Life insurance provides financial security to the family by helping to manage daily expenses and other financial requirements in case the breadwinner happens to pass away. There are different types of life insurance plans and you can pick one as per your need and financial planning. A whole life insurance is a type of life insurance that offers coverage for the entire life.

Table of Contents:

What is Whole Life Insurance?

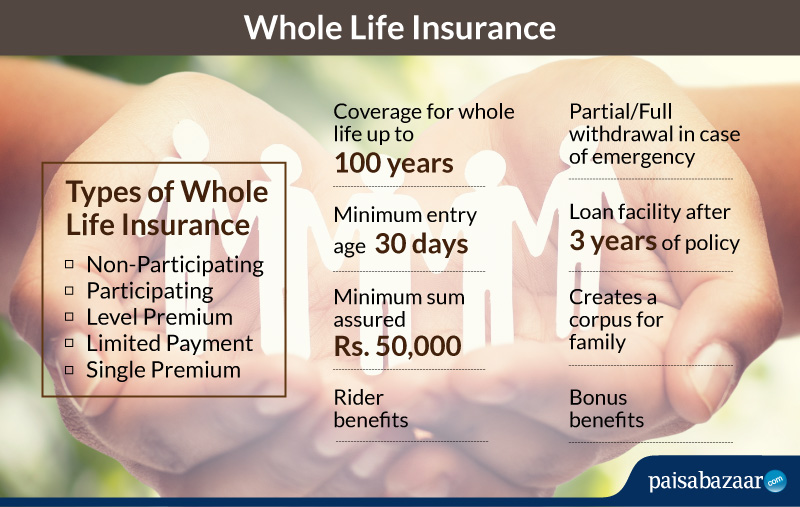

A whole life insurance policy provides coverage for the whole life, i.e. up to 100 years. It guarantees death benefits or the money assured to the nominee on the sudden demise of the policyholder anytime till the maturity age (100 years).

Thus, the insured is covered till his demise, provided all the premium amounts are paid. And if the insured crosses the maturity age, the policy automatically matures after which the policy holder gets survival benefit along with maturity benefit.

Types of Whole Life Insurance Policy

There are different types of whole life insurance policy. After a thorough evaluation of the features and benefits of the policy, select the type as per your need and affordability.

- Non-Participating Whole Life Insurance: It is a low-cost insurance plan which demands low and levelled premium throughout the policy tenure. No dividend or bonus is shared with the policyholder

- Participating Whole Life Insurance: Here the policyholder gets bonus and dividends from the insurance company

- Level Premium Whole Life Insurance: Premium is paid till the very end of the policy, with the premium remaining the same throughout the tenure

- Limited Payment Whole Life Insurance: Premium is paid for a limited period of time while the coverage is provided for the entire plan period (till the policyholder is alive or 100 years). Since the premium payment time is limited, the amount of premium is higher compared to that for level premium whole life insurance

- Single Premium Whole Life Insurance: Premium is paid only once and the plan is funded for life. It is an expensive plan in terms of premium paid

Factors to Consider before Purchasing Plans

- Check the online premium calculators before enrolling in a whole life insurance plan so as to get an estimate of the same

- Choose a plan that best suits your needs, i.e. your savings goal, term of plan, etc.

- Compare policies in terms of features of different insurance providers before narrowing down on one so as to get an idea of all the benefits you can avail

Eligibility Criteria

| Particulars | Details |

| Entry Age | 30 days-60 years |

| Maturity Age | 100 years |

| Minimum Sum Assured | Rs. 50,000 |

| Minimum Premium | Rs. 500 (Monthly) |

Documents Required to Purchase Plans

Always keep the required documents in place for a smooth purchasing process. Some of the common ones are:

- Identity proof (PAN Card, Aadhaar Card, etc.)

- Address proof (Voter ID card, Ration Card, Passport, etc.)

- Age proof (Birth certificate, Class 10 certificate, Passport, etc.)

- Bank account details (of beneficiary)

- Passport-size photographs (policyholder’s & beneficiary’s)

Note: This is a non-exhaustive list.

Claim Process

Follow the steps given below to file claims in case of any eventuality covered under the plan:

- Immediately contact the insurance company in case of any eventuality fit for filing a claim

- Register the same through modes, such as online, call, email or by physically visiting the branch office

- Fill in the claim form

- Submit all the required documents along with the claim form

- Company shall verify the authenticity of the claim and documents

- Once verified and found positive, claim amount is released

Documents Required for Claim Process

- Claim Form

- Death Certificate (in case of Death Claim)

- ID proof of beneficiary

- Original policy document

- Any other document asked by your insurance provider

Time Taken to Settle Claims

As per the IRDAI regulations, all insurance companies are required to settle claims within a span of 30 days from the date of receipt of all the documents needed for proper assessment of claims.

Riders

Riders are additional benefits provided with the insurance plans. These help extend the coverage of the plans and can be availed on payment of some extra amount. Some of the riders available with whole life insurance policy are:

- Accidental Death Benefit Rider: In case of accidental death, the nominee gets sum assured along with the rider benefit

- Accidental Total & Permanent Disability Rider: In case an accident led to loss of limbs or permanent disability, resulting in inability to work, the rider provides monthly income to the policyholder

- Critical Illness Rider: On diagnosis of some major critical illness like heart problem, cancer, etc., the policyholder gets financial help for treatment

- Waiver of Premium Rider: In case the policyholder dies during the policy term or is unable to pay future premiums for some valid reasons, the policy does not terminate, if this rider is included. Thus, future premiums are waived off and policy continues like before

- Accelerated Death Benefit Rider: In case the policyholder gets diagnosed with a terminal illness which shortens life span, this rider comes to the rescue. A part of the sum assured is paid in advance by the insurance company to the policyholder so as to cope with sudden crisis

Exclusions

A whole life insurance policy offers comprehensive coverage, but it does not cover all cases and situations. These are called exclusions. Death occurring under certain situations do not qualify for claims. Some of them are:

- Suicidal deaths, whether the person was sane or not

- Lifestyle-related deaths

- Death due to alcohol and drug abuse

- Death due to involvement in life threatening sports like cliff jumping, motor racing, paragliding, etc.

- Death due to involvement in any kind of illegal activity or terrorism

Note: This is not an exhaustive list. Situations can change as per the plan and/or insurance company.

Important Aspects

While checking and comparing various whole life insurance plans, consider the important aspects in order to reap the maximum benefits.

- Unlike a term plan, premium of whole life insurance policy is relatively higher since coverage is provided for the whole life

- Money can be withdrawn partially or fully in case of emergency, thus providing liquidity

- Grace period is allowed for 30 days starting from the due date of premium payment during which one can pay the premium if could not do so till the due date

- In order to receive the bonus and reap maximum benefits, pay premiums for the full premium payment term

Advantages of Whole Life Insurance

It is better to be prepared for any kind of eventuality in life. And life insurance is one such safety belt. Some of the benefits of whole life insurance are:

- Protection for Life: It helps the insured create a corpus for the family which includes sum assured and bonus (for participating plans). There is also death benefit along with maturity benefit, thus, the policyholder is covered no matter what

- Tax Benefit: Under Sections80C and 10(10D) of the Income Tax Act, 1961, the premium paid towards the policy and returns received are tax exempt

- Loan Facility: Insured can take loan against whole life insurance policy after 3 years of taking the policy