After buying a suitable SBI Life insurance policy, it is important to keep a track of your premium due date, bonus, fund status,etc. This can be done online or offline. However, to go the online way, you need to be aware of SBI Life Insurance login and registration process.

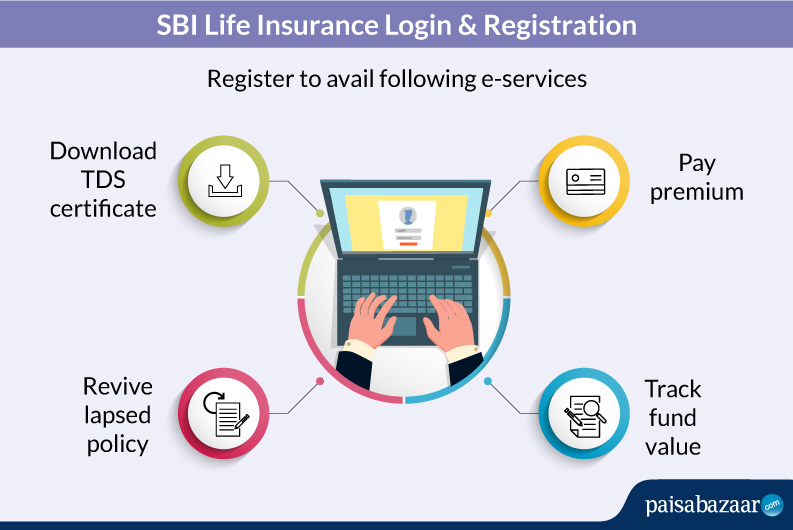

E-services Available on SBI Life Insurance Portal

Registered customers can avail the following online services offered by the company:

- Register for e-statements

- Pay premium online

- Download premium paid certificate/TDS certificate

- Revive lapsed policy

- Track fund value

How to Register on SBI Life Portal

After purchasing the suitable insurance plan from SBI Life, you have to register on the portal as a customer to avail various e-services offered by the company. Here are the steps to register:

- Visit the official website of SBI Life. Click on Login tab and select ‘Customer’ from the drop down menu.

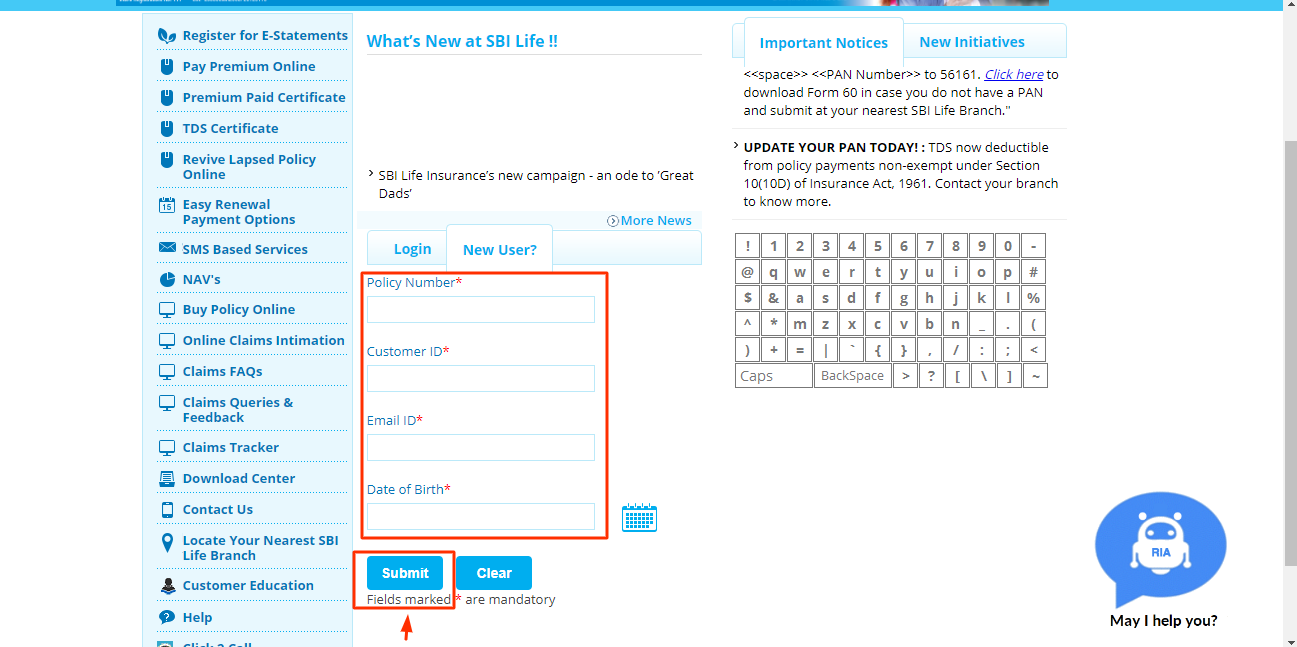

2. A new page will open. Here, under the ‘New User’ section, enter your policy number, customer ID, email ID, date of birth and click on ‘Submit’.

3. Your login credentials will be sent to on your email ID.

Note: The above SBI Login process is for ‘Customer’, including Group Customer, Corporate and Partners of SBI Life.

You can also register by visiting one of their branch offices. The policyholder needs to submit policy-related documents and other supporting documents for the registration process.

How to Login on SBI Life Portal

1. New Users

Once you have purchased a suitable SBI Life Plan, you have to register on their portal to avail any of the services offered by them. To know the registration process in detail, click here.

2. Registered Users

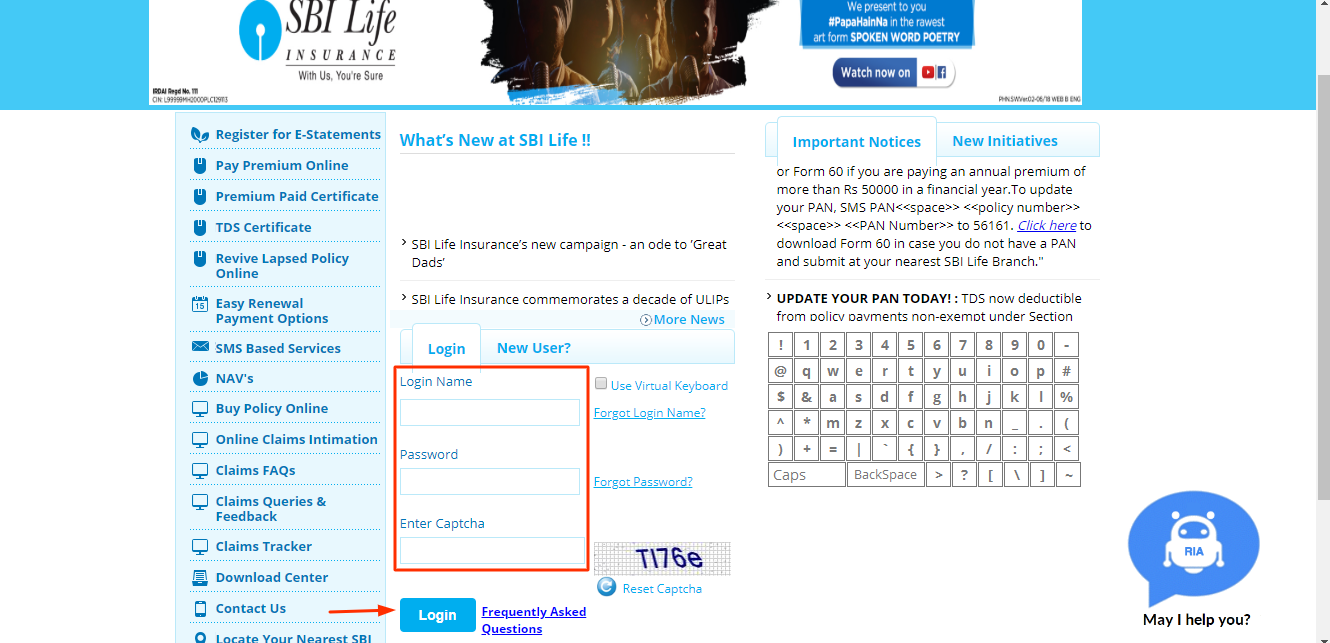

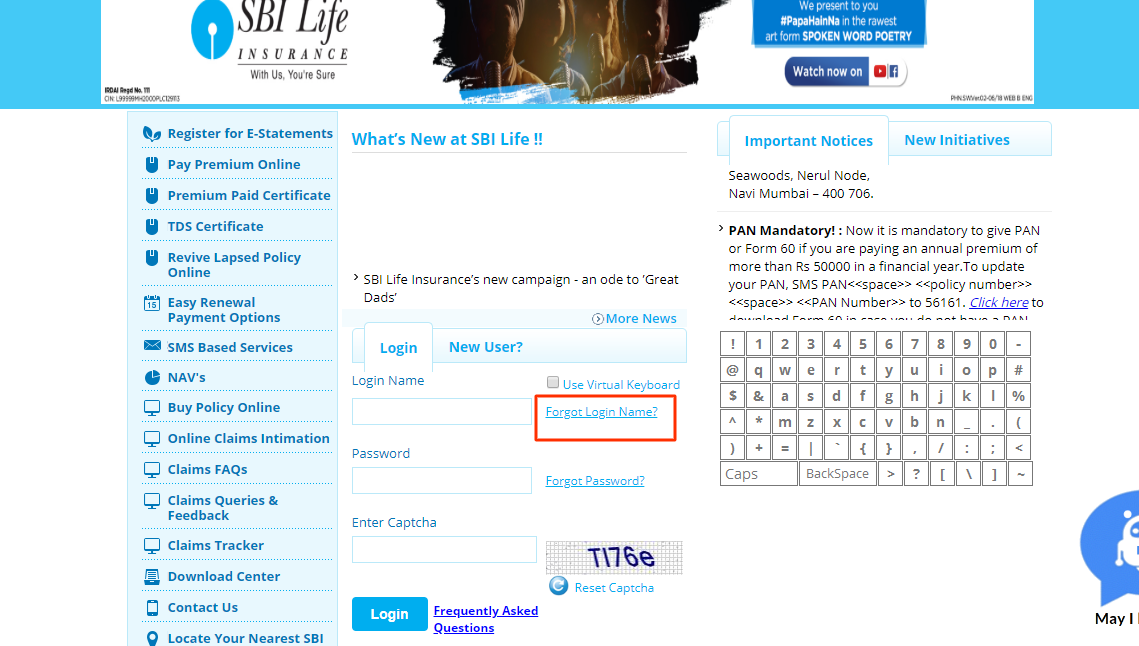

- Visit the official website of SBI Life, click Login tab and select ‘Customer’ from the drop down menu.

- On the next page, under ‘Login’ section, enter your Login name, password, enter Captcha and click on Login. After this, you will be able to manage your policy online.

3. If You Forget User ID

To recover your login name, follow the below mention steps:

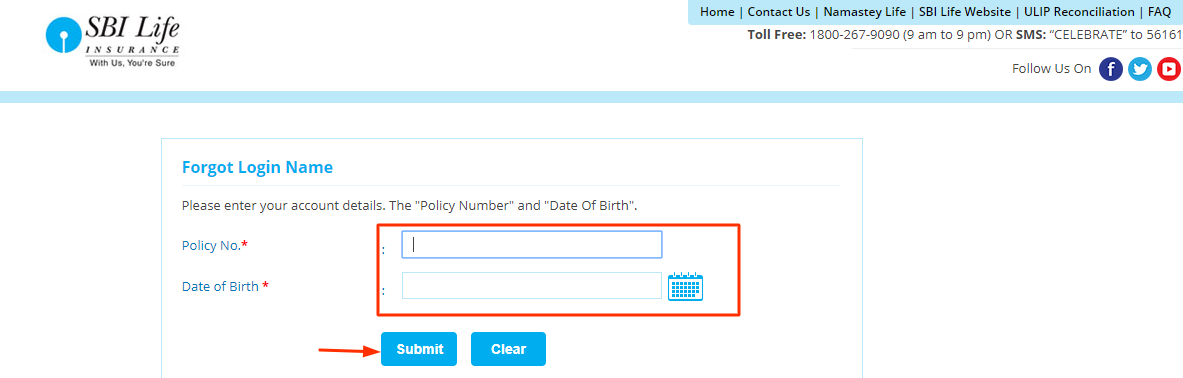

- Visit the official website of SBI Life, click on Login and select ‘Customer’.

- On the next page, Click on ‘Forget Login Name’.

- A new page will open, here, enter your policy number, date of birth and click on ‘Submit’.

- Answer your hint question and you will receive the login name on your registered email ID.

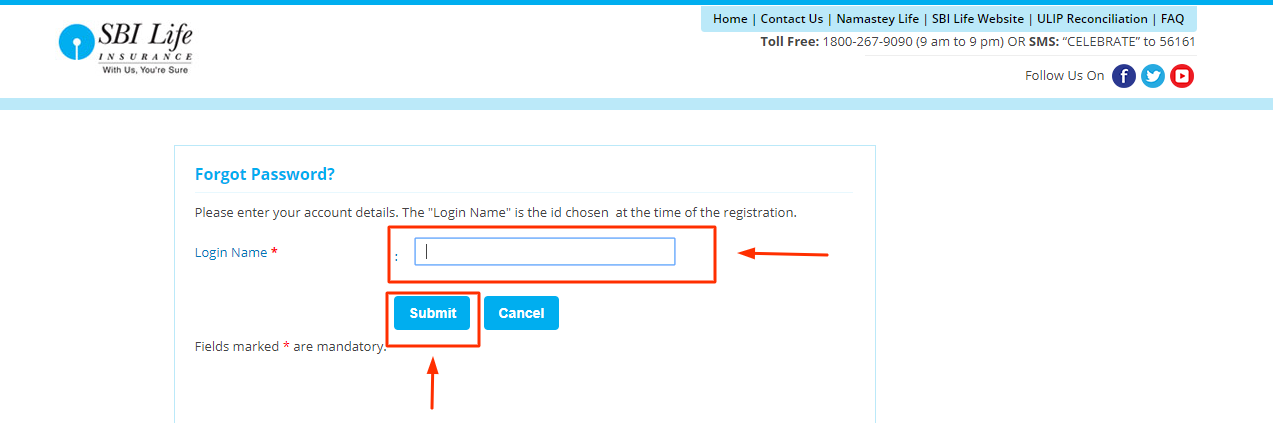

4. If You Forget Password

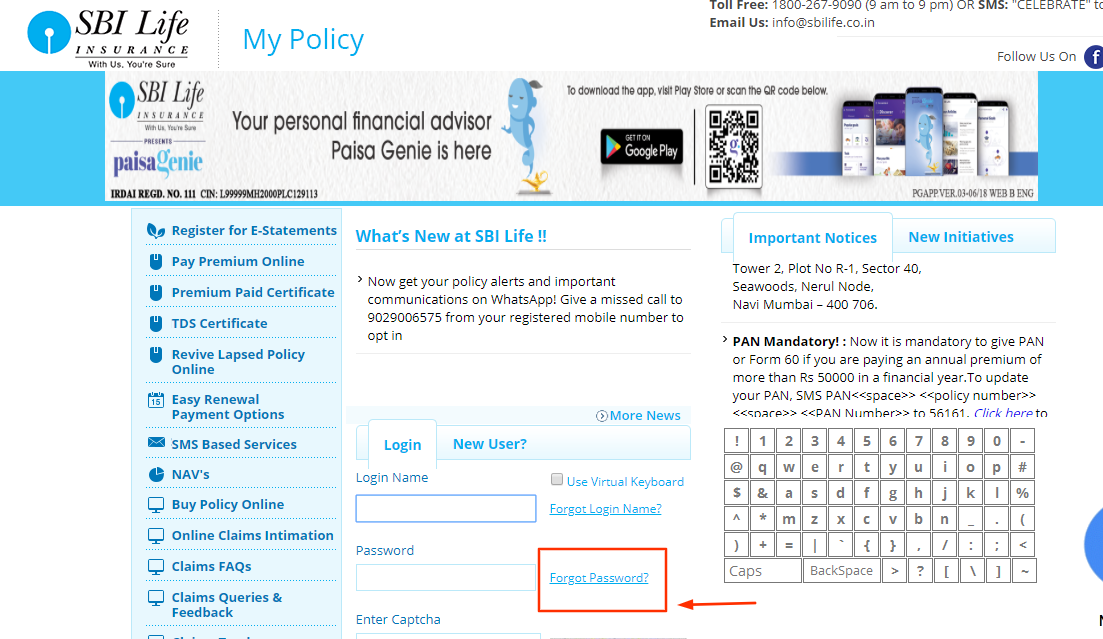

In case you don’t remember your password, follow the below mention steps:

- Visit the official website of SBI Life, click on Login and select ‘Customer’.

- On the next page, Click on ‘Forget Password’.

- A new page will open, enter your Login name and click on ‘Submit’.

- Answer your hint question and you will receive the reset password link on your registered email ID.

How to Use SBI Life Mobile App

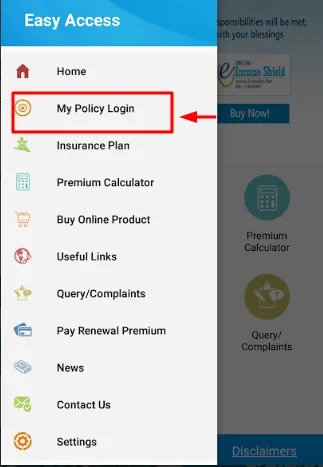

Apart from their web portal, insured can also avail various services their mobile application as well. The mobile application launched by SBI Life, SBI Life Easy Access App, is available on Android and iOS Store. Below are the steps on how to use SBI Life Mobile Application

- Download SBI Life Easy Access App from Google play store or from iOS Store

- Sign into your account using your registered user ID and password

- In case you are not a registered user, you first need to register yourself as a customer through their web portal and then can login here

Why Should you Use the Mobile App?

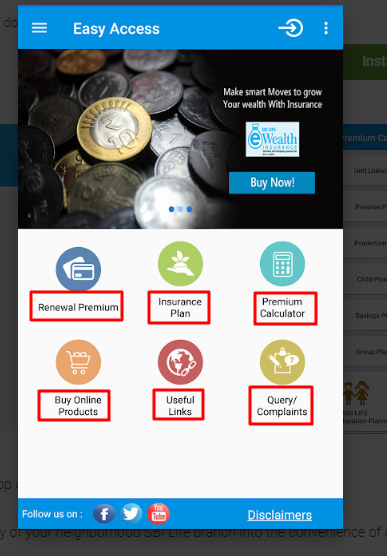

SBI Life Mobile Application provides a number of facilities to the customers:

- View your policy detail

- Pay your premium

- Browse through range of insurance plans

- Calculate estimate premium

Important Aspects

Following aspects should be considered while using the login process:

- Mobile number and Email-ID must be registered with the company

- You cannot register your spouse and children in the same account and have to register their policies separately

Benefits of Using the Insurance Portal

Some of the benefits of registering on the SBI Life website are:

- You can locate SBI Life branch office should you need to visit one

- Helps you track your policy premium due date

- You can make online payment for your policies

- Policyholder can check claim status without the need to visit the branch office or call up their customer care

- Helps you to keep a tab on your bonus status

FAQs

Q1. Can I get my address changed by visiting the branch office?

Yes. Submit the request form for change in address along with the original address proof for verification.

Q2. How can I update my email ID?

A policyholder can update the email ID by visiting the branch office, through the official portal or by using SMS service.

Online:

- Visit the official website of SBI Life, click Login and select ‘Customer’

- On the next page, under ‘Login’ section, enter your login name, password, Captcha and click login

- Under ‘My Policy’, select ‘Update Email ID’ option and click on ‘Submit’

SMS:

From your registered mobile number, SMS MYEMAIL<<space>>(Policy Number)<<space>>(New Email ID) to 56161 or 9250001848

Q3. How can I update my address through portal?

- Visit the official website of SBI Life, click Login and select ‘Customer’

- On the next page, Under ‘Login’ section enter your Login name, Password, Captcha and click login

- Under ‘My Policy’, select ‘Change of Address’ option

- Enter your policy number and upload the address proof

Q4. I have three policies with SBI Life. Do I need to create separate MyPolicy account for each policy?

No, the customer ID is the same for different policies belonging to the same policyholder.

Q5. How can you pay premium online?

You can easily pay the premium of your policy by clicking on ‘Pay Premium Online’ under SBI MyPolicy.

Q6. Can I update my bank account details online?

Yes, login to your MyPolicy to update your bank account details. The bank account proof should be in PDF/JPE format and not more than 400 kb.