Axis Mutual Fund AMC is one of the leading Asset Management Companies in India, run by Axis Bank. It offers numerous mutual fund investment options to investors who want to invest in various categories such as equity funds, debt funds and hybrid funds.

To avail maximum benefits of the investment in Axis Bank mutual funds, one can invest through the Systematic Investment Plan (SIP) route. It involves regular investment of small amounts of money, at predefined intervals, which cumulates a large corpus of wealth in the long run. This benefits an individual who doesn’t have a large amount of money at hand for lump-sum investment.

Get Your Free Credit Report with Monthly Updates Check Now

Table of Contents :

Best Performing Axis Bank Mutual Funds

| Fund Name | Category | 1 Year Return | 3 Year Returns | 5 Year Returns |

| Axis Long Term Equity Fund | Equity: ELSS | 15.27% | 19.21% | 13.2% |

| Axis BlueChip Fund | Equity: Large Cap | 21.91% | 23% | 12.43% |

| Axis Focused 25 Fund | Equity: Multi Cap | 20.65% | 20.13% | 14.39% |

| Axis Small Cap Fund | Equity: Small Cap | 21.22% | 15.26% | 12.47% |

All data as on Jan 13, 2020

What is SIP?

SIP is an acronym for Systematic Investment Plan (SIP) and refers to regular investment of small amounts of money in mutual funds at predefined intervals. These intervals could be weekly, monthly, quarterly, or annually. SIP ensures that an individual who doesn’t have enough money to invest as a lump-sum investment can also generate extra income by investing in mutual funds.

A Good Credit Score shows that you manage Your Finances Well Check Score

Also Read: Top Mutual Funds to invest in 2019 via SIP

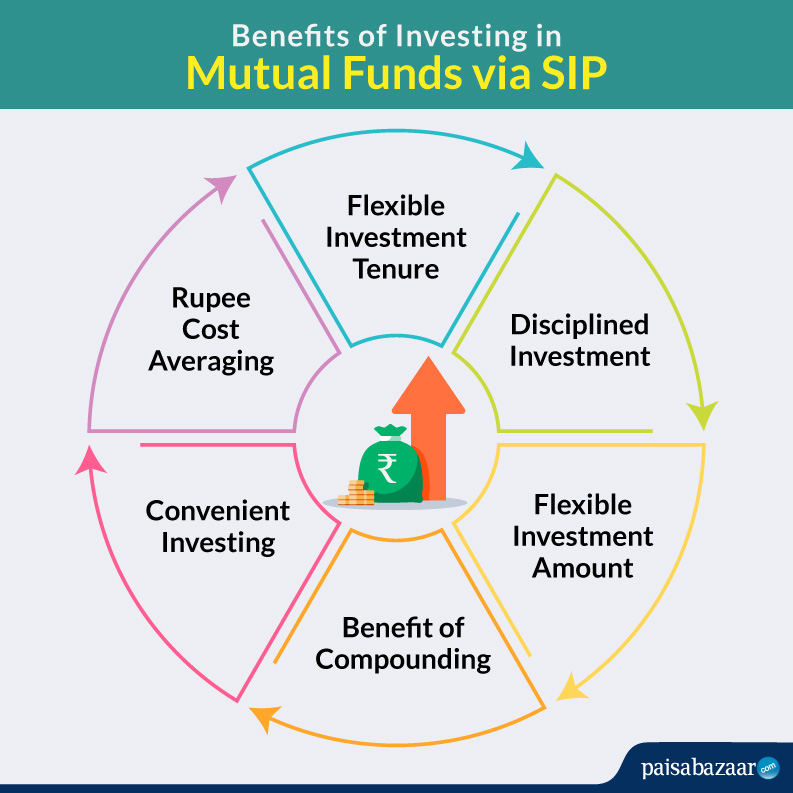

Benefits of Investing in Axis Bank Mutual Funds via SIP

Flexible Investment Tenure: This allows you to start and stop a SIP as per your wishes. Also, the process of changing the tenure at a later date after the start of SIP is hassle free.

Flexible Investment Amount: The USP of SIP is that you can change the value of your installments as per your income and savings capability. You are free to decrease or increase your SIP amount. This kind of flexibility is not available when you make a lump-sum investment.

Disciplined Investments: A disciplined approach towards investing helps in wealth creation over the long term. In SIP, an individual has to make regular investments which gives direction to her expenses.

Also, you can avail the facility of auto debit. This ensures that you’re consistent with your investments and remain invested in mutual funds for a long time.

Rupee Cost Averaging: It is an investment strategy which eliminates the need to time the market. A pre-decided amount is invested in Mutual Fund through SIP. This ensures that one buys more units of shares when the markets are cheap, and fewer units of shares when the markets are expensive. This approach reduces the cost per unit and is called ‘Rupee Cost Averaging’.

Ultimately, investors end up with better returns at a lower risk. RCA is one of the major reasons people invest in Equity Mutual Funds through the SIP route.

Long Term Benefit of Compounding: One of the most important features of Investment through SIP is that you benefit from the power of compounding. You earn returns on the returns accrued on principal. That is why, it is suggested that one should start investing in mutual funds as soon as possible, however small the amount is, because in the long run it will yield high returns.

Also Read: Calculate the Future Value of your Investment using SIP Calculator

How Does Axis Bank SIP Work?

When you invest through SIP, you buy units of mutual fund every month or any other pre-decided intervals from the amount you’ve invested. This amount gets deposited in Axis Bank mutual fund.

Although the amount an investor invests through SIP remains unchanged, the Net Asset Value (NAV) of the mutual fund changes as per its investment portfolio. It means that you buy less number of units when the NAV of the fund increases and more units when the NAV of the fund decreases. This balances out the market risk. Therefore, it is advisable to invest through SIP rather than making a lump-sum investment.

Get Free Credit Report with Complete Analysis of Credit Score Check Now

A Comparative Analysis of Top Axis Bank Mutual Funds

1. Axis Long Term Equity Fund

Category: Equity: ELSS

AUM: ₹19,817 crore

Axis Long Term Equity Fund is one of the best equity schemes run by Axis Bank. It is an Equity Linked Saving Scheme in which the investment upto ₹1.5lakh is eligible for tax deduction under Section 80(C) of the IT Act.

It has delivered returns at the rate of 15.86% in 5 year period and has outperformed its benchmark (10.83%) and average category returns (12.01%) by a significant margin.

It has invested around 67% of its total assets in equity or equity related instruments of large cap companies which ensures that the portfolio remains less sensitive to market fluctuations. It has allocated around 32% of its assets to mid cap stocks and meagre 1% to small cap stocks.

Overall, the investment portfolio of this fund would suit an investor who has a medium risk appetite. Minimum amount of investment through SIP is ₹500 for this scheme.

2. Axis Blue Chip Fund

Category: Equity: Large Cap

AUM: ₹5,746 crore

Blue Chip funds refer to those funds, which primarily invest in stocks of large cap companies which are the most valuable and least volatile on stock exchanges.

Axis Blue Chip Fund has invested around 99% of its total assets in stocks of large cap companies, which makes it a conservative investment portfolio that yields stable returns over the long run. It makes this fund the most suitable investment option for risk averse investors.

It has consistently outperformed its benchmark and average category returns in 1 year, 3 year and 5 year return framework. It has delivered returns at the rate of 13.06% in 5 year period which is significantly higher than the category average of 10.78%. The minimum amount for investment through SIP is ₹1,000.

3. Axis Focused 25 Fund

Category: Equity: Multi Cap

AUM: ₹7,978 crore

With around 79% of total asset allocation to equity and equity related instruments of large cap companies, Axis Focused 25 Fund has been a constant favourite of investors who have a medium risk appetite and want decent returns in the long run.

The fund has 22 stocks in the investment portfolio, and it has delivered returns at the rate of 6.80%, 17.59% and 15.54% in the 1 year, 3 year and 5 year time frame respectively. It has beaten its benchmark in 3 year period (14.60%) and 5 year period (10.99%) by a significant margin.

It also has a very low expense ratio of 0.74% and a new investor can start with investing the minimum SIP of ₹1,000. Later on, s/he can increase the value of SIP installment as per her/his income.

4. Axis Small Cap Fund

Category: Equity: Small Cap

AUM: ₹402 crore

In its category, this fund has outperformed its benchmark (S&P BSE Small Cap) remarkably.

It has delivered returns at the rate of 11.46% in 1 year, 11.48% in 3 years, 13.48% in 5years which are notably high as compared to the respective benchmark of -9.53% , 7.09% , and 7.41%.

This fund is suitable for investors with high risk tolerance as it has invested about 57% of its total assets in equity of small cap companies and the rest in stocks of mid cap companies. The minimum amount of investment through SIP stands at ₹1,000.

5. Axis Mid Cap Fund

Category: Equity: Mid – Cap

AUM: ₹2,549 crore

This fund has invested majority (around 82%) in equity or equity related instruments of mid cap companies, which makes it a perfect fit for investors who expect decent returns and have medium risk tolerance.

The fund has consistently outperformed its benchmark and category average returns in the 1-year,3 -year and 5-year framework. It has given over 8% returns in 5 years while the benchmark returns were at -2.05%.

The minimum investment through SIP is ₹1,000 for this mutual fund scheme.

Here is a List of Top 10 Mutual Funds to Invest in SIP

| Fund Name | 1 Year Returns | 3 Year Returns | 5 Year Returns |

| ICICI Prudential Bluechip Fund | 9.8% | 12.43% | 9.75% |

| DSP Tax Saver | 16.55% | 13.53% | 11.83% |

| Franklin India Equity Fund | 5.95% | 9.67% | 8.76% |

| ICICI Prudential Value Discovery Fund | 0.15% | 7.06% | 7.28% |

| Axis Long Term Equity Fund | 17.62% | 17.74% | 12.72% |

| Nippon India Tax Saver (ELSS) Fund | 3.67% | 4.01% | 5.16% |

| DSP Equity Opportunities Fund | 15.24% | 12.88% | 11.07% |

| Motilal Oswal Long Term Equity Fund | 15.9% | 15.63% | – |

| Aditya Birla Sun Life Pure Value Fund | -8.59% | 3.52% | 6.14% |

| HDFC Equity Fund | 9.61% | 12.47% | 8.07% |

List of Top Performing Axis Mutual Fund Schemes

| Fund Name | 1 year Return | 3 year Return | Category | Latest NAV |

| Axis Bluechip Fund Direct Growth | 18.61% | 16.73% | Large Cap Fund | 30.93 |

| Axis Bluechip Fund – – Direct Growth | 18.61% | 16.73% | Large Cap Fund | 33.47 |

| Axis Focused 25 Fund Direct Growth | 11.30% | 15.43% | Focused Fund | 29.23 |

| Axis Long Term Equity Fund- Direct Growth | 13.15% | 13.51% | ELSS | 46.69 |

| Axis Mid Cap Fund Direct Growth | 11.33% | 13.41% | Mid Cap Fund | 37.41 |

| Axis Small Cap Fund Direct Growth | 19.09% | 12.14% | Small Cap Fund | 30.04 |

| Axis Small Cap Fund – Direct Growth | 19.09% | 12.14% | Small Cap Fund | 32.06 |

| Axis Equity Saver Fund – Regular Growth | 8.67% | 9.02% | Equity Savings | 13.13 |

| Axis Equity Saver Fund – Direct Growth | 8.67% | 9.02% | Equity Savings | 13.79 |

| Axis Banking & PSU Debt Fund – Direct Growth | 12.20% | 8.55% | Banking and PSU Fund | 1,858.74 |

| Axis Triple Advantage Fund Direct Growth | 14.66% | 8.32% | Multi Asset Allocation | 20.49 |

| Axis Triple Advantage – Direct Growth | 14.66% | 8.32% | Multi Asset Allocation | 22.01 |

| Axis Short Term Fund – Direct Growth | 10.77% | 8.04% | Short Duration Fund | 22.3 |

| Axis Short Term Fund Direct Growth | 10.77% | 8.04% | Short Duration Fund | 21.19 |

| Axis Short Term Fund – Retail Growth | 10.77% | 8.04% | Short Duration Fund | 20.96 |

| Axis Treasury Advantage – Direct Growth | 9.58% | 8.01% | Low Duration Fund | 2,244.22 |

| Axis Dynamic Bond Fund Direct Growth | 13.23% | 7.96% | Dynamic Bond Fund | 20.06 |

| Axis Strategic Bond Fund Direct Growth | 8.09% | 7.57% | Medium Duration Fund | 18.56 |

| Axis Strategic Bond Fund – Direct Growth | 8.09% | 7.57% | Medium Duration Fund | 19.61 |

| Axis Treasury Advantage -Regular Growth | 8.93% | 7.51% | Low Duration Fund | 2,180.45 |

| Axis Treasury Advantage – Regular Plan | 8.93% | 7.51% | Low Duration Fund | 2,040.44 |

| Axis Gilt Fund Direct Growth | 15.56% | 7.16% | Gilt Fund | 17.39 |

| Axis Liquid Fund – Direct Growth | 7.26% | 7.11% | Liquid Fund | 2,143.57 |

| Axis Ultra Short Term – Regular Plan | 8.10% | 7.00% | Ultra Short Duration Fund | 10.85 |

| Axis Arbitrage Fund – Direct Plan | 6.90% | 6.89% | Arbitrage Fund | 14.36 |

| Axis Liquid Fund – Retail Growth | 6.84% | 6.52% | Liquid Fund | 2,010.29 |

| Axis Arbitrage Fund – Regular Plan | 6.48% | 6.13% | Arbitrage Fund | 13.77 |

| Axis Credit Risk – Regular Growth | 3.92% | 5.68% | Credit Risk Fund | 14.51 |

| Axis Regular Saver Fund Direct Growth | 2.73% | 5.31% | Conservative Hybrid Fund | 19.01 |

| Axis Regular Saver Fund – Direct Growth | 2.73% | 5.31% | Conservative Hybrid Fund | 20.72 |

| Axis Gold Fund Direct Growth | 22.40% | 4.84% | Fund of Funds | 11.61 |

| Axis Gold Fund – Direct Growth | 22.40% | 4.84% | Fund of Funds | 12.45 |

| Axis Gold ETF | 30.06% | 4.31% | Index Funds/ETFs | 3,326.29 |

| Axis Multicap Fund – Regular Plan | -0.09% | NA | Multi Cap Fund | 12.34 |

| Axis Dynamic Equity Fund – Regular Plan | 6.12% | NA | Dynamic Asset Allocation or Balanced Advantage | 11.12 |

| Axis Equity Hybrid – Regular Plan | 1.30% | NA | Aggressive Hybrid Fund | 10.77 |

| Axis Equity Advantage Fund – Sr. 1 – Regular Plan | 12.80% | NA | Fixed Maturity Plans – Hybrid | 12.45 |

| Axis capital builder fund Sr.1 – Regular Plan | -6.34% | NA | Multi Cap Fund | 10.38 |

| Axis Ultra Short Term – Direct Plan | 8.99% | NA | Ultra Short Duration Fund | 10.95 |

| Axis Credit Risk – Direct Growth | 18.96% | NA | Credit Risk Fund | 15.42 |

| Axis MCF – Direct Plan | 18.96% | NA | Multi Cap Fund | 12.72 |

| Axis Corporate Debt Fund – Regular Plan | 6.37% | NA | Corporate Bond Fund | 11.53 |

| Axis Corporate Debt Fund – Direct Plan | 7.36% | NA | Corporate Bond Fund | 11.74 |

| Axis DEF – Direct Plan | 6.12% | NA | Dynamic Asset Allocation or Balanced Advantage | 11.53 |

| Axis Equity Hybrid – Direct Plan | 14.59% | NA | Aggressive Hybrid Fund | 10.98 |

| Axis Equity Hybrid – Regular Plan Quarterly Dividend | 1.30% | NA | Aggressive Hybrid Fund | 10.77 |

| Axis Ultra Short Term – Regular Plan Weekly Devidend | NA | NA | Ultra Short Duration Fund | 10.07 |

| Axis Equity Advantage Fund Series 1 – Direct Plan | 7.31% | NA | Fixed Maturity Plans – Hybrid | 12.89 |

| Axis Ultra Short Term – Regular Plan Monthly Dividend | NA | NA | Ultra Short Duration Fund | 10.06 |

| Axis Capital Builder Fund Sr.1 – Direct Plan | -6.34% | NA | Multi Cap Fund | 10.59 |

| Axis Equity Advantage Fund Series 2 – Direct Plan | 1.31% | NA | Fixed Maturity Plans – Hybrid | 12.42 |

| Axis Equity Hybrid – Direct Plan quarterly dividend | 14.59% | NA | Aggressive Hybrid Fund | 10.99 |

Also Read: