For many people in India, a two wheeler is an important mode of transport. But in order to use it on the road, it is mandatory to get a two wheeler insurance policy, especially a third party coverage, under Motor Vehicles Act, 1988.

Table of Contents:

- Types of Two Wheeler Insurance Coverage

- Coverage

- Claim Process

- Exclusions

- Renewal Process

- Important Aspects

- FAQs

What is Two Wheeler Insurance?

An accident or a theft of a two wheeler can lead to financial stress because of the need for repairs, hospitalisation, treatment or a new vehicle. Thus, a two wheeler insurance policy provides financial coverage to the policyholder in times of needs like accidents, theft or repair.

Types of Two Wheeler Insurance Coverage

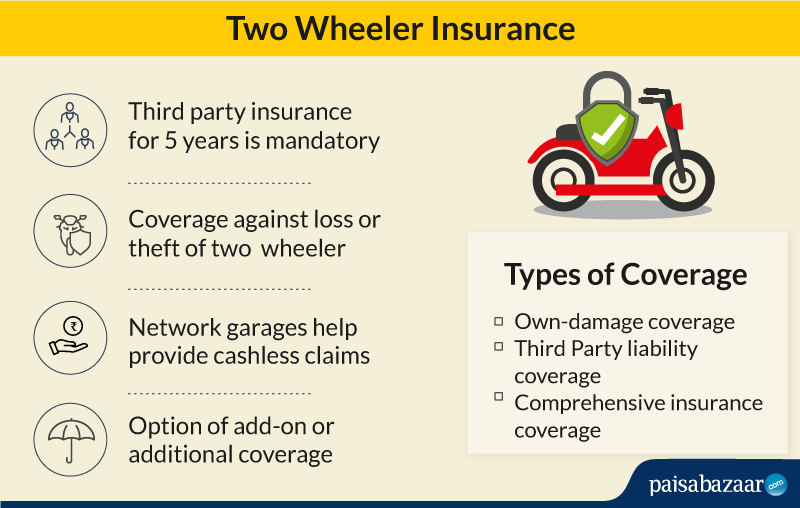

There are basically 2 types of two wheeler insurance coverage available in the Indian market. These are:

Third-Party Insurance: This type of insurance is also termed as liability insurance and is compulsory for every two wheeler owner. It covers the policyholder against legal liabilities arising out of bodily injury/death or property damage done to a third party (accidental) involving the insured vehicle.

Comprehensive Insurance: This type of insurance is also termed as package policy. It covers third-party liability as well as damage caused to the insured vehicle, and death/disability of the owner/driver due to an accident.

What Two Wheeler Insurance Covers?

A two wheeler insurance plan shall come to your financial aid in some of the following cases:

- Damage to the vehicle due to accidents

- Personal accident coverage for owner-driver

- Damage due to natural disasters

- Damage induced due to man-made disasters

- Third-party liabilities

- Loss or theft of two wheeler

Add-on Covers (Riders)

All vehicle insurance plans come with add-on covers in addition to the standard benefits offered. Following are the additional benefits offered on extra payment that you must buy along with your two wheeler insurance:

Personal Accident Cover: By buying this cover, you get insured against death or permanent disability due to the accident. Thus, on the death of the insured in an accident, the insurance company provides monthly income to the family.

Zero Depreciation Cover: This is the most important add-on cover that you must buy while finalising your bike insurance. With this add-on cover, your vehicle gets the original value, without deducting depreciation, in case it is lost or damaged.

Eligibility Criteria

In order to get the two-wheeler insurance, a person must be:

- 18 years or above

- Citizen of India

- Should possess a driving license

- Should have registration certificate of the vehicle

How to Apply for Two Wheeler Insurance

A person who is eligible to ride a two wheeler in India can apply for a two wheeler insurance policy, provided the individual has a valid driving license. One can apply for Bike Insurance in India either online or offline and below are the ways to do it:

Online

- Find out your requirement, whether you want only third party coverage or a comprehensive as well

- Compare insurance providers as per incurred claim ratio

- Use the online mode to compare coverage, exclusions and other benefits offered under various two wheeler insurance plans. Also compare the premium amount

- You can use an online aggregator to get quotes from different insurance providers

- After finalising the plan, visit the official website of the insurance company

- Provide your personal details, along with details of the two wheeler

- Include the relevant riders or add-on benefits

- Click on buy button

- Make online payment

Offline

- To buy an insurance policy offline, find an insurance agent or the insurance company you wish to go for

- Fill up the relevant forms on the basis of your requirements

- If you directly approach the insurance company, you can avoid the additional fee charged by the agents. Some banks and third-party dealers can also help you in completing the application process

- Your application process will be complete after submitting the necessary documents and making the payment

Claim Process

In case of any untoward incident like accident or theft, immediately inform the insurance provider

- If the two-wheeler was involved in an accident or was stolen, file an FIR and produce its copy to the company

- Then, you can then apply for registration of the claim by producing related documents like claim form, a copy of the registration of the vehicle (RC), etc.

- One can also get a cashless claim if the vehicle is repaired in any of the network garages of the insurer

- Payment will be done after an evaluation of the damage and the cost of the repair

- In case policyholders take the two wheeler to a garage not covered under the network, they have to make the payment themselves.

- The amount is reimbursed after submitting the payment bills and vouchers to the insurance company

Documents Required to Process Claims

In case of a theft of the two wheeler or an accident leading to injury to the owner-rider, damage to the vehicle or third party liability, inform the insurance company as soon as possible. Also, submit the following essential documents:

- Duly filled in claim form

- Copy of the insurance policy document

- Copy of the driving license of the person driving the vehicle at the time of accident

- FIR (theft, third party liability)

- Sets of keys, service booklets and warrant card (theft)

- Repair bills and receipts

Time Taken to Settle Claims

An insurance company can take somewhere around 10-30 days for claim settlement. Motor Insurance provider companies have two options to settle the claim.

One is cashless option where the company pays for the repairs done at one of the network garages while the other is reimbursement where the claim is settled if the insured repairs his vehicle in the garage which does not come under the network of the insurance company.

Exclusions

Below are some factors that can lead to rejection of a two-wheeler insurance claim. These are also called exclusions.

- Regular wear and tear

- Driving under the influence of drugs or alcohol

- Driving without license

- Underage driving

- Using commercial vehicles for private purpose or vice versa

- Staged crash

- Expired policy

- Electrical/mechanical breakdown

- Crossing geographical limits

- Damage or loss due to war

- Consequential damage

Companies Offering Two Wheeler Insurance in India

Some of the insurance companies providing two wheeler insurance in India are as follows:

- Bajaj Allianz

- Reliance General Insurance

- Universal Sompo

- ICICI Lombard

- TATA AIG

- National Insurance

- IFFCO Tokio

- Bharti AXA

- Universal Sompo

Renewal Process

A two wheeler insurance policy needs to be renewed every 1 year, 3 years or 5 years, as the case may be. The renewal of two wheeler insurance takes only a few simple steps, viz.:

- Check if your insurance provider offers online renewal option

- Go to their official website (desktop or mobile)

- Log in using the credentials provided to you at the time of purchasing the policy

- Enter the policy number and other details asked

- Click to get the quote for renewal premium

- Pay the premium using any of the modes provided by the insurer

- Your policy will be renewed till the next due date

Important points for renewal

- To renew your two wheeler insurance policy, you should keep a track of the due date as renewal needs to be done before the due date

- If the renewal is delayed even for a single day, i.e. after one day post the due date, your bike/scooter will need inspection by the insurer

- For a package policy, if renewal is kept at bay for more than 90 days, accrued benefit of No Claim Bonus (NCB) will be nullified

Important Aspects

- Always make sure to compare the bike insurance plans online so that you can avail the best insurance plan suited for your needs

- Every vehicle insurance company makes a certain amount mandatory for you to pay for the expenses caused due to mishaps. This mandatory amount is known as compulsory deductible (~500 rupees). If you choose to pay some more money as a voluntary deductible, there will be a decrease in the premium you pay for your motorbike insurance

- Always follow all the safety measures while driving and opt for discounts from accumulated no claim bonus (NCB) on your next renewal

- Get anti-theft devices fit in your two-wheeler as it will further lower premium

- Old two wheelers get low IDV (Insured Declared Value) due to the loss of value over time. So, the premiums for older vehicles are lesser than the new ones

- You can also get a concession in the premiums if you are a member of the IRDA registered Automobile Association of India (AAI)

- Also understand that your premium depends on various factors like type of vehicle, your lifestyle and your past driving history

Advantages of Two Wheeler Insurance

With the emergence of new insurance providers every year in the market, the facilities and benefits of two-wheeler insurance are evolving with time. Following are some of the benefits of buying bike insurance:

- One can get a personal accident cover of up to Rs. 1 lakh

- Bike Insurance protects you from the legal liability of any damages caused by your vehicle to a third-party

- By buying two-wheeler insurance, you can get protection from unforeseen natural calamities like storms, earthquakes, etc.

- Add-ons like depreciation of the vehicle further increase the benefits of buying a two wheeler insurance

- Motorcycle insurance can be easily bought or renewed online without much hassle

- If you have not claimed for insurance before and buying a new vehicle, the insurance provider provides easy transfer of No Claim Bonus (NCB)

- One can get a cashless garage service if you have bought two-wheeler insurance

- You can keep track of your bike insurance policy online by logging on to the website of your insurance provider