types of life insurance plans, and the decision to buy a particular plan depends upon the optimal combination of needs and affordability of the customer. The plans are designed by the insurance companies keeping in mind various groups of customer base and their insurance needs, thus giving them a wholesome basket of plans to choose from.

FAQs

FAQs

Q1. Why is whole life insurance expensive than a term plan?

A whole life insurance plan provides you with death benefit and maturity benefit, both. Also, the insurance plan covers you for your entire life. A term plan does not provide one with maturity benefits and the coverage is for a specific period of time. Thus there is a difference in the premium amounts of both the plan.

Q2. Can I have two different types of life insurance plans simultaneously?

Yes. You can have any number of life insurance plans depending on your requirement.

Q3. Why am I being charged with more a higher premium than my wife?

Life insurance plans generally cost much for males than for females. This is the reason you are being charged more than your wife.

Q4. Should I hide about my smoking habits as this clearly is fetching me less premium?

No. you should never hide or manipulate any detail asked by the insurance company. This will affect you adversely in the future. The insurance company may deny claims as there was no proper disclosure of information in the first place.

Q5. I have invested in mutual funds. Do I still need to invest in a life insurance policy?

Life insurance is not an investment. It is a way of safeguarding your family in your absence and you pay for it in the form of regular premiums. So it does not matter if you have invested your money in mutual funds or not. One should always have a suitable life insurance policy, especially if you have dependents to take care of.