Insurance provides protection against risks that may damage any of your possession, be it property, house or vehicle. Car insurance is a type of motor insurance policy which helps the policyholder manage financial losses associated with various risks, such as car accident, theft or loss of the car.

What is Car Insurance?

Car insurance, which comes under vehicle insurance policy, is mandatory in India under the Motor Vehicles Act, 1988. It provides financial support to the car owner to manage situations like repair costs due to accident, theft or loss of the car. This insurance plan includes a compulsory third party coverage to manage any injury or damage to another person, vehicle or property caused by the insured car.

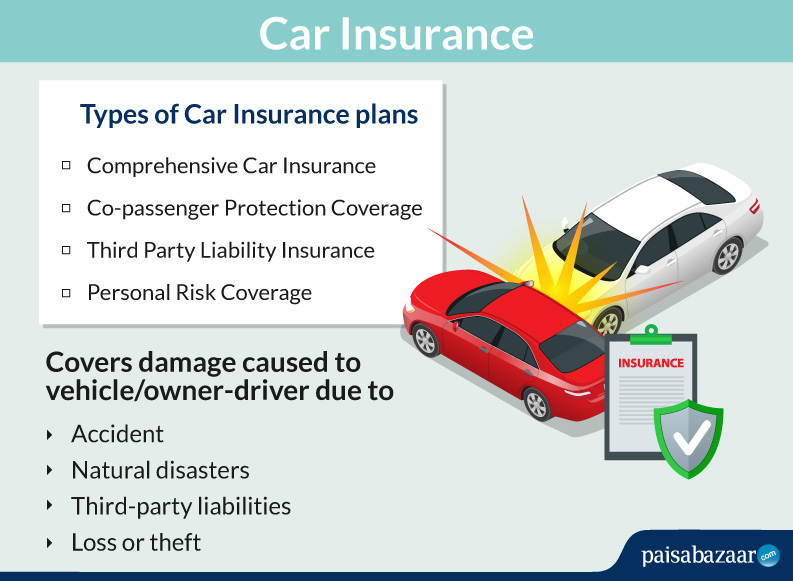

Types of Car Insurance

A car insurance can be divided into 4 broad categories. They are:

Comprehensive Policy: It is an all-inclusive plan which provides end-to-end coverage for all the risks related to the car, first party, co-passengers and third party. It also provides coverage against all natural disasters or human-made catastrophes, including earthquakes, landslides, floods, strikes and riots.

Co-passenger Protection Coverage: Some insurance providers offer personal accident coverage for co-passengers, though this can be availed by paying an additional premium. In case of the death of the passenger or the one who is driving, you can get 100% compensation for it. If there is any type of permanent disability from any injury, a 100% compensation can be claimed.

Third Party Liability Insurance: Law in India mandates the purchase of this policy for everyone. It provides coverage against liabilities arising from any harm caused to third-party and property by the insured car.

Personal Risk Coverage: A policy usually provides coverage only for the owner of the car. However, instead of the driver, any other person in possession of a valid license can also be covered by purchasing personal injury coverage rider.

What all it Covers?

The coverage provided by car insurance usually varies from provider to provider. However, some situations and cases are covered by almost all of them. Let us look at some of the points:

- A car insurance policy protects the driver/owner of the car in case he/she meets with an accident while driving

- It covers any legal or financial liability arising due to injury to a person or damage to another vehicle or property by the insured car

- The policy covers any loss or damage to the car due to the following reasons:

- Accidental and external damage

- Fire and explosion

- Riot and strike

- Malicious act

- Burglary, housebreak, theft

- Natural calamities like earthquake, landslide, storm and flood

- Terrorism

How Car Insurance Functions?

It makes sense to understand how a car insurance functions. This will help in planning better for the coverage that you need as per your requirement.

- First you need to choose the cover you need for your vehicle. This will depend on the type of the car you own, the place where you live and its engine capacity. Since third party insurance is compulsory, the policyholder has the option to choose between comprehensive policy and personal accident cover

- After this, the insurance provider inspects the car to be insured to calculate the insured declared value (IDV) by considering various factors, such as car brand, model number, manufacture year, claim history, etc.

- In case of any accident, damage or loss of the car, the policyholder first needs to intimate the insurance company by calling the toll-free number

- To process the claim, s/he also needs to submit the required document for reimbursement

- In case of a cashless claim process, the surveyor from the insurance provider will analyse the estimate prepared by the garage and will directly pay to the garage after the repair

- In case of reimbursement claim mode, you have to make the payment after the repair and the provider will reimburse the amount later

Eligibility Criteria

It is compulsory for all types of car, old or new, to get a car insurance, along with a third-party insurance coverage. To be eligible to get this insurance, a person should be 18 years and above, a citizen of India, should possess a driving license and should possess the RC of the car.

Claim Process

In case of any eventuality, you need to make a claim with the insurance company to get the compensation for the financial loss. It makes sense to understand the steps to go ahead with the claim process.

- The first step while applying for a claim is to immediately inform the insurance provider after any accident or damage or theft. Then, you can apply for the claim by producing related documents like claim form, a copy of the registration of the vehicle (RC), and other documents

- One can also get a cashless claim if one repairs their vehicle in a garage covered under the network of the insurance provider. The repairs and replacements done in network garages are cashless as provided by the insurance companies

- In case, the policyholder takes his vehicle to the garage not covered under the network, he would have to pay for the claim which can later be reimbursed from the insurance company

Documents Required For Claim Process

In case of accident or damage done to you, car or to the third party, intimation to the insurance company is important. Along with that, following are the essential documents which need to be submitted for timely claim:

- Duly filled in claim form

- Copy of the insurance policy

- Copy of the driving license of the person driving the vehicle at the time of accident

- FIR, in case of third party damage, death, bodily injury

- All the sets of keys, service booklets and warranty card in case of theft

- Repair bills and payment after the repair is being done

Time Taken to Settle Claims

Car insurance companies have two options to settle the claim; one is through cashless where the claim is settled directly by the insurance company, if the insured gets the vehicle repaired at the network garage. The other is reimbursement claim, where the insured pays the bill and the insurance company later reimburses the amount.

Add-on Covers

Apart from the standard coverage provided by the provider, you can also opt for additional benefits, called add-ons, by paying an extra amount. These advantages vary for every provider. Some of the add-ons are:

- Zero depreciation cover: As your car ages, the value of the parts of your car depreciates. Thus, during claims, the compensation is given after deducting this depreciation amount. But on getting this cover by paying an extra amount, the claim amount will include the depreciation amount

- Engine protect cover: A comprehensive car insurance fails to protect the engine; however, on getting this extra coverage, the provider will cover the damage done to the engine

- Roadside assistance cover: As part of this add-on cover, the provider will provide round-the-clock assistance for situations like arranging for fuel, tyre change, a mechanic, etc.

Exclusions

A car insurance provides mental peace and relaxation after buying a car; however, the insurance does not cover all types of cases. Some situations not covered, also called exclusions, are:

- Wear and tear

- Depreciation or any consequential loss

- Mechanical or electrical breakdown

- If the damage caused by a person driving the car is under the influence of alcohol or drugs

Renewal Process

One can renew his or her policy through online mode after the required inspection either by you or by a surveyor; following are the steps:

- Visit the insurance provider page and click on renewal tab under car insurance

- Proceed by entering your car policy, registration or engine number and click on renew my policy

- After entering the required information, you will be able to see your current policy. If needed, you can buy add-on or optional coverage or go ahead with paying premium

Companies Offering Car Insurance in India

Almost every other insurance company provides motor insurance in India. Some of insurance companies providing car insurance in India are:

- Reliance General

- Bharti AXA

- Bajaj Allianz

- Oriental Insurance

- Tata AIG

- HDFC Ergo

Important Aspects

Low premium costs are usually the sole deciding factor while choosing a car insurance product and this could also mean not having an adequate protection cover. You should consider other important points as well before buying a policy.

- The car insurance premium is directly linked to IDV of your car. Sometimes people choose to decrease the IDV to be able to pay a lesser amount in the premium but doing this causes the value to be written off completely in the event of an accident. This is why it is recommended to choose a policy which will provide the highest IDV even if it means to pay more amount as a premium.

- It is ideal to go for comprehensive insurance cover as it will provide complete protection for the damage caused to your car and self in an accident. Furthermore, it will also protect your car against thefts, accidental fires and other damage. One should not overlook personal accident cover,as it will provide protection against any physical loss or disability during a car accident.

- Third party insurance is mandatory for everyone as per the Indian Road Safety Act and Indian Motor Vehicles Act. So, if you are buying a car for the first time, make sure to get third party insurance cover before hitting the roads.

- At the time of making your car purchase, your car dealer may offer you an insurance policy that may not necessarily be your best option. As a thumb rule, buy a car insurance policy only after comparing features and quotes from multiple insurers.

- The policy seeker can choose between additional covers to customise their policy as per their needs. You can opt for Personal Injury Protection which is for the protection of you (owner) and any other who drives. Other coverage that you can consider are – collision cover, risk coverage for the different accessories and quick road assistance add-on.

Advantages

After buying a car, the next big thing is getting a car insurance. You should not delay in getting one because of its advantages. Let us look at some of them:

- One need not worry about the financial losses that might occur due to any unfortunate or untimely accident

- Compensation towards third party accident can dig a hole in your pocket. However, if you have insured your car, you can approach your insurance provider and get claims for such cases. Hence, paying a regular premium every month can help you build a significant corpus to pay off these liabilities

- Car insurance can also act as a substitute for health insurance cover for co-passengers. Some insurance companies provide risk coverage for the injuries suffered by the passengers present in the car when the accident happened.