What are Dividend Yield Funds?

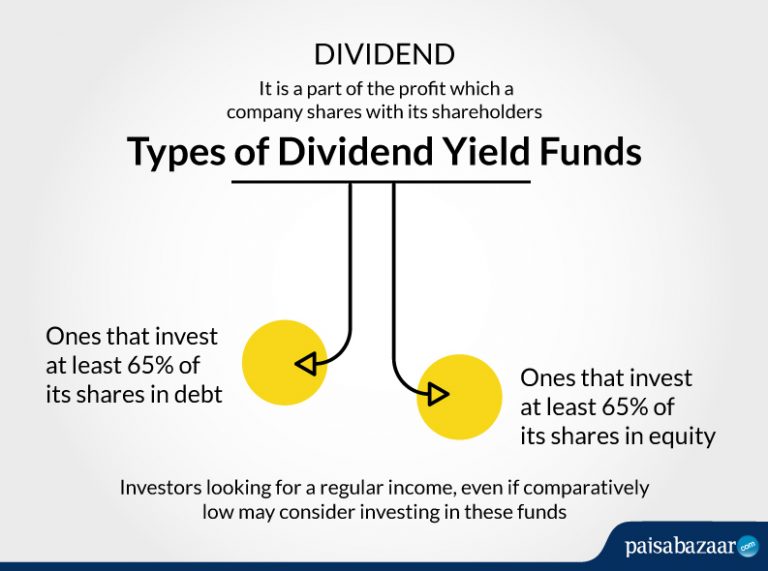

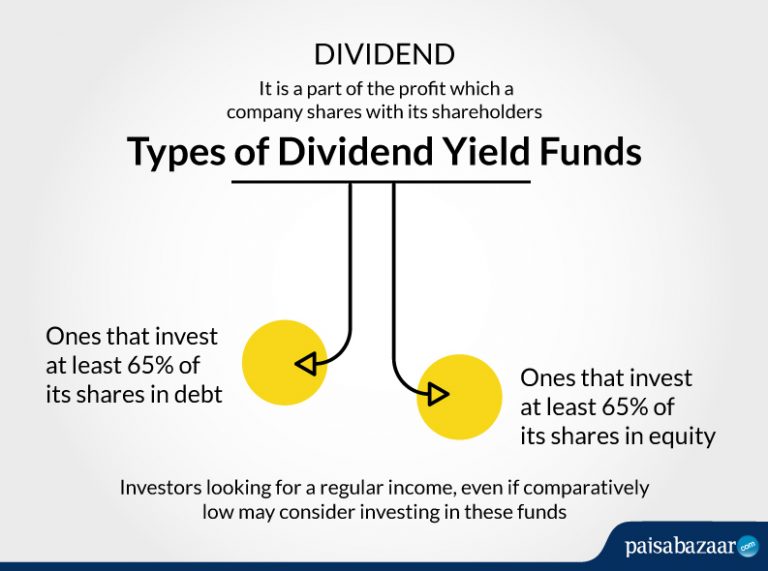

Dividend refers to that part of the profit which a company shares with its shareholders. A dividend yield fund is a mutual fund that invests in shares/stocks of only those companies that pay high dividends.

- As per the guidelines laid down by SEBI, these schemes must invest a minimum of 65% of their assets in dividend yielding stocks

- Since companies can only afford to pay high dividends if they have substantial profits to distribute, dividend yield funds typically tend to invest almost exclusively in high-quality stocks with a proven track record

- Investors who are looking for a regular income, even if comparatively low, but regular should consider investing in these funds

Dividend Yield funds are of two types; ones that predominantly invest in equity shares (at least 65%) of the company offering high dividends, and second, that majorly invest in debt shares (at least 65%) of the company.

To learn more about what Dividend Yield funds are, Click here

Get Your Free Credit Report with Monthly Updates Check Now

List of Dividend Yield Funds to Invest

Depending upon their past 5-year returns, given below is a list of top Dividend Yield Funds that you may consider while investing-

| Fund Name | AUM (Cr) | 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) |

| Principal Dividend Yield Fund | 155 | -10.92 | 0.77 | 5.89 |

| UTI Dividend Yield Fund | 1,987 | -12.75 | -1.53 | 3.33 |

| Templeton India Equity Income Fund | 699 | -18.84 | -4.21 | 1.68 |

| ICICI Prudential Dividend Yield Fund | 134 | -26.33 | -9.09 | 0.53 |

| Aditya Birla Sun Life Dividend Yield Fund | 600 | -13.83 | -8.01 | -0.48 |

Data as on 18 May 2020; Source: Value Research

1. Principal Dividend Yield Fund

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| Principal Dividend Yield Fund | -10.92 | 0.77 | 5.89 | 9.56 |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | 7.99 |

Data as on 18 May 2020, Source: Value Research

For instance, if you had invested a sum of ₹65,000 for a period of 5 years at a CAGR of 5.89% (as on 18 may 2020), your corpus at the end of your investment (which would be today) would have been ₹86,534.26

- The fund functions with the objective of providing capital appreciation, through the mode of dividend distribution by investing predominantly in a well diversified portfolio of companies that have a relatively high dividend yield

- Out of the fund’s total assets, 70.56% have been invested in large cap stocks, 23.64% in mid cap and 5.81% in small cap stocks

- Additionally, only 2.4% of the fund’s investments have been made in cash & cash equivalents

- The fund is considered suitable for investors looking forward to long term capital growth through investments in equity and equity related securities

A Good Credit Score shows that you manage Your Finances Well Check Score

2. Templeton India Equity Income Fund

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| Templeton India Equity Income Fund | -18.84 | -4.21 | 1.68 | 7.43 |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | 7.99 |

Data as on 18 May 2020, Source: Value Research

For instance, if you had invested a sum of ₹75,000 for a period of 5 years at a CAGR of 1.68% (as on 18 May 2020), your corpus at the end of your investment (which would be today) would have been ₹81,515.27

- The fund is known to focus majorly on Indian, emerging market stocks that have the potential to attract dividend yield by using a value strategy

- The fund suits the investment needs of investors who are willing to create a huge corpus for themselves in the long run

- It is suggested that only investors with a minimum of 5 years of investment horizon should invest in this fund

- Being an equity focused fund, 95.33% of the fund’s total assets have been invested in equity and equity related securities

- The fund’s top investments have been made in the Power, Software and Gas sectors; with the top 3 holdings in Infosys Ltd., Xinyi Solar Holdings Ltd., and Power Grip Corp. of India

3. UTI Dividend Yield Fund

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| UTI Dividend Yield Fund | -12.75 | -1.53 | 3.33 | 7.49 |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | 7.99 |

Data as on 18 May 2020, Source: Value Research

A Good Credit Score shows that you manage Your Finances Well Check Score

- Predominantly investing in dividend yielding equity and equity related securities, the fund managers also tend to keep a check on the cash flow generation, management quality, earning growth prospects, industry scenario, etc

- The fund’s investment objective is to generate capital appreciation for its investors, whilst having the flexibility to position itself actively across the market cap spectrum

- It is advised that the investors willing to supplement their portfolio with varied strategies while increasing equity allocation with an intent of relative downside protection should find this fund suitable

- Additionally, the fund provides twin benefits of capital appreciation and dividend yield, upon staying invested for a minimum of 5 years

4. ICICI Prudential Dividend Yield Fund

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| ICICI Prudential Dividend Yield Fund | -26.33 | -9.09 | 0.53 | – |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | – |

Data as on 18 May 2020, Source: Value Research

For instance, if you had invested a sum of ₹95,000 for a period of 5 years at a CAGR of 0.53% (as on 18 May 2020), your corpus at the end of your investment (which would be today) would have been ₹97,544.33

- The fund is considered ideal for conservative investors looking to benefit from higher returns and achieve medium term investment goals such as retirement and wealth creation

- The fund operates with an investment objective of providing medium to long term capital appreciation to its investors by predominantly investing in equity and equity related securities

- Owing to this, the fund has invested 97.1% in equity and related securities and the remaining 2.9% in cash and equivalents

- It is advised that the investors stay invested in the fund for a minimum of 5 years in order to benefit from their investments

5. Aditya Birla Sun Life Dividend Yield Fund

| 1-year Returns (%) | 3-year Returns (%) | 5-year Returns(%) | 7-year Returns(%) | |

| Aditya Birla Sun Life Dividend Yield Fund | -13.83 | -8.01 | -0.48 | 6.15 |

| S&P BSE 500 TRI | -16.72 | -2.13 | 3.27 | 7.99 |

Data as on 18 May 2020, Source: Value Research

For instance, if you had invested a sum of ₹85,000 for a period of 7 years at a CAGR of 6.15% (as on 18 May 2020), your corpus at the end of your investment (which would be today) would have been ₹1,29,079.99

- The scheme intends to provide capital growth and income by investing primarily in a well diversified portfolio of high dividend paying companies

- The fund managers work on creating a diversified portfolio such that it focuses on companies with high dividend yield, robust cash flows, and reduced volatility

- Out of the fund’s total investments, 45.44% has been invested in large cap stocks, 37.105 in mid caps and the remaining 17.46% in small cap stocks

- The fund’s major allocation has been made in the energy (18.08%), financial (16.12%) and FMCG (15.80%) sectors

Your Credit Score Is Now Absolutely Free Check Report

Advantages

- These funds deliver a stream of high dividends to their investors, indicating steady cash-flows in the form of regular dividend income

- Dividends offered are tax-free at the hands of the investor, thereby giving investors a high tax-exemption threshold

- Dividend funds help investors minimize the market volatility risk and act as a hedge against market turmoil

- Since these funds are always associated with organizations that have proven records, they are always assured of high returns in the future

- Dividend Yield funds provide a significantly better yield on investments in the long run as the fund managers only include bluechip stocks in the portfolio, which have historically excellent financial track records

- The investments made in dividend yield funds involves a marginal level of risk, which makes it suitable for investors with any investment horizon and risk appetite

How to Invest in Dividend Yield Funds

You can invest in Dividend Yield funds through either of the following ways-

- Offline mode of investing– If you are not confident of your knowledge, you may choose to invest through a broker. However, investing in a fund through a broker will make you eligible for investments through regular plans that offer different returns and varied expenses in investment. If you wish to invest in the fund independently, you must visit the nearest branch of the AMC of your fund. Don’t forget to carry the following documents-

- Identity Proof (Aadhar Card)

- Canceled cheque

- Passport size photos (around 4-5)

- PAN Card

- KYC documents (for KYC verification)

- Online mode of investing– If you do not wish to add on to your expense of commissions or brokerage, you may visit online investment platforms such as Paisabazaar.com wherein you can choose from and compare more than 1,700 funds- all in one place, instead of following the long procedure of visiting the website of each AMC and then choosing from them. Here, you can select the fund in which you want to invest, look at the details and compare similar schemes as well as use SIP Calculator or Lumpsum Calculator to estimate the future value of your investment

Get Free Credit Report with Complete Analysis of Credit Score Check Now

Frequently Asked Questions

Ques. What is the difference between Dividend Yield and Dividend Option funds?

Ans. Dividend yield funds invest in companies which declare high dividends and are regular in terms of dividend declaration. On the other hand, the dividend option of a mutual fund simply gives an investor the choice of receiving returns in the form of a regular and steady flow of income, termed as dividends. Mutual funds which provide dividend option generate returns by means of capital appreciation only.

Ques. What is the Dividend Distribution Tax (DDT)?

Ans. Companies distribute their profits among their stakeholders in the form of dividend declarations. Such dividends are treated as part of the income of stakeholders. The tax levied on such income is called Dividend Distribution Tax (DDT). However, unlike other forms of income, where income tax is charged at the receiver of the income, DDT is charged on the dividend declaring company itself. This way, dividend income is tax-exempt at the hands of the recipient shareholder. However, the dividend income in excess to Rs. 10 lakh in a year is chargeable at 10% income tax for individuals, HUF, partnership firms or private trust.

Ques. What is the current Dividend Distribution Tax (DDT) rate?

Ans. The tax treatment of dividend yielding mutual funds is different for equity and debt funds. While dividend yielding mutual funds (equity) are taxed at 10% (11.64%, including Surcharge and Cess), dividend mutual funds (debt) at 25% (29.12%, including Surcharge and Cess).

2 Comments

Great article, learned more here than at any business articles!

I spent a great deal of time to find something

like this