Most of the deaths in India occur because of road accidents, says a report recently published in a daily. To manage the consequences and effects of these accidents, a motor insurance is necessary, as it gives financial support to take care of any loss or damage to own vehicle or of a third party.

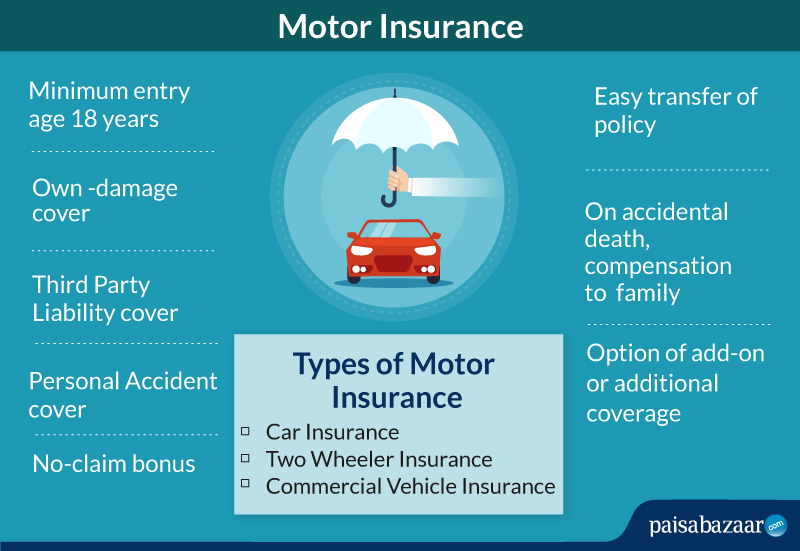

What is Motor Insurance?

A motor insurance includes insurance for all types of vehicles, including private cars, two wheeler and commercial vehicles. It provides financial protection against damage related to any accident, theft or loss of the car. It also takes care of any bodily injury arising due to accidents or theft.

Types of Motor Insurance

It makes sense to get protection from the loss incurred by a vehicle owner due to accident or theft of the vehicle. There are three types of motor insurance on the basis of the vehicle that is insured.

Car insurance : This insurance is valid for all privately owned cars and not for cars used for commercial purpose. This is a comprehensive private vehicle insurance to overcome the financial losses incurred due to risks associated with the car.

Two wheeler insurance: This insurance covers bikes, scooters, scooty, etc. It helps the owner get coverage for any risks associated with the two wheeler.

Commercial vehicle insurance: Commercial vehicles are those vehicles that are not used for personal use. They are used to transport goods or passengers from one place to another. This insurance protects businessmen from the losses incurred due to theft or damage to the commercial vehicle. Also, the insured will get protection from third-party liabilities and accident coverage for the driver of the vehicle with this type of insurance.

Types of Insurance Cover

Third Party Insurance: This type of automobile insurance covers third-party liabilities. The expenses of any unintentional damage caused to a third party or their property due to your insured vehicle can be covered with third party insurance. According to law, it is mandatory to give compensation to the third- party in case of accidents causing serious injuries, disability or death of the person or damages to their property.

Comprehensive Insurance: Comprehensive motor insurance covers you and your vehicle against any unforeseen damage to your vehicle or a third-party and their property. It also covers death/disability of the driver, owner, and passengers due to an accident by the insured vehicle.

What all Insurance Covers?

Purchasing a motor insurance helps to get coverage for various requirements. Let us understand the various sections of coverage offered:

- Damage to the insured vehicle due to accident, riots, burglary, thefts, terrorism, natural calamities and man-made calamities like fire, explosion, flood, storm, earthquake

- Third party legal liability will cover accidental death and injury to the third party, along with any damage done to third party property

- Under personal accident coverage, the insurance company bears the cost of any medical treatment of the driver needed after any eventuality that occurred while driving

Documents Required To Buy Policy

Certain documents are required to purchase a motor insurance irrespective of its type. They are:

- Passport size photograph

- Driving license or PAN card

- Proof of permanent residence

- Registration certificate of the car

Eligibility Criteria

In India, a motor insurance can be bought for private cars, two wheelers and commercial vehicles. To be eligible to buy a motor insurance, you must own a car, can be old or new, should be above 18 years of age, should be a citizen of India and should possess the RC of the car.

Add-on Covers

A policyholder usually gets a comprehensive coverage under a motor insurance; however, he/she can get additional benefits or add-ons by paying some extra amount. Following are some add-ons available along with a comprehensive insurance policy:

Zero depreciation cover: An insurance company usually deducts a certain amount as depreciation of your vehicle from the sum insured. But if you opt for zero depreciation cover, the insurance company will pay the original value of your vehicle in case of damage or theft.

Key replacement cover: If you misplace the key of your vehicle, you can claim for reimbursement. With this add-on cover, the insurance company provides a part of the cost incurred for the substitution of the key.

Engine and electronic circuits cover: If your vehicle is damaged due to engine failure or electronic circuits, you can claim for reimbursement with this add-on cover.

Roadside assistance cover: In case your vehicle breaks down while traveling through remote locations, you can call for assistance with roadside assistance cover. Other assistance can be arranging for fuel or mechanic in case of any problem while travelling and you can’t get any help.

Documents Required For Claim Process

In case of an accident or a damage, it is important to intimate the insurance company about the incident on their toll-free number and lodge the complaint. Afterwards, submit the following documents to the insurance company:

- Duly filled in claim form

- Driving license

- Registration certificate

- Police report (in case of an accident)

- Non traceable certificate issued by the police (in case of theft)

- Original repair estimate bill (in case cashless service is not opted for)

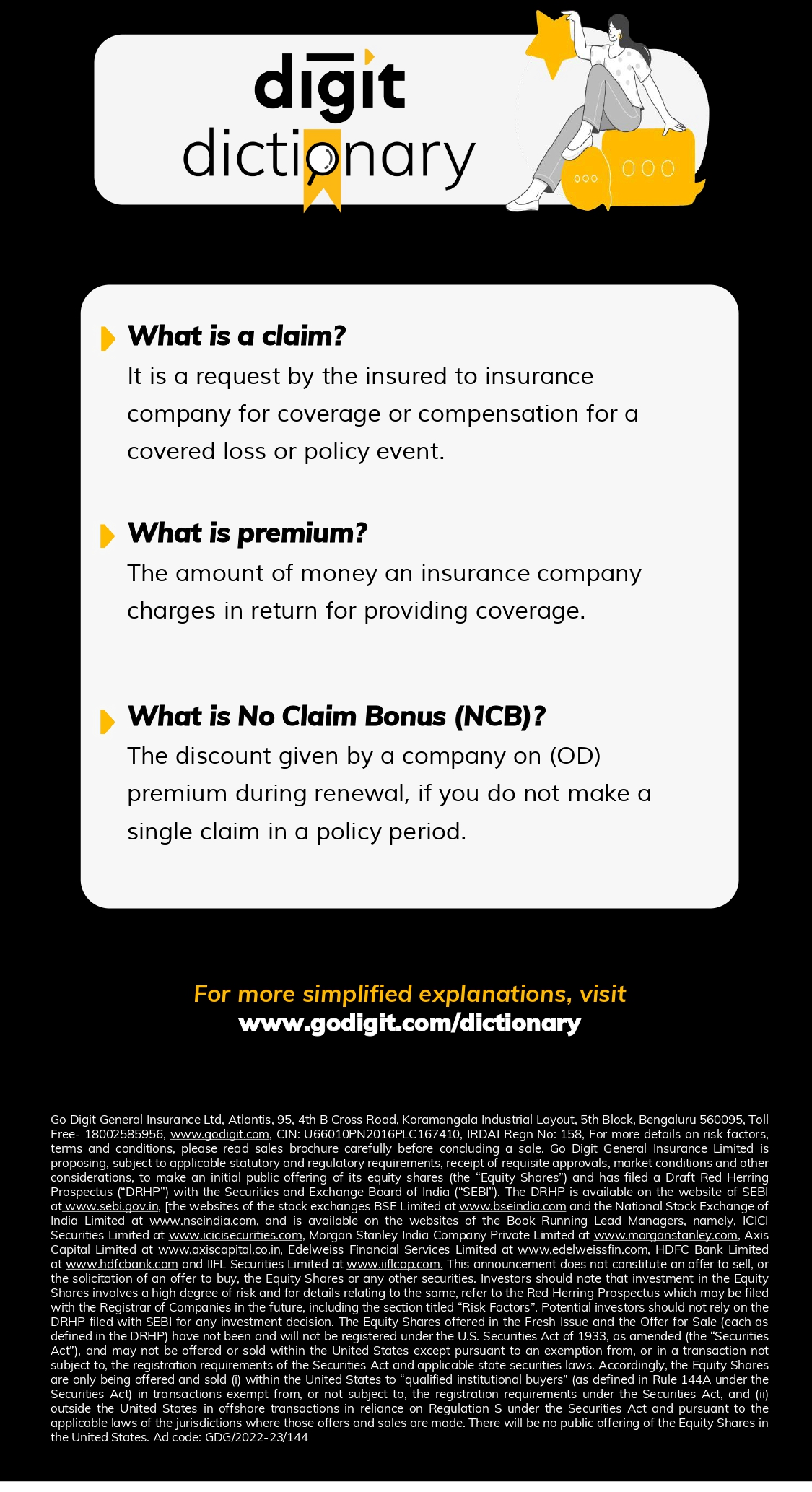

Claim Process

- In case of any claim, immediately inform the insurance company and register your claim

- In case of accidental vehicle damage, insurance provider will assign a surveyor to survey the vehicle and claim

- At the time of survey, the insured needs to submit all the necessary documents like RC book, D/L, permit, load challan etc. for verification

- The policyholder must also file an FIR with police, if there is any case of property damage, injury to the third party, or theft.

- After approval of the claim, insured can either take his vehicle to the network garage or repair it in any garage of their choice

- If the insured opts for cashless garage facility, payment for necessary repair work will be made directly to the network garage

- In case insured chooses to repair his vehicle to any other garage, S/he may claim under reimbursement process by sending claim form and repair bills to the insurance company

Exclusions

A motor insurance offers various kinds of coverage for a peaceful driving experience. However, certain situations and cases are not included in the coverage, also called exclusions. Let is look at some of them:

- Normal wear and tear

- Damage due to malicious activity

- Damage by the person driving the vehicle without a license

- Mechanical/electrical breakdown

- Consequential loss

- Damage occurred outside geographical boundaries

How Long Does It Take To Pay Out the Claim?

After the required documents are submitted to the insurance company, the surveyor will be assigned for the inspection. If the garage covered under the network provider is nearby the accident/damage area, then claim process will be cashless, else, the insured can repair it on their own and submit the bill to the insurance company which will be reimbursed within 30 days.

What is IDV?

The value of your car when you make a claim in the market is termed as the insured declared value (IDV). This is the highest sum your insurer will have to pay you at the claim of your vehicle insurance policy. You cannot claim money more than the IDV.

Renewal Process

The policy term for motor insurance usually varies from one year to three years which the policyholder can renew online by visiting the official webpage of the insurance provider. At the time of renewal, policyholder should know about no claim bonus (NCB). It is the bonus received for every claim-free year. NCB includes discounts in premiums of your policy at the time of renewal as a reward for following the safety measures while driving your vehicle. The rate of discount increases at each renewal which is why it is advised not to claim your insurance money for minor damage.

Companies Offering Motor Insurance in India

Some of the general insurance companies providing motor insurance, i.e. Car Insurance and two wheeler insurance policies in India are:

- Bajaj Allianz

- Bharti AXA

- HDFC Ergo

- Iffco Tokio

- ICICI Lombard

- Royal Sundaram

Important Aspects

Before purchasing a motor insurance, it is important to check and compare the plans well so that you get the best deal. Let us look at some points to keep in mind while purchasing the policy:

History of the company: Insurance is an indefinite asset and so it is important to stay alert while choosing the insurance policy. Many companies will publicise their service for the wrong reasons. It is your call to investigate the history and previous claim records of the company to choose the right one.

Financial stability of company: There are cases wherein the insurance providers failed to maintain a financial balance resulting into loss of money of their investors. To avoid this, you should check the financial stability of the insurance provider by checking their financial statements and growth rate over recent years.

Cost: Another essential thing to consider is the cost you would bear to buy coverage. As a policy seeker, it is important to compare quotes from different insurance companies and choose the one offering maximum benefits.

Look for key features: There is a general set of features offered by all insurance providers. These features include personal accident cover, third-party cover, etc. Check for these necessary covers before finalising your insurance provider.

Check add-on covers: Different insurance providers offer different add-on covers based on the type and value of the insurance. Check for the available add-on covers, benefits and discounts offered to compare for the right insurance policy and the insurance company. Some of the standard add-on covers include zero depreciation cover, personal accident cover, roadside assistance cover.

Advantages

Lack of legal enforcement and negligence in following traffic rules are contributing to the increasing number of accidents taking place in India. Following are the benefits one can avail:

Reduces your liabilities: In case the third party is harmed or injured from the insured vehicle, the insurance company will pay off the charges for the injuries/damage if the vehicle is covered under the third party. It also sets you free from any legal liabilities that the policyholder could incur because of the accident.

Damage to vehicle covered: Any damage done to your vehicle as a result of disasters caused by human error can be covered under comprehensive insurance policy. The claim process can be cashless or reimbursement.

Hospital bill payment: If you are injured or get permanently disabled in an accident, the insurance company pays the hospital bills and other medical charges under personal accident coverage.

Reimbursement on death: In case of fatal accidents, the family of the insured gets compensation from the insurance provider.