Table of Contents :

An asset management company is a firm which pools funds from the investors and invests it into different investment options such as equities, debt, real estate, gold etc.

There can be multiple funds with different investment objectives managed by an asset management company. An AMC is run by fund managers who first set the investment objective, evaluate market risk and reward profile and then decide the investment strategy.

For example, a debt fund of an AMC would primarily invest in bonds and government securities and the investment objective is to generate moderate returns but at minimal risk.

Also Read : List of TOP 10 Best SIP Investments

Get Your Free Credit Report with Monthly Updates Check Now

How Does an Asset Management Company Work?

While investing in an AMC, basically you are investing in a fund managed by the AMC. The returns of the funds are market-linked and therefore depend on the performance of the fund. A well-managed fund has the potential to deliver relatively higher returns.

In return, the fund would charge a small fee called a fund management fee. It is a prime source of revenue generation for the AMC. A fund is expected to generate competitive returns in its category to maximize its subscribers and hence, the revenue.

While selecting a fund for investment, the market reputation of the asset management company plays an important role. Investors trust those funds which are managed by well-known and reputed AMCs. To strengthen its investor base and deliver quality returns, an AMC follows a comprehensive process. He is a list of all necessary steps than an AMC undergoes , in order to perform at par with its peers:

- Efficient Asset Allocation: To maintain investors’ trust, an AMC has to judiciously invest their money in different types of investment instruments. Distribution of assets amongst debt and equity depends on the market conditions and prospective interest rates. Professional expertise and experience of fund managers plays a great role in efficiently allocating resources to different asset classes.

- Formulating an Investment Portfolio: Constructing an investment portfolio is the most crucial decision an AMC takes. It involves a thorough amount of research and analysis to formulate a risk -adjusted portfolio, which will not underperform even during turbulent market swings. Taking calculated risks in case of equities and investing in highly rated securities is how fund managers construct a portfolio.

- Assessment of Performance: The AMCs are answerable to its investors and trustees for its investment decisions. For this, periodic assessment of fund performance is done taking into consideration the fund returns, NAV Value, asset allocation, etc. This review sheet is available to all the investors and trustees of the AMC.

Mutual funds, Index Funds, Exchange Traded Funds (ETFs) etc are all examples of various types of funds managed under an umbrella AMC.

Read here : Best ETFs to Invest

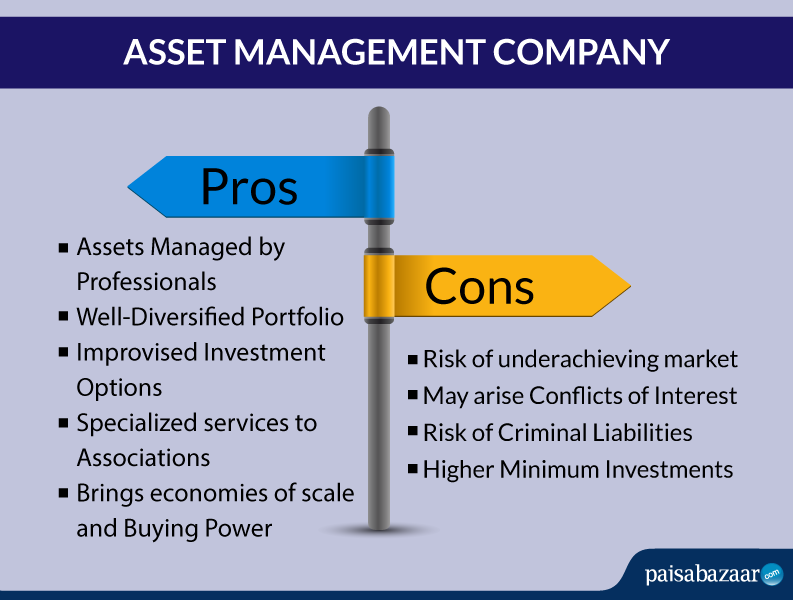

Pros and Cons of Asset Management Company

Who Regulates AMCs?

An Asset Management Company (AMC) is regulated by the capital market regulator, Securities and Exchange of India (SEBI). Further, AMCs are also passively regulated by the Association of Mutual Fund of India (AMFI) in order to protect the interests of the investors.

Also Read : What is SEBI?

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Top Asset Management Companies in India

Currently, there are 44 asset management companies operating in India. All of the AMCs are registered under AMFI. Here are the top asset management companies in India:

| AMC Name | AUM (₹ Cr.) | Total no. of schemes |

| HDFC Mutual Fund | 362762.79 | 119 |

| ICICI Prudential Mutual Fund | 338768.2 | 230 |

| SBI Mutual Fund | 307841.17 | 134 |

| Birla Sun Life Mutual Fund | 254181.98 | 159 |

| Reliance Mutual Fund | 223271.93 | 183 |

| Kotak Mahindra Mutual Fund | 161381.68 | 85 |

| UTI Mutual Fund | 157865.86 | 183 |

| Franklin Templeton Mutual Fund | 126034.46 | 65 |

| Axis Mutual Fund | 102267.4 | 53 |

| IDFC Mutual Fund | 82493.29 | 56 |

| DSP Mutual Fund | 77619.03 | 69 |

| L&T Mutual Fund | 73496.7 | 37 |

| Tata Mutual Fund | 53640.7 | 55 |

| Sundaram Mutual Fund | 31220.13 | 79 |

| Mirae Asset Mutual Fund | 29260.92 | 16 |

| Invesco Mutual Fund | 24647.9 | 45 |

| Motilal Oswal Mutual Fund | 19694.49 | 16 |

| LIC Mutual Fund | 16293.94 | 23 |

| Canara Robeco Mutual Fund | 15886.68 | 26 |

| Edelweiss Mutual Fund | 12128.22 | 35 |

| HSBC Mutual Fund | 12039.7 | 36 |

| Baroda Mutual Fund | 11180.52 | 21 |

| JM Financial Mutual Fund | 7710.09 | 17 |

| Principal Mutual Fund | 7279.79 | 22 |

| BNP Paribas Mutual Fund | 7243.52 | 23 |

| IDBI Mutual Fund | 6486.44 | 22 |

| Mahindra Mutual Fund | 4971.83 | 11 |

| Indiabulls Mutual Fund | 4529.96 | 15 |

| Union Mutual Fund | 4307.03 | 16 |

| BOI AXA Mutual Fund | 3127.89 | 17 |

| PPFAS Mutual Fund | 2116.02 | 3 |

| IIFL Mutual Fund | 1522.58 | 4 |

| Quantum Mutual Fund | 1513.64 | 9 |

| YES Mutual Fund | 1421.44 | 3 |

| Essel Mutual Fund | 1040.54 | 10 |

| Taurus Mutual Fund | 434.87 | 10 |

| Quant Mutual Fund | 216.74 | 13 |

| Shriram Mutual Fund | 132.57 | 4 |

| ITI Mutual Fund | 66.5 | 4 |

| Sahara Mutual Fund | 53.87 | 14 |

Source: Economictimes, Data as on Oct 2, 2019

Also Read : Top 10 Mutual Funds to Invest in 2020

A Good Credit Score shows that you manage Your Finances Well Check Score

FAQs on Asset Management Company

Q. What is the largest asset management company in the world?

A. The size of AMC is measured based on the value of net assets under management. Currently, DSP AMC is the largest AMC in the world.

Q. What is the difference between hedge fund and asset management company?

A. Asset Management company is an institution that pools in funds from numerous investors and invest them in various financial instruments, via various mutual fund schemes. These funds focus on long term wealth generation. Hedge Funds on the other hand, pools resources from investors and employ complex investment strategies to generate high returns, taking a high risk on investment.

Q. What does asset management company do?

A. Asset Management companies manages multiple mutual fund schemes where investors invest their money in order to earn returns. This money is invested in various financial instruments such as equity securities or debt securities. The formulation of investment portfolio is done by the AMC.

Q. What is the role of asset management company in a mutual fund?

A. An AMC is the regulating body of a mutual fund. It oversees all the administrative, managerial and operating functions of the mutual fund. The brand name of AMC is dependent on the performance of the mutual fund schemes under its banner.

Q. Who regulates asset management companies in India?

A. The capital market regulator, Securities and Exchange Board of India (SEBI) regulates the AMCs in India.